Trending Assets

Top investors this month

Trending Assets

Top investors this month

Boric on Lithium: Bluster & Bravado or Forthcoming & Factual?

I always find market psychology such a fascinating topic. I have a theory that most news leads to weak hands being the first ones out (or FOMO being the first to rush in). Perhaps that's what happened on Friday following Chilean President Gabriel Boric's televised announcement on Thursday evening that Chile planned to nationalize its lithium resources.

Chile’s President Gabriel Boric announced on Thursday night his government would nationalize the country’s lithium industry, applying a model in which the state will partner with companies to enable local development.

_Shares of some of the world’s biggest lithium mining companies traded sharply lower on Friday after Chilean President Gabriel Boric unveiled a new state-led strategy to develop its vast resources of the metal.

_

Shares of Sociedad Química y Minera de Chile, one of the world’s top lithium producers, and partially owned by China’s Tianqi Lithium Corp., fell Friday nearly 19% in New York. U.S.-based Albemarle Corp., the only other producer in Chile, was down 10%. Both companies extract lithium from salty brines located under Chile’s northern Atacama salt flat.

Sellers seemed to ignore a few key points, however.

The first being that ALB & SQM have contracts in place until 2043 and 2030, respectively:

The two lithium miners already operating in Chile, Albemarle (NYSE: ALB) and SQM (NYSE: SQM) will continue to do so until their contracts expire. Without naming them, Boric said he hoped that lithium miners already present in Chile would be open to negotiate state participation before the end of their contracts.

The contract for the world’s no.1 producer, Albemarle, runs out in 2043, while the contract for the second largest, SQM, ends in 2030.

Secondly, according to the Chilean government's post on the nationalization strategy, the 'bill is subject to the approval of the National Congress'.

Investors treating Boric's statement as a certainty may want to think again.

According to this January 2023 Bloomberg article:

Chileans have already rejected two constitutions in referendums — the current one that was written in 1980 and last year’s — and they are quite capable of rejecting a third.

Investors will find some reassurance in the guiding principles established in lawmakers’ agreement in December to relaunch the constitutional process, both Gomez and Zuniga said. Those ideals — including respect for private property, central bank autonomy and a two-house congress — will be mandatory in the proposed new charter.

Unlike in the prior attempt, which called for eliminating the senate and making water rights revocable, the guidelines clear the way for a balance between a free-market economy and a “democratic and social state of law,” according to Gomez.

“We have fragmentation in congress that prevents any government or coalition from functioning,” Gomez said. “The president has to agree with more than 15 parties to advance policies, and doesn’t have a majority."

Boric's statement also mentioned favouring DLE technology, which I have advised investors to exercise caution when considering this unproven technology:

Codelco and state miner Enami will be given exploration and extraction contracts in areas where there are now private projects before the national lithium company is formed.

There will be a unit in charge of advancing technology to minimize environmental impacts, including favouring direct lithium extraction (DLE) over evaporation ponds — the method currently used.

Applying DLE is expected to speed up production and avoid vaporizing billions of litres of water. The technique, however, is relatively untested at major scale, which could initially mean less output and profit.

It's also important to remember what occurred the last time Boric attempted to have such measures approved by Chile's Congress in May 2022:

A constitutional assembly in Chile has rejected plans to nationalise parts of the crucial mining industry in a blow to progressive hopes of overhauling the neoliberal Pinochet-era political settlement.

The proposal, known as article 27, would have given the state exclusive mining rights over lithium, rare metals and hydrocarbons and a majority stake in copper mines.

But it faced fierce opposition from the mining sector and was voted down last week in a defeat for progressive hopes of redistributing wealth in the world’s top copper producing nation.

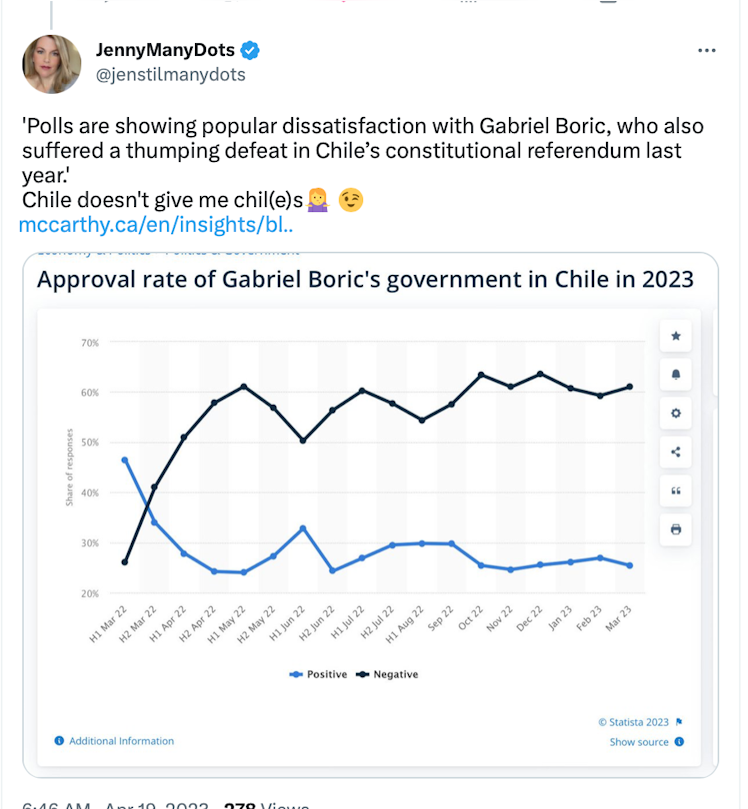

Given Boric's current approval ratings, it appears he may have difficulty getting this bill passed as well:

Perhaps lithium investors will find some solace in news expected this week, as Boric's administration seeks a deal with copper producers in the country:

The administration of President Gabriel Boric is optimistic over an agreement between Tuesday and Wednesday, Mining Minister Marcela Hernando said at a seminar Tuesday in Santiago.

“We understand that several points of consensus have been reached,” Hernando said.

The comments come after the government presented amendments to the bill on Monday that would lower the maximum tax burden for copper producers to 48% of operating profit, from the 50% previously proposed. This would bring the average tax rate to 42.1% based on prices over the past 10 years, according to previous data presented by Finance Minister Mario Marcel.

The Senate’s Finance committee will vote on the bill later Tuesday with a vote at the Senate floor scheduled for Wednesday. The bill will then head back to the lower house for a potential final vote.

It's doubtful that the likes of Anglo, Lundin Mining, and Glencore would be eager to acquire and expand assets in Chile if copper were likely to be nationalized.

Anglo Chile Chief Executive Officer Patricio Hidalgo applauded the Chilean government’s willingness to discuss modifications to its copper royalty bill, which will go to a senate vote this week. Besides proposed tax rates, he is also keeping a close eye on stability factors, hoping for something akin to the current guarantees.

“Our commitment to the $10 billion project portfolio in the next decade remains unchanged,” he said. That includes $6.5 billion at Los Bronces and Collahuasi, $1.8 billion for water and the rest on climate change-related initiatives.

Lundin Mining Corp, which recently made Chile’s first big copper acquisition in nearly a decade, is setting targets for its new Caserones mine and waiting to expand its existing Candelaria mine, its CEO said in an interview.

The expansion will add up to 25,000 tonnes of copper production annually, he said. Candelaria produced 126,300 tonnes in 2022, according to Chile’s Cochilco, and Lundin estimates 145,000 to 155,000 tonnes for 2023.

In a vote of confidence in Chile when other mining giants had been holding off on investment, Lundin recently purchased the Caserones mine for $950 million from JX Nippon Mining & Metals. It was the Chilean market’s biggest acquisition since 2015 when Antofagasta paid $1 billion for a 50% stake in the Zaldivar mine from Barrick Gold Corp.

Glencore is eager to takeover TECK, not for coal but for their prized copper asset in Chile:

$TECK's QB2 project in Chile is expected to produce 285,000 to 315,000 tonnes of copper annually between 2024 and 2026. Overall, Teck expects to increase copper production to between 545,000 and 640,000 tonnes per year in the same time period.

Investors should take a deep breath and consider all the facts before panic selling, particularly when it's an entirely different commodity than an extremely unpopular politician is likely just blowing smoke about...

financialpost

Teck versus Glencore: What you need to know about the takeover battle gripping mining industry

Teck Resources and Glencore are fighting over a $23.2-billion takeover that could rewrite Canada's mining industry. Read why it's important.

Already have an account?