Trending Assets

Top investors this month

Trending Assets

Top investors this month

Netflix: "This Is When It All Matters" $NFLX

In June 2004, Netflix announced the first price hike for its standard DVD subscription service (+10%, from $19.95 per month to $21.99 per month).

But just five months later, Netflix reversed course.

As a result of a “changing competitive landscape” (a resurging Blockbuster, along with incursions by Walmart and Amazon), the company announced in November that the price would be lowered to $17.99 (they also introduced a lower-tier that allowed access to two DVD’s at a time for $11.99 a month). As noted in a 2005 CNN Money article, that was an ominous signal: “Price wars in tech are never a good sign.” In the 2004 shareholder letter (back when Netflix had ~2.6 million subscribers and ~$500 million in sales), management spent a fair amount of time discussing the competitive dynamics within the DVD market (“2004 was also a year in which we demonstrated our willingness to make hard choices — including lowering prices and deferring profitability — to protect our market leadership.”). But while Netflix’s streaming (SVOD) service wouldn’t launch for another three years, it was already clear by that point that management had their sights set on a bigger prize: “delivering a superior home entertainment experience”.

In the 2005 annual report, management wrote the following:

“We also anticipate the emergence of a significant downloading market once two primary hurdles are cleared: the availability of deep and compelling content and the technological challenge of getting the content from the Internet to the TV, where people want to watch it. We are absolutely focused on positioning Netflix to lead this market. It’s important to remember that downloading is just another way to deliver content, an alternative to the mail, or the local video store, or to cable, or to satellite delivery. The winners in downloading will be the companies that provide the best content and the best consumer experience, and that’s what we do best. With millions of online subscribers addicted to the Netflix Web site, we will have both a mass audience and the most compelling consumer experience in the market, which will give us critical advantages as we begin to offer downloading as a second delivery option.”

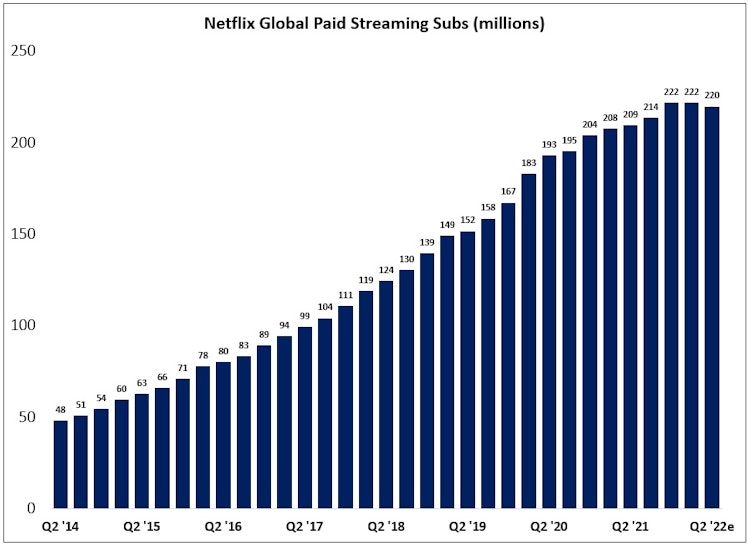

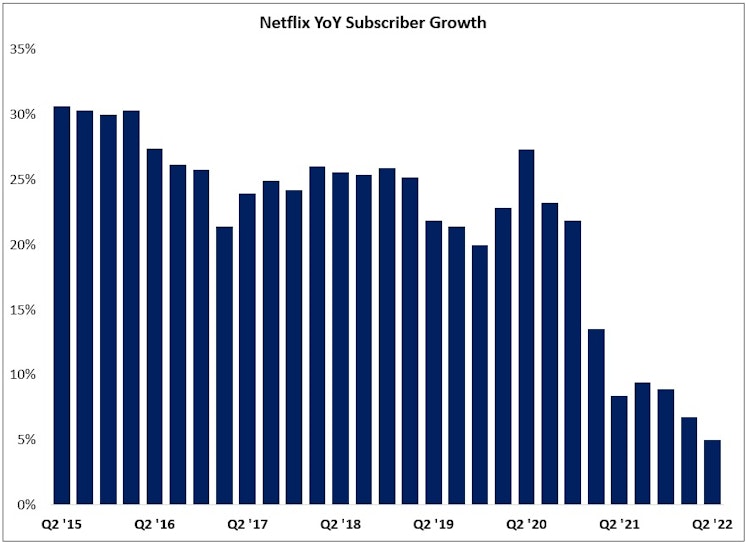

Jumping to the present, we can see that Netflix’s “absolute focus” on the streaming market has paid off. In Q1 FY22, the company reported that their customer base reached 222 million paid subscribers around the world, an increase of ~180% over the past five years (note that the company shut down its Russian service in Q1, which was a ~700k hit to the sub base).

But as that second chart shows, the pace of subscriber growth has slowed meaningfully in the past 18 months; what was once assumed to be a temporary hangover from the pandemic now appears to be a larger issue. For context, here’s what I wrote about Netflix’s sub growth back in June 2021:

“One thing to consider as we think about the future is whether we’re resetting a base to grow off of (above 54 million net adds every two years) or if we’ve flatlined around that level. That’s not an unimportant question to answer, particularly as it relates to the TAM. Naturally, if you comp against a large and growing base, adding 27 million net subscribers every 12 months will have less of an impact on the growth rate than it did a few years earlier. This is bound to happen over time - you can’t add tens of millions of subs in perpetuity - but if it’s happening now, that’s a notable development. We’ll see if a meaningful increase in the number of content releases in 2H 2021 and into 2022 can provide investors with some reassurances on that front.”

In hindsight, the idea of leveling off at 25-30 million net adds per year looks overly optimistic (to say the least). The fact that CFO Spencer Neumann felt the need to reiterate that there will be revenue growth and paid net adds in 2022 is telling. This significant change in expectations has (rightly) led to consternation in the market, with NFLX down ~70% from its 2021 highs.

As always, my primary objective is to try and understand what this all means for a long-term investor / business owner; in this post, I will try and answer four key questions: (1) What just happened? (2) What are the long-term implications for Netflix? (3) What are the long-term implications for the industry? (4) Does this materially change the long-term investment thesis?

thescienceofhitting.com

Netflix: "This Is When It All Matters"

In June 2004, Netflix announced the first price hike in the company’s history for its standard DVD subscription service (+10%, from $19.95 per month to $21.99 per month). But just five months later, Netflix reversed course; as a result of a “changing competitive landscape” (a resurging Blockbuster, along with incursions by Walmart and Amazon), the company announced in November 2004 that the price would be lowered to $17.99 (they also introduced a lower-tier that allowed subscribers access to two DVD’s at a time for $11.99 a month). As noted in a 2005 CNN Money article, that was an ominous signal: “

Already have an account?