Trending Assets

Top investors this month

Trending Assets

Top investors this month

Economic Update - PCE & Sentiment

Stocks are down across the board today on stronger than expected inflation data, causing worries that the Fed may keep rates higher for longer.

The Fed’s preferred inflation gauge, personal consumption expenditures (PCE), posted a MoM increase of 0.6% in Jan. Up from a 0.2% increase the prior month and the fastest pace since June 2022. YoY the PCE index rose 5.4%. Core PCE, which excludes food and energy, rose 0.6% MoM and 4.7% YoY.

The final results of the University of Michigan consumer sentiment survey was 67 in Feb, up 3.2% from Jan. Consumer sentiment is 17 points above the all-time low seen in June 2022, but 20 points below its historical average. The improvement was due to a 12% increase in the short-run economic outlook as other components were flat.

In housing, new home sales increased by 45,000 to 670,000 in Jan, a MoM increase of 7.2% but a YoY decrease of 19.4%.

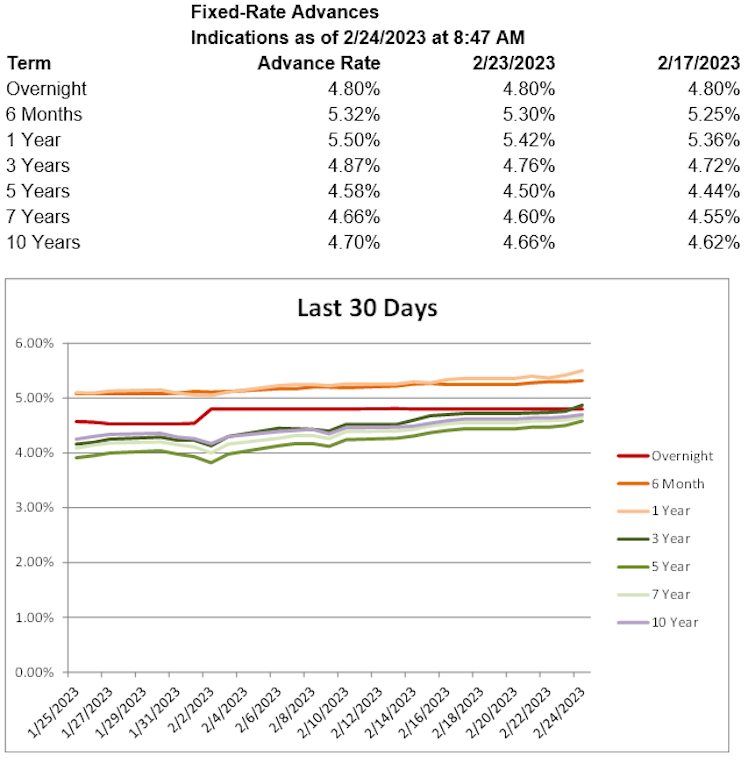

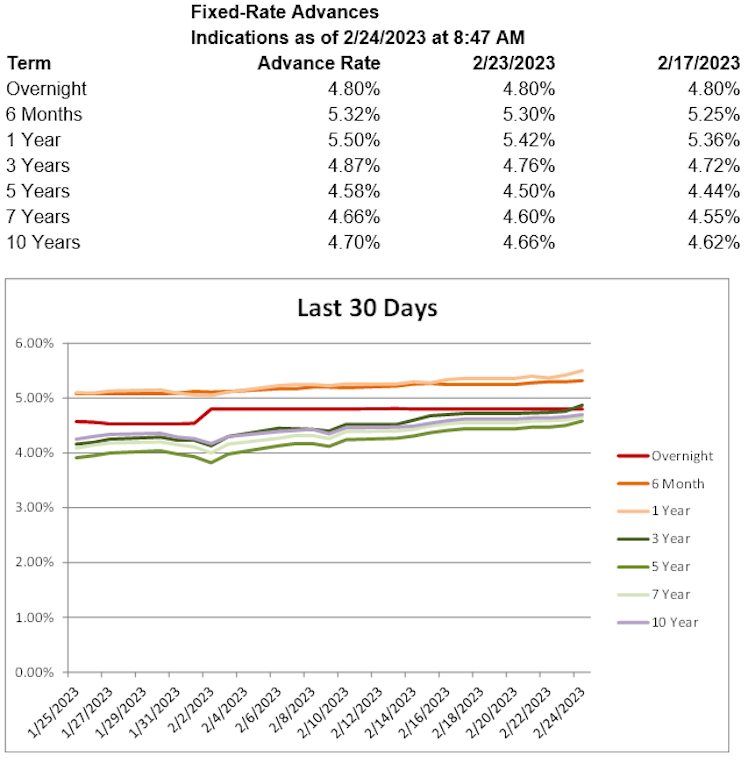

Treasury yields are higher, with the 2-year T yield up 11.6 basis points to 4.81%, the 5-year T yield up 10.7 basis points to 4.22% and the 10-year T yield up 5.3 basis points to 3.95%. Advance rates are lower on terms less than 3 months, higher on terms greater than 3 months.

Already have an account?