Trending Assets

Top investors this month

Trending Assets

Top investors this month

What Moves This Stock? Carvana

A lot of factors influence $CVNA. That’s hardly rocket science — car sales in general are an indicator for the broader US economy, let alone a catalyst for Carvana’s share performance.

However, if we look under the hood, Carvana’s ability to execute its long-term business plan will determine if shares can return to their former glory.

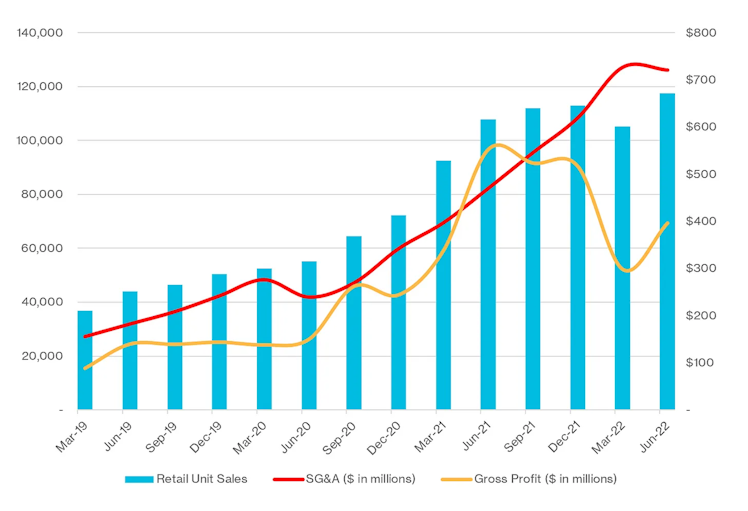

In April, Carvana announced a priority shift from scaling its platform to achieving profitability, by way of streamlining the company’s cost structure. In other words, it wants to take an ax to its SG&A.

That same day, Carvana fired 2,500 employees. Brutal.

Its goals are quite ambitious — the company set a FY23 goal of $3,000 SG&A per retail unit sold, excluding D&A as well as share-based compensation. (SG&A per unit = how much overhead it costs to produce a single sale.)

For context, Carvana’s SG&A per unit sold was $4,440 for FY21. For the first half of FY22, this metric is up to $6,029.

If we reverse engineer their $3,000 goal into a total dollars basis, assuming 425,000 unit sales (close to FY21’s output), that’s $1.28 billion of SG&A. Through six months of 2022, Carvana’s SG&A totaled $1.34 billion, excluding D&A and SBC.

So, the road ahead isn’t exactly clear of obstacles.

But Carvana has made progress.

For instance, it expects about a $125 million reduction in annual run-rate payroll after its April layoffs. Moreover, the company believes it can reduce SG&A per unit sold by $200 to $300 just by optimizing operations and raising internal benchmarks — although that’s obviously easier said than done.

Long story short, CVNA shares will reflect the company’s ability to reduce SG&A in the near- and mid-term.

Good points! $CVNA is an interesting one, no doubt. I passed on owning it as too many unknowns and due to heavy cash burn

Already have an account?