Trending Assets

Top investors this month

Trending Assets

Top investors this month

Embracer Group $THQQF - Endlessly Interesting

Embracer Group is the latest in a long list of gaming companies I have been digging into recently and they are by far the most interesting. The company owns the IP rights to make games for some of the largest franchises in the world. Before we dig into that, let's learn more about the company. BTW disclaimer, all numbers are in SEK which translates roughly to 10 cents against USD so 100 SEK would be $10 USD.

Embracer is really a collection of a bunch of game studios from around the world. You probably recognize some of these studios for those who play any games. There is a lot to dig through from gearbox Softwares Borderlands Series to Coffee Stain Studios Valheim and Satisfactory, or THQ Nordics Spongebob and Star Wars games. Of course, all this combines into one mega-company that tends to grow more through acquisitions.

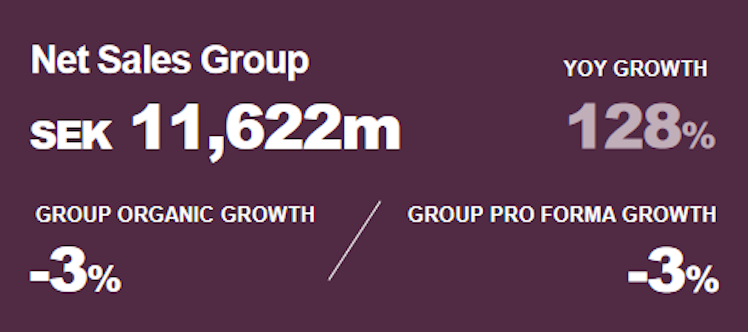

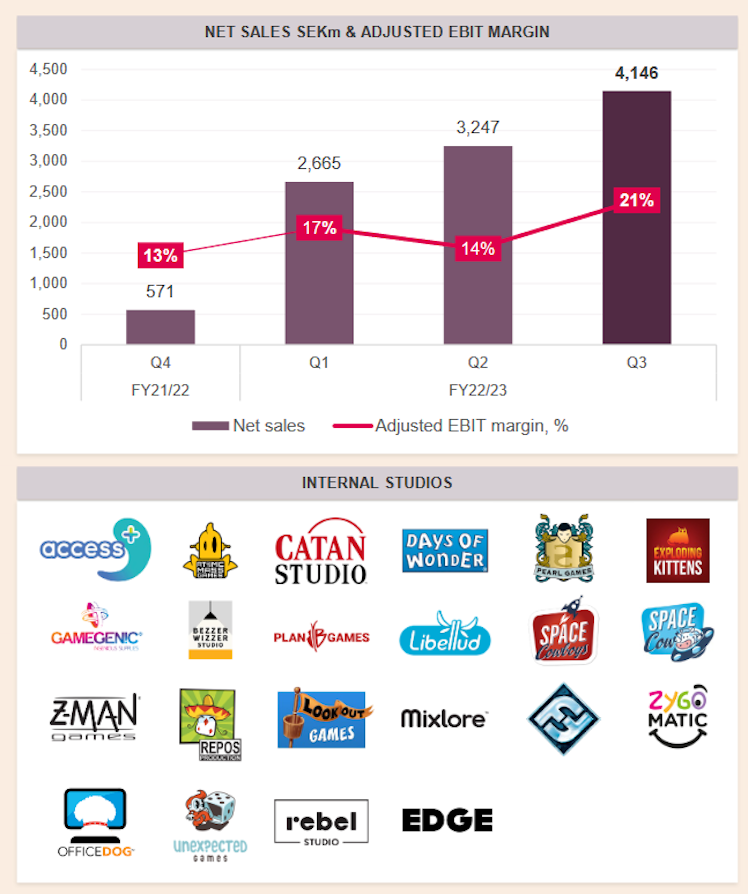

This is demonstrated in the company's net sales spanshot. Massive YoY growth but negative on the organic side. Whether this is good or bad is probably up for debate.

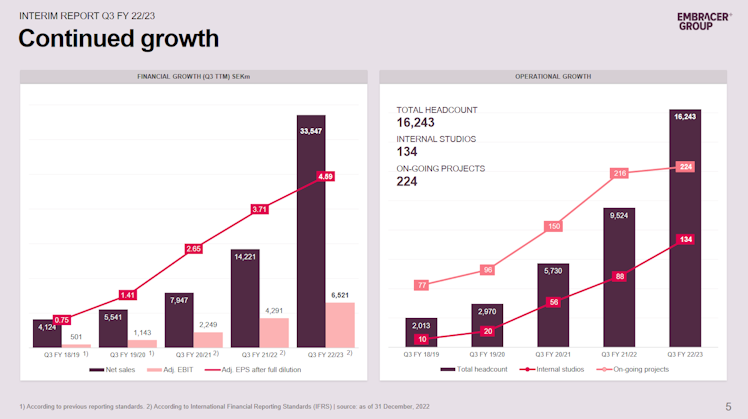

What isn't up for debate is the MASSIVE growth over the last few years. The revenue growth in just the last 4 years has been 700% a CAGR of almost 70%. And if you look at EBIT it's over 1,000% growth in those last 4 years.

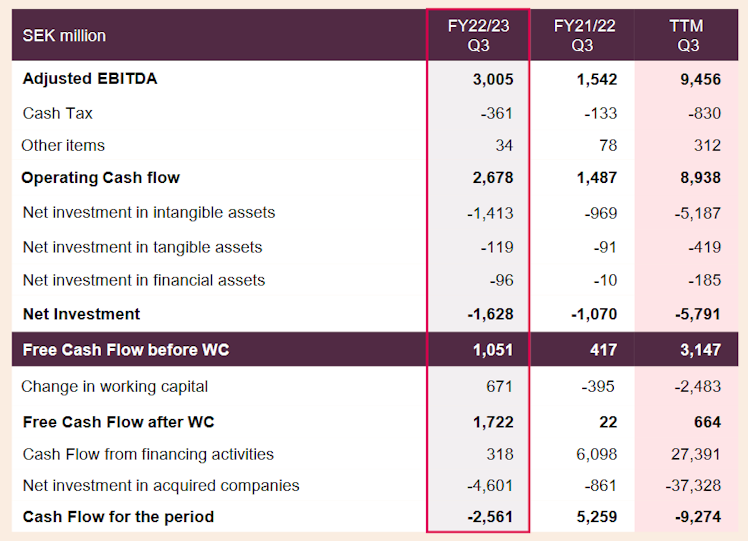

This does come with the downside of being cash flow negative. Which is admittedly a big turn off especially for a company that does 33 billion in SEK revenue. Something I find weird also is their presenting this narrative of Free Cash Flow positivity before investments in internal studios. Seems like kind of a red flag.

This is not necessarily a bad thing especially given that a lot of this money has been going towards acquiring IP rights to massive franchises like:

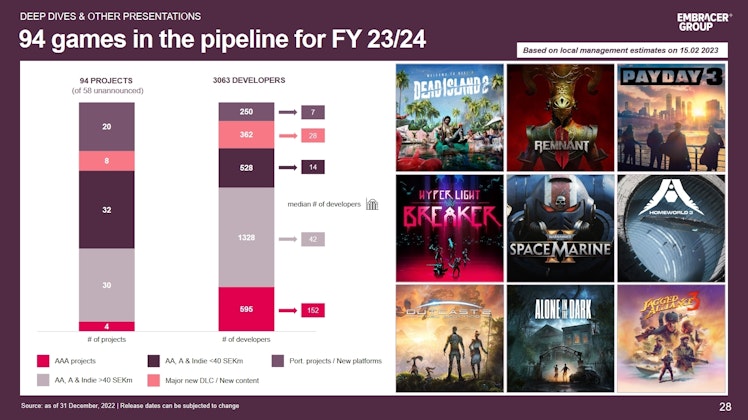

And speaking of pipeline its massive with over 200 games in their pipeline and over 90 slated to come out in the next 2 years Embracer is seemingly set for a while. And something further I think this is just a really interesting data point in general for how much it man power it takes to develop games on the level the various studios develop games.

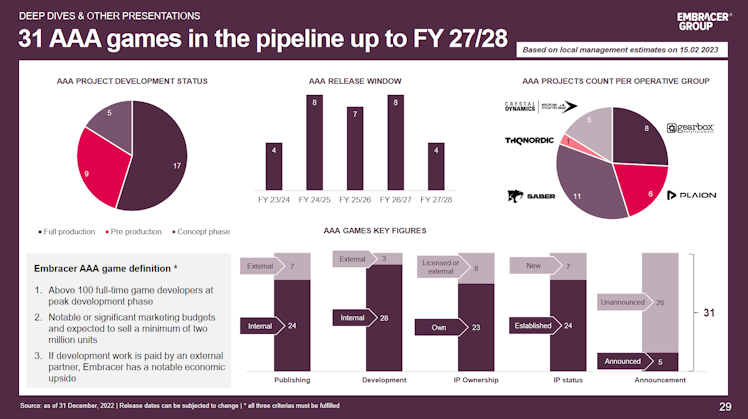

While Embracer is working on very few of what they consider Triple A Games they have a disproportionate amount of developers dedicated to them. This of course makes sense when you consider these games often have significantly more polish and larger budgets overall as they hope to make more money with them. Also as a side note many of the games listed on the right are continuations of massive franchises and if Embracer can deliver a great gaming experience I expect their explosive revenue growth to continue well into the future.

Another thing I like to see is the forward thinking of the company. Another part of their pipeline is Triple A Games that aren't expected to be released for 4-7 more years.

And the craziest part about all of this is video games isn't even everything the company does. Alot of revenue comes from the tabletop segment and the dozens of IP the company owns in that space as well. Representing 10% of revenues TableTop games are a rapidly growing part of the company as well.

While this is a pretty basic overview of the company just looking at their most recent report I think it might be worth taking a deeper dive and really learning more about the Embracer Group. I do hope one day they list on a US exchange though, they are currently only listed on the Stockholm NASDAQ under the ticker $THQQF and information is somewhat hard to come by outside their IR website.

Already have an account?