Trending Assets

Top investors this month

Trending Assets

Top investors this month

The Case for the Copper Bull Grows

News this week, reinforcing my view that copper is the best space to be in...

Levels of government support continue to increase:

GoRozen's research report "The Problems With Copper Supply" spoke in depth of declining head grades significantly reducing copper production in the future.

We continue to see that play out, particularly in Chile - the world's largest copper producing country:

https://www.mining.com/web/anglo-american-cuts-2023-copper-output-target-on-poor-chilean-ore-grades/

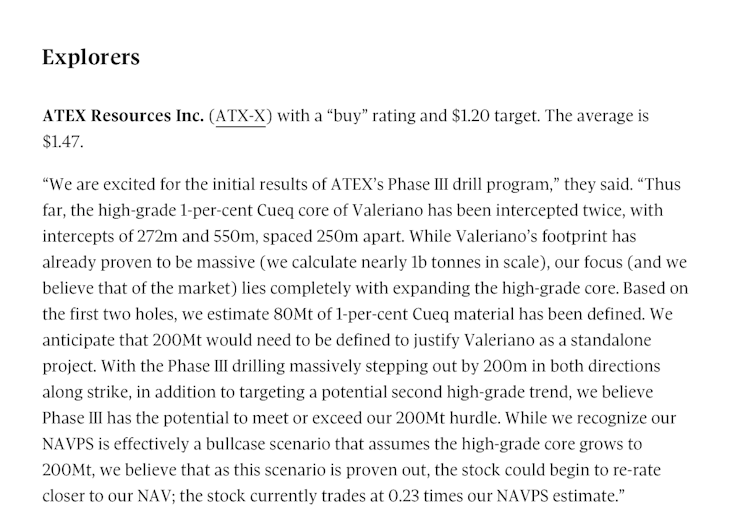

Desjardins on copper in Globe & Mail this week:

“Despite the near-term market balance, we believe copper could see a continuation of the recent positive momentum, driven by the potential easing of COVID-19 restrictions in China and low in-country warehouse levels, in conjunction with the potential for global interest rates to peak shortly,” they said. “We remain bullish on copper’s long-term outlook, driven by increased demand as global policies turn toward electrification, set against a backdrop of a dearth of new discoveries.”

Their top pick for a junior miner the same as mine $ATX.V, a Pierre Lassonde play in Chile that I have written about here previously:

The European Union (EU) and Chile inked on Friday a fresh partnership deal that will give the bloc greater, easier access to lithium, copper and other raw materials that are key to the transition to renewable energy sources.

Analysts at Goldman Sachs said they now expect copper to be undersupplied in 2023 and “peak supply is now immovably fixed in mid-2024 … generating deficits from that point.”

They said China may seek to rebuild depleted inventories next year, adding to copper demand, and predicted prices would average $9,750 a tonne in 2023 and $12,000 in 2024.

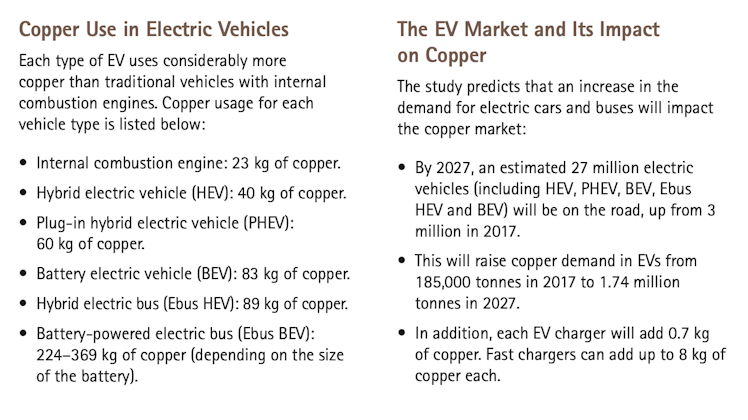

Gigafactory growth - according to the International Copper Association, EV's don't just require lithium - they require a lot of copper:

The global energy crisis is driving a sharp acceleration in installations of renewable power, with total capacity growth worldwide set to almost double in the next five years, overtaking coal as the largest source of electricity generation.

Utility-scale solar PV and onshore wind are the cheapest options for new electricity generation in a significant majority of countries worldwide. Global solar PV capacity is set to almost triple over the 2022-2027 period.

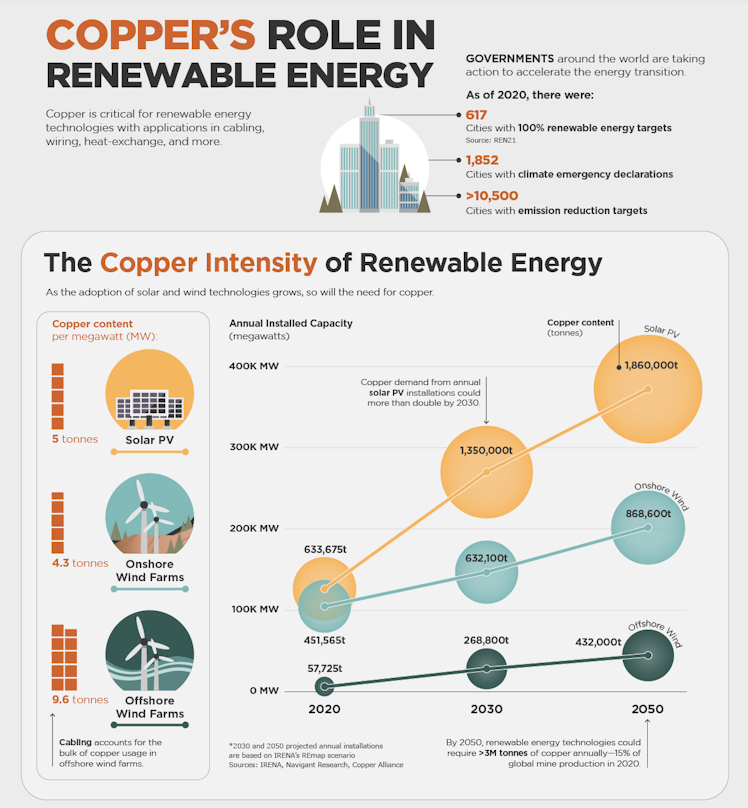

Copper plays an enormous role in renewable growth:

The writing is on the wall. I hope you have copper in your portfolio, it's currently about 70% of mine.

Visual Capitalist

Visualizing the Copper Intensity of Renewable Energy

Copper is critical for the transition to clean energy. This infographic charts the copper usage of renewable energy technologies.

Already have an account?