Trending Assets

Top investors this month

Trending Assets

Top investors this month

Dividend Growth Investing While Young

"Compounding is the 8Th Wonder of the World

Einstein once said, “Compound interest is the eighth wonder of the world. He who understands it, earns it… he who doesn’t… pays it.” Over time, your dividends will earn more dividends. Then your dividends that were earned by prior dividends will earn you more dividends. It seems simple, but it is surprisingly hard to wrap your head around just how powerful compounding is till you play some numbers and graphs. We will do that here.

Take Lowe’s ($LOW) for example. For the last ten years, the stock’s average dividend yield has hovered around 2%. 10 years ago today, one share of $LOW cost you $26.98. Let’s assume an initial investment of $10,000. Using Sharesight, I can back-test the performance of that investment with dividends reinvested and the result is shocking.

From June 2012 to June 2022, the stock price moved from $26.98 to $186.33. In 10 years, the stock price grew by almost 6x. Add to that appreciation, 10 years of growth and compounding dividends and your position would have grown from $9,982.60 on June 11th, 2012 to $64,920.20 on June 10th, 2022.

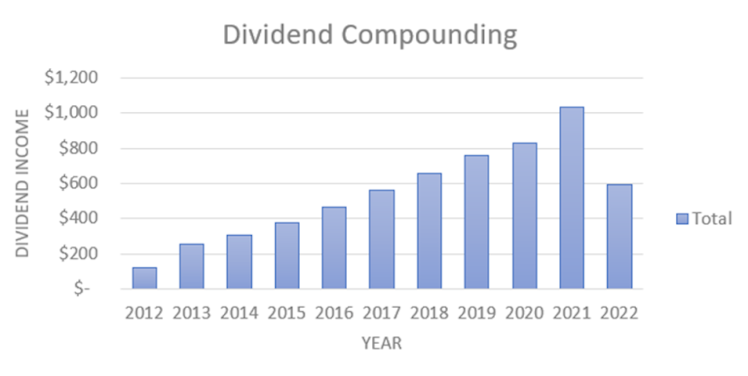

Meanwhile, your quarterly dividend payout began at $59.20 and grew to $296 which yielded you a total dividend payout of $5,960.70. With just 10 years of holding, your dividend payout grew by more than 5x and yielded you a total of $5,960.70.

The magical variable in this formula is time. In 10 short years, you can see in the graph below that the dividend payouts start to resemble an exponential curve. If I had back tested for 20 years instead of 10 years, the dividend would have grown from $4.24 to $339.20 and that curve would be more pronounced. This simply goes to show why it is a good idea for dividend growth investors to start early. The younger you are the more time you have available to you for compounding."

This was a snippet from a new article I wrote titled Dividend Growth Investing While Young.

Give it a read if you'd like more information on why the common adage that young investors should take on more risk than older investors and pursue high-growth investment strategies is flawed.

Dividend Dollars

Dividend Growth Investing While Young | Dividend Dollars

Young investors should not overlook the powerful wealth-builder of compounding through dividend growth investing.

Already have an account?