Trending Assets

Top investors this month

Trending Assets

Top investors this month

THE GLOBAL CAPITALIST: "Now Do Japan"

Hey all - check out my latest post on Substack: "Now Do Japan", where I chat about the Bank of Japan's uncharted path towards a tightening monetary regime.

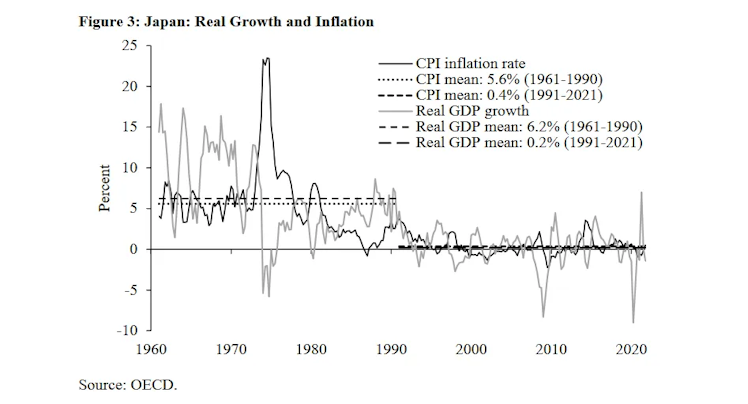

In February, Japan posted its highest inflation reading in over 40 years — invoking memories of the Baburu Jidai, or the “Bubble Era” of the 1980’s. Much ink has been spilled over this era of exuberance, which often finds parallels to other financial manias of lore, including the South Sea and Dot Com bubbles. Infamously, the Tokyo Imperial Palace, home of the Japanese emperor, once received an appraisal that valued the property greater than the collective value of Californian real estate. Of course, this boom era followed the entrenched bust known today as Japan’s Lost Decade, an era of paltry economic growth and deflation. Even today, the Nikkei 225 (Japan’s largest stock index) remains nearly 10,000 points (-30%) below the peak seen in 1989, prompting some to question if Japan had ever escaped their lost decade.

---------------

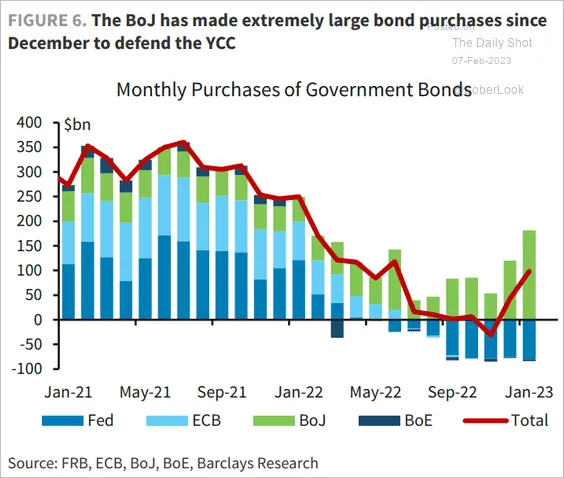

A reversal in policy, including the dissolution of bond purchases or a hike in interest rates, would represent a massive shift in philosophy from the BoJ. Not only that — but these actions would add considerable stress to the ongoing economic tightening attributed to the actions of central bank peers. It’s estimated that the Bank of Japan deployed upwards of $300B to defend the yield curve cap in the wake of the December ‘22 announcement. This incremental liquidity was alleged to be the primary driver of looser financial conditions in the back half of last year.

open.substack.com

Now Do Japan

The Bank of Japan continues to zig while the rest of the world zags

Already have an account?