Trending Assets

Top investors this month

Trending Assets

Top investors this month

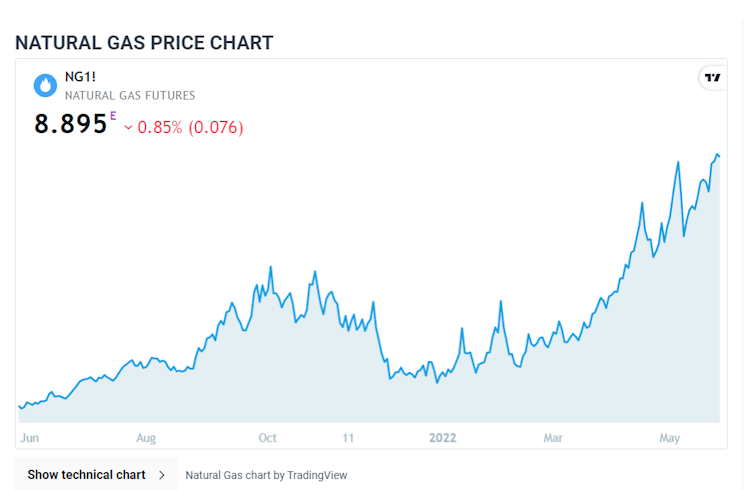

Natural Gas: North American Supply Crisis

For your watchlist:

$ARX.TO

$TOU.TO $TRMLF

$SDE.TO

Research firm Goehring & Rozencwajg released another outstanding natural resource market commentary, this one entitled Natural Gas and "The Gas Crisis Is Coming To America". I have attached a link and if you are a commodity investor, you will find it's a fascinating read. For that matter, if you are a consumer that is concerned about the price of your energy bill, it's an excellent explanation as to why heating your home has suddenly become unaffordable - and if you think it's bad now, just wait six months.

The May 18th report suggests that natural gas prices will 'surge and converge with international prices within the next six months'. Record gas prices have impacted the European economy, closing fertilizer & metal smelting facilities. Coal demand in Europe is at all-time highs.

Slower-than-expected shale growth will push the US market into a deficit and prices could surge by almost four-fold. The Marcellus & Haynesville fields produce almost 40% of US gas, and G&R believes that they will soon begin to show the first signs of exhaustion. After reaching peak production levels, shale basins enter a steep decline. Most analysts take shale production completely for granted, and it's important to note that shale growth is limited.

Newly imposed taxes and regulations in both Europe & North America will likely restrict much needed growth of the energy sector. After previously stating he would not impose such a tax, Boris Johnson's government did a recent u-turn and implemented a 25% windfall tax on oil & gas companies. JP Morgan’s Managing Director for Global Energy said in an interview that a windfall tax “creates unpredictability for projects that take years to develop.” BP Plc said it will look again at its plans in the UK, and Shell Plc said that “a stable environment for long term investment” was fundamental to its plan to invest as much as £25 billion into the UK’s energy system in the next decade. Most analysts expect smaller explorers and producers to be hit much harder than majors.

In addition to growing fears of a windfall tax being implemented here, North American producers are grappling with the SEC's new proposed rules on climate disclosure. The National Mining Association told the SEC its “incredibly consequential and complicated rule” would impose substantial administrative burdens on companies. “This climate rule making is unlike anything I’ve seen in my 25-year career in securities law, in the breadth and scope of the proposals,” said David Lynn, at law firm Morrison & Foerster. Complying with the rules could be more expensive than the SEC estimates, as companies will for the first time be required to report their greenhouse-gas emissions including, in certain cases, those from their suppliers and customer. Short-sighted government policies will likely cause energy companies to suppress domestic E&P, ensuring supply deficits continue for the foreseeable future.

Forbes

SEC Climate Rule Opens A New Front In Biden’s War On Oil And Gas

President Joe Biden promised to end the use of oil and natural gas in the United States during his campaign, and also talked about mounting a “whole of government” approach to achieving that goal. Since taking office, he has worked to follow through on those promises.

Already have an account?