Trending Assets

Top investors this month

Trending Assets

Top investors this month

Can Sea, which has dropped by 17%, bargain-hunting?

The fate of the SEA may be in the hands of the Federal Reserve.

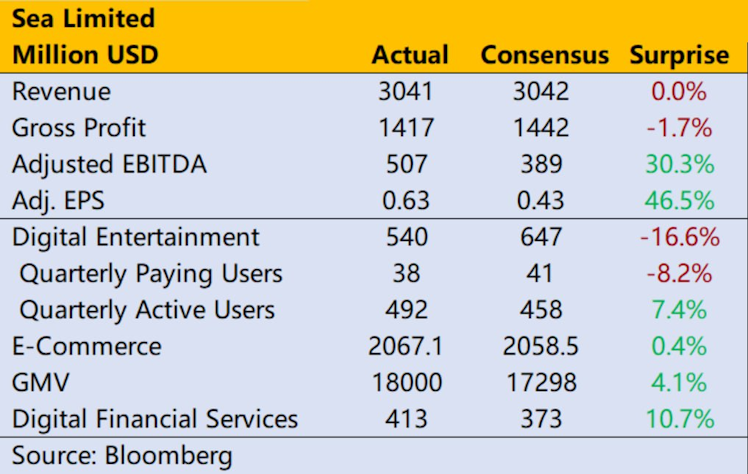

Before May 16th,$SE Announced the 23-year Q1 financial report, because the market looked at the previous financial report with new eyes and ears, it naturally raised its expectations for this period. Revenue was barely in line with expectations, while profit levels were significantly lower than expected, so in open low's case, it fell 17%.

From the data point of view, the three plates of Sea have different performances

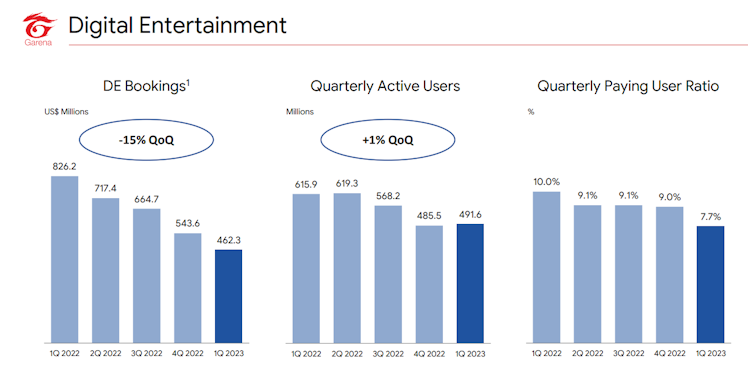

The GAAP revenue of Garena in the game sector was 540 million US dollars, down 43% year-on-year, which was also lower than the expected 647 million US dollars. This was also the result of the previous game FreeFire entering a recession and withdrawing from the operation of League of Legends in Taiwan; The adjusted EBITDA is US $230 million, slightly higher than the market expectation of US $222 million, because the overall game business is relatively mature, so the profit margin is well controlled.

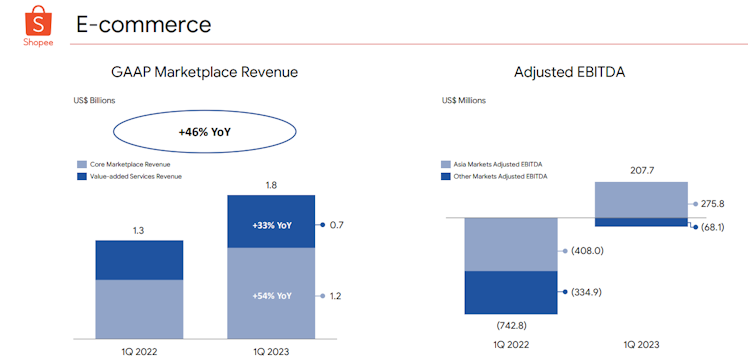

The overall GMV of Shopee, an e-commerce business, increased again year-on-year and remained flat month-on-month, reaching US $18 billion, slightly higher than the market expectation of US $17.3 billion, and its revenue was US $2.06 billion, which was flat with the market expectation. The adjusted EBITDA was US $201 million, higher than the market expectation of US $178 million. Among them, the core income related to commodity trading and advertising increased by 53% year-on-year.

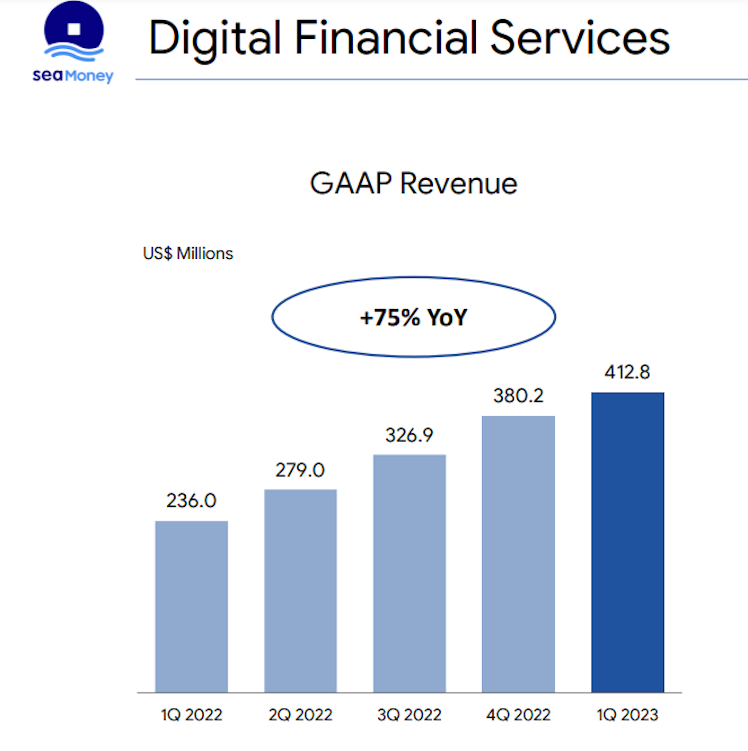

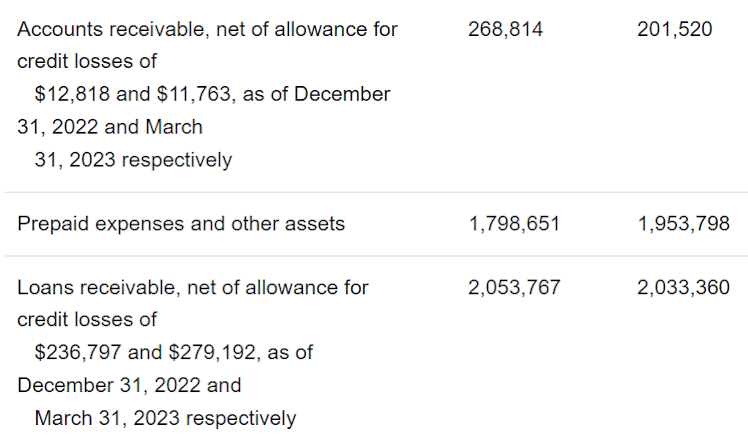

The revenue of Sea Money, a financial business, was US $413 million, up 75% year-on-year, and continued to maintain rapid growth, which was higher than the market expectation of US $372 million. The adjusted EBITDA was USD 99 million, which was higher than the market expectation of USD 68 million. Overall loan receivables were $2 billion, but the company recorded a bad debt loss of $281 million, which also hurt the overall profit margin.

So far, the company's overall revenue was US $3.04 billion, up 4.9% year-on-year, which was the same as expected, and the adjusted earnings per share was US $0.43, lower than the expected US $0.63.

Investment highlights

1.With the enhanced external competitive environment, the monetization ability of e-commerce business is enhanced.From 22Q4 to turn losses into profits, the company also began to break its arm to survive, all for profit margin. At present, Shopee only operates in Southeast Asia and Brazil, and its single order loss in Brazil also decreased by 77% this quarter. The overall e-commerce business achieved EBITDA of US $276 million, with a loss of US $408 million in the same period last year. The company's marketing control expenditure also played a key role.

Second, logistics services have been significantly improved, and user stickiness has been improved.The value-added business income of Q1 e-commerce was USD 700 million, up 32.6% year-on-year, mainly related to logistics business. By cooperating with more third-party logistics, the company also launched Shopee Express, and also piloted face-to-face return service in some markets.

Third, the rapid growth of financial business is also the inevitable result of tight credit cycle.With the growth of financial business, the revenue growth rate of Q1 is still 75%. On the one hand, the payment business related to e-commerce is growing rapidly, and on the other hand, it is borrowing. However, with the arrival of the tight credit cycle after the tight currency cycle, the loan quality is also the key to the company's profit margin.

Why did investors flee in a hurry

First, the game business is not connected.Because "Free Fire" has entered a recession, and the new games released before have not yet reached such a high level, the new game "Undawn" to be released in the future will have to wait for a while. At present, the game only relying on agents cannot achieve the goal of recovery, so the active users and revenue of the company's game business have declined, and the company has turned to maintain the profit margin of the game business.

Second, bad debts are too high, and rapid growth may not be worthy of the name.In financial digital business, the increase in credit default rate led to an increase in bad debts, which was shown in the first two quarters. At present, although the company has expanded its sources of funds (besides its own deposits, it also cooperates with local banks), because of its close connection with e-commerce business (the connection between Shopee and SeaMoney), the tightening of credit environment may also affect the cash flow of e-commerce business, which is a point that the market considers more.

At present, the company has just started to make profits, so it is greatly affected by bad debt losses. However, as the high interest rate continues to surprise, the bad debt rate is too high, and the profits of e-commerce will eventually be eroded.

Third, the e-commerce business is still facing fierce market competition.Since Q2 2022, Shopee's GMV has remained at the level of USD 18-19 billion for three consecutive quarters, and when GMV will resume growth is also the focus of market attention. At the same time, the competition from Tik Tok is inevitable. Because most sellers of Tik Tok just entered at the end of 22, the products of Tik Tok are mainly low-customer products, and Shopee's low-customer products begin to lose. Of course, this is not the focus of Shopee. However, with the increase of the richness of Tik Tok's electric products, Shopee's high-customer products will gradually be impacted. In addition, there are $BABA Lazada also continues to use the support of its parent company to enhance its overseas advantages.

Valuation and Prospect

We made a simple valuation for Sea in the 22Q4 financial report At that time, the market outlook was that the company realized profit ahead of schedule, enhanced monetization ability, and continued to grow in e-commerce and financial business.

> In 2023, it is expected that the adjusted EBITDA will be 900 million US dollars and the game business EV will be 4.5 billion US dollars; If the e-commerce business is given 15 times (Amazon and JD are both about 15 times) and the expected $1.8 billion in 2023, the EV of the e-commerce business is $27 billion; If the financial business is given 6 times EV/Sales, the expected revenue in 2023 is 1.7 billion US dollars, and the EV of the financial business is 10 billion US dollars.

But why did the market feedback get worse after Q1 financial report?The main concern is that the monetization ability and profit rate are not as good as expected.

If the game continues to fail and open source cannot be opened, although the profit margin of e-commerce business increases, it is difficult to resume growth, and the financial business generates more bad debts to erode profits, then the previously expected revenue and profit (EBITDA) level will decline, or the corresponding valuation multiple will be lowered (the company needs longer time to achieve its goal). If the valuation is 80 USD/share, the current performance market is more likely to give a discount.

Therefore, it is not unreasonable for the stock price in the secondary market to fall.

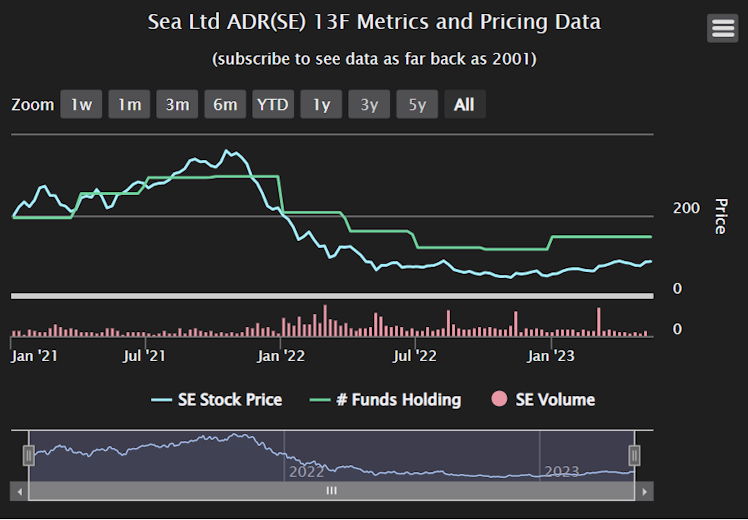

After all, according to the recently released 13F for the first quarter, the number of funds holding SEA increased by 9.6%, among which the number of funds opening new positions increased by 55%, indicating thatEveryone is optimistic about the prospect of 22Q4 financial report. On May 16th, the open low went low, which was not good news for institutional investors.

With the current risk-free rate of return, it may be the best choice for investors to choose temporary shelter for these companies with increased uncertainty.

Already have an account?