Trending Assets

Top investors this month

Trending Assets

Top investors this month

Size Really Doesn't Matter

What the BRICS Expansion Means

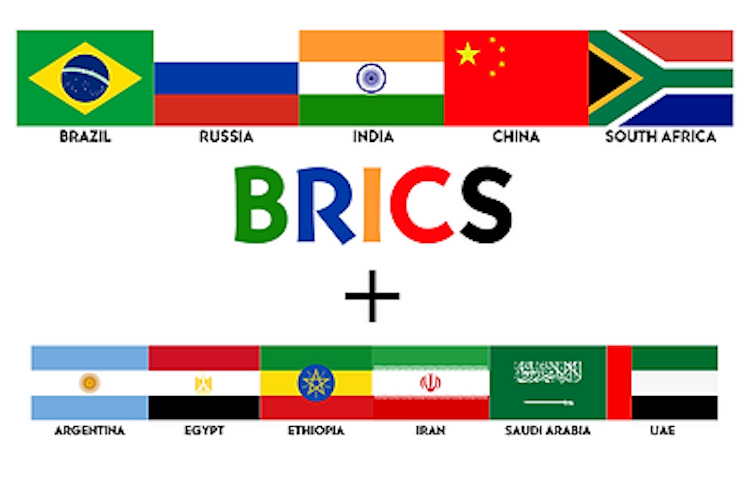

On Thursday, it was announced that the BRICS bloc of developing countries would expand its membership from five to eleven countries. This newly expanded group will have significant economic weight and could be considered more influential than some existing developed economy groups such as the G7.

Ain’t no party like a BRICS club party

The newly expanded BRICS group will account for 47% of the world’s population and 37% of the world’s Gross Domestic Product (GDP) when measured by purchasing power parity (PPP). If you compare this to the G7, that group represents 9.8% of the global population and 29.8% of GDP. The difference in size is stark.

But it’s not all about size. There are many frictions when it comes to the countries within the BRICS and up until now the group hasn’t been anywhere near as influential as it would like to be.

So what is the BRICS and why does this expansion matter?

### What is the BRICS group?

The original BRICs were a group of four emerging market countries: Brazil, Russia, India, and China. Goldman Sachs economist Jim O’Neill first used the term in 2001 in a research piece detailing which fast-growing economies he expected would begin to dominate by 2050.

Subsequently, from 2006 onwards, foreign ministers of the four countries would meet fairly regularly until 2009 when a full BRICs meeting occurred in Yekaterinburg in Russia. South Africa then joined the group in 2010 to give the BRICS acronym, with the capital S, that we are more familiar with today.

The group has until now been focused on financial cooperation such as setting up an emergency foreign currency fund and a World Bank style institution called the New Development Bank which lends for infrastructure projects within the group. Overall, it is certainly up for debate whether the BRICS group has produced anything concrete up until now.

Argentina, Egypt, Ethiopia, Iran, Saudi Arabia, and the United Arab Emirates were the six new countries to be added this week. This new expansion has in particular been driven by China as it looks to challenge a United States-led West.

### Why expand the membership?

Why is the BRICS group looking to expand and why these countries in particular? To answer that question, it is important to consider the broader global macroeconomic and geopolitical backdrop.

The world has changed significantly as a result of the COVID-19 pandemic and the Ukraine conflict. Western energy policy is now focusing not only on new renewable sources but also on promoting domestic energy production for energy security reasons. The West is becoming increasingly less dependent on fossil fuels and as such oil and gas imports.

Industry is being brought back to the West and to its allies away from China and other manufacturing hubs in what is being termed re-shoring or near-shoring. Industry used to go where it was cheapest. The recent supply chain disruptions of the past few years highlighted new risks in being able to manufacture goods and ship them around the world. Supply chain security has become increasingly a consideration.

Geopolitical tensions are rising, firstly with the Russian conflict in Ukraine and secondly with China posturing when it comes to Taiwan. The Taiwan situation is fuelling discontent between the United States and China, to the point where we have seen the United States imposing export controls on advanced computing and semiconductor manufacturing items to China late last year and a ban on tech investment into China from American companies earlier this month. With recent sanctions on Russia as a result of the Ukraine conflict and these measures from the US pre-emptively hindering China ahead of a potential invasion of Taiwan, economic battles are becoming increasingly prominent.

It is well-publicised that the Chinese economy is becoming increasingly problematic. The real estate sector is on the edge of collapse, demographics in the country are delivering an increasingly aging population and the hugely anticipated post-COVID rebound has been near non-existent. There is a limited window for China to use its economic clout to move the global political needle in its direction.

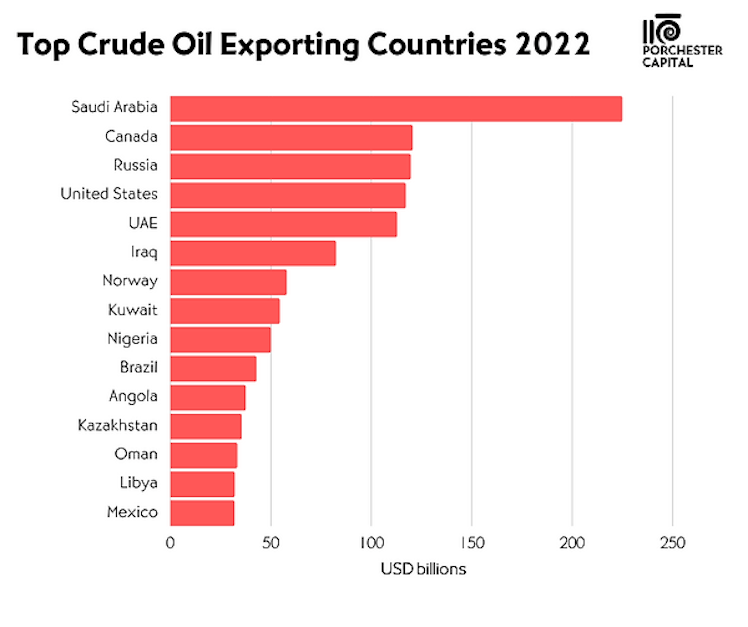

Although the West is moving away from fossil fuels as a primary means of energy generation, countries like China and India remain hugely fossil-fuel dependent. With Saudi Arabia and the UAE now joining the BRICS, the group now has three of the top five oil exporters among its members. Over the past year, there has been a huge increase in Russian oil exports to China and India as sanctions have meant lower exports to the West from Russia. China and India have been able to pick up cheap oil that Russia has been keen to export to fund the war effort.

We already see how much of an influence OPEC has when it comes to dictating the crude oil price. A tie-up of the largest oil producers in the world with China will give the country more friendly nations willing to export oil to it at prices that it wants, whilst being able to dictate the future of the global oil economy via the BRICS for the increasingly short window that the West remains oil dependent.

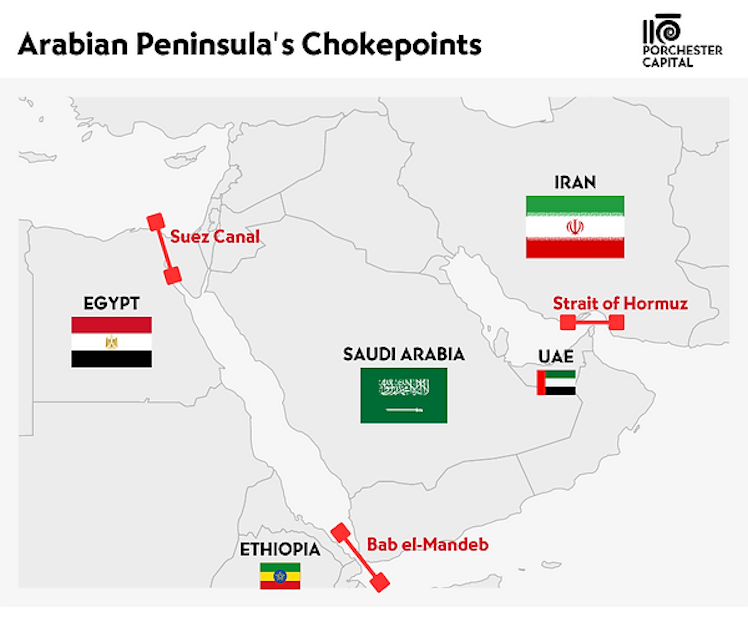

The other area that China cares about is shipping. As the manufacturing giant that it is, it needs to know it can import the raw materials and commodities it needs and can export the finished goods around the world.

Egypt, Ethiopia, Saudi Arabia, the UAE, and Iran are all strategically placed when it comes to the maritime chokepoints around the Arabian Peninsula. The Suez Canal, Bab el-Mandeb, and the Strait of Hormuz now find themselves neighboured by countries that have joined the expanded BRICS that China can feel like they can influence.

Not only could the expanded BRICS put China in a position to dictate the global oil economy to upset the West, but also able to disrupt shipping lanes out to the Mediterranean and beyond. Whilst the United States has used its own economic weapons to try and stifle China, it seems China is looking to equip itself with its own.

### Problems, tensions & instabilities

There is a problem for the expanded group, and was already an issue before and why the BRICS group has achieved little since the countries first began associating. The countries and economies in the group differ hugely. They have entirely different ambitions and agendas, some are closer allies to the West than China would like and simply some sit at other ends of the Earth from each other. The initial grouping was coined by an economist at Goldman Sachs to cover a series of countries that he expected to have strong growth. Apart from this, they have little in common.

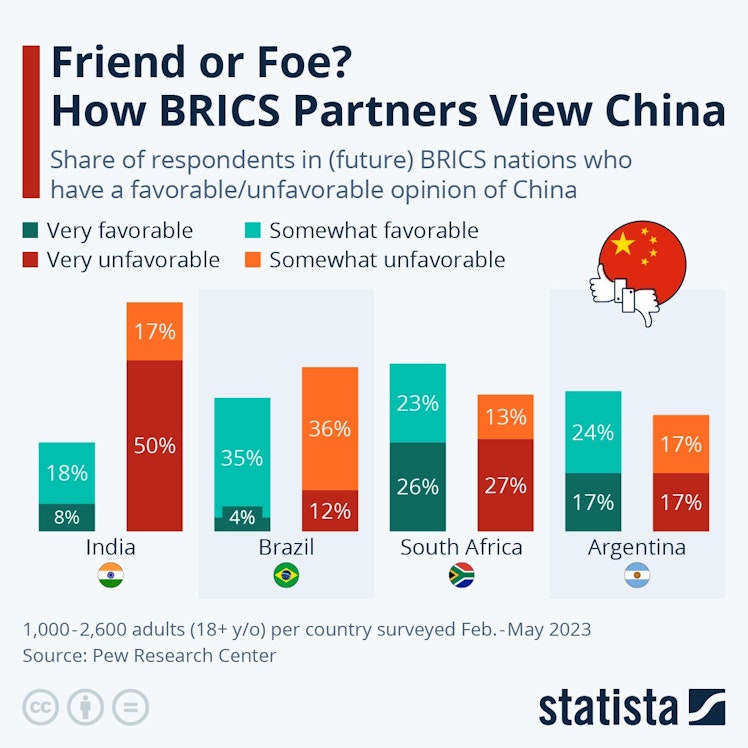

China will want to lead the group, however, if economic and demographic trends continue as they are, India will have a very fair claim to be the largest and most influential country in the group. This is already becoming evident in other spheres, with India for example beating Russia to the southern pole of the Moon with the Chandrayaan-3 mission. Russia's Luna-25 mission had crashed into the moon only days before.

Countries like Brazil and South Africa which continue to have ties to the West, likely now consider their standing in the group to have reduced with the expansion, and may not be as favourable as before when it comes to initiatives taken by the group.

Vladimir Putin didn’t even travel to the conference this year for fear that he would be arrested under the International Criminal Court arrest warrant issued for him in March this year. Demonstrates that not all the members necessarily have each other's backs.

Additionally, it is worth considering the stability of the newly added countries. The Argentinian and Egyptian economies are both in significant distress with sky-high inflation, hugely volatile currencies, and mounting piles of debt. Saudi Arabia and Iran only restored relations early this year after decades of tensions and conflict.

### What does it mean for investing and markets?

As a group in itself, it’s unlikely the newly expanded BRICS will be able to deliver much for its respective member countries and that it could impact those markets themselves. It hasn't done much until now, and given the country's differing targets and agendas, it is likely to achieve anything ground-breaking any time soon. However, it demonstrates increasingly China’s want to drive geopolitics more in its direction and to find new avenues to put pressure on the West.

If China continues to want to disrupt the political balance, this could add further stress on Chinese stocks, and potentially Taiwanese stocks if tensions go as far as an attempted invasion of Taiwan.

Additionally, if China looks to weaponise oil markets, this could push oil prices up in the West, as it looks to assert influence on the oil-producing countries to sell it cheap oil whilst pushing up the oil price for everyone else. OPEC already adjust the oil price in their favour and a few years ago were willing to temporarily sink the oil price to slow down the shale sector in the US. Why wouldn’t these countries look to do something similar if China made it worth their while?

Porchester

© 2023 by Porchester Capital

All articles from Porchester Capital are purely intended for informational purposes and should not be considered investment advice.

Already have an account?