Trending Assets

Top investors this month

Trending Assets

Top investors this month

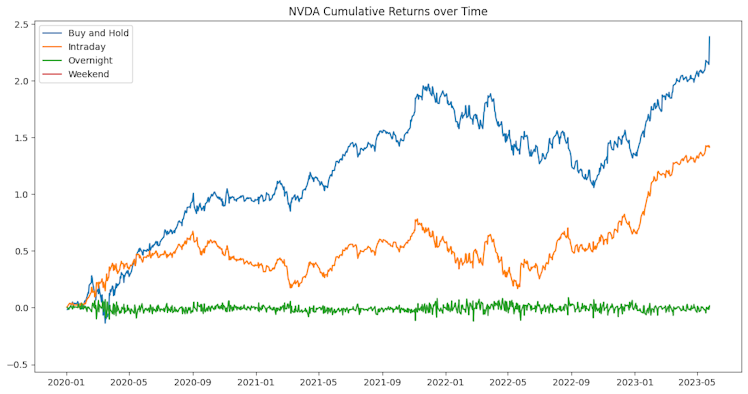

Decoding the Matrix of Profit: Inside NVDA's Return Landscape

The financial chessboard is a war zone, a labyrinth of opportunities waiting to be unlocked by strategic moves. It's not just about owning a piece of the game - it's about understanding the rules, anticipating the tactics, and refining your approach. Let's take a deep dive into one of our knights on the board, NVIDIA (NVDA), through the lenses of different holding strategies: Buy and Hold, Intraday, Overnight, and Weekend.

Buy and Hold

NVDA's performance under the classic Buy and Hold strategy underscores a fundamental truth of investing: longevity is a virtue. Delivering an average daily return of approximately 0.28%, this strategy cuts through the noise, allowing you to ride the wave of long-term growth. It's the grandmaster's choice, a strategy born out of patience and foresight.

Intraday

Switch gears to Intraday trading, a high-intensity game of tactics and timing. This isn't for the faint-hearted; it demands a constant pulse on market movements. With NVDA, you could potentially pocket an average return of about 0.165% per day - a quick, short win for the agile trader willing to play the game.

Overnight

Then there's the Overnight strategy, where you exploit the silence of non-trading hours. With an average daily return of a modest 0.0019%, it's not about dramatic wins but strategic positioning, a buffer against intraday volatility.

Weekend

Finally, the Weekend holding strategy - buying at Friday's closing bell and selling at Monday's opening bell. This one hasn't been the strongest performer for NVDA, with average returns of -0.2843% per weekend. But in the grand scheme of things, it's a move that can be finessed, balancing out the risk-reward ratio when analyzed against broader market trends.

In Closing

The financial market is a complex beast, a multi-dimensional chessboard with endless moves. NVDA, like any piece on this board, can make or break your game, depending on your strategy. Remember, though, the past is no oracle. It’s always crucial to stay informed, analyze the patterns, and brace for volatility.

Already have an account?