Trending Assets

Top investors this month

Trending Assets

Top investors this month

Looking for Ore-Some Returns? - Ferrexpo (LON: FXPO)

The September Idea Competition terms highlight two things. The trade idea must be:

- A stock which will increase the most percentage-wise;

- Over the next 12 months.

Given the state of the global economy over the medium term (energy crisis, rising rates, Chinese real estate concerns… to name some issues!), I investigated situations that were dependent on an event occurring over the next year which would be a catalyst for a company, rather than a company with potential for rapid and organic growth.

One event that has dominated the world over the past year is the Russia-Ukraine conflict. The timeline on this war resolving itself has been very unclear, however the outlook has changed slightly recently.

With successful Ukrainian counter-offensives occurring in the North-East of the country and Putin’s subsequent announcement of a partial mobilisation of reservists, it appears the situation has escalated. This could see an acceleration of the war and a sooner end to the conflict. As such I have looked for Ukrainian businesses, who have seen a huge fall in their stock value and could see a huge rally if the situation were to resolve itself fairly rapidly.

Obviously most investors in the “West”, don’t have access to the Ukrainian Exchange on their accounts. This is when I came across Ferrexpo.

Ferrexpo is a Swiss domiciled, London listed, Ukraine based producer of iron ore pellets and constituent of the FTSE 250. Prior to the conflict, it was the third largest producer of iron ore pellets globally, with its exports representing 4% of Ukraine’s export revenues. Iron ore pellets are an important component in the production of steel.

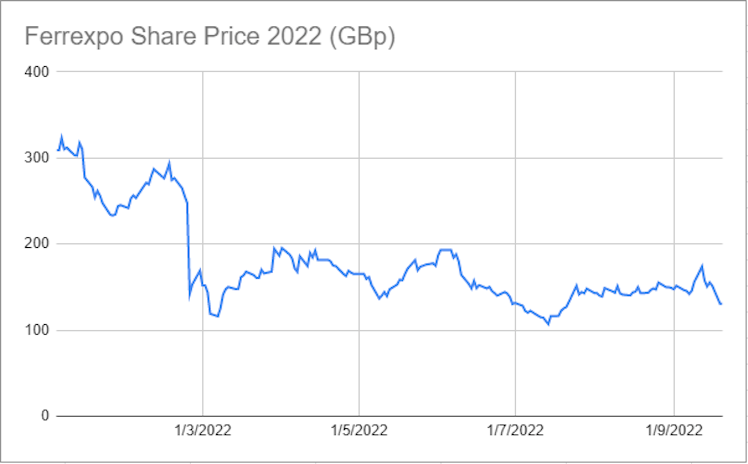

The stock price understandably saw a huge fall as the conflict broke out losing close to -50% of its value.

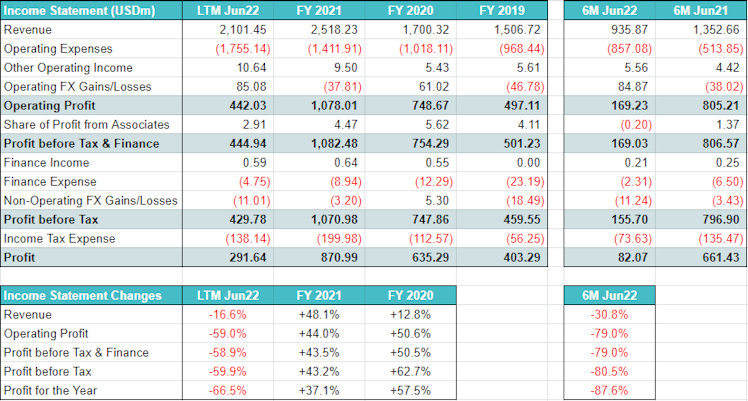

There has been no fighting near the company’s operations and as such no current impact on infrastructure. No significant impact on the number of employees either, with only 6% listed in the Ukrainian forces. The company continues to operate however its exporting ability has been hampered, and has driven its fall in earnings. Revenues have declined for 1H 2022 by -31% as compared to same period last year. Profit after tax down -88% for same period as compared to last year.

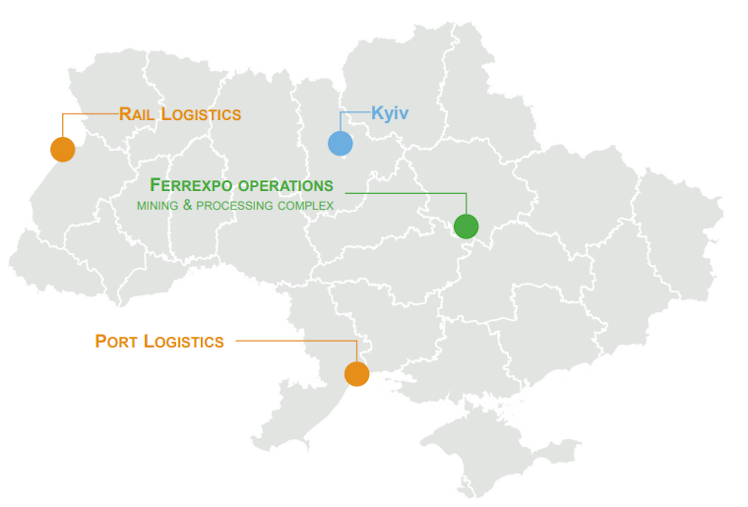

Exporting is currently still done via rail and barge into Europe, however seaborne exports via the port of Pivdennyi are suspended. The Ukraine rail network was suspended in late February and then partially lifted. Current exports remain only those done via Europe.

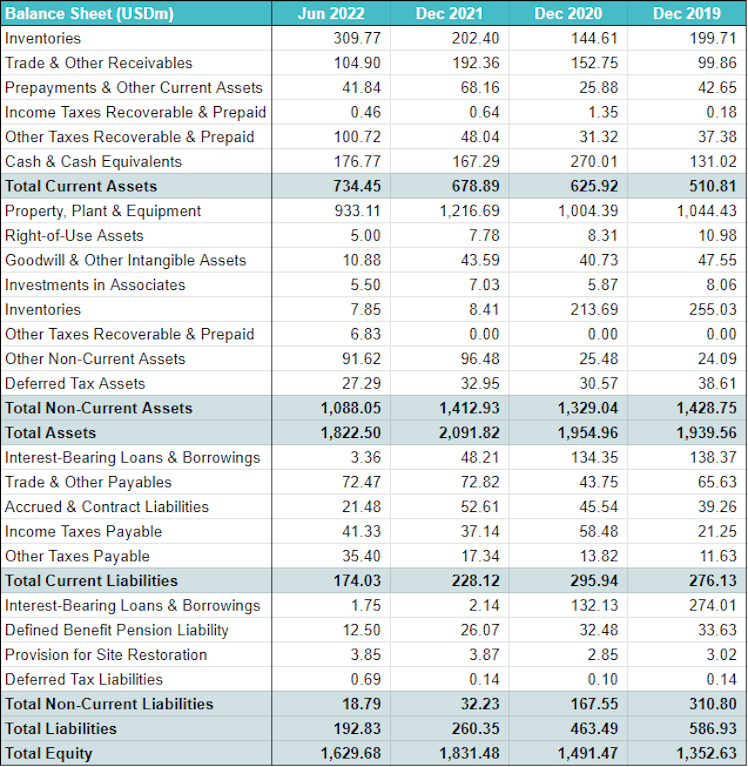

The balance sheet is very healthy, inventories have risen due to the company’s reduced ability to export, but there is little risk of the firm going under, with very little debt and a huge net cash position of USD 177m. Little debt means it is barely affected by rising rates too.

Value Drivers

In the case of the war ending, there are two main accelerators of Ferrexpo’s revenue.

Firstly, export routes out of Ukraine should reopen, which has been the main driver of the fall in revenues as opposed to any operational issues in the mining and pellet manufacture. The significant inventory build up will help the company to begin exporting rapidly.

Secondly, a huge rebuilding project in Ukraine would begin, and since steel is a critical component in the construction of infrastructure and buildings, there would be a sudden surge in demand for iron ore locally. Ferrexpo having their operations in the centre of Ukraine would put it at a significant advantage when it comes to shipping iron ore around the country.

Risks Beyond War

Obviously the biggest risk is the war dragging on longer or Russia gaining the upper hand, however I foresee a few others.

Iron ore demand has principally been driven by the Chinese construction and house building market. If concerns around the Chinese real estate market continue to last, this would temper iron ore demand and prices. I expect this to be significantly mitigated however by the Ukrainian rebuild.

Another risk is a recent court ruling against the company, losing an appeal for a case that it had won once before. Ferrexpo will appeal the ruling and are confident of winning. Given our one year timeframe, this risk is mitigated, since Ukrainian courts are taking much longer to resolve cases given the war. If anything, the recent sell-off on the back of the news has given a better entry point for an investment.

Already have an account?