Trending Assets

Top investors this month

Trending Assets

Top investors this month

SLT Core Portfolio: $NVDA - From Chip Player to Full-Stack Accelerated Computing Platform Builder

If you follow the tech and/or investment space from near or far, I am sure that you are already familiar with NVDA. The company got the 12th place of our Quality-Growth screener.

I am aware that some of you might cover the company and have extensive knowledge on NVDA so any comment on this post would be much appreciated.

Thesis

- The innovative full-stack solution powering NVDA's flywheel enables the company to have pricing power and gain market share over its closest competitors.

- In addition to being the undisputed leader in GPU, NVDA is also a pioneer of DPU, enabling the company to be ideally positioned to meet the growing computing demand of datacenters. Whoever leads in AI will rule the world? NVDA remains at the forefront of AI hardware technology, as it continues to release more powerful and faster products for computing AI workloads.

- Massive opportunities within strong secular trends like the Cloud, AI, the Metaverse, and Autonomous Vehicles.

- NVDA has margins and profitability well above its peers. This is being done, while investing heavily in R&D, thanks to lower COGS and SG&A. Strong balance sheet and FCF generation.

- A rerating of the stock was necessary given the valuation levels experienced last year, however, the correction since the beginning of the year could be too extreme. We believe that the current market price offers the opportunity to buy a key player in tomorrow's digital world at an attractive price.

Source: Nvidia

Company Description

The company pioneered accelerated computing to help solve the most challenging computational problems. Founded in 1993 by Jensen Huang, Chris Malachowsky, and Curtis Priem, the company employs more than 25k people and is headquartered in Santa Clara, CA.

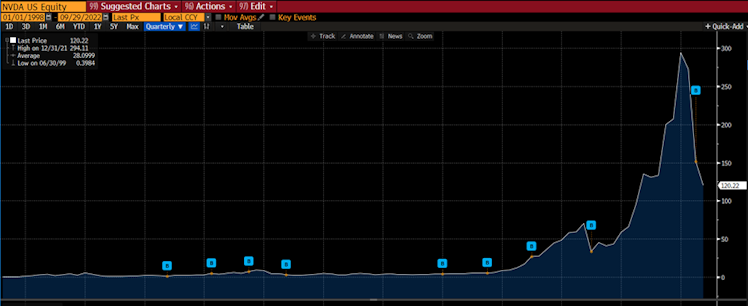

Despite seeing its shares sinking c.60% YTD, NVDA is still one of the biggest company on earth with a market capitalization of more than $300B. Since its original focus on PC

graphics, NVDA has expanded to several other large and important computationally intensive fields. Fueled by the sustained demand for exceptional 3D graphics and the scale of the gaming market, the company has leveraged its GPU architecture to create platforms for scientific computing, AI, data science, AV, robotics, AR and VR. The company transformed from being a single chip vendor to become a global computing platform.

NVDA reports revenue as follows:

- Gaming (46% of FY2022 revenue): products for the gaming market include GeForce RTX and GeForce GTX GPUs for gaming desktop and laptop PCs, GeForce NOW cloud gaming for playing PC games on underpowered devices, SHIELD for high quality streaming on TV, as well as platforms and development services for specialized console gaming devices.

- Data Center (40% of FY2022 revenue): NVDA’s computing platform is focused on accelerating the most compute-intensive workloads, such as AI, data analytics, graphics and scientific computing, across hyperscale, cloud, enterprise, public sector, and edge data centers. The company is engaged with thousands of organizations working on AI in a multitude of industries and has partnered with the main cloud industry leaders such as Amazon, Microsoft, Alphabet, IBM…

- Professional Visualization (8% of FY2022 revenue): NVDA’s GPU computing solutions enhance productivity and introduce new capabilities for critical workflows in many fields, such as design, manufacturing, and digital content creation.

- Automotive (2% of FY2022 revenue): the company works with several hundred partners in the automotive ecosystem including automakers, truck makers, tier-one suppliers, sensor manufacturers, automotive research institutions, HD mapping companies, and startups to develop and deploy AI systems for self-driving vehicles.

Source: Nvidia

Competitive Advantage

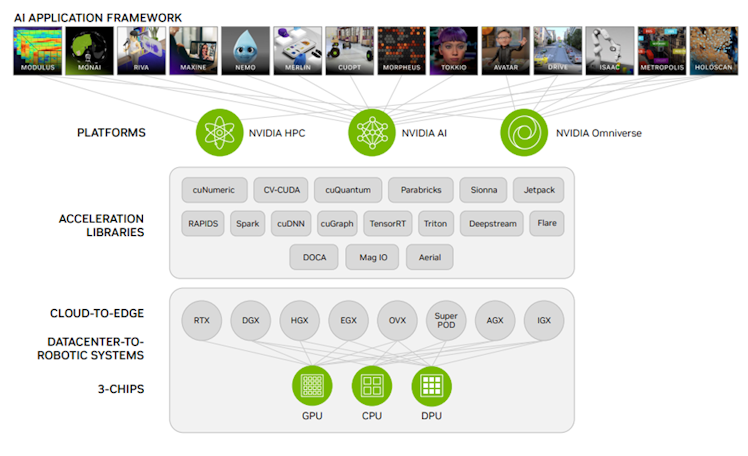

Differentiation - NVDA’s full-stack approach: This full-stack innovation approach allows NVDA to deliver order-of-magnitude performance advantages relative to legacy approaches in target markets. While the computing requirements of these end markets are diverse, the company addresses them with a unified underlying architecture. The programmable nature of this architecture allows the company to make leveraged investments in R&D and with nearly three decades of a singular focus, NVDA is expert at accelerating software and scaling compute by a Million-X, going well beyond Moore’s law.

Source: Nvidia

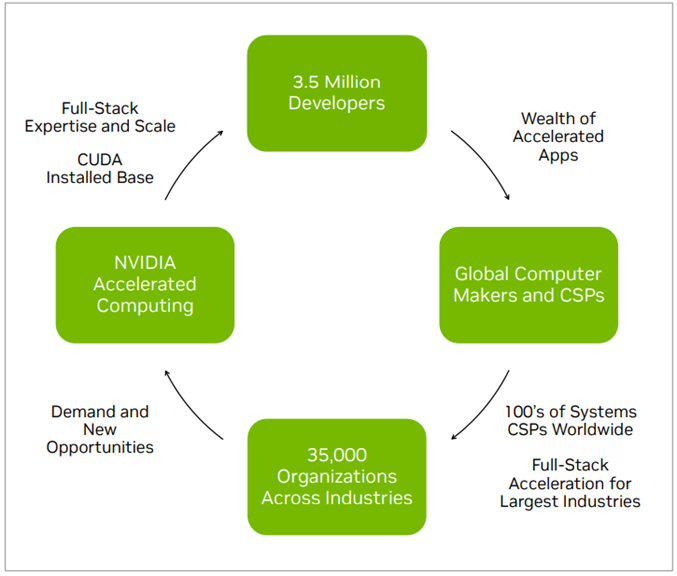

It can support several multi-billion-dollar end markets with the same underlying technology by using a variety of software stacks developed either internally or by third party developers and partners. NVDA’s multi-sided platform creates a virtuous cycle for all stakeholders but also for NVDA.

- For developers: NVDA's unique architecture and large installed base give developer’s the best performance and greatest reach.

- For computer makers and communications service providers (CSP): the company's rich suite of platforms lets partners build one offering to address large markets including media & entertainment, healthcare, transportation, energy, financial services, manufacturing, retail, and more.

- For customers: NVDA is offered by virtually every computing provider and accelerates the most impactful applications from cloud to edge.

- For NVDA: Deep engagement with developers, computing providers, and customers in diverse industries enables increasing expertise, scale, and speed of innovation across the entire accelerated computing stack.

The above is propelling a powerful flywheel.

Source: Nvidia

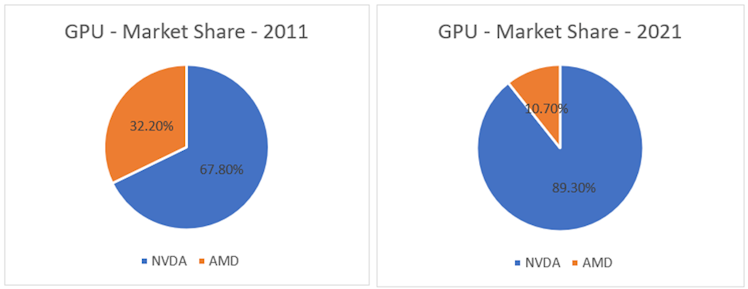

In terms of hardware products, we are not technology experts and will not jump into a fastidious features comparison between AMD and NVDA’s products for example. However, and combined with the above flywheel, when simply looking at the evolution of the GPU market share and especially given AMD being a winner in terms of affordability, we believe NVDA must have a better product with pricing power to be able to gain market share years after years while charging a higher price.

Source: Bloomberg, SLT Research

Sustainable growth

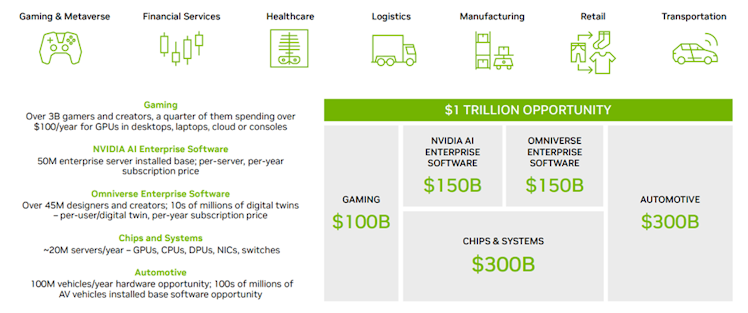

In its last investor’s day, NVDA highlighted that over the long-term, its full-stack platform serves industries generating $100tn in revenue, and NVDA believes it can address 1% of it, representing a $1tn opportunity.

Source: Nvidia

By segment, NVDA's massive opportunity can be broken down as follows:

- Enterprise Computing: NVDA sees a $300bn opportunity in this segment including $150bn in hardware (half of chips and systems in the above slide) complementing the $150bn in AI enterprise software. Industry leaders are building on NVDA with 1300+ go to market partners across, NVDA Certified systems are available everywhere with 170+ systems, and 30+ partners.

- Hyperscale Computing: Hyperscale represents a $150bn market opportunity (half of chips and systems in the above slide) for NVDA as AI continues to permeate major industries and more dollars move into the space. As already mentioned, NVDA serves key cloud players and expects the cloud server market installed base to grow to 35mn servers by 2025. In addition, it estimates that 100% of consumer internet applications will adopt AI with e-commerce worldwide sales reaching $7.4T by 2025.

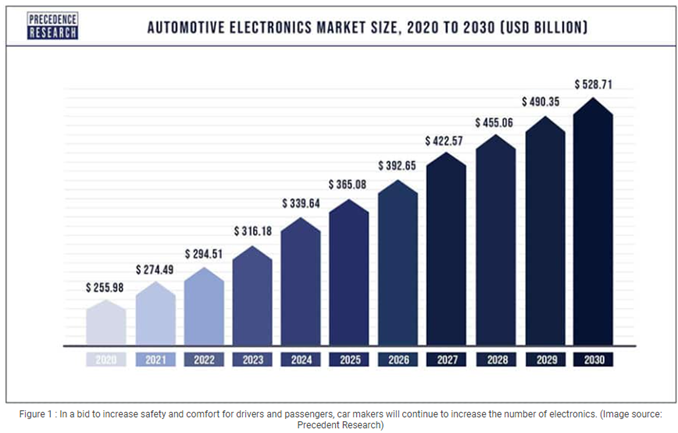

- Automotive: NVDA estimates the opportunity to represent $300bn. Currently, less than 10% of vehicles dispose of a level 2+ of automation (level 2 and 3 relates to partial and conditional automation respectively). This low penetration is set to exceed 50% by 2030. EV vehicles have also forced manufacturers to rearchitect cars into software-defined vehicles using large computational power. CEO clarified the opportunity relates only to devices within the vehicle, not software or infrastructure. According to Precedence Research, the global automotive electronics market is projected to reach $529bn by 2030, mainly because of rapid adoption of the Internet of Things (IoT) and artificial intelligence (AI) in automobiles and surge in demand for automobiles that are equipped with automated driving.

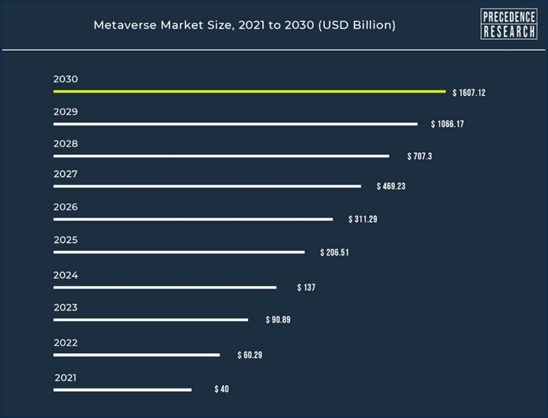

- Omniverse: According to NVDA, virtual worlds are essential for the next era of AI and represents a $150bn opportunity. Omniverse is key from creation to simulation in a virtual world. One of the applications is digital twins. Once a product has been designed and tested virtually, a digital twin can act in symbiosis with its physical twin and help constant evolution by capturing real worked data, thanks to IoT sensors, and feed it into the digital model to perform simulation on the digital twin. The latter market is poised to grow by $32bn during 2022-2026. NVDA's development of its omniverse is likely to make the company a key player in the Metaverse. Still according to Precedence Research, the global metaverse market size is projected to be worth around $1.6tn by 2030, a CAGR of 50.74% from 2022 to 2030.

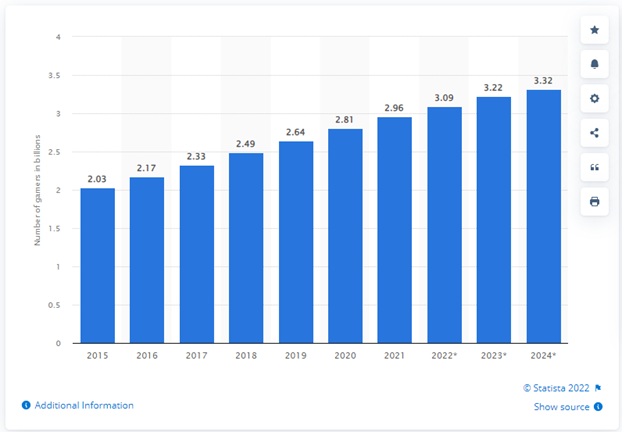

- Gaming: NVDA’s $100bn gaming opportunity calculation is fairly simple and has been explained as follows. There are 3bn gamers and NVDA estimates that, over time, a quarter of them will spend over a $100 a year for high performance GPUs (which gives us at least $75bn). The below chart plots the number of active video gamers worldwide from 2015 to 2021, with forecasts from 2022 to 2024.

Financials

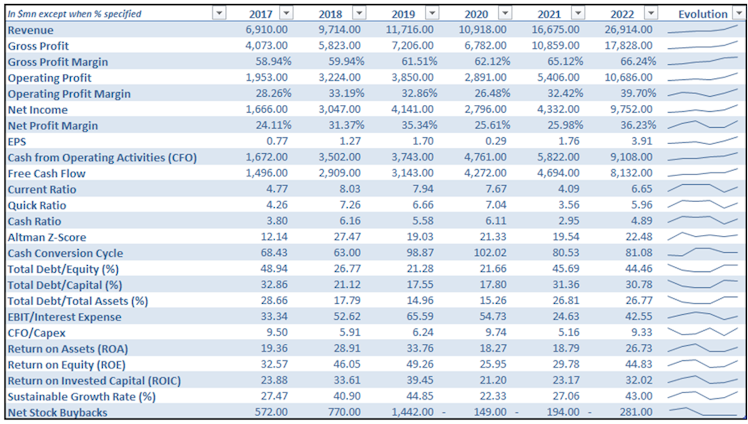

The company grew its revenue at a 25.43% CAGR over the last 6 years with a spike in 2021-2022. The revenue surged over the last two years mainly as gaming really benefited from the pandemic and lockdowns worldwide.

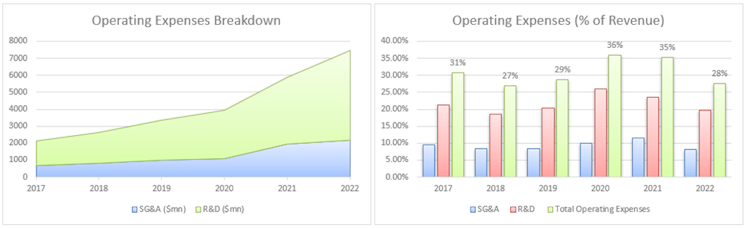

As the company scaled, and combined with a better revenue mix, gross profit margin improved by more than 7% during the period covered. Logically, NVDA’s operating profit margin followed the same trend over time, and improved even more (c.11.5%). Let’s now delve a bit deeper into the company’s operating expenses:

SG&A expenses represented only 8.05% of FY2022 revenue and have been consistently around 10%. NVDA has been investing heavily in R&D over the years, with the latter representing more than 70% of operating expenses and accounting for c.20% of revenue. We specifically appreciate the fact that, thanks to declining COGS and low SG&A, the company augmented its operating profit margin to 39.70% with constantly investing 20% or more of its revenue in R&D.

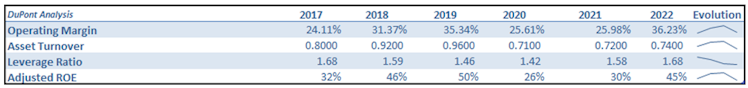

However, we cannot observe the same trend regarding NVDA’s ROE. The latter has been more volatile, oscillating from single to double during the period. We decided to run a three stages DuPont Analysis to better understand the causes.

If we only compare FY2022 with the beginning of the period, we would be happy to see that ROE increased in line with the operating margin, despite decreased in asset turnover ratio, and given a similar leverage ratio. However, in 2018-2019, ROE was similar or higher despite (slightly) lower margins and leverage ratio. This analysis helps identifying a decrease in the asset turnover ratio, in other works a reduction in NVDA’s assets productivity. We believe this difference between 2018-2019 and 2022, is related to the fact that intangible assets have been multiplied by 3x, fueled by increasing goodwill (non-productive asset) as a percentage of total assets.

Paying attention to cash flow now – CFO increased in line with net income (correlation of 0.93). We’d like to add more color and mention that the increase in non-cash working capital (negative impact on operating cash flow) was actually offset by stock-based compensation. We are not a huge fan of the latter, and SBC accounted for 22% of CFO. However, it is relatively common in the technology sector, and even adjusted for SBC, NVDA’s CFO was more than $7bn as of FY2022. The same can be observed regarding FCF (1.43% FCF yield). Despite not reducing share count over the last three fiscal years, the management has been committed to use its cash to repurchase shares and/or repay debt in its recent history.

NVDA balance sheet is very sound. From a liquidity point of view, current assets represent more than 6.5x current liabilities. As of July 31st, 2022, the company was sitting on $17.04bn of cash, cash equivalents and short-term investments (STI) vs. total debt of $11.84bn, resulting in net cash or equivalents of $5.2bn.

From a solvability perspective, NVDA level of debt is reasonable. Total debt represents less than 50% of total equity and less than one third of total assets. This is mitigated by the FY2022 EBIT covering more than 40x the company’s interest expense. The Altman’s Z-Score above 20 depicts even more NVDA’s financial strength, implying a probability of bankruptcy of c.0.

- Outlook

Source: Bloomberg

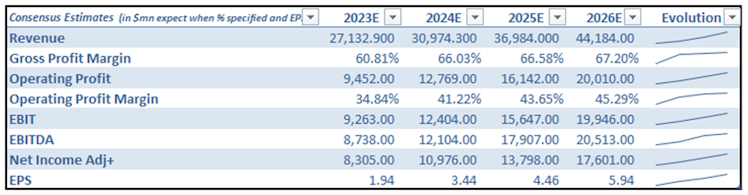

Looking at the consensus estimates for the next 4 years, and despite a flat-ish revenue growth expected in 2023, caused by slowing demand over recession fears and in gaming (lockdown easing), revenue is set to continue its impressive growth, fueled by growth drivers enumerated earlier. Longer term, gross profit margin is likely to remain in the high 60s. The 6% drop in margins for the current exercise is mainly related to sustained inflation. This will have a short term impact on the bottom line however, we remain confident over the long-term, which is always our area of focus at SLT Research. It is worth to highlight the 2026E operating profit margin of 45.26%, a c.6% increase from 2022.

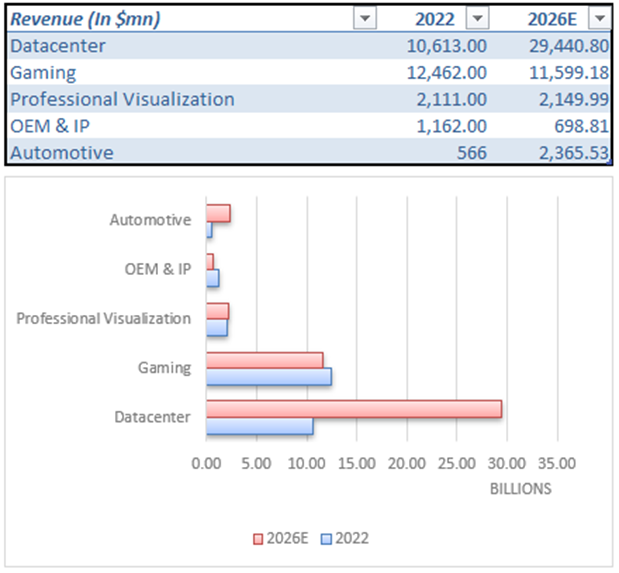

- End Market Breakdown – 2022 vs. 2026:

Source: Bloomberg

The biggest change in the expected revenue mix resides in gaming moving from the top contributor to only 25% of total revenue - datacenter, not surprisingly given having the bigger opportunity, is expected to account for more than 60% of NVDA revenue in 2026.

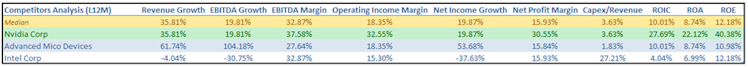

We understand NVDA is unique and not limited to GPUs manufacturing however, we thought it would be interesting to ran a quick comparison with close competitors: AMD and Intel.

NVDA growth lagged AMD’s over the LTM but we put more focus on the company’s superior margins vs. competitors and hence profitability. Capital expenditures are relatively low compared to revenue.

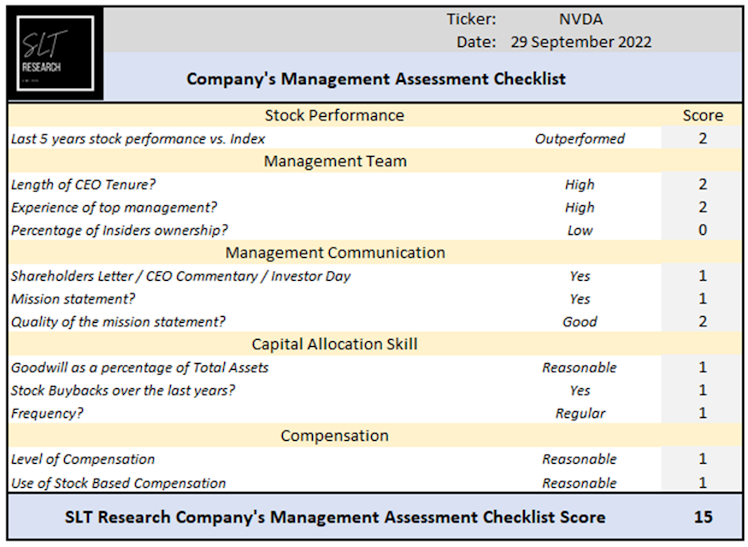

Management and ESG Considerations

NVDA’s co-founder Jen-Hsun Huang occupies both President and CEO positions for almost 30 years now. He is surrounded by an experienced best-in-class management team working together for a long time now. Colette Kress is the CFO and joined the company 9 years ago. She previously occupied a similar role at Cisco after having spent 13 years at Microsoft. Debora Shoquist is the executive VP in charge of operations. Prior to joining NVDA in 2007, she had a similar position at JDS Uniphase. Insiders hold approximately 4% of the company.

NVDA is a “learning machine” that constantly evolves by seeking challenging opportunities that matter to the world, and that only it can solve. It attracts the world's best people, so the company can achieve its highest aim: building a company that lets us do our life's work, at the highest level of our craft. It is clear that NVDA has demonstrated since its creation that every decision is made following its vision statement: “transform how the world experiences computing”. The company is not stingy with regards to communicating information to shareholders, providing details on earnings and regular update on the business and the company in general.

NVDA has not historically been an aggressive actor in the M&A landscape, favoring deals of smaller company closing at prices below or around $100mn. Management announced their withdrawal from Softbank’s Arm acquisition ($35bn) for regulatory concerns. However, goodwill jumped to more than $4bn in 2021, representing c.10% of FY2022 total assets, after the company completed the acquisition of Mellanox in a $7bn cash transaction for which 3.4bn was classified as goodwill. Combined with NVIDIA’s leading computing expertise, Mellanox’s high-performance networking technology will enable customers to achieve higher performance, greater utilization of computing resources and lower operating costs. However, it appears that the company paid an higher than average premium for this deal.

Management initiated a small dividend back in 2012 which slightly increased. LTM dividend yield is less than 15bps. We like to see low dividends for this type of company given the massive opportunity ahead. Continued investment in R&D and in itself – especially given a ROIC c.20% higher than the company’s WACC – is the preferable option to generate and compound shareholder value over the long term in our opinion.

Another way to enhance shareholder value/return, is to repurchase shares by doing it opportunistically. NVDA’s management nailed it as showed in the below charts. Management did not buy back shares in the last 3 fiscal years when the stock returned c.780% over the period. After seeing the share price plummeting since the beginning of the year, the management announced a more than $5bn shares repurchasing program, at a more attractive valuation.

Stock Buyback Event | Source: Bloomberg.

Price vs. Buyback Yield | Source: Koyfin.

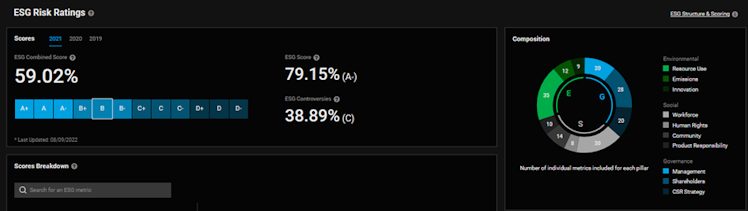

ESG: The company is leading its group regarding Environmental, Social and Governance matters (Bloomberg ESG Scores). With a DeGiro ESG risk rating of B, NVDA disposes of a good relative ESG performance and above average degree of transparency in reporting ESG data publicly.

Source: DeGiro

Valuation

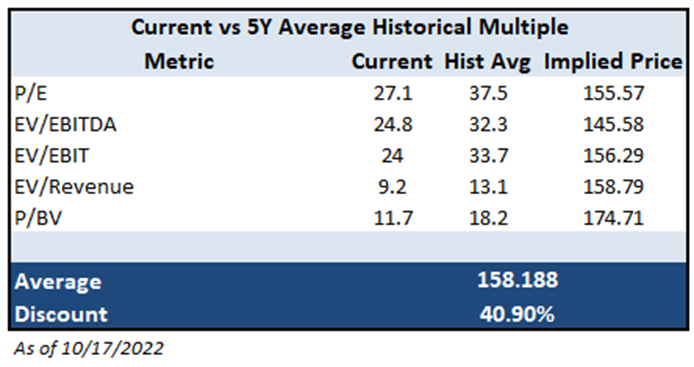

The company is currently trading around -1 standard deviation from all historical multiples presented above and are all 20% lower than their respective 5Y average. Hence, shares of NVDA are trading, on a relative basis, at a steep discount to historical average. One could argue that a price of 27.1x earnings is still relatively high, especially when compared to peers.

However, we believe that NVDA’s growth perspective by serving a massive TAM and technological savoir-faire/differentiation justify a premium. In addition, the long-term thesis did not slightly change over the past few months and the global market sell-off offers an opportunity to initiate a position (shares of NVDA were trading at 5Y historical average just a few months ago).

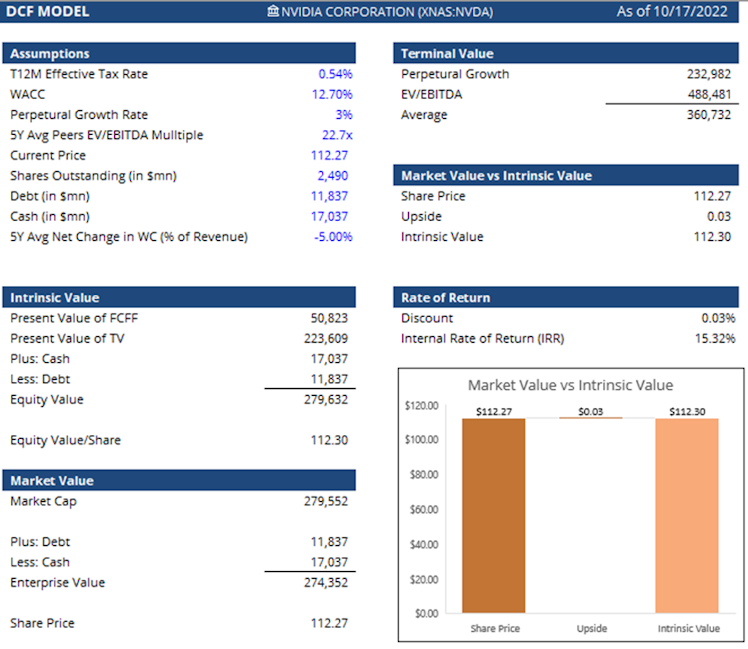

To supplement the multiples based valuation, we decided to take a closer look at NVDA’s intrinsic value assessed by DCF model, using consensus estimates to calculate the next 4 years FCFFs.

In order to define the terminal value we used a blended approach using the average of the values derived from both, the perpetual growth rate and an “exit multiple” (EV/EBITDA). In order to keep a (very) conservative stance, we decided to run a version of the model using a peer group 5Y historical multiple of 22.7x.

Our key takeaway is that shares are currently trading at a fair price using the peer group average multiple, and our strategy is not focused on buying at very deep discount, but rather focused on buying outstanding businesses at a reasonable price. It is also worth mentioning that NVDA historically traded at an EV/EBITDA multiple 129% higher than peers emphasizing the conservative nature of the above intrinsic value.

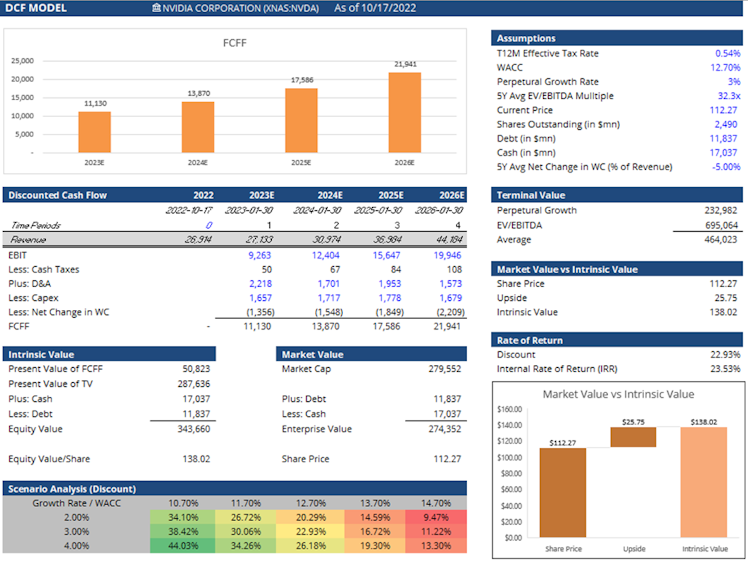

Running the DCF model using NVDA’s historical EV/EBITDA multiple tells us obviously a different and even nicer story.

Our calculation implies a lower discount to intrinsic value than using multiples, but still very attractive around 20%. The scenario analysis also shows that more upside can be unleashed in the case of better growth (3% FCFF in 5Y is a conservative assumption for a company

like NVDA) or with lower cost of capital.

Risks

Key risks for us include:

- Short-term: Although PC gaming demand seems resilient to macroeconomic weakness, any macro uncertainty could weigh on PC gaming demand trends. Given NVDA’s c.53% exposure to the PC gaming segment, any consumer PC gaming weakness poses downside risk to Wall Street estimates.

- Long-term: NVDA's GPUs could gain lower than expected deployment into datacenter applications as hyperscale customers further adopt deep learning as a new and effective way of processing large unstructured data sets. Any significant decrease in the adoption of deep learning by hyperscale customers or increase in competition could result in downside risk to consensus revenue and earnings estimates. Longer time than expected in autonomous vehicles development and commercialization is also representing a risk.

Disclaimer: The information provided in this post is for information only and solely on the basis that you will make your own investment decisions after having performed appropriate due diligence.

Already have an account?