Trending Assets

Top investors this month

Trending Assets

Top investors this month

$GPRO: The Biggest Turnaround Story of 2022?

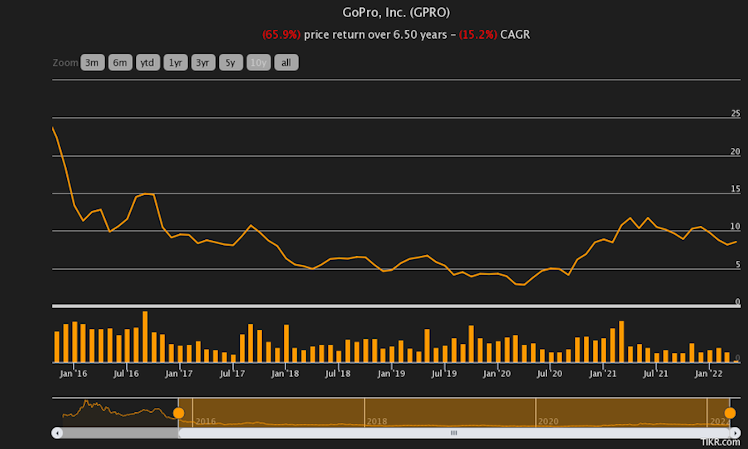

$GPRO could be one of the biggest turnaround stories of the past couple years.

Business model is pivoting towards highly profitable subscription models, gross margins are increasing, the CEO's stake is large, and management is buying back shares at a big discount.

I am doing more research, but here are some quick numbers on the business and turnaround.

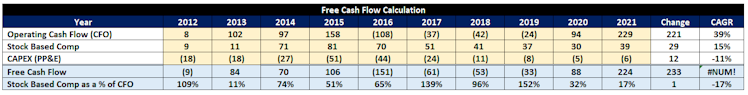

FCF has grown rapidly since switching to a subscription model business.

In 2016, FCF was at -$151 and now is at an all-time high of $224!

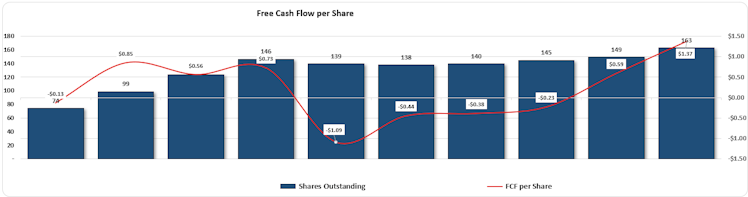

In spite of moderate share dilution, $GPRO has grown FCF/share in a very impressive fashion over the past few years.

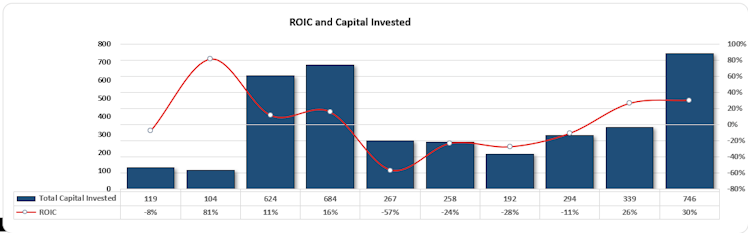

Similarly, ROIC has increased significantly as a result of the increased investment and sits at 30% currently.

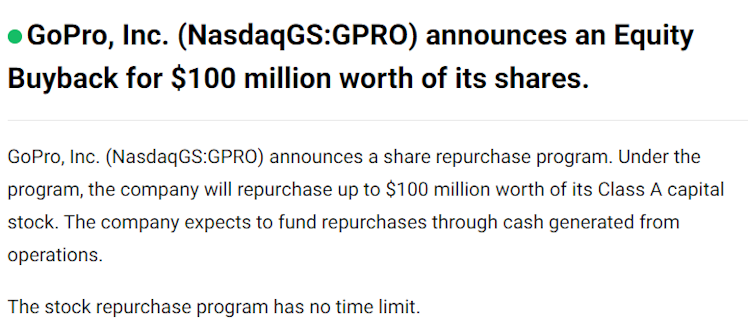

The company's capital allocation looks promising too, with the buyback of $100 million while shares remain at historical lows.

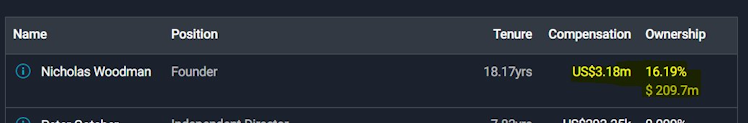

Nick Woodman, founder and CEO, owns over 16% of the company.

This is the kind of leadership stake I like to see.

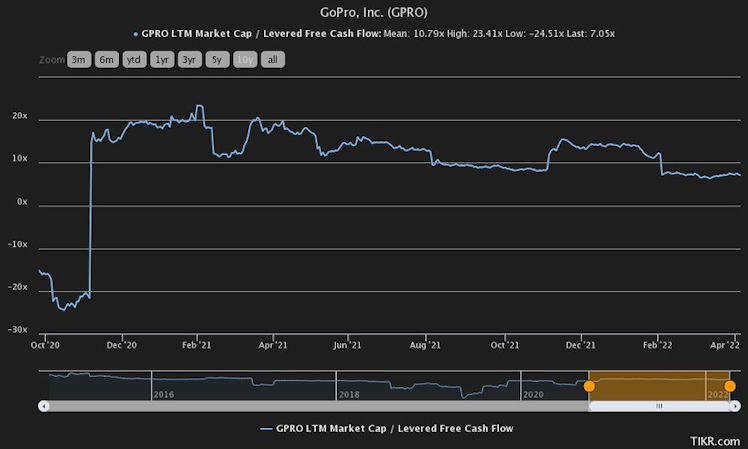

From 17 to 7 P/FCF has fallen steadily since GPRO's remarkable turnaround.

In essence, the market has yet to re-rate the company's shares, which have remained in the $8 range for the same time period.

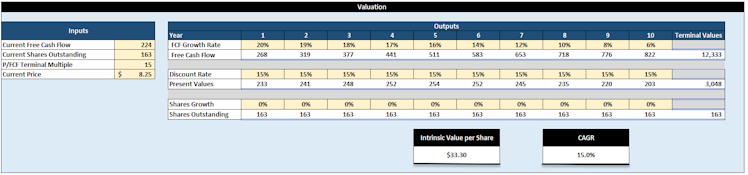

I have calculated an intrinsic value of $33 per share based on a DCF model with conservative growth rates (while also leaving out incoming buybacks).

If the market caught on within the next couple of years, one would easily be able to double or triple their money.

I'm still doing more research, but the numbers look promising.

At the end of the day, CEO Nicholas Woodman decides whether $GPRO will be successful.

What do you think? Yay or Nay?

Is $GPRO undervalued and due for a re-rating?

38%Yep!

61%Nope.

18 VotesPoll ended on: 4/10/2022

Already have an account?