Trending Assets

Top investors this month

Trending Assets

Top investors this month

Carrier $CARR: The Path to Becoming a Global Climate Champion

The below is an extract of the latest deep dive released in our newsletter. In this write-up, we cover $CARR.

For the full write-up (in-depth analysis of financials, industry, management, valuation and more) you can click here --> Carrier: The Path to Becoming a Global Climate Champion

If you enjoy this memo, make sure that you subscribe to our newsletter. You can always join as a free subscriber, spend some time evaluating our work and decide later if you want to jump in.

---------------------------------------------------------------------------------------------------------------

SEGMENTS

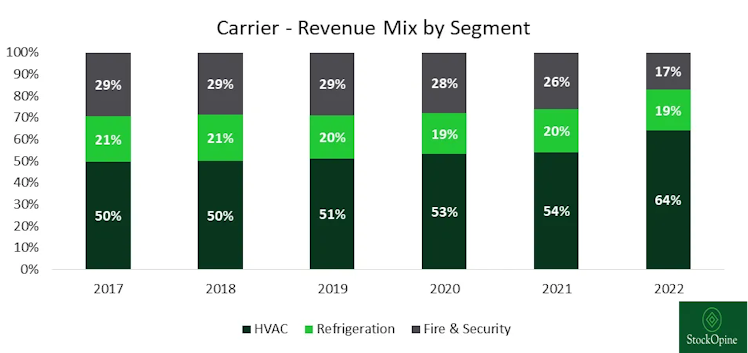

Carrier operates through three main segments: HVAC, Refrigeration, and Fire & Security. In FY 22, these segments accounted for approximately 64%, 19%, and 17% of the Company's revenue (excluding inter-segment eliminations), respectively. This represents a change from the 2019 revenue mix, where HVAC accounted for 50%, Refrigeration for 21%, and Fire & Security for 29%.

Source: Stratosphere.io, StockOpine Analysis

The increase in the HVAC segment's contribution primarily stems from higher organic growth (6.8% CAGR from FY17 to FY22) and the acquisition of Toshiba Carrier Corporation (TCC) in 2022. Conversely, the decline in the Fire & Security segment is attributed to lower organic growth (0.4% CAGR during the same period) and the divestment of Chubb Fire & Security Business (“Chubb”) in 2021. Furthermore, in Q1'23, Carrier announced its intention to exit the Fire & Security business to further concentrate on its HVAC/R business.

“The result will be a new Carrier with higher revenue and EBITDA growth profiles, leading market positions globally with a portfolio unlike any other company in the world.” David Gitlin, CEO

In terms of geographic revenue distribution, Carrier generates 60% of its sales from the Americas, 23% from Europe, Middle East, and Africa (EMEA), and 17% from the Asia Pacific region. This reflects a change from FY 19, where the Americas accounted for 55%, EMEA for 30%, and Asia Pacific for 15% of revenue.

Regarding revenue sources, new equipment sales contributed 77% to the company's revenue in FY 22, while parts and services (aftermarket) accounted for the remaining 23%. This compares to a split of 72% and 28% in FY19, respectively.

Management’s target is to grow aftermarket sales to $7+ billion by 2026, implying a CAGR of approximately 9% and compares to historical low single-digit level growth prior the spin off. It shall be noted that Patrick Goris, CFO, recently indicated that their aftermarket business (c. $5B) only covers 20%-25% of the available revenue of its installed base and that expanding on this front is a key priority. Additionally, aftermarket sales have higher margins (+10%) thus any expansion will be margin accretive.

HVAC SEGMENT

This segment provides a wide range of products and services for both residential and commercial customers. Notable offerings include air conditioners, heating systems, heat pumps, controls, and aftermarket components. Carrier's portfolio encompasses renowned brands such as Carrier, Toshiba, Bryant, and Automated Logic, further establishing its market presence in the HVAC industry.

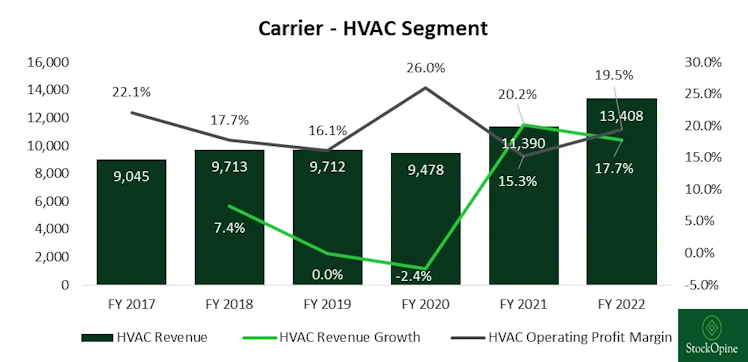

Source: Carrier 10-K Reports, StockOpine Analysis

The HVAC segment of Carrier has exhibited significant revenue growth in 2021, driven by a 17% organic growth fueled by favorable market conditions such as increase new construction, stay-at-home trends, higher distributor stocking levels, and pricing improvements.

In 2022, the HVAC segment grew 18%, with organic growth of 12% primarily attributed to price improvements rather than volumes. The remainder was driven by the consolidation of TCC results. Moving into Q1’23, HVAC segment seems to hold strong with organic growth of 6%, orders up 5% and backlog up by double digits year-over-year with the driving factor being commercial HVAC and aftermarket sales.

The HVAC segment underwent significant changes in recent years as part of its strategic focus on its core businesses, resulting in notable impacts on profitability. The most notable changes include:

- In 2017, the sale of the investment in Watsco Inc (HVAC distributor) which resulted in a gain of approximately $380 million. If you are interested to read more about Watsco Inc, here is our write-up released in April.

- In 2020, the sale of the investment in Beijer Ref (HVAC distributor) generated a gain of approximately $1.1 billion.

- In 2022, the acquisition of control in TCC which led to the recognition of a fair value gain of $705 million.

These transactions had varying effects on the financial performance of the HVAC segment, contributing to changes in profitability over the years. Excluding non-recurring gains and losses, HVAC adjusted operating profit margin averaged at a rate of 15.8% from FY19 to FY22 with FY22 adjusted margin standing at 15.2%. The lower adjusted operating margin in FY22 compared to adjusted operating margin of 15.7% in FY21 is mainly due to the acquisition of TCC which had 70 bps dilutive impact.

TCC, a variable refrigerant flow ("VRF") and light commercial HVAC business, was previously operated as a joint venture between Carrier and Toshiba, with ownership stakes of 40% and 60% respectively. In August 2022, Carrier acquired an additional 55% ownership for $930 million, increasing its total ownership to 95%. Since the acquisition, TCC has contributed approximately $800 million in sales.

Considering an estimated annual sales of $1.9 billion, Carrier's acquisition of TCC implies a price-to-sales multiple of approximately 0.9x. When compared to Carrier's average Price/Sales multiple of 1.9x, it appears that the Company did not overpay for the acquisition.

REFRIGERATION

The Refrigeration segment offers transport refrigeration equipment and monitoring systems for trucks/trailers and shipping containers as well as commercial refrigeration products. Transport refrigeration products are used for the management and monitoring of temperature-controlled environments necessary for the transport and preservation of food, medicine and other perishable cargo. Commercial refrigeration equipment includes refrigerated cabinets and freezers.

Along with the announcement in Q1’23 of the intention to exit Fire & Security business, the Company also announced its plans to exit its Commercial refrigeration business. The divested part approximates to [$1](https://commonstock.com/asset/1:equity).1B sales or ~28% of Refrigeration segment and will be margin accretive as it had an adjusted EBITDA margin at the high single digit levels (lower than the average).

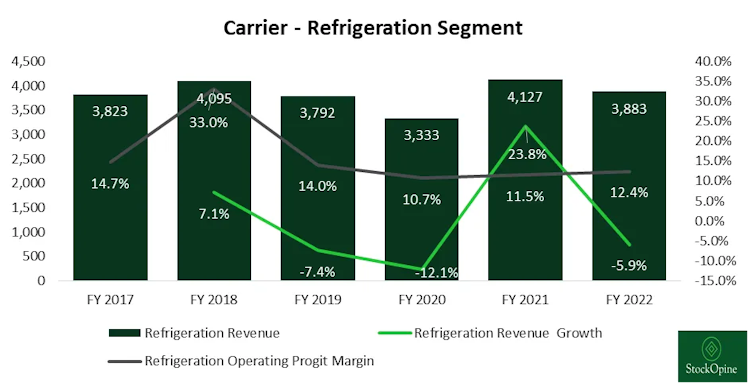

Source: Carrier 10-K Reports, StockOpine Analysis

During FY17 to FY22 the refrigeration segment grew at a CAGR of 0.4% while organic growth stood at 2.8%. The spike in revenue observed in FY21 was mainly driven by transport refrigeration which grew by 28% as a result of global supply chain improvement and Covid-19 vaccine monitoring. The significant increase in operating margin observed in FY18 can be attributed to the divestment of the foodservice equipment business, Taylor, for $1 billion, resulting in a gain of $799 million. Using adjusted operating margin, the refrigeration segment's profitability averaged 12.5% from FY19 to FY22, with FY22 standing at 12.4%.

FIRE & SECURITY

The Fire & Security segment provides residential, commercial and industrial technologies for property and fire protection. The segment provides installation and maintenance services for products such as fire, intruder alarms, access control systems and video management systems.

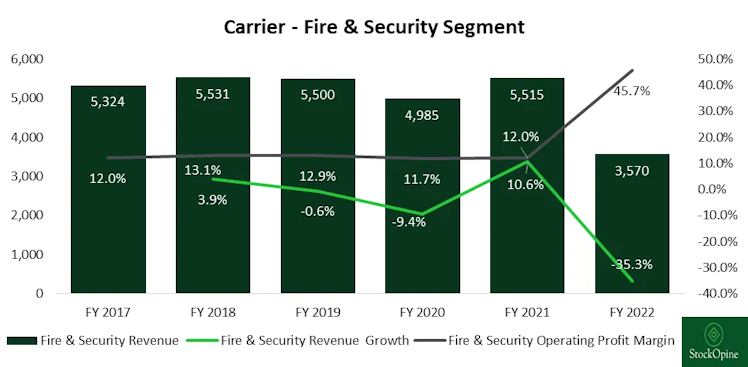

Source: Carrier 10-K Reports, StockOpine Analysis

The Fire & Security segment has experienced relatively flat organic growth with a CAGR of 0.4% over the period under review. However, in FY22, there was a significant decline in revenue due to the sale of Chubb for $2.9B, resulting to a gain of $1.1B. Chubb generated $2.2B in sales in FY21.

When excluding the impact of the Chubb sale in FY22, the segment's adjusted operating profit averaged at 13.7% over the period, with FY22 adjusted margin standing at 15.2%. It is evident that the Chubb business had lower margins compared to the rest of the segment. Management successfully sold Chubb at a 13x EBITDA multiple and expects to sell the remaining businesses at even higher multiples due to their superior profitability. It is worth noting, that the planned divestment is likely to be margin neutral to the Company as it had a similar EBITDA margin with the HVAC segment in FY22.

--END OF EXTRACT--

📢 The rest of the business overview covers the Acquisition of Viessmann Climate Solutions and Investments in joint ventures. Hope you enjoyed this extract! If you did, consider signing-up and/or share it with friends. Your support will be appreciated.

🤝 As a reminder, students with an .edu email can benefit from a 50% discount (if you face any issues or you are a student without an .edu email but wish to subscribe to the paid tier contact us).

---------------------------------------------------------------------------------------------------------------

Disclaimer: The content of our newsletter is not a trading or investment advice and we do not provide any personal investment advice tailored to the needs of any recipient. The information provided should not be considered as a specific advice on the merits of any investment decision.

www.stockopine.com

StockOpine’s Newsletter | Substack

We focus on quality companies, providing high-quality fundamental research and stock ideas. Click to read StockOpine’s Newsletter, a Substack publication with thousands of subscribers.

Already have an account?