Trending Assets

Top investors this month

Trending Assets

Top investors this month

Atacama Copper: A Formula for Success

I have repeatedly mentioned the risks involved when investing in the junior mining sector, from paid stock promoter deception to geopolitical risk, to "lifestyle companies" and poor drill results, share prices can drop off of a cliff overnight and news must be monitored constantly.

When you come across a company like Atacama, however, it makes you see why the risk/reward potential can be so appealing. With a management dream team in one of the most geologically promising areas on earth, it's hard not to get excited about what the future holds for $ACOP.V.

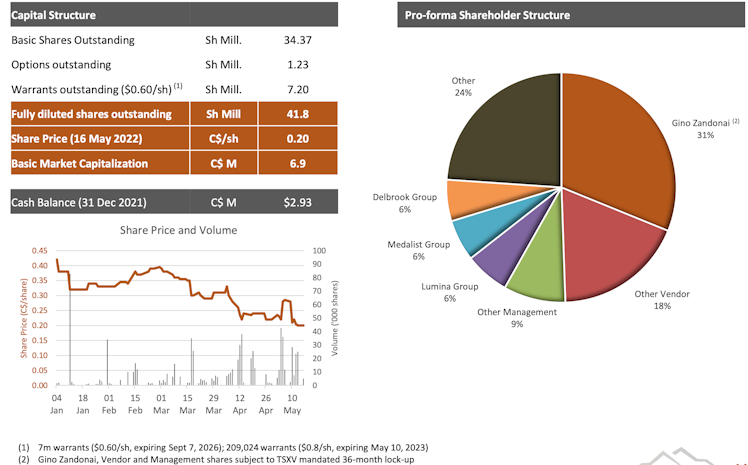

The link below is for an older Crux Investor interview with Gino Zandonai of Atacama Copper, but it's the first one I watched that made me keen on the company. At the 16:40 mark, Gino tells Crux that he aspires to be the next "top medium sized mining company in Chile" with a $300-$400 market cap in the next five years (now less than four). The current market cap for Atacama is ~$5 million so if Gino is able to achieve what he has set out to do, investors could look forward to a 60- 80x return.

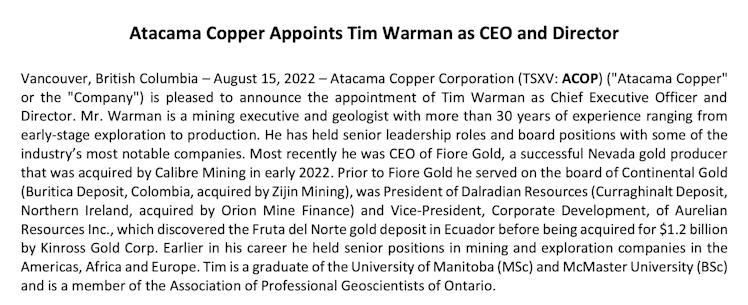

There are limited numbers of knowledgeable & experienced people left in the mining industry that are capable of bringing a mine from exploration to production, and Tim Warman and Gino Zandonai are two giants among them. Gino is now in the role of VP Business Development at ACOP so that he can pursue further acquisitions for the company - Gino is known as one of the leading experts in the Atacama region.

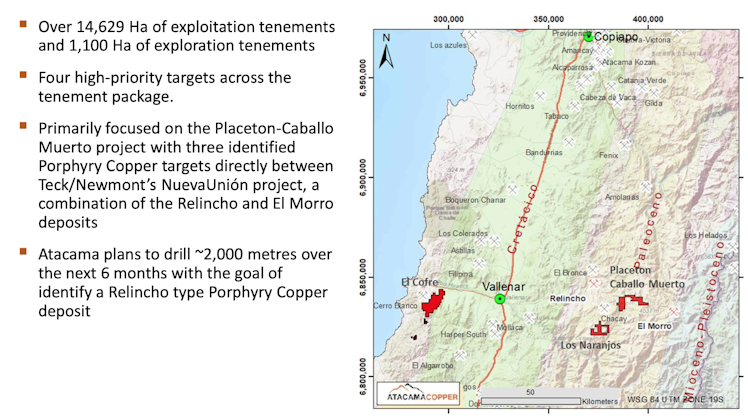

In their August 2022 corporate deck, Atacama states that drilling will occur over the next six months, meaning we should be wrapping up about now and results are likely due in the near future.

Backed by Lumina Group, it's not just Gino & Tim that bring a proven track record:

Inside ownership and strategic investors speak volumes:

Atacama hasn't seen a whole lot of love on the TSX-V, as investor impatience tends to get the better of some. With news expected shortly, I am happy to take some of those shares from the restless & risk-averse - because this one is definitely in good hands and I have high hopes that management will deliver.

Please DYODD - I'm always happy to answer any questions that I can.

Junior mining stocks are higher risk than other sectors and I don't usually invest more than 1-2% of my portfolio in them; it's highly unusual for me to exceed 5%.

Atacama currently sits at 4.8% of my portfolio.

Already have an account?