Trending Assets

Top investors this month

Trending Assets

Top investors this month

One of the bright sides

Its been a painful year for most asset classes, the last one. But one of the bright sides of the drawdowns induced by normalisation of monetary policy is higher long-term expected returns for both equities and fixed income.

I fully advocate investing in stocks and constructing a well researched equity portfolio of individual securities to the ones who have the time and resources to do that. But a passive, indexing based approach is most appropriate for most long-term investors.

The new environment, though it sounds counter intuitive, is a god-send for investors who are just starting off on their investing journey and are in the early innings of building their wealth.

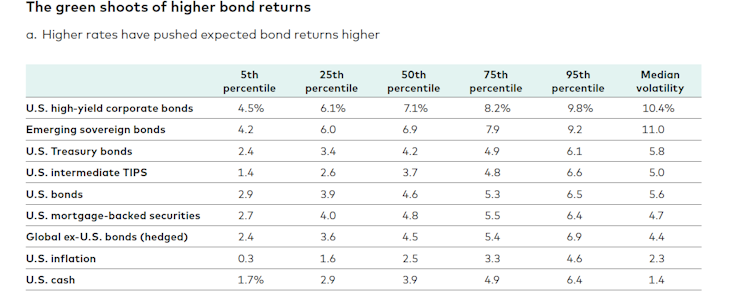

If you have a 10-year horizon, you are now getting 4%+ for almost zero risk (via U.S treasuries), with highly rated corporate bonds yielding close to 6% in some cases.

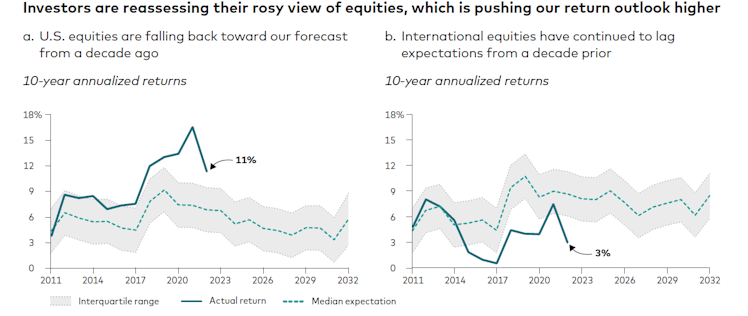

Equities too, with lower valuations and drawdowns offer much better long-term expected returns than they were during the pandemic frenzy.

Lower entry prices would eventually push up your long-term returns if you can bear some volatility along the way.

For those who still want to pick stocks, you can actually park your capital in cash while you DYOD on individual securities and still earn a decent short term return.

One of the bright sides of the new cycle for me, undoubtedly.

Already have an account?