Trending Assets

Top investors this month

Trending Assets

Top investors this month

UPST loans

A lot of confusion about $UPST taking on loans on its balance sheet and if in poor economic times will UPST cont to be able to sell those loans.

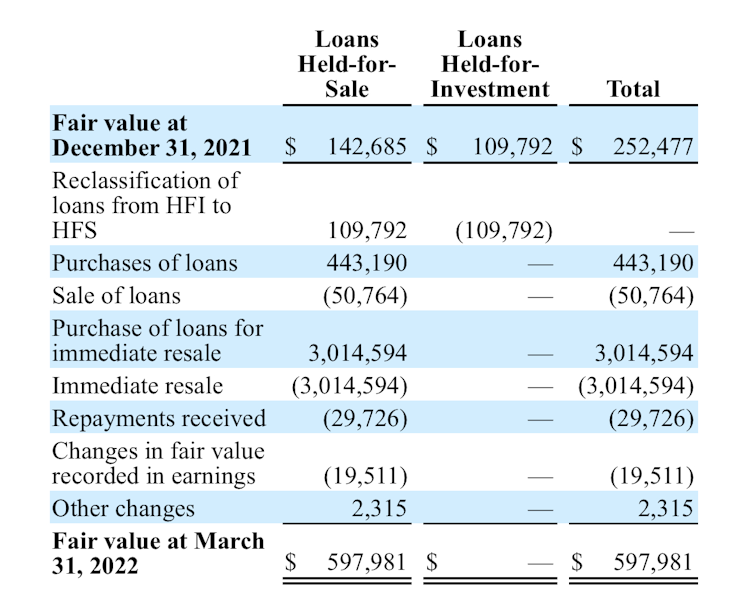

Investors where unhappy Q1 2022 when UPST took loans onto their balance sheet to “add liquidity to the market.” It was a small percentage of loans originated that quarter as you can see. Only 443 mil held for sale. Sold 50 mil worth. But originated and immediately sold over $3 billion in loans. Ending the Q1 2022 with 593 mil in loans which was up from loans on its balance sheet of 252mil end of Q4 2021.

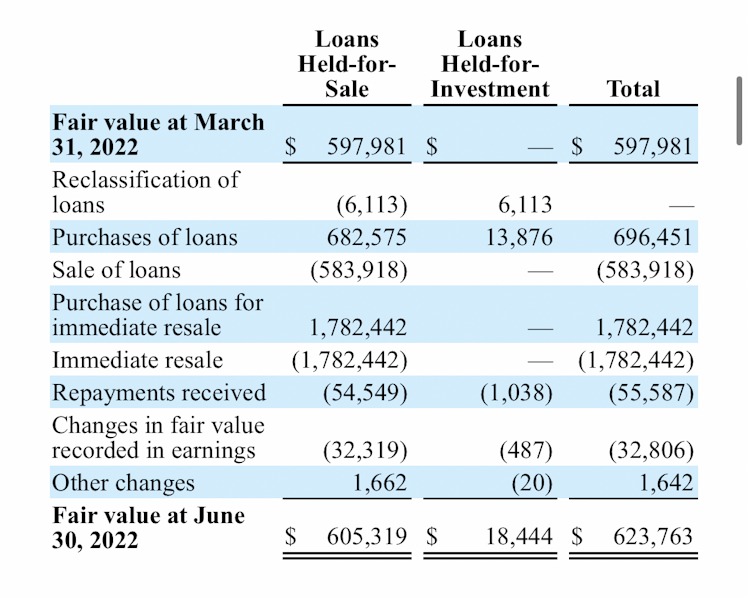

In Q2 purchased an immediately sold $1.7 bil in loans. Also purchased 680 mil and sold 583 mil. So yes the ending loan balance did go up 26 mil qoq. But UPST is still involved in selling $3 billion in Q1 and $2.36 bil in Q2.

Lastly 2/3 of the loans on its balance sheet are R&D loans mostly for its car lending. “Our balance of loans at the end of the quarter were $624 million of which $484 million represented R&D loans principally in the auto segment” per CFO. So it only has left to sell 240 mil in loans which it had taken on in Q1 2022.

Already have an account?