Trending Assets

Top investors this month

Trending Assets

Top investors this month

Appian down -27%: Volatility is Normal

It's a tad disconcerting if you celebrate loudly when your stocks are up and are silent when they are down.

My most recent memo on Appian noted that Appian's stock was up 200% in the last month. (Side note, with a market cap of $11 billion, Appian is not a penny stock, lest you think I am dumpster diving)

Today, Appian dropped 27%. This is likely due to the short squeeze playing out as well as the market having a down day.

And to be fair, as pointed out by @gregxfund , Appian is not considered to be in the highest echelon of SaaS stocks, so the run-up was arguably irrational.

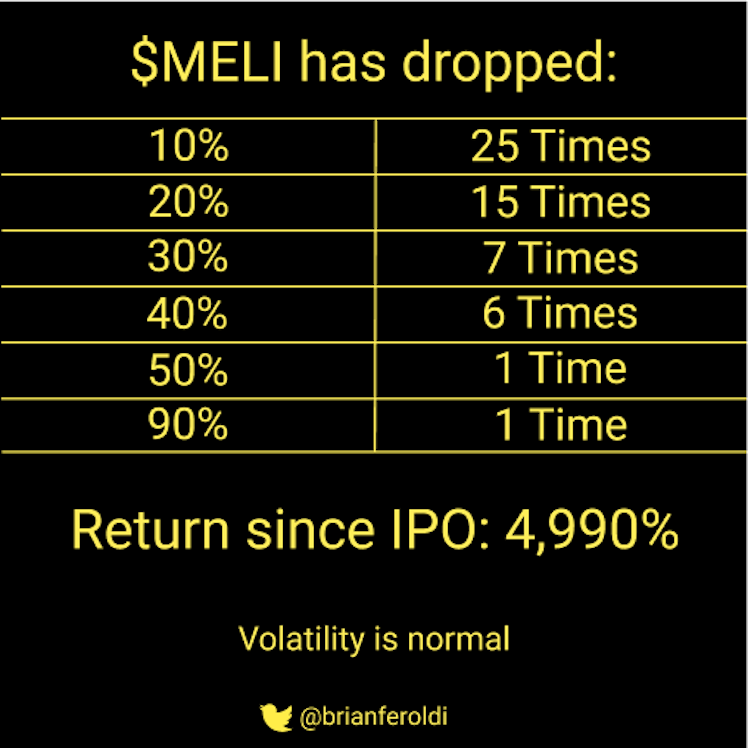

Days like today remind me of this Long Term Mindset meme by Brian Feroldi:

I'm definitely not trying to compare Appian to Mercado Libre.

The point I want to make is companies that offer a 'new way of doing things' are highly volatile, because the market is constantly trying to price the likelihood that the 'old way of doing things' gives way.

By definition, the 'new way of doing things' is more risky. It's new and unproven after all.

Big ups and big downs are part of the journey if you are a long term investor.

While I'd love to be able to say I sold Appian at the top when I posted my memo two days ago (@gregxfund even suggested as much), the true story is much more boring:

I bought into Appian once in mid 2018 and I haven't sold or bought more since. I didn't know the last month was going to be so amazing, and I didn't know today was going to be a 20% drop.

In the short term, I have no ability to predict what the market will do.

If I had sold on a day that $APPN was up 10% in order to lock in some gains, then I would be sitting on 10% gains instead of 60% gains.

One way to deal with uncertainty is to give yourself guidelines for selling. For me, one guideline is to not sell simply because of price action.

The most recent earnings report showed Appian's business was improving, not getting worse. So I have held on, accepting the volatility, and yes, also the risk that I could end up losing money.

Exposing yourself to risk is necessary if you want to realize gains.

Would love to hear from any others on this- do you have a point where you start selling to lock in gains?

Already have an account?