Trending Assets

Top investors this month

Trending Assets

Top investors this month

Thoughts On What Moves $SFM Over The Long Term

Sprouts Farmers Market has certainly been on a wild ride over the last few weeks. From crashing down to $23 a share after poor earnings to having shot past $30 a share after their most recent earnings. These drastic moves in price aren't incredibly important in the short term. However I think we can use the recent earnings to figure out what metrics Sprouts investors should focus on moving forward.

Today I want to talk about what I have noticed moves the needle the most.

Long Term (5+ Years - Forever)

1.) New Store Openings.

Right now Sprouts relies very heavily on opening new stores in order to grow revenue. They have been fairly consistent given a large amount of cash used to open new stores at a rate of 10% per year. This is why Q1 earnings were such a bad reaction. Investors thought $SFM didn't have strong enough pricing power to pass along inflation to customers. If their already slim margins we're to compress even more Sprouts might have to slow the store opening machine. It turns out the fears we're mostly unjustified as in Q2 Sprouts proved they definitely have the pricing power.

2.) Stable Same-Store Sales Growth.

While $SFM certainly isn't driving same-store sales growth with their measly 1-2% target it is important for Sprouts to continue driving growth. After Sprouts reported massive drawdowns in same-store sales growth in the first half of 2021 the bleeding has stopped and growth has once again resumed. It is certainly worth watching moving forward given the laser focus the company has on opening new stores. As long as same-store sales are increasing at basically any amount it's a good thing.

3.) Private-Label brand growth.

While not brought up many Sprouts has a private label brand that allows the company's reach to extend outside of just its stores. Following the growth of this business, the segment has been attractive despite the infrequent updates. In April it was reported that the Private-Label business had grown by 16.1% Y/Y. This is even faster than their 2021 growth rate of 15.8% Y/Y. So while not showing off much this high-margin segment is worth closely looking at every new earning.

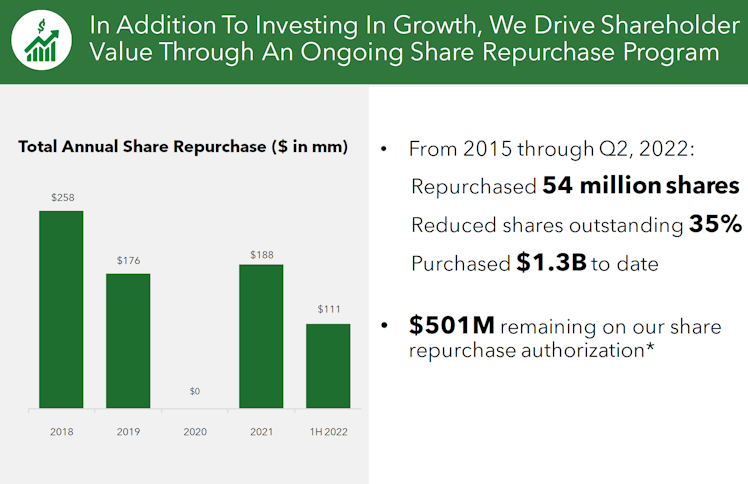

4.) Buybacks.

Of course, I want to mention the incredible amount of buybacks Sprouts has been doing. In March of this year, the Board approved a new $600m Buyback program through 2024. This represents approximately 15% of the shares outstanding. This announcement came after $SFM bought back 15% of its shares in the last 3 years. While this feels slightly conservative I expect buybacks to ramp up as macroeconomic conditions improve. And most investors know Buybacks are a great idea for companies unable to use the cash to grow, arguably even better than dividends.

I think there is still a lot of value to be unlocked moving forward as Sprouts continue expansion. With this there are several things to keep in mind. Especially as inflation seems to be here to stay at an elevated level. But overall the direction seems solid and its why $SFM occupies such a large part of my portfolio.

Already have an account?