Trending Assets

Top investors this month

Trending Assets

Top investors this month

STZ: Are the Stars Aligned?

This is a pretty brief overview of my thoughts on Constellation Brands for the Commonstock Stock Pitch. I will follow-up in a few weeks with a more robust outlook on the industry. I am bullish on the alcoholic beverages industry (somewhat of a reopening trade) as well as the cannabis industry, which Constellation has exposure to through Canopy Growth.

Who is Constellation Brands? Constellation Brands is a leader in the alcoholic beverages space. They’ve been around for 75 years and are one of the leading CPG companies. They sell alcohol, mainly beer, wine, and spirits, with a large focus on higher-margin premium products. Their customer base is in the range of LDA (Legal Drinking Age) to DMD (Damn Near Death). They are divesting most of their lower-margin brands to focus on higher margin opportunities, which is creating some short-term volatility in their numbers.

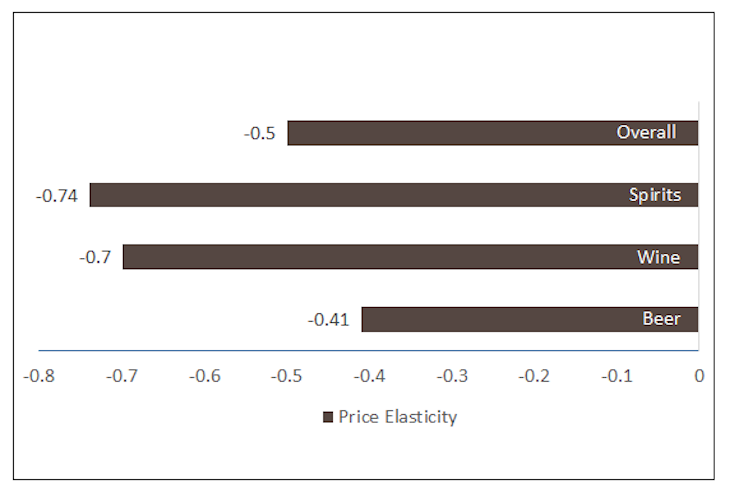

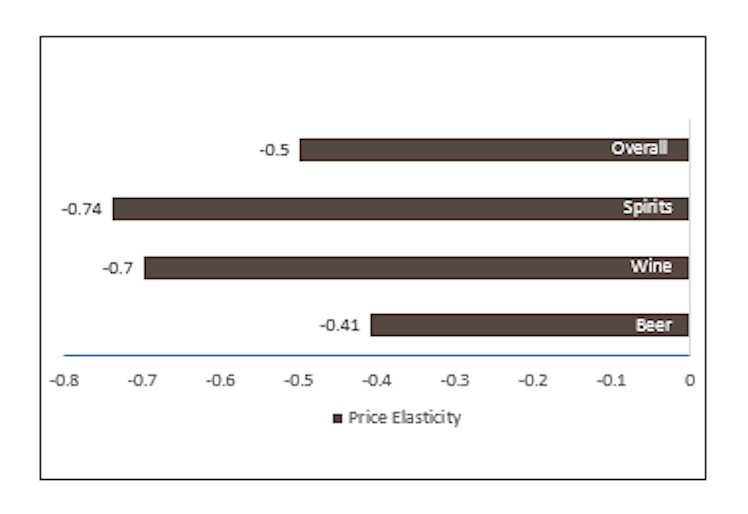

Beer, their main focus, is the most price elastic of all the alcoholic beverages (consumers will switch and it’s not as sticky as spirits).

But their plan is to increasingly pivot into more premium products in both their beer and wine and spirits portfolio. I expect margins to increase due to their new pricing structure here, but they do have incremental headwinds as they transition and divest.

Their investment in Canopy (a cannabis company) was ahead of the curve, but Canopy is poorly executing on growth goals. The cannabis market still has room to run, but the regulatory headwinds haven’t cleared as quickly as expected.

Q4 2021 Earnings: Constellation had a beat on Q4 earnings today, but are getting beat up in the market. Their sales were stronger, margins were higher, and they sold a lot of beer (+15% y/y). Their wine and spirits segment is a drag because of the divestments. However, the retained portfolio has grown, as illustrated below, showing that a lot of this noise is only temporary.

With that being said, I am disappointed with their guidance - especially because a lot of it is coming from an expected slowdown in beer and continued headwinds in wine and spirits. Their Canopy investment is a mess (and Canopy is now acquiring another cannabis company).

But I think that they are positioned for success over the long-term.

- They have a lot of spending projects in the pipeline

- They have poised themselves to capture the premium beer market

- They are opportunistic investors (Canopy was an early bet on the cannabis market).

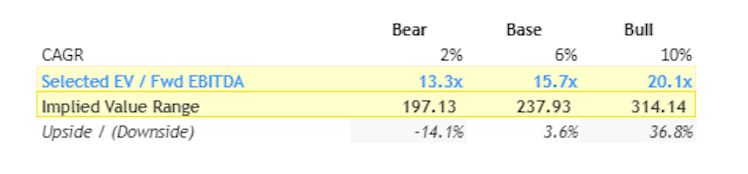

Constellation is a solid company with good fundamentals. I expect margins to increase due to premiumization, but headwinds will come in brand recalibration and adjustment. Based on their valuation, they are currently undervalued relatively, with a base case upside of 3.6% into 2024.

Alcoholic Beverages Market Overview

There are 3 ways to make money in the alcoholic beverage industry:

- Higher Prices → Leveraged through premiumization/scarcity/innovation

- Higher Volume → Higher turnover and selling more product

- Lower Costs → Owned Distribution and economies of scale

Most competitors in the space have a single line business model - alcohol. Alcoholic beverages (AB) are (relatively) inelastic goods that act as a tool of social capital.

The industry has some headwinds and tailwinds. They can have a pretty diverse array of product offerings that can be accessed at several different price points in different locations (creating opportunity for a deep portfolio vs a broad portfolio as shown below). But they do have regulatory headwinds and are exposed to consumer fickleness.

Tailwinds

- Options for consumption: Consumers can access alcohol from a variety of places. There is a significant profit differential between on-premise (bars, restaurants) and off-premise (at home).

- Product Portfolios: Companies have two different types of product portfolios: breadth (many products across many types of alcohol) vs depth (a few lines across one type of alcohol).

Headwinds

- Government Regulation: They have diminishing returns if overconsumed, which results in extensive government regulation. Due to the strict regulations, it’s hard for new companies to gain market share.

- Time to Create: The business is RISKY because if a product doesn’t sell well, that is years of work lost

Company Framework

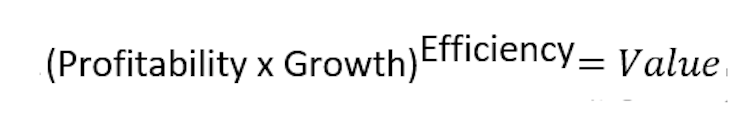

The way that I think about companies is through this framework -

Profitability multiplied growth is compounded by efficiency. That’s a business - and if companies can execute on all three of these variables, that is what creates value for shareholders in the long run.

There are different levers that a business (here, an alcohol business) can pull for all 3 of these variables:

- Profitability: Innovation, aging, and pricing power

- Growth: International expansion and wider networks

- Efficiency: Scale advantages and curating their distribution system

If the company can deliver on all three of those variables, that is going to create an ultimate value prop.

Constellation’s Framework

Constellation Brands is positioning themselves across three different avenues:

- Profitability = Premiumization

- Growth = New Markets

- Efficiency = Distribution

Four Segments

Beer: ~67% of sales

Constellation is the top seller of imported beer in the U.S., with a large focus on premium beer products. They are increasingly focused on hard seltzer, showing their ability to move quickly on trends.

- Modelo (~144mn cases, +16% growth)

- Corona (~149mn cases; +1% growth) → growth to 440mn cases by 2025

- Pacifico (~11mn cases, +13% growth)

- Imported beer leads the market: Imports and ABAs are growing in terms of market share, with Craft falling back. With their focus on Modelo and Corona, STZ is well positioned to capture the growing import market.

- Sales are driven by volume, not price changes: Mostly a tailwind of volume growth (especially in their Mexican beer portfolio). This gives them the optionality to use pricing as a lever to continue growing here.

- Premium Beer Growth: High-end beer is expected to have a 10Y 6% CAGR, which will give STZ strong positioning in that market - they are primarily tackling growth through space and distribution, versus innovation. That makes sense in the beer space - because of the price elasticity of the product, they are better served to focus on breadth versus depth in their beer portfolio.

- Sales Growth: If executed correctly, this will give them 4-6% retailer sales growth (primarily through assortment, high-end options, and consumer optimization), which will provide substantial support to their topline beer sales.

- Cannibalization: The company sees most new lines as incremental growth (~90%) versus cannibalization (10%) because 50% of expected growth is coming from increased consumption and new buyers.

Wine (28%) and Spirits (5%)

- They plan to grow through premium power brands with industry leading margins. This portfolio is messy right now with divestments, but once everything shakes out, I think that they will be well positioned to move forward. Most of their portfolio (~70%) is concentrated in the ultra premium and luxury category ( > $15)

- Tequila: They have to get on top of tequila. They acquired Mi Campo, which is craft tequila, giving them exposure to the market.

- More Tequila!! Whiskey dominates the spirits market (44% market share) with Tequila taking increasing market share (+58% growth). They should continue to acquire Tequila companies moving forward.

Profitability: What is Premiumization?

A lot of Constellation’s appeal is coming from their shift to a premium product portfolio. A premium product is a function of:

Premium = Pedigree + Longevity + Price Appreciation + Critical Acclaim

What STZ is “premiumizing” in my opinion is more of the lower end of premium. Not finely aged bottles like a Brown Forman (the very premium > $50/bottles), but rather products that command more pricing power across the board, which plays into the breadth of their product portfolio

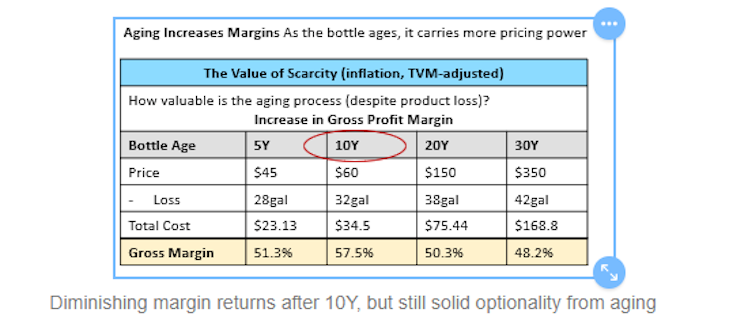

The below table shows the power of scarcity - there are diminishing returns after 20Y of aging the product. But the older the bottle, the more you can charge - you can command more premium and because of that, it’s a terrific consumer psychology lever.

But like most things, scarcity value is really a function of consumer perception of premium. That’s what translates into pricing power. So Constellation has a lot of room to run here, especially as they explore the spirits and wine segment more. They can use age as a leverage in their selling process.

If they are able to premiumize, they are able to expand margins. Pricing optimization has a positive impact on margins - on the conservative end, we can assume that a 1% increase in price will lead to a ~50bps expansion in margins.

Growth = How do they tap New Markets?

STZ jumped on Canopy back in 2018. It hasn’t been a great investment so far, but it is a signal of a management team that is open to these opportunities.

But Canopy is a sore spot for STZ. STZ doesn’t control the company, but they do exert influence. I think its a sign of the lengths that STZ is willing to go to execute on new things in the market. They went after Canopy early, back when cannabis was pretty taboo. As regulation becomes more lax, this mindset will be beneficial for them, and they have leverage from being a relative first mover in the space.

- The Market: The cannabis market is expected to reach C$70bn in sales by 2023, with the U.S., Canada, and Germany accounting for most of the market. CBD is fast growing because of the lack of regulation around it ($22bn TAM) but if the federal government reduces overall regulations, the TAM expands to $60bn.

- U.S. Optionality: Canopy is working with Acreage to sell Canopy brands in the U.S., which will give Canopy scaling power once things get regulated (if?). They are positioned to capture the upside if things do work out, which is good. However, I don’t think the Biden administration is going to move very quickly here.

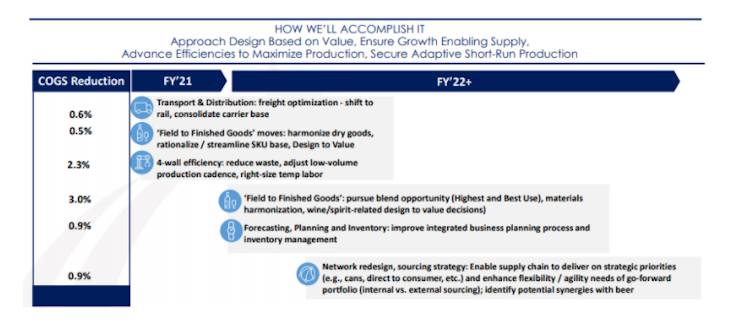

Efficiency = How do they distribute?

They have a lot of opportunity to optimize distribution, which will compound both growth and profitability. There are a lot of things to think about in the distribution chain, from the product creation, to product distribution and delivery. They currently have wholesale distribution with separate networks for their beer and wine and spirits portfolio. It’s important that they are considering more inventory management methods and other synergies, especially as the PMI continues to tick up.

If they can optimize distribution, that will translate to a meaningful increase in gross margins. This all takes time to scale effectively, but will be beneficial to the bottom line if done correctly.

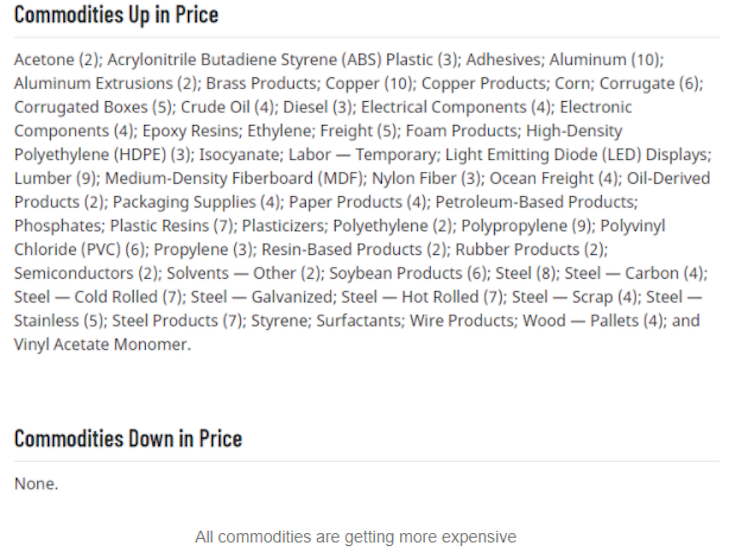

Speaking of the PMI, they do have raw material inputs that need to be watched closely.

Commodity Price Pressure

- Glass: hedged through a JV with Owens-Illinois, the world’s largest glass container manufacturer (supplies ~55% of needed glass). Still is an important input.

- Aluminum and steel kegs: all prone to price increases and shortages.

- Grapes: They have contracts with > 100 growers, but this is exposed to climate change risks (drought, wildfire). This was highlighted as a headwind in their Q4 report.

Valuation

Below are some rough numbers. Their current valuation places them at a $44bn market cap or ~$224/share. Using a ~6% CAGR (roughly in line with the expected growth of the beer market), I can pencil in a 3.6% return into 2024 as a base estimate. If they rate up with DEO and SAM in the bull case scenario, they have even more upside opportunity.

As always, I want to flush these numbers out more, but I think that there is upside to Constellation, especially if Canopy is realized. They are a company that prices in growth and moves quickly.

Final Thoughts

These are some quick thoughts around Constellation and how they are positioned to capture some of the growth opportunities in the market. I think that Constellation is in a good spot right now - they are trading below what they are worth due to momentary headwinds. I think that they are fast movers in a pretty slow space, and they are taking advantage of opportunities (even if the success doesn’t manifest right away).

Opportunities

- Shift to higher-margin, more premium products which will come with pricing power

- They are spending in the right direction, and those investments will take time to materialize

- Exposure to high-growth opportunities (some of which currently seem early) including cannabis, hard seltzer, and tequila

Risks

- They do have some headwinds from the portfolio transition into higher margin products

- They are exposed to commodity price fluctuations

- Consumer interest is a fickle beast

- The Sands Family owns the majority of their STZ.B stock (10 votes per share) and could make a decision that isn’t beneficial to all shareholders

I think that alcoholic beverages are an interesting reopening play - people will return to bars, celebrate, hang out, and I am making the assumption that alcohol will play a part in that. I think that we are going to explore different “recreational activities” moving forward (psychedelics, etc) and Constellation could be one of the first to recognize and move on that. $STZ $STZ.B

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

www.newswire.ca

Canopy Growth to Acquire The Supreme Cannabis Company

/CNW/ - Canopy Growth Corporation ("Canopy") (TSX: WEED) (NASDAQ: CGC) and The Supreme Cannabis Company, Inc. ("Supreme Cannabis" or "Supreme") (TSX: FIRE)...

Already have an account?