Trending Assets

Top investors this month

Trending Assets

Top investors this month

Buy the dip in one of the companies with least top-line risk in semis: $ASML

If you prefer to read this post in a pdf (to underline or due to comfort), you can do that here. Don’t forget to come back to upvote it if you enjoyed it ;)

Summary

- ASML is a wide moat business in an industry that is out of favor.

- I go over the semiconductor industry and how ASML fits in it.

- There might be a downcycle looming in the background, but we explain why ASML is expected to be resilient through it.

- Geopolitics and inflation are two other risks for the company, but I explain why there are not too worrying over the short term.

- I go over valuation from two angles: multiples and an inverse DCF.

My idea for Commonstock’s Buy The Dip Competition might be controversial: it’s ASML. I say it might be controversial because semiconductor companies are entirely out of favor right now, with many signs pointing to a semiconductor bust and a rapid fall in demand. Investors willing to invest in semis might be uncomfortable going against the current but…

In investing, what is comfortable is rarely profitable. - Robert Arnott

It comes without saying that ASML might drop more from here, but that’s just something unpredictable. I also think estimating a 12-month return is quite complex (if not impossible) because, over a short period, the market rules valuations, not company fundamentals.

This post aims to guide you through the reasons that might help ASML insulate from a supposedly incoming bust and explain why I think it’s one of the semiconductor equipment companies with the least top-line risk. To achieve this objective, I’ll follow this index:

- Introduction to ASML and where it fits in the industry

- What has happened to semiconductor stocks: The shortage, the rise and the fall

- ASML’s protection against a semiconductor bust

- Geopolitics: The China ban and the Chips Act

- Inflation risk?

- Valuation

- Risks

- Semis typically lead

- Conclusion

Note that points 1 and 2 aim to give some context on the semiconductor industry and the company, whereas the rest are more focused on why ASML might be a safe investment over 12 months.

Before jumping right into the discussion, I discussed ASML with the guys at Chit Chat Money. The podcast has just been released (timely) and addresses some of the topics I’ll discuss in this post. You can listen to it here.

Without further ado, let’s get started!

(1) Introduction to ASML and where it fits in the industry

Before going into what ASML does, I think it’s essential to understand where it fits in the industry. When I started researching the company, I felt lost reading the annual report because I didn’t really know how the semiconductor industry was organized.

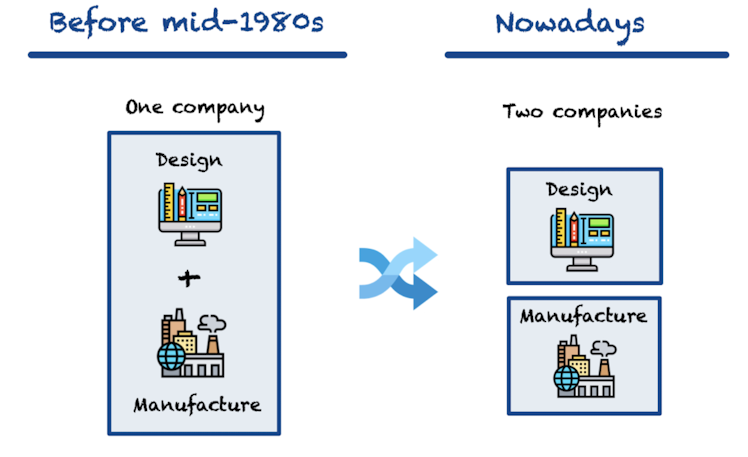

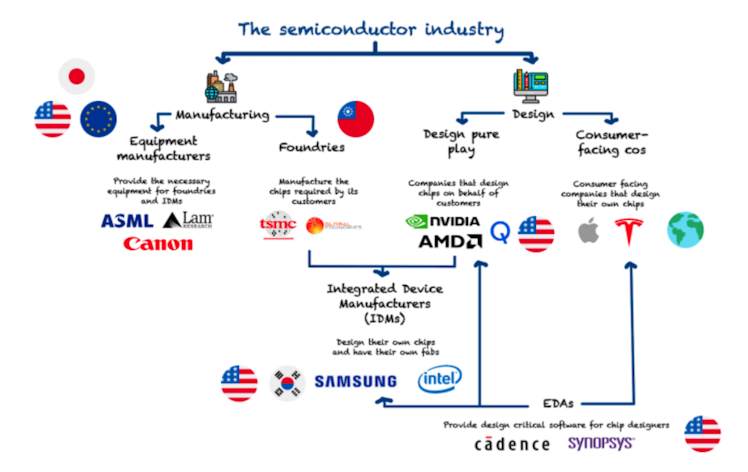

The semiconductor industry is divided into two main parts: design and manufacturing. Until 1980, these two parts were carried out by the same companies (known as “IDMs” or Integrated Device Manufacturers), but, as the costs to run a fab increased exponentially, they were separated and carried out by specialist companies.

Companies that specialized in design were known as Fabless (because they didn’t own a fab), and companies that specialized in manufacturing were known as Foundries. Today, companies such as Nvidia or AMD can be considered Fabless companies, whereas companies such as TSMC can be considered Foundries. IDMs did not entirely disappear (Intel, Texas Instruments…), although they are rare now.

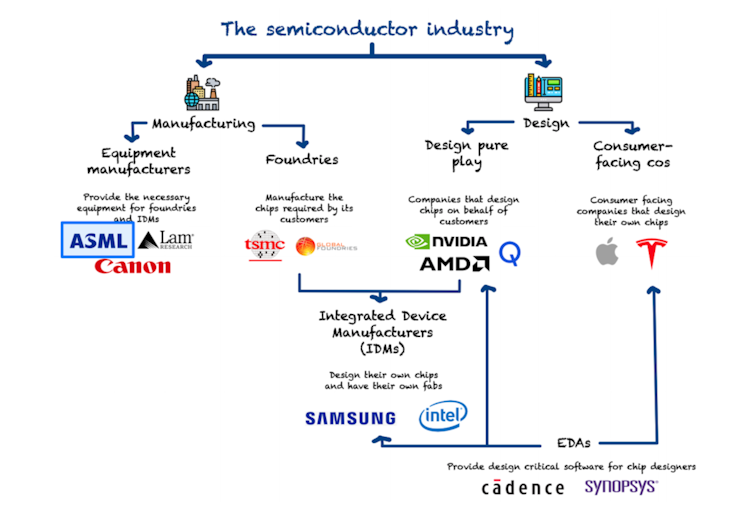

You might be wondering, where does ASML fit? Is it a foundry, or is it a fabless company? The answer is: “none.” Over the decades, as chip manufacturing increased in complexity, a whole ecosystem was built around fabless companies and foundries. As Moore’s law advanced, design companies needed specialized software to fit more transistors into the same area, so EDAs (Electronic Design Automation) were born. Due to more complex designs, foundries relied more and more on external equipment suppliers (during the very beginning, they built their equipment in-house). This segment is precisely where ASML fits.

I prepared the following chart to illustrate how the semiconductor industry is organized (company logos are not exhaustive):

ASML is an equipment manufacturer that serves foundries and IDMs. The company has two main business lines:

- System Sales (74% of total sales in FY 2021): sales of lithography and metrology and inspection equipment to chip manufacturers

- Service and field option sales (26% of total sales in FY 2021): software updates for the systems and “consultancy” services for chip manufacturers to help them run the systems. This business line is directly related to the size of the installed base.

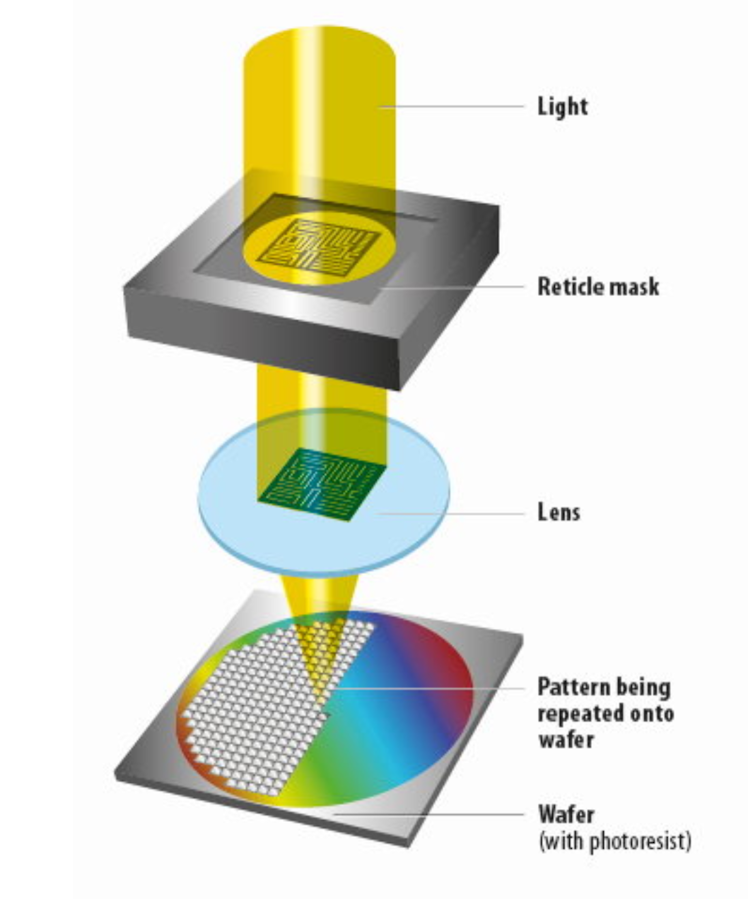

ASML’s bread and butter is lithography equipment, which is used to print the previously-designed chip pattern into a silicon wafer by passing light through a mask that contains the design. This is a simple visual representation of how it works:

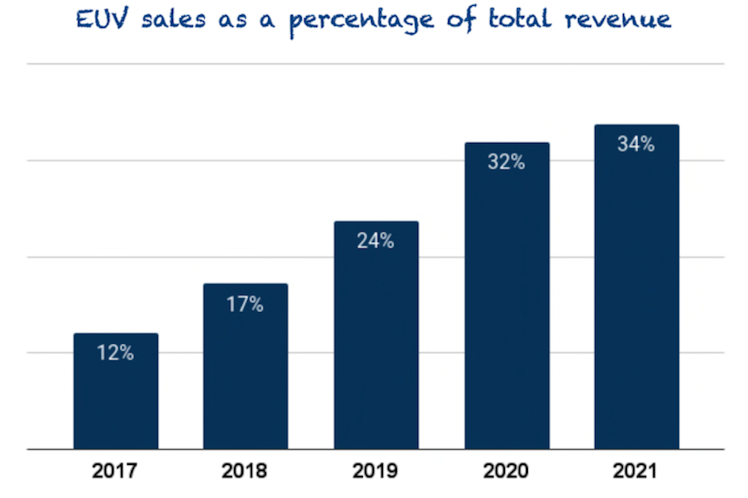

The company has been investing billions over many decades in this technology and has managed to lead the DUV (Deep Ultraviolet) segment and enjoy a monopoly in EUV (Extreme Ultraviolet) segment. DUV can be understood as “trailing edge” lithography equipment, whereas EUV is the “leading edge.” The main difference between both is the light source used.

The most advanced chips nowadays require EUV, although DUV is also used for the majority of the layers in these chips. As technology advances, chips will increasingly require more EUV layers.

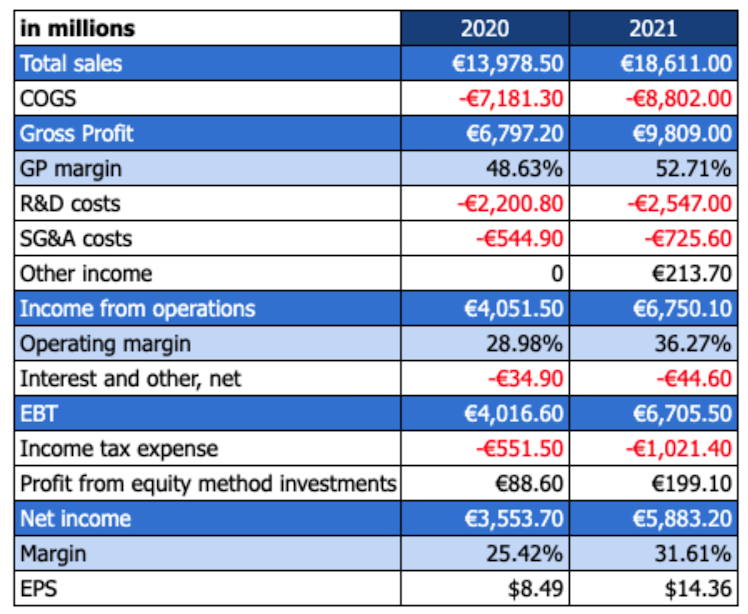

With the rise of semiconductors and a staggering reliance on lithography, ASML has grown fast and is now one of the largest companies in the world. Financials for the last two years can be found below so you can grasp company size and profitability:

As you can see, ASML enjoys healthy gross margins, which are passed through to a great extent to the bottom line thanks to the company’s dominant position.

Summarizing this first section (which I don’t intend to make the central part of the discussion): ASML is an equipment manufacturer in the semiconductor industry. The company is the leader in lithography equipment used by foundries and IDMs to “print” the design of a chip onto silicon wafers. With the rise of the semiconductor industry in general and the increased use of lithography equipment in manufacturing, ASML has become one of the largest and most essential businesses worldwide.

(2) What has happened to semiconductor stocks: The shortage, the rise and the fall

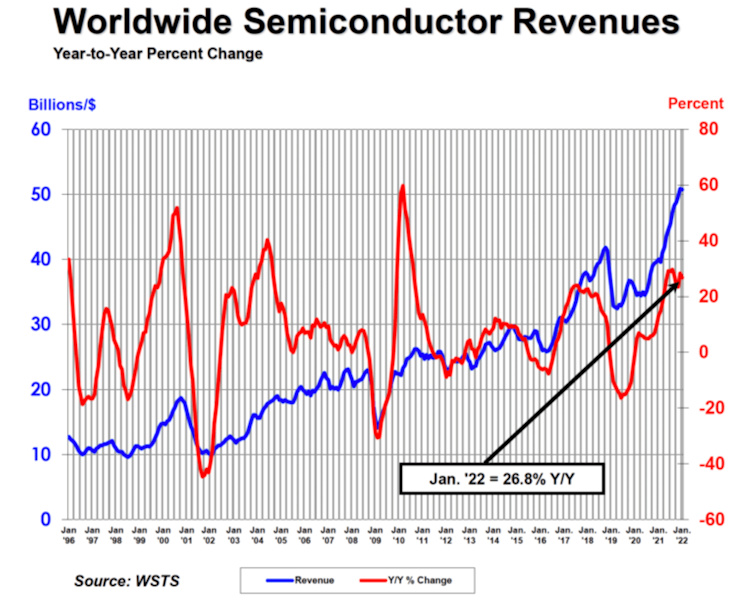

The semiconductor industry has historically been cyclical, suffering periods of boom (where demand clearly outpaces supply, making prices rise) and bust (where the opposite happens). However, despite these cycles, the long-term trend has remained intact, and the industry has grown by a factor of 5 in the last 25 years. Moreover, this trend is expected to accelerate as more of the world jumps into digitization:

Why do violent cycles happen in the semiconductor industry? The explanation is quite simple. When demand is high and outpaces capacity, chip manufacturers start building new capacity (i.e., fabs) to try to meet all the future demand. However, building a fab can take several years, and, during this period, demand might change significantly. The result is that when capacity comes “online,” demand might be low, creating an oversupply that makes prices collapse.

During COVID, many chip manufacturers halted production due to lockdowns and reduced demand. The problem was that when the world opened up, demand picked up quickly and outpaced supply. As a result, inventories dried up and left chip manufacturers “behind the curve.” Of course, this shortage made prices skyrocket, and many chip companies benefitted from the shortage.

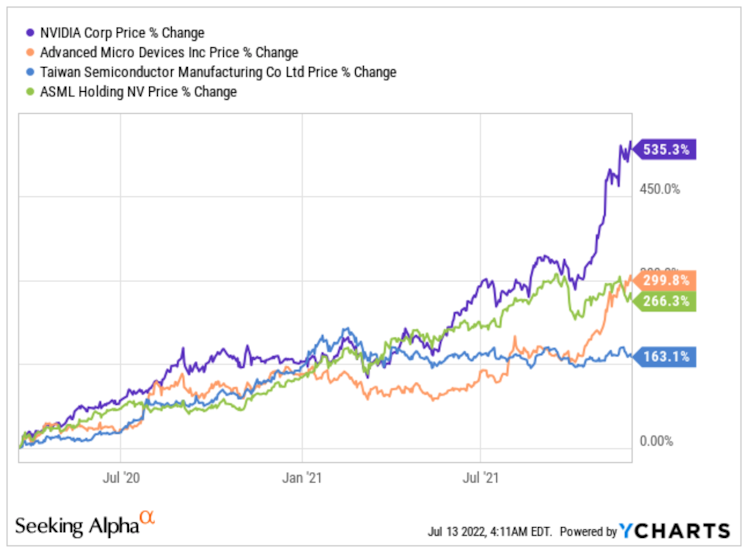

From the bottom in March 2020, many semiconductor stocks became baggers fast:

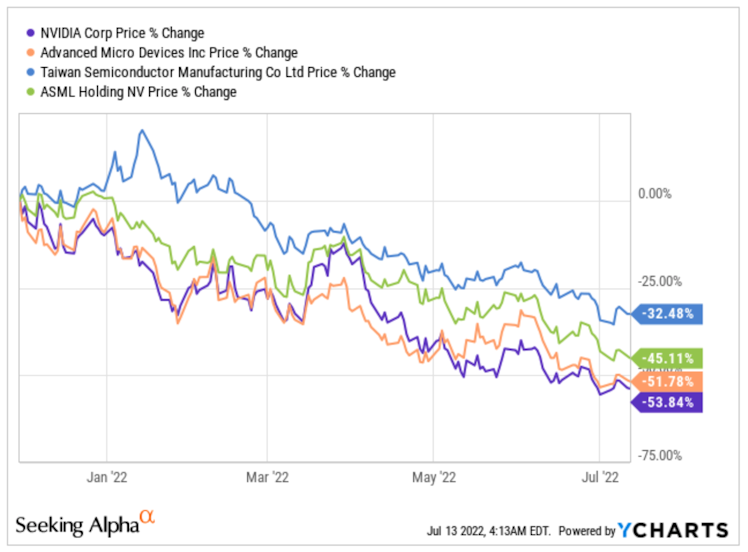

Of course, this move didn’t seem sustainable, and they have been dropping substantially since November:

So, what happened? The market has changed its perception and now believes that the capacity expansions these companies have undertaken during 2021, together with a possibly lower demand caused by a recession, are driving the industry into a violent semiconductor downcycle. While this prediction might turn out to be accurate, I doubt it will impact the long-term secular tailwind that semiconductors are expected to enjoy. However, as this pitch focuses on the next twelve months, I’ll explain ASML’s protection against a potential downcycle over the short term.

(3) ASML’s protection against a semiconductor bust

First, it goes without saying that the market is already pricing in a semiconductor bust in semiconductor stocks. Of course, I don’t know to what extent the downcycle is being priced in (and I don’t think I’ll spend my time predicting it), but knowing that the market overshoots both ways, we don’t have any reason to believe the market is being conservative here.

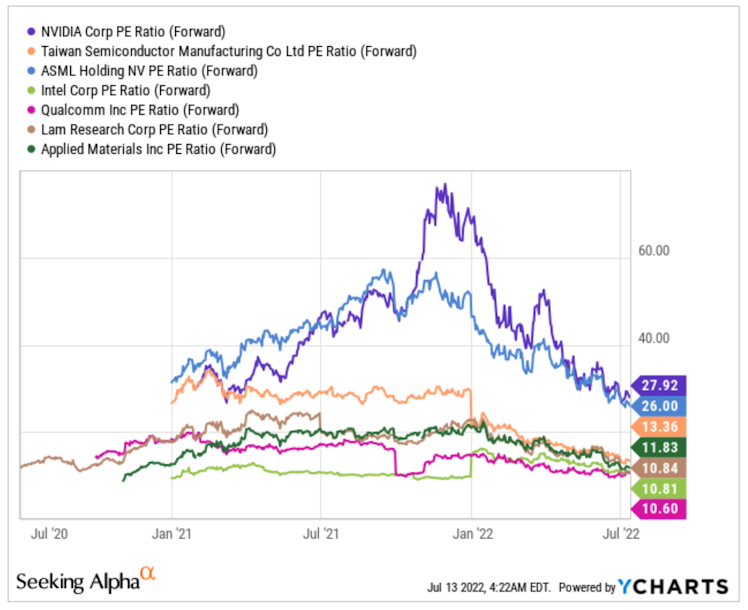

Forward valuation metrics for many chip companies have collapsed from their peak. They don’t seem high anymore after accounting for the growth the industry is expected to enjoy going forward:

The debate here is that, while stock prices have contracted, the forward earnings estimates have to come down still to reflect the semiconductor bust (i.e., they have not been revised yet), making these companies optically cheap but realistically expensive. While this is a fair argument, I think ASML must not be bundled with the rest. Let’s see why.

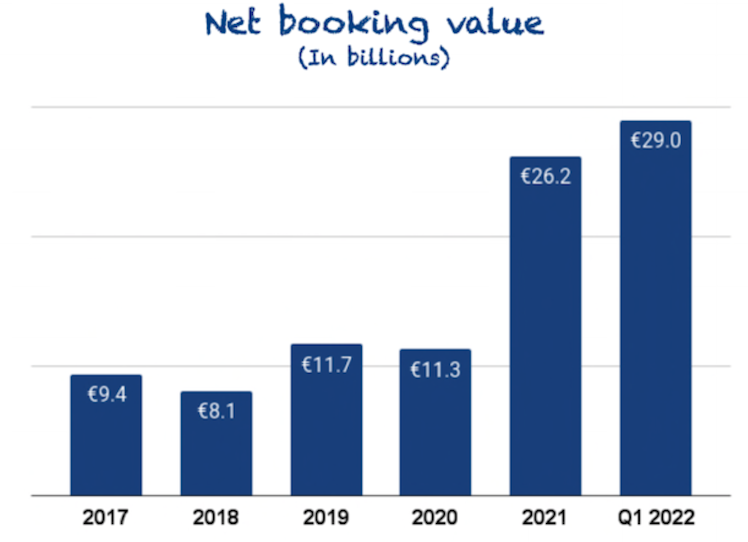

ASML currently has a supply problem. The company is unable to meet demand by a hefty margin. If we look at Net Bookings (which measure how much of the demand has not been serviced yet), it has gone exponential amidst the semiconductor shortage. Net bookings currently stand at €29 billion, while 2021 revenue was €18.6 billion, so there’s potentially more than a year’s worth of demand yet to be serviced:

ASML’s supply problem is not expected to be resolved anytime soon because lithography systems are very complex to manufacture (some have more than 100k parts), and the manufacturing cycle is quite long. Additionally, most parts are manufactured by third-party suppliers (hundreds), so a capacity expansion plan must be agreed upon with the whole supply chain (something the company is working on right now).

Many investors argue that this “Net booking value” metric is not 100% reliable because a considerable amount might be attributable to double ordering. Double ordering comes from the fact that ASML’s customers might have ordered too many systems when demand was outpacing supply but might now cancel these orders if the demand landscape changes (and it seems to be changing). This, in my opinion, is a fair point when it comes to DUV but is not as founded when it comes to EUV.

DUV might indeed suffer cancellations because it’s more commoditized, and customers don’t depend heavily on it to differentiate from peers. ASML also has competition here so customers might have an alternative if cycle times are long once they re-order the systems.

However, EUV is an entirely different story. ASML’s main EUV customers are TSMC, Intel, and Samsung, and they do rely heavily on this system to differentiate against competitors. Not long ago, Apple ditched Intel and went to TSMC because the latter was able to make the most advanced digital chips thanks to ASML’s EUV technology and their knowledge on how to use it appropriately. I highly doubt that any of these companies will cut their EUV orders putting their competitive position at risk. Intel would fall into the same mistake yet again.

Another reason EUV might be resilient in a downcycle is that many customers are making prepayments to receive these systems. For example, Intel recently announced it would receive the most advanced EUV system (high-NA) around 2025, which it had to make a prepayment for (the amount was not disclosed but was probably a hefty one). This means that if Intel were to cancel this order now, it would not only risk its competitive position but also forego this money. EUV orders currently take two years to be met, and that’s not a queue high-end chip manufacturers would be willing to go at the back of.

As the chip industry shifts to EUV, ASML becomes more protected against a future downcycle:

ASML’s reliance on EUV has accelerated recently, but it should accelerate even further in the coming years thanks to increased demand and high-NA EUV (its most advanced system), priced around $300 million a piece.

Now the obvious question is: what if DUV orders get canceled en-masse? There’s a pretty substantial buffer here too. In a recent conference, ASML’s management stated that DUV is undersupplied by 40%, which means that even if DUV orders are cut by 20%, there’s still a 20% buffer until these cancelations reach the top line of the company.

All in all, the semiconductor industry might be going into a challenging period where demand might fall, and capacity expansion plans might stagnate. Even though all semiconductor stocks have come down significantly to reflect this, I think that ASML has the least top-line risk for the above reasons. I see there are two possible scenarios:

- The downcycle is short-lived: in this scenario, order cancellation will not reach ASML’s top-line (only net booking value would be impacted)

- The downcycle is long-lived: in this scenario, order cancellations might reach the top line but the impact wouldn’t be huge

I am inclined to believe that scenario 1 is more probable, and thus why I am here writing this pitch.

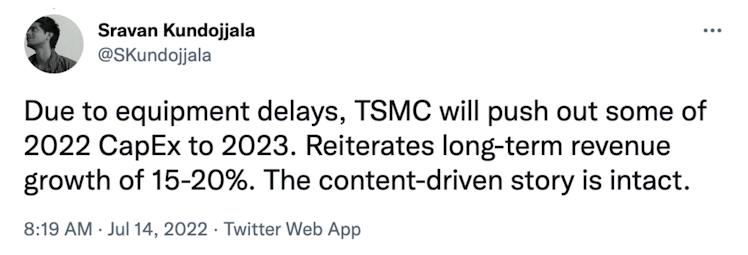

Fresh news: TSMC’s Capex

TSMC reported earnings today and they were pretty good, showing that execution also matters and we shouldn’t extrapolate individual company performance to a whole industry too fast. The most interesting part for the ASML thesis was the following:

CapEx for 2022 will be lower than anticipated, but this is only to equipment delays not due to cancellations. This evidences further that supply constraints will help ASML insulate from cancellations and is great to see.

(4) Geopolitics: The China Ban and the Chips Act

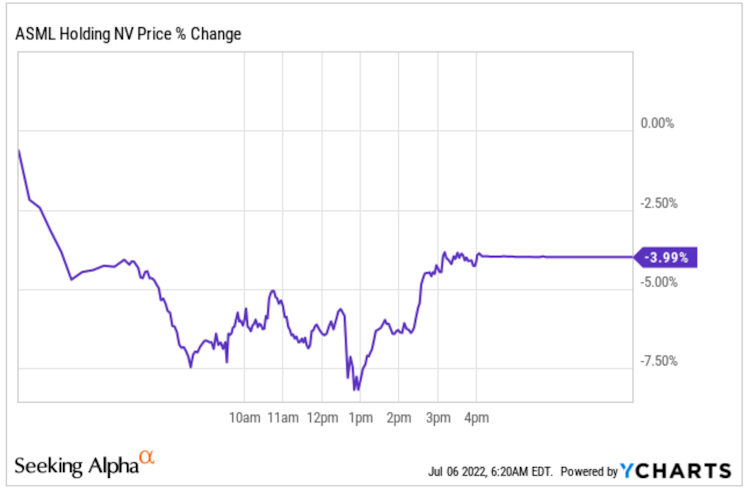

ASML is one of the most important companies in one of the most important industries worldwide, and as such, it’s not immune from political debate and “intervention.” Last Friday, Bloomberg released a report stating that the US was pushing the Netherlands (ASML’s home country) to ban exports of DUV equipment to China. EUV exports have been banned for a long time, and DUV is the next move by the US to isolate China from chip manufacturing technology.

As you can imagine, ASML’s stock dropped quite substantially after the announcement, although it was aided by general market sentiment to end the day on a rather positive note considering the circumstances:

Losing China as a market might sound really worrying, but the truth is that it “only” makes up 14% of ASML’s sales (FY 2021). China is the largest consumer of semiconductors, but when it comes to manufacturing, the country has been left behind and is the 6th player. China is mostly absent from the global semiconductor supply chain:

Even though 14% is lower than some might have expected, isn’t this a threat to our 12-month thesis? The answer is no, due to two reasons.

First, as we saw before, ASML is supply-constrained (especially in DUV), so if China’s demand were to fall off, the undersupply percentage would get shorter. Still, it wouldn’t impact the company’s financials as those systems would go to other customers waiting in the queue.

Secondly, there’s another side of the coin to the geopolitical battle besides blocking China. The US and the EU want to secure the domestic supply of semiconductors due to its strategic importance (the EU especially doesn’t want to repeat what happened with the energy crisis), so they are in the process of passing the Chips Act to incentivize domestic manufacturing. It must be working because TSMC, Samsung, Intel, and Global Foundries (all ASML customers) are already announcing important investments in these geographies.

A large percentage of the cost of a fab is the equipment it includes, and ASML manufactures a significant portion of this equipment, so this should be a pretty substantial tailwind that should help counter some of the China-ban impact. For these reasons, I think that ASML’s top line is also protected over the short term from geopolitical risks, and it might benefit from them over the long term. This said, the China export ban is just a rumor right now, and we’ll have to keep a close eye on its evolution.

(5) Inflation risk?

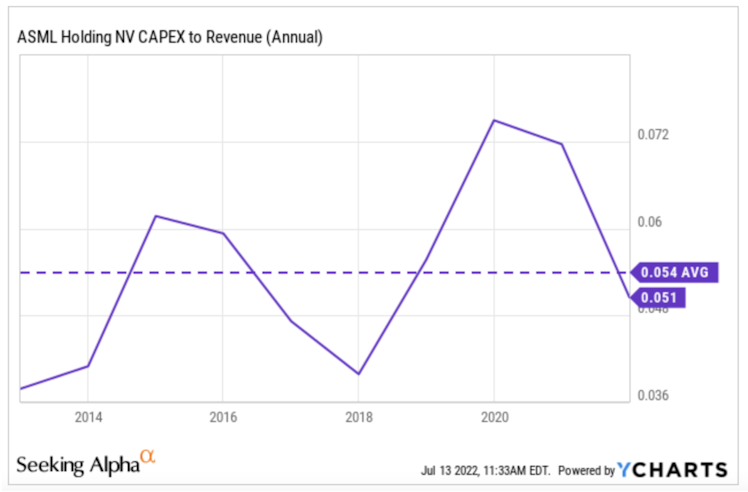

How can I pitch a capital-intensive manufacturer during an inflationary period? Aren’t these companies worse off during such periods? The answer to the second question is obviously a resounding “yes,” but counterintuitively, ASML has a capital-light model. CapEx as a percentage of revenue has averaged 5.4% over the last decade:

How is this possible? The answer lies in the supply chain. As ASML outsources most of the manufacturing of the parts needed for its systems, Capex is borne by its suppliers. These suppliers have either little bargaining power with ASML or are owned in part by the company, so the rise in commodity prices has only marginally impacted the company. In addition, ASML’s strong pricing power has allowed the company to defend margins amidst the inflationary environment.

(6) Valuation using two methods

I’d like to come at valuation from two angles: multiples and an inverse DCF.

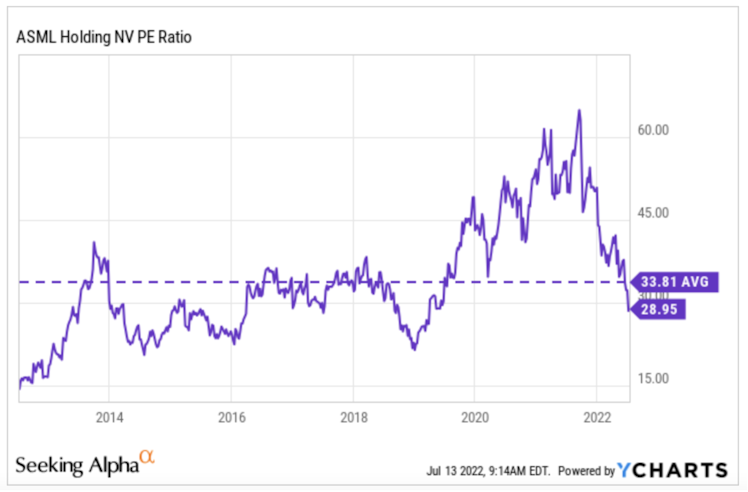

Multiples: ASML currently trades at around 29x LTM earnings and 22x NTM earnings. LTM P/E ratio is below its 10-year average of 33x, although we must take into account that the past is never a perfect proxy of the future, especially in the current volatile interest rate environment. It’s also true that an argument can be made about the stronger competitive position of the company now with respect to 2012, especially considering that the shift to EUV (where ASML is the sole manufacturer and the moat is the widest) is currently underway:

Regarding the forward P/E, skeptics can indeed argue that the “E” might not be sustainable as it has not been revised downward yet. This would make the stock optically cheap on a forward basis but realistically expensive (depending on the downward revision). While this makes sense for many semiconductor companies, part of this report has been oriented on demonstrating that the ASML’s “E” is more sustainable than that of its peers, at least over the immediate short term. If I were to give my opinion on these numbers (subjective as it is), I would say that paying 29x LTM earnings and 22x forward earnings for a monopoly in such a high-growth industry is not excessive. Of course, it’s not ridiculously cheap either, but that’s the price you pay for quality.

Inverse DCF: doing a two step inverse DCF I also conclude that the company might be reasonably valued. I prefer inverse DCFs to “regular” DCFs because it takes all the forecasting (which I don’t think anybody is good at realistically) away from the exercise and lets me see if what is baked into the price is reasonable.

At the current price, this is what is baked in:

- FCF growth years 1-5: 13%

- FCF growth years 5-10: 10%

- Terminal rate: 3%

- Discount rate: 10%

There’s an important thing to take into account, though. FCF for 2021 was north of €9 billion, but I decided to bring this down to €6 billion because some of this FCF is not sustainable as it comes from the prepayments made for high-NA EUV which are not expected to be recurring in nature. This is also the reason why investors shouldn’t use FCF metrics to value the company. It appears optically cheaper than it really is by using the FCF yield or the P/FCF.

I think ASML can beat these numbers, driven by EUV and DUV systems sales, growing revenue from ancillary services to its installed base (which are higher margin), and a small portion of additional prepayments for high-NA EUV. However, it’s also important to consider that when a high-quality and durable business appears fairly valued in an inverse DCF, it’s probably undervalued. I outlined the reasons behind this in the following article: ‘What makes quality undervalued’.

(7) Risks

Not everything is beautiful at ASML, and there are two main risks that investors should take into account. The first one is the possibility that the government gets so involved that the company gets close to being nationalized. I think it comes without saying why too much public intervention is bad for a private company.

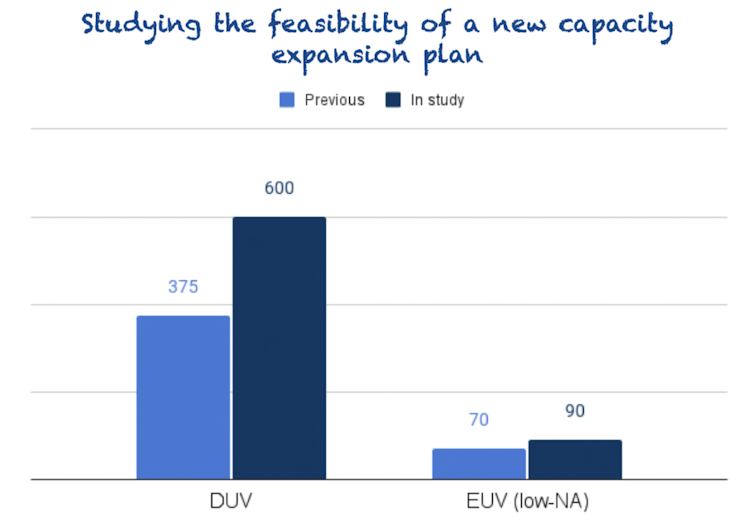

The second risk is the fact that the company fails to expand capacity to meet future demand. This is not worrying from a competitive standpoint because there is no alternative (so customers can’t switch) but would obviously put a cap on future growth. Management recently said they are planning an important capacity expansion plan with suppliers, which will be fully communicated to shareholders during investor day. As it stands, these are management’s objectives for capacity (the graph shows expected capacity in 2025):

Anyhow, both of these risks are longer term in nature and should not impact the short or medium term of the company thanks to its supply-constrained nature and the absence of alternatives.

(8) Timing: Semis typically lead

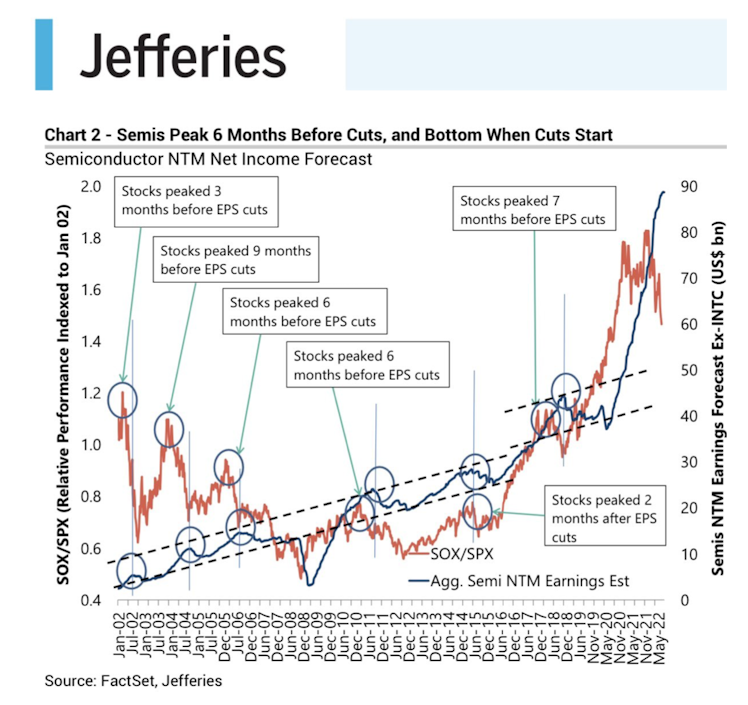

I never try to time the exact bottom because I feel it’s impossible to do, and I might miss a great deal of the upward moves. It’s important to understand that volatility moves both ways, up and down. This said, I came across this chart that portrays how semiconductor stocks bottom well before the cuts start to spread across companies:

Of course, I wouldn’t base any purchase or sale decision on the chart above, but it’s something worth noting for those investors trying to wait for clear blue skies before opening positions. It’s ironic how the market works, but when the consensus is that the risk is high, it’s probably the safest time to invest, whereas when there’s no risk looming in the background, the market is at its riskiest point.

(9) Conclusion

I hope this post helped you understand ASML, where it fits in the industry, and why I think it’s one of the safest stocks in the semiconductor space amidst a looming downcycle. Of course, every investor should do their own due diligence because it’s the only way of truly building conviction.

I follow ASML (among other high-quality companies) in my research service ‘Best Anchor Stocks.’. There’s a two-week free trial if you want to try it out!

Disclaimer: nothing mentioned here should be taken as a buy or sell recommendation. This is just my opinion. Do your own due diligence.

Seeking Alpha

Stock Picks, Stock Market Investing

Already have an account?