Trending Assets

Top investors this month

Trending Assets

Top investors this month

Monster Beverage: A Beast Unleashed

Note: Today’s write-up on Monster Beverage continues the discussion from last week on Celsius, as well as the most recent update on Fever-Tree.

In the late 1990’s, Rodney Sacks and Hilton Schlosberg were searching for Hansen Natural’s next leg of growth. They had purchased the company in 1992 for $14.5 million, but Hansen Natural was still looking for “a real point of differentiation” in ready to drink (RTD) beverages. Their most recent attempt was an energy drink, Hansen’s Energy, that hit the U.S. market in 1997 (after focusing on Europe for a decade, Red Bull also entered the U.S. market in 1997). That effort ultimately paved the way for the April 2002 launch of Monster Energy Drinks, which Hansen sold in 16-ounce cans for roughly the same price as the 8.4-ounce Red Bull offering. (A strategy reminiscent of Pepsi’s “twice as much for a nickel” advertising campaign from the 1930’s.)

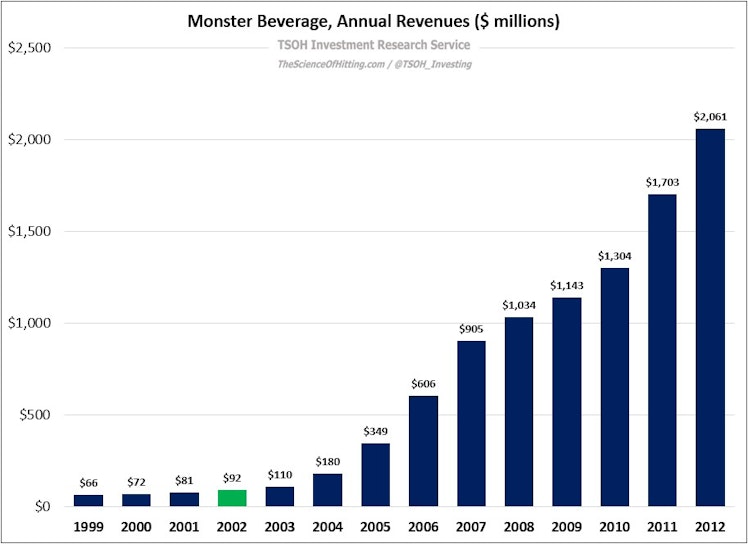

From a business perspective, the beast had been unleashed: by 2012, annual revenues had crossed $2 billion - up >20x from a decade earlier (Hansen Natural would change its name to Monster Beverage in 2012).

This success didn’t go unnoticed; as discussed in the Celsius write-up, Monster’s distribution in the early 2010’s was handled by a combination of Coca-Cola’s network and Anheuser-Busch wholesalers. That lasted until a momentous 2014 announcement: through a strategic partnership, Coca-Cola would contribute its energy drink brands (NOS, Full Throttle, etc.) and pay $2.15 billion in exchange for a 16.7% equity stake in Monster, which would be the beverage giant’s “exclusive energy play” (as a result of subsequent share repurchases, Coca-Cola’s stake is now up to 19.6%). In addition, the Coca-Cola system would become Monster’s global distribution partner; as Sacks said in 2017, “The key for us was International distribution… To truly be an International brand, we needed a distribution partner with their reach.”

Read the remainder of the MNST write-up at the TSOH Investment Research Service

thescienceofhitting.com

Monster: A Beast Unleashed

Energy drinks and ~200,000% stock price appreciation

Already have an account?