Trending Assets

Top investors this month

Trending Assets

Top investors this month

Buy the dip in $RICK to profit from human desire

Strip Clubs - Music, Booze and (almost) naked women. What's a better place to look for a sound long-term investment idea? Seriously though, in my opinion, RCI Hospitality Holdings, or more commonly known as RICK, offers a very compelling long-term investment based on multiple factors in a stigmatized industry.

Let's begin with a TLDR of my thesis: RICK is a high-margin business with a deep moat rolling up a recession-proof(yep, strip clubs are recession-proof. I'll get to that later) industry while having very capable capital allocation and a cheap valuation.

RICK operates in two main sectors: Nightclub/Stripclubs and Sports bars.

What makes the nightclub industry so appealing? There are roughly 2200 clubs in the US of which around 500 meet RICKs acquisition criteria, with around 49 RICK is a big player, but still owns a small share of the market. Due to regulatory hurdles (most municipalities won't give out new operating licenses), the amount of clubs isn't increasing and many are owned by aging people looking for an exit. This is where RICK, as the only public roll-up in the sector, is a preferred buyer.

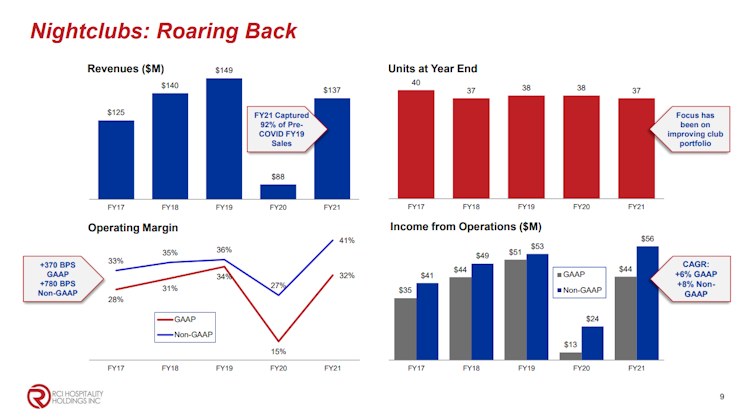

Night clubs have excellent profitability if operated well. RICKs club operating margin has steadily increased over the recent years (excluding 20 due to lockdowns) up to a 32% GAAP operating margin. Note that even though 2020 should have been a disaster, RICK still managed to stay profitable! Clubs are a very resilient business.

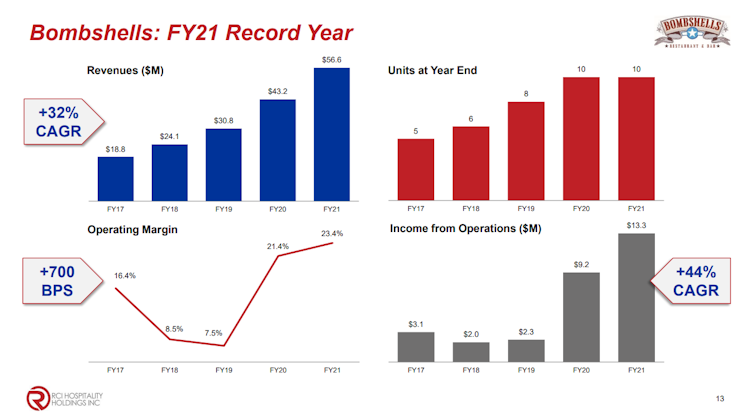

The second segment is the military-themed sports bar brand Bombshells. Bombshells are currently being built by the company and they are looking to franchise it in other geographies where the RICK management isn't as well versed. RICK is running a similar strategy to its clubs here: Focusing on high-margin businesses. Bombshells have above-average alcohol sales compared to peers and thus manages to rock high operating margins of 23% already while in the growth phase. RICK owns the real estate for its clubs and bars and still manages to generate 25-33% Cash on cash returns on newly opened Bombshells, showcasing the high profitability of the concept. RICK is open to spinning out Bombshells in the future to take advantage of a higher multiple than the standalone company would fetch. RICK already turned down a $280 million offer for its bombshells, according to the CEO.

Besides the main segments, RICK also has some optionality with two digital projects they are developing: An NFT pass for its clubs to increase loyalty and win a new generation of customers, and AdmireMe, a competitor to only fans. Admire me is especially interesting due to the low capital investment( under $1 million) and its potential to cross-sell between performers in the club: Performers will be encouraged to advertise their admireMe services to offline clients and vice versa online. This could create a nice network effect with low capital at risk.

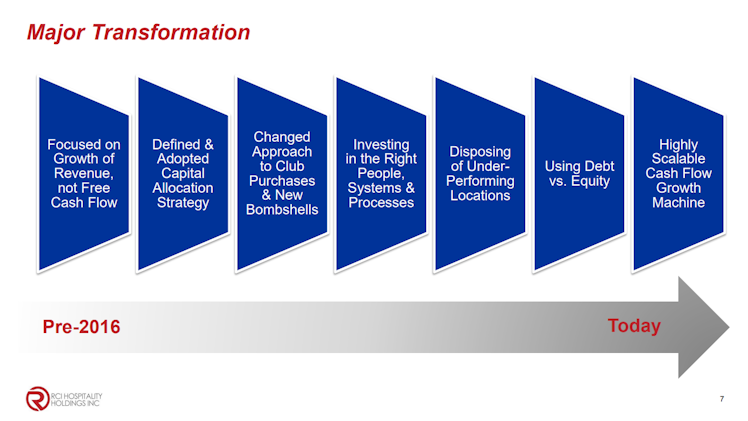

RICK went through a major transformation in the last 6 years. If I looked into the company before 2016 I would have never invested a cent into it! In 2016 a shareholder recommended "Outsiders: Eight Unconventional CEOs and Their Radically Rational Blueprint for Success" by William Thorndike to CEO Eric Langan. The book, one of my all-time favorites, is a case study on 8 unconventional CEOs that outperformed by using absolute rationality in operations and capital allocation. Eric understood the book and transformed the company.

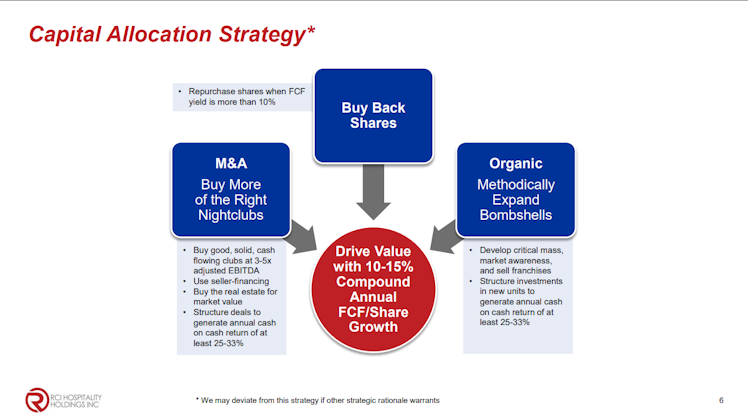

Back in the day, RICK thought it would create value by increasing revenue. By any means. This led to many poorly performing clubs and overall stagnation in Free Cash Flow. Part of the revenue maximization was also diluting shareholders. RICK then started to sell bad assets and focus on Free Cash Flow per share as its goal and came up with the below capital allocation strategy. The strategy is simple but effective:

- If good, cash-flowing clubs are available for purchase buy them between 3-5 times EBITDA with the real estate at market value if they are expected to generate 25-33% cash on cash returns.

- Grow the Bombshell franchise at the same 25-33% cash on cash return hurdle rate.

- If shares trade at least a 10% Free Cash Flow yield and there are no better opportunities, buy back shares.

I earlier mentioned that strip clubs are recession-proof, let me elaborate on that.

Eric mentioned in an earnings call on Twitter that in a recession the clubs switch from quality customers to quantity of customers with discounts. This process takes a few months, but it keeps the business going at a similar rate.

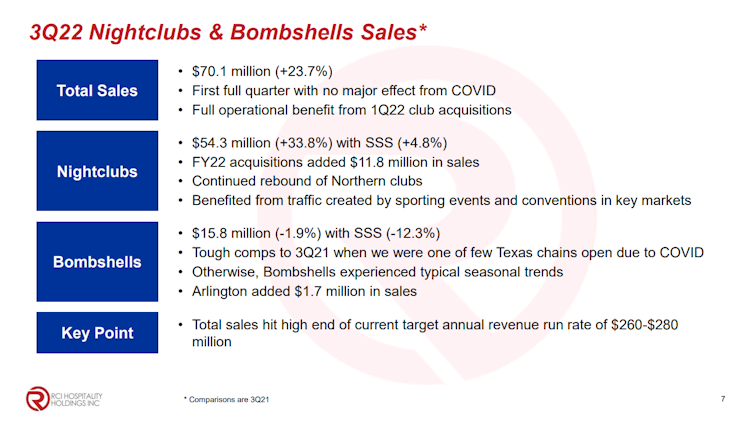

Yesterday RICK gave an update on Q3 sales and confirmed the high end of the current run rate of $280 million. At a 32% EBITDA margin TTM (with some covid headwinds) that would leave us around $90 million in EBITDA or a 7x EV/EBITDA.

RICK also has been buying a lot of shares lately. In Q3 they retired almost 2% of shares so far (168000 shares). Since RICK has a buyback hurdle rate of 10% FCF yield and they publicly mentioned $65 per share as the price under which they repurchase, we can assume a $6.5 FCF per share guidance.

To sum it up again: RICK is a high-margin business with a regulatory moat in its main business that is led by an owner-operator(Eric owns around 8% of the company) and a management team with long tenures that deploy a smart capital allocation strategy and are trading around a 10% FCF yield. On top of that, they own a portfolio of real estate in the best locations.

What do you think about RICK? Do you know the company and if not did I manage to get your attention with this pitch? Let me know in the comments and leave a like :)

Disclaimer: I am long RICK with around 7% of my portfolio currently.

Already have an account?