Trending Assets

Top investors this month

Trending Assets

Top investors this month

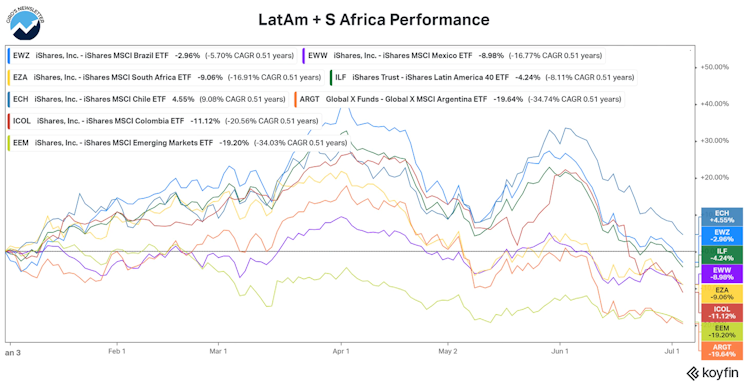

Stock performance in LatAm

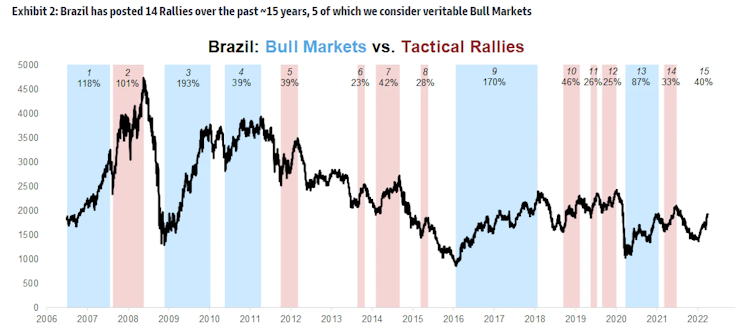

On Apr 10th, we dig up the fundamentals that explain a bull market for Brazilian Equities, splitting it between “tactical bull market” and “structural bull market.”

Even though the EWZ was registering a +35% YTD performance, we highlighted that election, global turmoil, higher expected rates increase, and funds’ technical positioning was terrible.

Fortunately, the timing was right, and most of LatAm’s ETFs are now performing in the negative territory in 2022.

Although we were not expecting a swift move in such a short time, let’s recall what we wrote about market cycles on Mar 6th:

That are multiple interrelated and overlapping cycles affecting markets:

- Structural cycles, long-term condition expectations of trend growth and inflation, and other factors might affect the long-term outlook.

- The global and business cycles, such as changes in growth and inflation relative to trend, impact returns in the medium term.

- Mini-cycles in risk appetite are often driven by a material change in growth rates or rate shocks caused by geopolitical or political risks or material shifts in monetary policy.

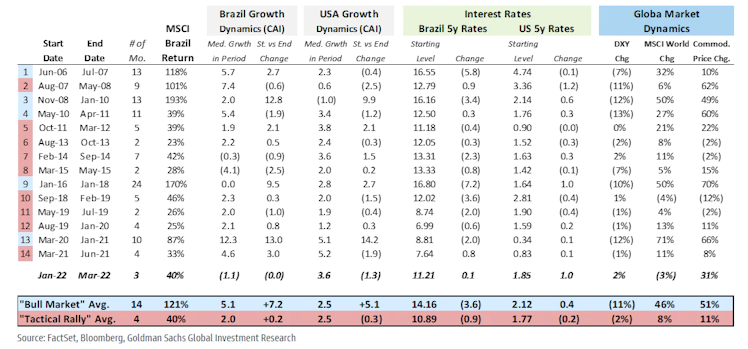

On Apr 10th, we dissect what a structural bull market looks like in Brazil. For every structural bull market that has ever happened, there was a particular combination of i) falling local interest rates, ii) accelerating growth rates (Brazil’s CAI), and iii) stable global markets.

EM equities and local bond yields are typically negatively correlated (especially for high-yielding EMs), so unsurprisingly, Brazilian interest rates rally during equity bull markets. For example, in the previous bull market, between 2016 and 2018, Brazilian equities had a 170% positive return.

The starting level for the Brazil 5y rates was 16.8%, dropping by 7.8% to 9%. This interest rate level is so monstrous that the Equity Risk Premium (Equity Yield - Bond Yield) is negative, meaning that index investing is not worth the risk.

Just considering the negative 7.8% impact on rates would be translated into a ~90% increase in equity value, partially explaining the 170% bull market rally. This is true for the previous cycles as well.

Nowadays, even though profits are skyrocketing with commodity prices, the Brazilian Federal Funds (“Selic”) increased from 2% to 13.25%, so it was hard to imagine equities overperforming bonds during the hikes.

Brazilian equities can post a bull market somewhat independently of US rate moves. However, there is a clear pattern that long-lived rallies coincide with significant US Dollar downside and large rises in global equity and commodity prices.

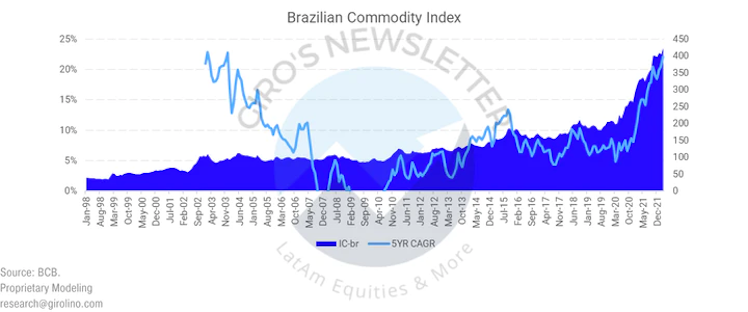

Currently, ~50% of Brazil’s Stock Exchange comprises companies benefiting from the higher global inflationary period, highlighting metals, mining, and oil and gas industries.

The Brazilian Commodity prices index hit its all-time high in 2022, with its five years annualized return also reaching its historical maximum.

However, it’s important to highlight that commodity prices without a supportive interest rate and supportive Dolar performance are insufficient to trigger a bull market or sustain it for long.

On January 30th, we wrote about how the FED suggested that near-term risk increased, and prices should adjust to that given the uncertain path ahead, indicating consecutive hikes ahead and a sizeable opportunity in the Oil and Gas industry.

Although Chair Powell clarified that FED’s job isn’t to set a floor to stock prices — the so-called FED Put, their decisions are influenced by stock prices and volatility.

In our last Food for Thought (“FFT”) edition, on July 3rd, we raised the possibility of gears changing. After collapsing the stock market and consumer confidence, the FED might turn to a dovish stance — more details in the following weeks.

giro.substack.com

Food for Thought #23

Fintech dilemma and the base case for 2H22

Already have an account?