Trending Assets

Top investors this month

Trending Assets

Top investors this month

Converge Technology - A Canadian Growth Machine

Converge $CTS is a software provider that specializes in helping its clients develop their Information Technology infrastructure, specializing mainly in the migration of physical servers to cloud-focused environments. CTS's main strategy is to acquire smaller regional IT providers, expand their margins through cost synergies and improve customer penetration through cross-selling of products and services, but they have solid organic growth too.

Converge has four main business verticals: Advanced Analytics, Cloud, Cyber Security and Digital Infrastructure.

Market Growth

Worldwide spending on IT services is expected to grow by approximately 8% CAGR to 2025.

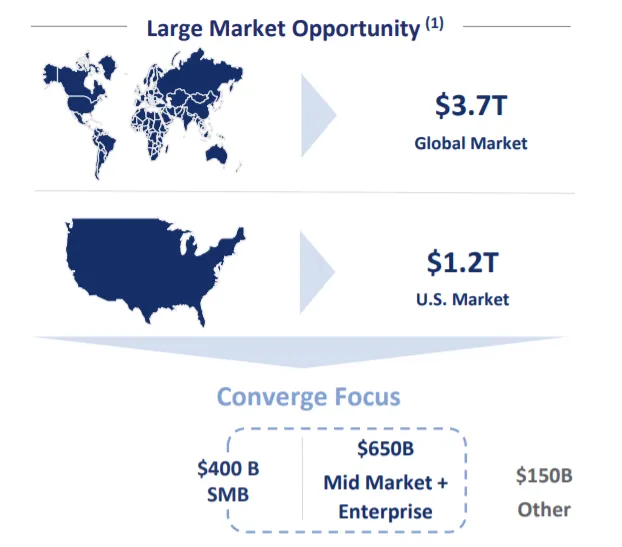

According to Converge, the potential international market is $3.7 trillion dollars, with up to $1.2 trillion in the United States alone, however Converge is currently focused on working with small and medium-sized companies, which would represent a potential market of $400B.

There are around 80,000 direct competitors of Converge but none has more than 5% of the market share. Is a very fragmented market where CTS's acquisition strategy is highly relevant, since it has a large market to consolidate.

CTS currently has around 2,000 clients, well diversified, both by industry and by weight, since the top 10 clients do not exceed 20% of income and are spread over more than 6 industries.

Key Ratios

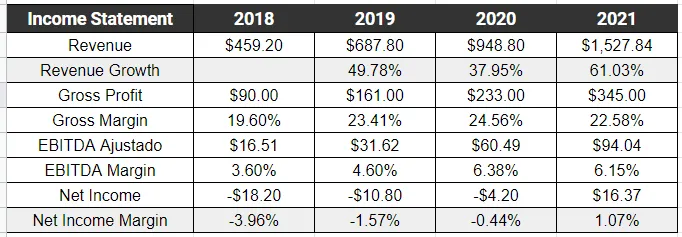

- Revenues have grown at an outrageous 50% CAGR, and in 2021 around 10% of the growth came organically, but they had close to $250M of income that they could not materialize due to problems in the supply chain, in a normalized environment they would expect organic growth to have been close to 20%.

- Gross Profit grew from 19% to 22% and mgmt expect to continue to rise as sales from Managed Services and other higher margin business lines grow.

- Net Debt is -$60M.

- Capex is a 1.5% of sales, so we could consider CTS a Asset Light business.

- I'll like to add that, dispite making a lot of adquisitions, the Goodwill only represents 10% of the Market Cap, which is a good sign of how they buy companies at a cheap price.

Management Team

The co-founder and current CEO, Shaun Main, has extensive experience in the IT Services industry, since he previously held positions in Pivot Technology Solutions, a Canadian company also focused on offering IT services that was acquired in 2020 by Computacenter.

Shaun has done a great job designing and executing his strategic acquisition plan with Converge and hasn't changed any aspect of the plan since 2017 so he knows what he's doing and trusts that strategy.

Shaun is highly aligned with the shareholders, since he is currently the second largest shareholder in the company, with approximately 4% of Converge's shares, equivalent to almost 70 times his annual salary.

For the last 6 months the management team has been buying shares and they have not made any sales. This is a great sign because when insiders sell shares the reason may be that they want to buy a house, a car or pay for a vacation, but when they buy the reason is only one: They are convinced that they are going to make money with their company.

Valuation

Considering the past 50% rev growth and 6% EBITDA margins, I estimate a 20% growth for the next 5 years (both organic and inorganic) and an increase in margin to 8% EBITDA

This would represents ~$5.6B of revenues in 2027, and a EBITDA of ~$450M.

Using a conservative 10x EV/EBITDA multiple, the target price for 2027 is around $30 CAD, a 40% annual return or +450% return if buying at actual $5.50 CAD.

If you wanted to make a 15% return the next 5 years (according to my estimates), the target price TODAY would be $14 CAD. More than a 2x of current price.

Final Thoughts

✓ Is a good business model in a fragmented sector with tailwinds that will favor growth, both organic and inorganic.

✓ Opportunity to improve margins and financial ratios that would give a boost to the share price, since the current ratios hide the true potential behind it.

✓ Great management team, fully aligned and that has proven to be faithful to its strategic plan and carry it out optimally.

✓ It is highly undervalued even making a conservative projection.

While this bear market has destroyed the stock price, Converge has been adquiring companies and growing organically because of the strong demand of IT Services, making a time bomb that could explode in any moment.

Already have an account?