Trending Assets

Top investors this month

Trending Assets

Top investors this month

SLT Core Portfolio: Olaplex ($OLPX) - Long Version

OLPX was our pick for the September Idea Competition, and to thank everyone who upvoted or commented our contribution, we decided to post a longer version of our analysis of the company. We also wanted to take advantage of this post to congratulate the finalists and all participants for their great work.

Without further ado, below is the full analysis we have performed and used to write our contribution to the competition.

Thesis

- Unique brand with relatively low awareness, supported by loyal stylists and customers.

- Growth driven by increased penetration and "premiumization" of the market. Significant whitespace to fill with adjacencies and new geographies.

- Unique combination of robust top-line growth and solid profitability, fueled by an asset-light operating model and experienced management.

- Attractive absolute/relative valuation.

Company Description

OLPX was founded in 2014 after two chemists, Eric Presley and Craig Hawker, discovered its patent-protected active ingredient: bis-aminopropyl diglycol dimaleate (“bis-amino”). It works on a molecular level to dramatically improve hair from within by protecting, strengthening

and repairing disulfide bonds in hair that break when damaged.

Through a concentrated network of third-party manufacturers and suppliers, OLPX produces and retails a suite of premium hair care products (11 in total) that are designed to promote hair health through a regimen of treatment, maintenance and protection.

Since OLPX products are relatively new and not very well-known to the general investor, we thought it would be interesting to explain briefly the technology behind each product, which is one of the main reasons why OLPX is disrupting its industry. Our hair contains millions of disulfide bonds and these bonds give the hair its structure, strength and stability. When disulfide bonds are broken, it results in damage and generates an unstable sulfate group, which usually pairs with three oxygen molecules and causes a negative reaction. OLPX’s key ingredient works to prevent the latter scenario, as it pairs with the single sulfur hydrogen molecule faster than the three oxygen molecules in order to prevent the negative reaction.

The company sells its products via three channels:

- Professional (43% of 2021 sales): first channel launched in 2014 using external distributors such as SalonCentric and Beauty Systems.

- Specialty Retail (29% of 2021 sales): sales through Sephora, SpaceNK, Douglas, and ULTA.

- Direct-to-Consumer “DTC” (28% of 2021 sales): sales generated on OLPX own website and Amazon.

With regard to geographic exposure, the company derived 58% of 2021 sales from the US.

One of the most unique features of the OLPX business model is the company's asset-light operating model. As mentioned above, the distribution is mainly performed by third-party distributors. From a production standpoint, the company sources its key inputs of bis-amino

(developed by a contract manufacturer using OLPX’s patented formula), essential oils and specialty chemicals from third-party suppliers. From there, OLPX enlists third-party contract manufacturers to produce, label and bottle all products and utilizes third-party logistics providers for warehousing and distribution.

Competitive Moat

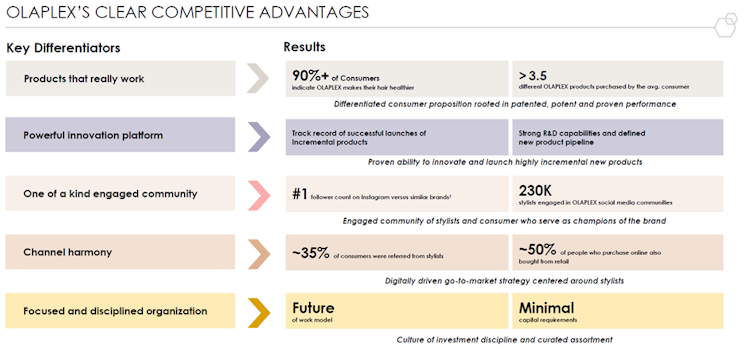

Patent-Protected Technology: OLPX is the only company offering a product able to repair hair on a molecule level and not simply mask hair damage. The company currently has a portfolio of 100+ patents, with c.80 protecting current OLPX’s key ingredient. Interestingly it includes not only hair but applications to new segments like nails and skin care. Remaining patents cover an alternative formulation to bis-amino that holds further opportunity for OLPX existing and future products.

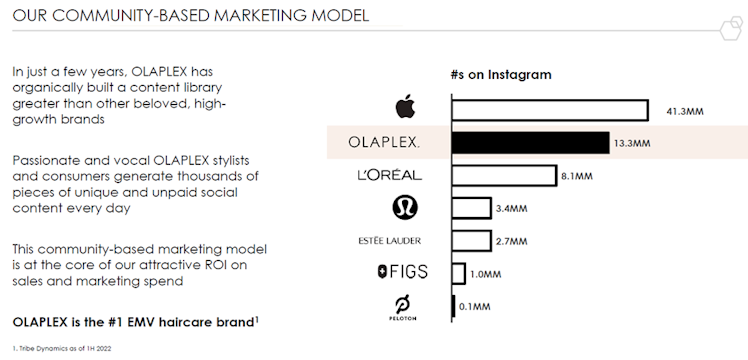

Community: Loyal stylist community is an underappreciated asset and contributes to the competitive moat. Over a short period of time OLPX created a strong community and what we believe is a smart overlooked strategy. Since the beginning, the company focused on and turned to the professional stylists. The community consists of more than 262k stylists in OLPX-led communities on Facebook. Its TikTok videos count more than 1.1bn views. The company has more than 2.3m followers on Instagram where almost 14m posts referring to OLPX products have been published.

- Where the competitive advantage stands is that, to the question “what sources do you rely on for information about hair products and tips?”, more than 60% of the respondents said that recommendations from stylists are a leading factor in haircare purchasing decision.

To summarize, the company strategically gathered professional stylists in order to create an unpaid network of advertisers that increase awareness and build credibility for the brand.

Asset-light operating model: compared to most of competitors, OLPX operating structure gives it a competitive advantage, especially at its stage of the business cycle. Here are the reasons why:

- Focus on R&D and Customer: the business model is created in such a way that the company can focus on developing new products after having collected customer and professional feedbacks. The execution part of the business is then passed on to other service providers.

- Financial Flexibility: another important feature of the asset-light business model is the relentless focus on de-risking the business model by reducing operating leverage. Asset light businesses are famous for turning every fixed cost into a variable cost. Even if hair care is pretty stable, OLPX is operating solely in the premium end of the market, hence financial flexibility might turn out to be a nice feature to have.

- Faster Response Times: one of the most important characteristic features of asset-light business models is the ability to quickly respond to customer requests and changing demands.

Sustainable Growth

Global hair care represented a $82bn opportunity in 2021, but OLPX operates only (at the moment) in a subset of the hair care market which is prestige hair care. It represents a $13bn category and accounts for just 16% of the overall hair care market globally, but this is expected to change with OLPX being a driving force behind the “premiumization” of the market, a phenomenon already observed within the makeup and skincare segments for example.

Taking a look at the current per capita spend on prestige hair care compared to prestige skin care demonstrates a strong market potential. Simplistically, the global prestige hair care market today is $13 bn in size and per capita spend is $1.70 (only 24% the spend of skin care),

In other words, if per capita spend for prestige hair care shift toward the one observed in skincare, it would significantly increase the prestige hair care TAM. In addition, this market is pretty fragmented with the top 3 players representing less than one third of retail sales. Consumers have been looking for more differentiated products and given OLPX unique products, coupled with their ability to digitally engage with stylists and final user, the company is exceptionally well-positioned to consistently grow its share of the market.

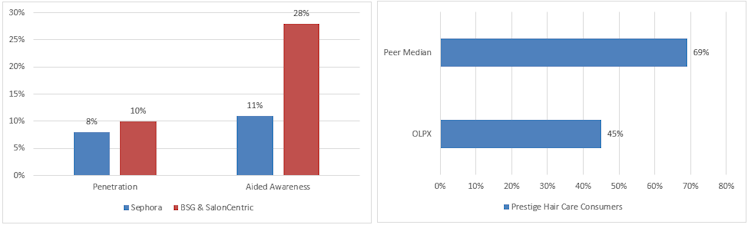

More interestingly, the company still has a lot of room to grow, as its penetration of specialty retailers and professional distributors, and aided awareness are still very low.

Source: company data

Accordingly, the company estimates that 45% of prestige hair consumers have aided awareness of the OLPX brand, which compares to the median 69% for its competitors. We expect brand awareness to rise, and given strong conversion rate (8% penetration at Sephora with just 11% of aided awareness), its represents OLPX greatest near-term upside opportunity, especially given OLPX impressive repeat sales rate of 17%, way higher than hair care peers (4-6%).

Longer-term, the company has multiple options to support sustainable double digits growth:

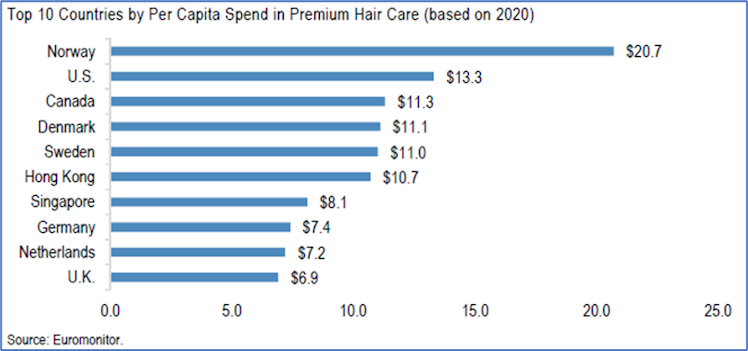

- International: new avenues for growth derived from entering markets where the company does not currently have a presence. OLPX mentioned that it expects roughly half of its growth to come from outside of the US in the medium- long-term. At this stage, the developed markets should offer the most tangible near-term international opportunity. European countries accounted for six of the top ten countries by per capita spend in the premium hair care category in 2020. However, China and Latin America are expected to be the main long-term growth drivers.

- New products: Despite having a suite of 11 products, there are still plenty of premium hair care sub-segments the company does not address currently. The main one being hair color where OLPX is completely absent. Another opportunity resides in adjacent products. As already mentioned, the company’s patents portfolio includes application of its key ingredient to skin and nail care. Regarding the major beauty sub-categories in the premium segment, skin care has generally been the fastest growing sub-category in recent years and is expected to maintain its growth leadership through 2025. Global skin care represents a $155bn opportunity and it’s worth mentioning that an OLPX’s survey showed that 82% of consumers familiar with the brand would like to see a skin care line from OLPX and 51% would switch out their current skin care brand for an OLPX skincare line.

Financials

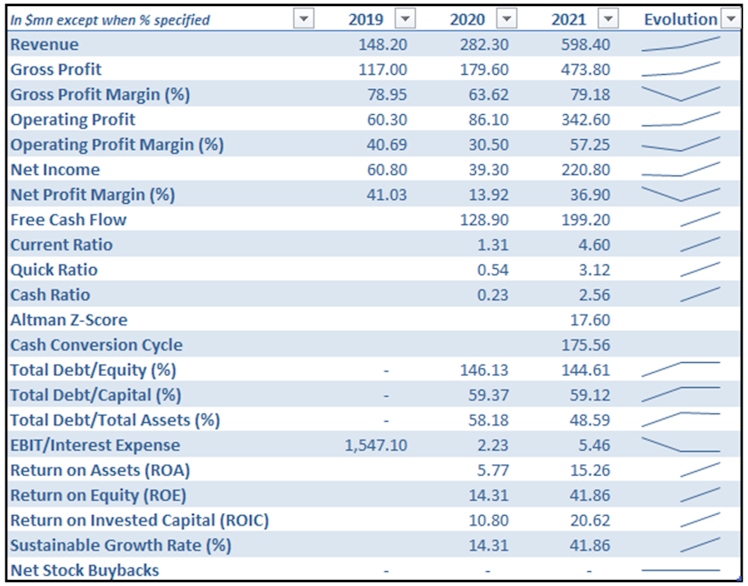

Since the company is pretty recent and only IPO'd a year ago or so, we will focus on 2021 numbers but mainly on the outlook.

Fiscal Year 2021 compared to Fiscal Year 2020:

Net sales increased 112.0% to $598.4 million

- Net sales increased 131% in the United States and increased 91% internationally.

- Professional increased 65.8% to $259.0 million, or 43.3% of net sales.

- Specialty Retail grew 246.6% to $176.0 million, or 29.4% of net sales.

- Direct-To-Consumer rose 117.1% to $163.0 million, or 27.3% of net sales.

Net income increased by 462.1% and adjusted net income increased by 110.2%. Diluted EPS was $0.32 for fiscal year 2021, compared to $0.06 for fiscal year 2020. Adjusted Diluted EPS was $0.40 for fiscal year 2021, compared to $0.21 for fiscal year 2020.

From a liquidity point of view, current assets represent 4.6x current liabilities, mainly due to IPO proceeds in 2021. As of Q2 2022, the company has enough cash to cover more than 2x total current liabilities. From a solvability perspective, OLPX level of debt is reasonable given its growth profile. As per latest earnings, the net debt represents 68.57% of total equity, down 141.5% YoY. Given the company’s ability to generate cash and high margin profile, we believe OLPX will quickly delever its balance sheet, and it is confirmed with the downward slopping gearing trend observed YoY. 2021 EBIT was at a level able to cover more than 5x the company’s interest expense. The Altman’s Z-Score way above 3 (17.6) shows that OLPX probability of bankruptcy is close to 0. Global solvability is good.

The company is FCF positive and stock based compensation represented only 2% of the 2021 FCF. The company went public a year ago and so logically, has not repurchased shares and has a retention ratio of 1.

Outlook:

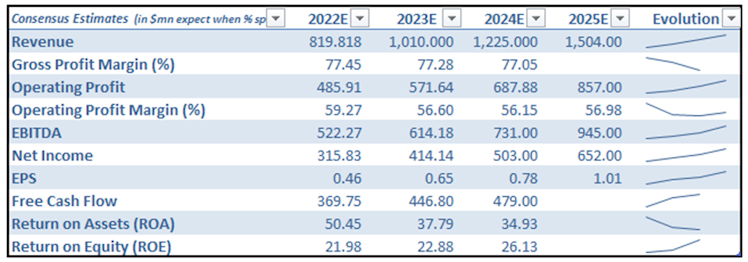

Revenue grew exponentially over the last few years and is expected to reach $1.5bn by 2025,

growing at an implied c.25% CAGR from 2021 sales. As already explained in the above section and given OLPX multiple upside paths, we believe this growth rate is more than achievable.

OLPX currently operates with an attractive margin structure thanks to its asset-light business model (almost 80% of gross profit margin in 2021). OLPX is not expected to bring manufacturing in house however, consensus expects COGS to increase due to its international expansion (negative supplier mix) and inflation. When we couple OLPX's relatively leaner cost structure with the company's premium positioning allowing from strategic pricing across the portfolio and favorable channel mix shift impacts as the company grows (DTC exhibits

higher margins), we believe the company can maintain gross profit margins in the high 70s.

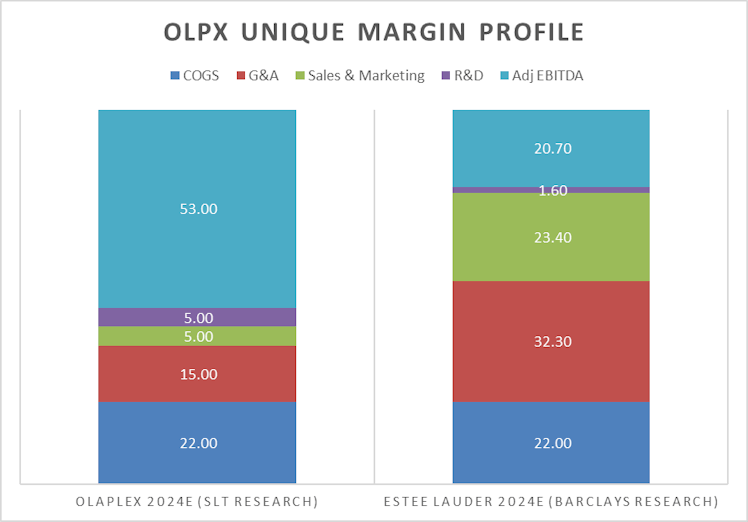

Even if gross profit margin is comparable (slightly higher) to competitors, OLPX differentiates

itself with relatively low operating expenses:

- SG&A: OLPX operates an extremely lean organization of 100+ employees with no corporate headquarters. The company generated c.$6mn of revenue/employee (around 6x more productive than Estee Lauder or L'Oréal for example). Another interesting feature is the low sales expenses. As previously mentioned, community based marketing is at the core of OLPX low customer acquisition cost. With OLPX word of mouth advertising and combined with increased brand awareness, we believe the company will be able to maintain relatively low SG&A expenses, around 20% of revenue over time.

- R&D: Research and Development costs were surprisingly (almost) non-existent during the last years. We expect, especially given OLPX attractive cost structure, the company to invest in R&D in order to stay ahead of the innovation curve. We would like to see R&D representing between 4-5% of total sales in the coming years.

The below graph is inspired from a Barclays Research report and, in our opinion, represents easily and visually, the company's unique margin profile. OLPX margins rival not just those seen across Consumer Staples, but likely place the company in the top tier of all companies in the S&P500. Even still, after assuming incremental investments as the business further scales, we can observe below that OLPX EBITDA margin is expected to be 2.5x higher than best-in-class beauty peer (Estee Lauder), and even further above the average Consumer Staples

company.

Source: SLT and Barclays Research estimates.

Management and ESG Considerations

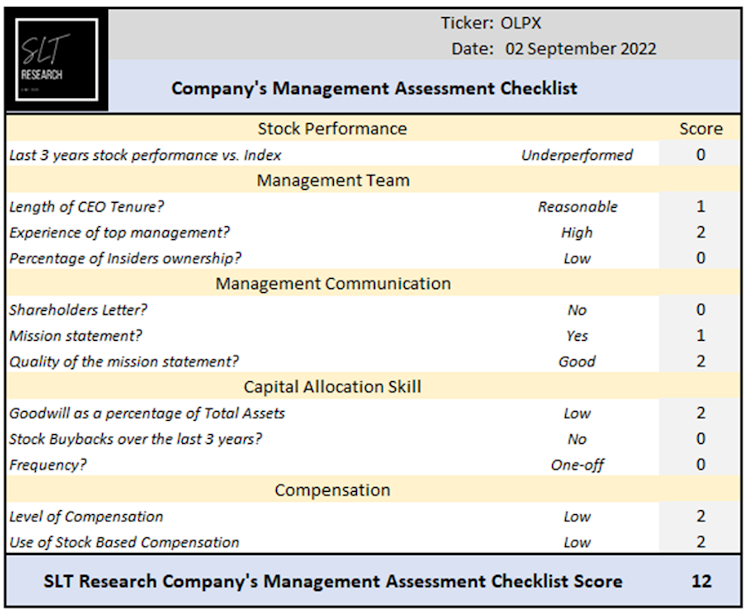

OLPX scores average following our company’s management assessment checklist. However

it is important to note that the stock performance and buybacks items impacted negatively the score but are not really representative since the company went public only a year ago.

Management has strong industry experience. CEO Jue Wong joined OLPX almost three years ago after departing Moroccanoil, a competitor offering hair and body care products. CFO Eric Tiziani joined OLPX in August 2021 and previously occupied a similar position at Unilever North America. COO & Chief Legal Officer Tiffany Walden is part of OLPX since 2016 where she occupied different positions.

To support our words, below is a tweet from Justin B.

The company historically made smart strategic decisions and the one that stand out to us is

the decision to go from the professional channel to DTC. The professional channel is highly strategic for the company as it effectively serves as a customer acquisition tool given professional stylists help to build and reinforce the brand’s credibility with consumers. DTC is a critical channel for OLPX going forward as it commands the highest margin as the company is able to price at retail value, offers the company timely insights on consumer trends, and

positions the company well in light of the structural consumer shift to e-commerce. Ultimately management created a synergistic omnichannel distribution strategy to drive consumer engagement.

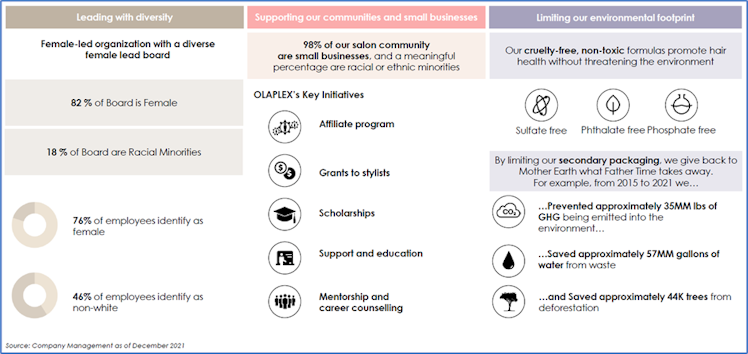

ESG: Across the broader beauty market, ESG characteristics are increasingly being factored in consumers’ purchase decisions, and ultimately becoming an important brand loyalty consideration. This trend can be particularly observed in the buying behaviors of younger consumers, which make up 56% of OLPX’s consumer base, per the company’s estimates.

Valuation

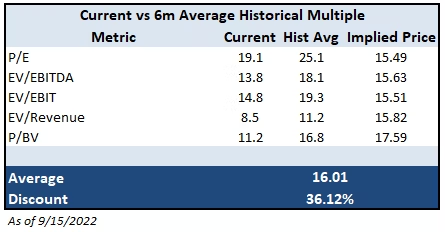

The company is trading at a more than 30% discount vs. average historical and well below -1

standard deviation. However, given OLPX short history as a publicly traded company, we believe it is more relevant to look at OLPX valuation on a relative basis compared to Beauty

peers, accounting for growth perspective differences:

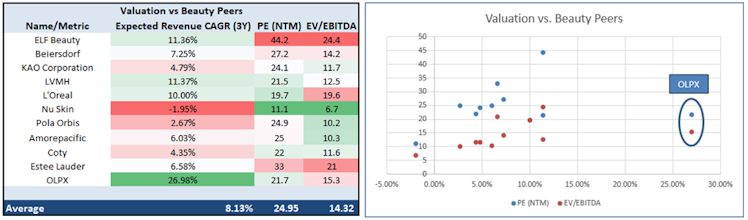

Interestingly, when we take a closer look at the relationship between future growth expectations for these companies vs. current valuation, multiples suggest that OLPX’s valuation is very attractive vs. its Beauty peers. OLPX trades at a PE ratio similar to L’Oréal but has its expected growth is significantly higher. When we compare OLPX to Estee Lauder which can be considered as its closest competitor, we can see that currently the company trades at a significant discount, using both PE and EV/EBITDA, while as we have seen before, OLPX is expected to post EBITDA margins 2.5x higher and to grow at a 3.1x higher rate.

Risks

- Competition: OLPX operates in the competitive beauty/hair care industry. We are confident with OLPX patents portfolio protecting its technology however, massive competitors like L'Oréal, Estee Lauder and Coty are investing massively in science-based products and if it reaches the same level of efficacity as OLPX products, it is likely to put downward pressure to OLPX margins.

- Lack of business diversification: OLPX currently operates with one brand in one category.

- Supplier concentration risk: OLPX's finished products are currently manufactured by just three third-party manufacturers. Cosway Company accounted for 70%+ of OLPX revenue.

As always, thanks for reading. We hope you have enjoyed this analysis. Please don't hesitate to upvote the post, and feel free to drop a comment if any further clarifications are needed.

Disclaimer: The information provided in this post is for information only and solely on the basis that you will make your own investment decisions after having performed appropriate due diligence.

Already have an account?