Trending Assets

Top investors this month

Trending Assets

Top investors this month

$LYFT Earnings - Positive report, more positive outlook

Brian Roberts (LYFT CFO):“Our Q4 results also outperformed our most recent outlook. And, while the first quarter of 2021 continues to be uncertain primarily due to COVID-19 headwinds, based on current recovery expectations, we should experience a growth inflection beginning in the second quarter that strengthens in the second half of the year.”

It’s been about a week since LYFT reported earnings on February 9th, and I thought I’d do a retrospective on the thoughts I had since writing LYFT – Underpriced and Underestimated. To be clear, I’m very satisfied with performance, up +33% since purchase Jan 27th. Disclosure: I still hold my long LYFT position and a naked call option ($45 dated Jan 2022); I’m considering selling the call.

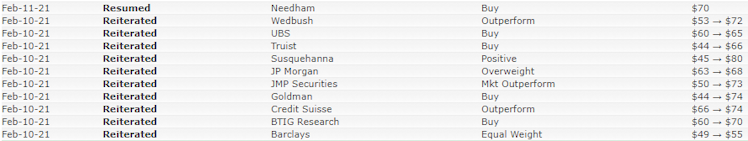

Summary: Still bullish on LYFT price growth ($58 at time-of-writing), and still see 18%+ upside to the high end of my initial estimate of $59 to $68 by the end of the year (Wall St consensus is now $69, up from $53 pre-earnings). Expect business metrics to improve Q/Q given Brian's optimism quoted above.

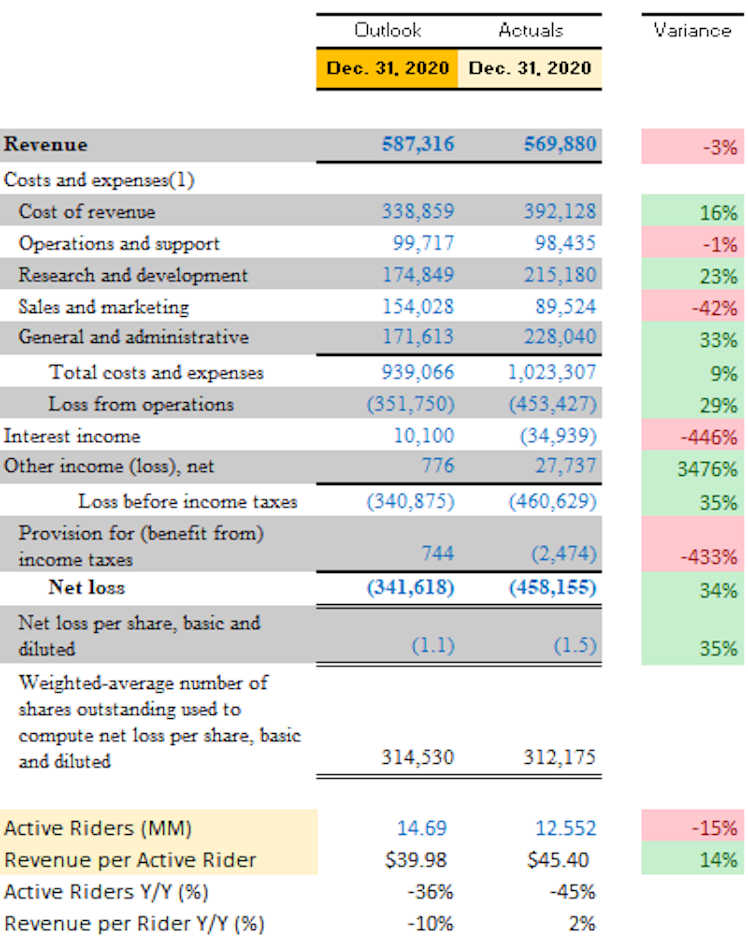

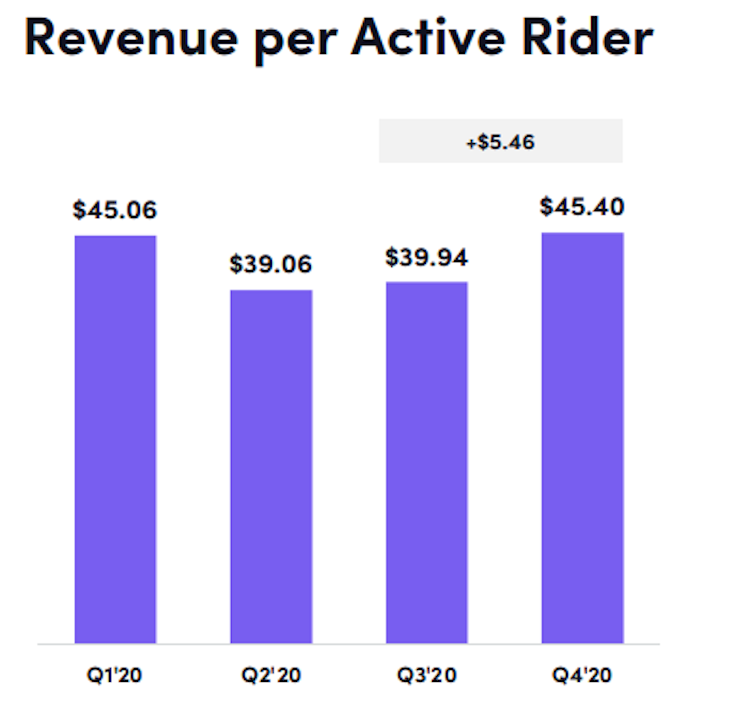

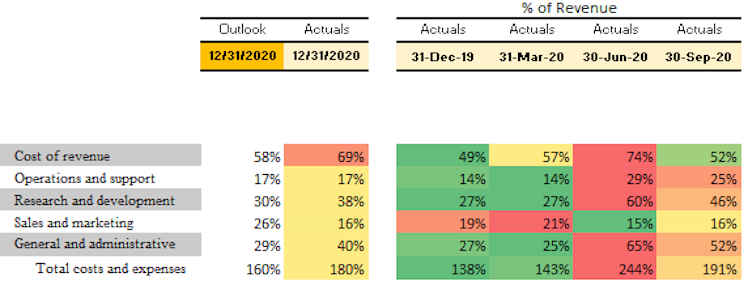

Things I got terribly wrong: While I was only -3% off revenue (due to missing Active Riders forecast by -15%, offset by Revenue per Active Rider beating my expectation by +14%), my simplistic OpEx assumptions as a % of revenue were way off at the line item level (to be expected). While costs are indeed declining as a % of revenue, not in the areas I expected (R&D, G&A, COGS) and in variable more controllable costs such as Sales & Marketing. More on margin expansion further down.

edit: oops, the variances are wrong for the negative numbers.

By pure luck, things I got directionally right:

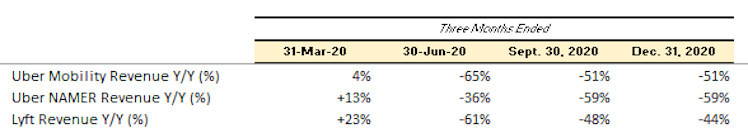

- <<LYFT is recovering fast(er) in terms of ridesharing (vs. Uber)>>: LYFT reported revenue down 44% y/y, improved from -48% y/y. On the other hand, UBER reported the same y/y performance Q/Q for both Mobility (-51% y/y) and NAMER (-59% y/y)

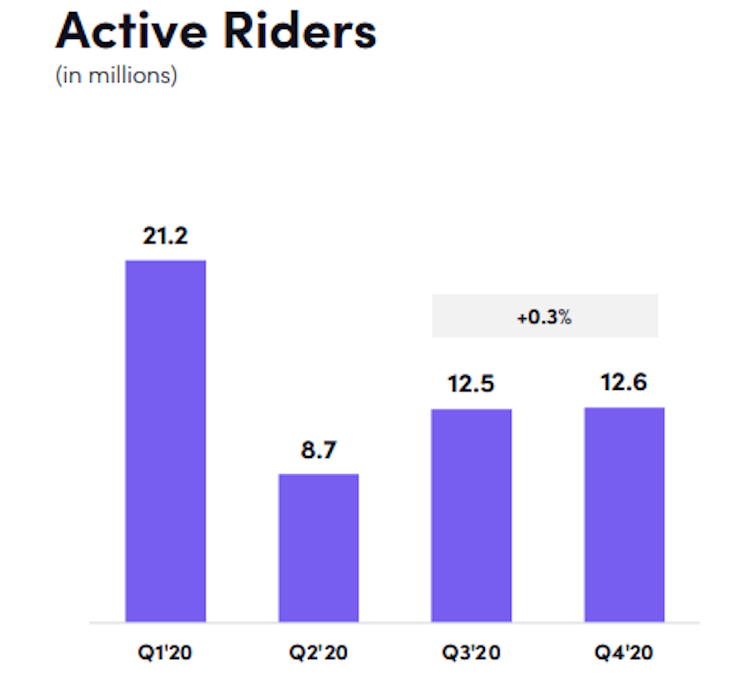

- <<If rideshare recovery continues linearly, we might expect a full recovery by August 2021. Distribution of a vaccine is likely to pull this forward in the medium term but mounting COVID cases and slow vaccine distribution could mean short-term recovery may not follow recent trends.>> This proved to be the case as Active Riders remained basically flat Q/Q, a slowing demand attributed to COVID in their financial results: “Recovery trends seen in Q3 2020 continued into Q4 2020, but demand in the latter part of Q4 2020 was negatively affected by the surge in COVID-19 cases and the reintroduction of restrictive measures intended to curb the spread.”

- <<Revenue per Active Rider was resilient and likely to reach pre-COVID levels quickly>>: In fact, they had the highest revenue per active rider in the last eight quarters. I find this extremely encouraging during a time when ridesharing is down nearly -50% y/y.

- <<Margin expansion will continue post-recovery and LYFT will reach profitability in 12-18 months>>: LYFT reported beating their own expectations in terms of cost-cutting and margin expansion: “we successfully eliminated $360 million in fixed costs on an annualized basis versus our original 2020 plan, exceeding our target cost reduction by 20%”. It seems that OpEx, as a % of revenue, has passed the worst part of the pandemic. It helps that LYFT has previously maintained a stronger margin profile than it currently has to bolster my confidence that margin expansion can continue. Q/Q, for each $1 of revenue, LYFT earned $1.28 in adjusted EBITDA.

What did Wall St think? A number of groups reiterated their positions from Equal Weight (1), Outperform/Overweight (4), or Buy (6) after the earnings call, increasing consensus price target +31% from $53 to $69.

Concluding Thoughts: The recent price growth is great confirmation bias in the thesis that LYFT price justified upside and continues to instill confidence in reaching profitability at scale. Implied volatility is ~58% at time of writing on my call option, which prompts me to consider whether I should sell or not. +18% upside in one year would be great but I can’t help think I might be able to find another solid trade in the months before LYFT reports profitability, justifying selling early. I’ll likely hold my long position.

Already have an account?