Trending Assets

Top investors this month

Trending Assets

Top investors this month

Sonos: The Hardware Machine

After vacation and catching up on some work, I should be back to posting on a more regular schedule moving forward. Thanks to everyone who reads my analysis. I appreciate it and hope you've found it to be of value.

-----

Like Roku is an operating system (OS) for a smart TV, Sonos is an OS for a smart audio system. The competitive environment and economic model, however, differ between the two. Sonos has a virtual monopoly in wireless home audio and makes money from hardware. Roku has competition in smart TV OS and makes money from advertising.

Why does Sonos have no real competition?

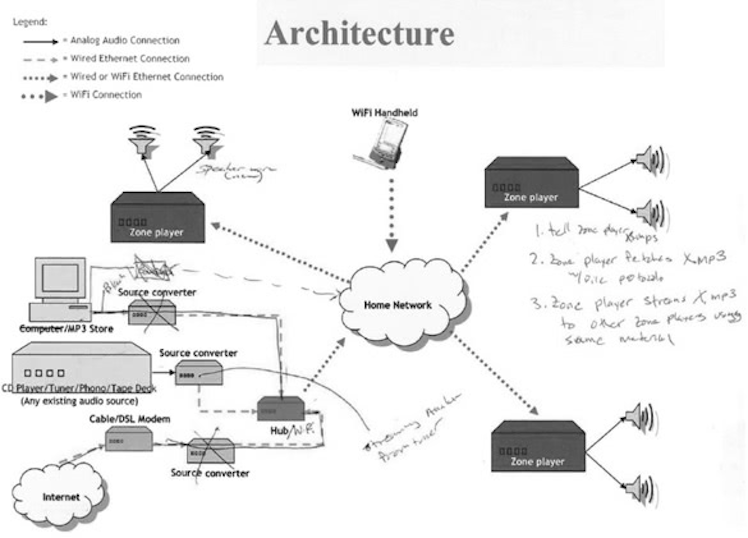

It starts with the fact that any audio experience is enhanced when multiple speakers work together. Years ago (prior to Wi-Fi becoming widespread), Sonos patented the networking architecture that allows speakers to communicate directly with each other over Wi-Fi, which allows the listener to synchronize audio and control multiple speakers from one place (the Sonos app).

Because Sonos owns the architecture, no competitor can offer a comparable in-home sound system (read: experience) as Sonos (hence why Sonos’ stated ambition is to be “the world’s leading sound experience brand.”) Make no mistake — Sonos competes with other brands, but they offer products; Sonos offers a system. Today, the system is mainly in homes, but the long-term opportunity is to expand into cars and commercial settings.

Unlike audio, there is little benefit to multiple TVs working together — you can’t really change the experience with a new architecture. Roku may have a superior OS, but it competes on the same dimensions as others.

Consumer expectations for audio and TV are also different. If Sonos put ads on its speakers, nobody would buy them. But nobody bats an eye at TV ads. As such, Sonos makes money on its hardware; it sells a premium product at a premium price. Roku makes money on advertising; it sells inexpensive hardware at roughly breakeven to create scale and feed its ad network.

Audio systems and TVs are also at different stages of adoption. Until the arrival of Sonos, multi-room home audio was reserved for ultra-wealthy audiophiles — a comparable in-home sound system would have cost $20-50k to install 20 years ago because of the wiring complexity. With no existing upgrade cycle for Sonos to tap into, it has had to build the market largely from scratch. Roku, on the other hand, can tap into the existing TV upgrade cycle (accelerated by the transition to streaming), and at an approachable price point ($25), it’s not too difficult a sale.

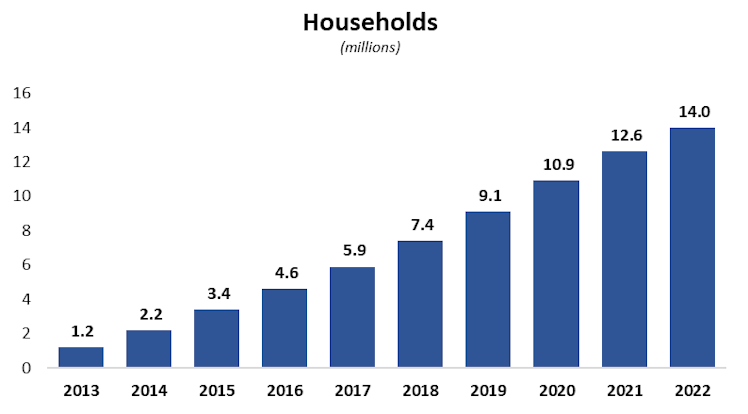

Both Sonos and Roku were founded in 2002, but Roku has ~5x the active accounts (households) as Sonos. Just six years ago, however, Roku had fewer accounts than Sonos does today. The purpose of this comparison is to frame the opportunity as Sonos sees it. Over time (perhaps a decade or more), it envisions tens of millions of homes across the world adopting smart home audio systems.

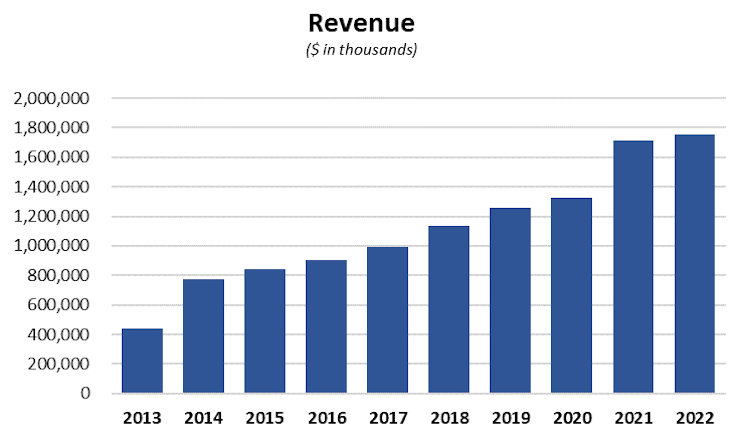

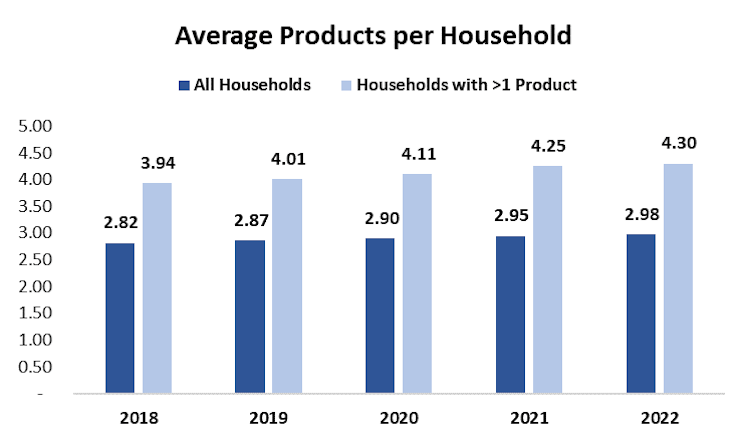

Much of Sonos’ historical growth is attributable to word of mouth (the #1 method of new household acquisition). When customers are your biggest advocates, it’s always a good sign. When those customers never leave, it’s a great sign, and when they buy more products over time, that’s how you deliver 17 consecutive years of revenue growth in an ultra-competitive industry.

In essence, that’s the Sonos flywheel: existing households bring in new households, and all households buy more products over time (and continue to spread the word to family and friends), creating a virtuous cycle.

-------

Continue reading at: Sonos: The Hardware Machine - by Gallagher (substack.com). If you enjoy my research, please consider subscribing or sharing with a friend.

investorsperspective.substack.com

Sonos: The Hardware Machine

Who's better at hardware?

Already have an account?