Trending Assets

Top investors this month

Trending Assets

Top investors this month

Weekly Market Update (Wk#30)

Dear Fellow Investors,

Excuse my long-form write-up; I just wanted to share a few thoughts on the market.

The equity market reported a strong comeback after a choppy start to the five days, spurred by a better-than-expected response to the FED monetary policy decision and remarks from Chairman Jerome Powell.

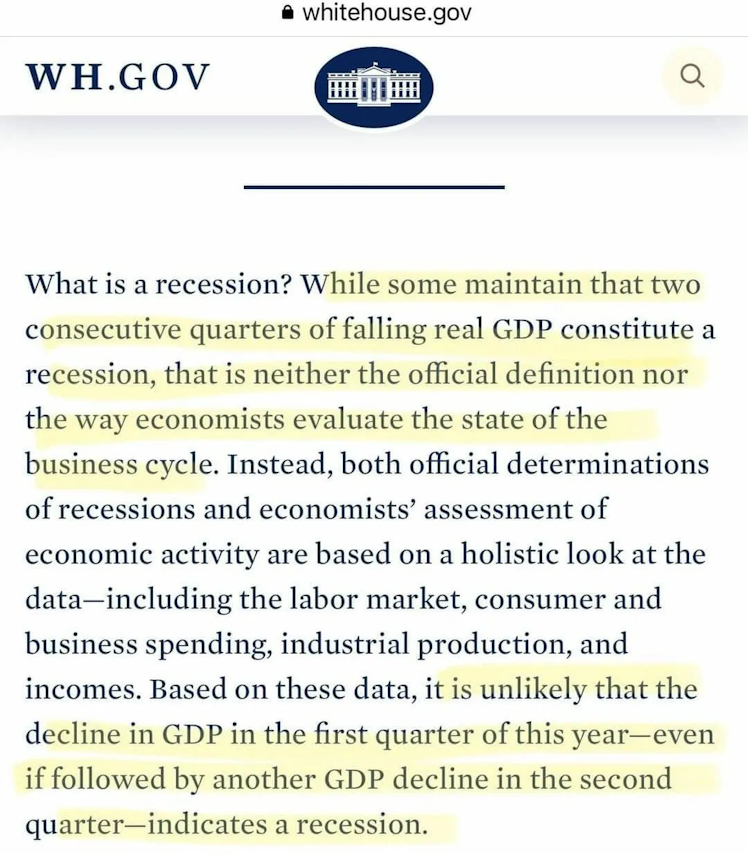

Due to the robust labor market, some may argue that we are not in a recession, while others insist that we are based on the definition.

The Fed continues to foresee positive GDP growth throughout the entire year. If that were the case, the worst-case scenario that traders had projected when stock prices were at their lowest would have been greatly exaggerated.

So, let’s have a look at last week’s developments.👇

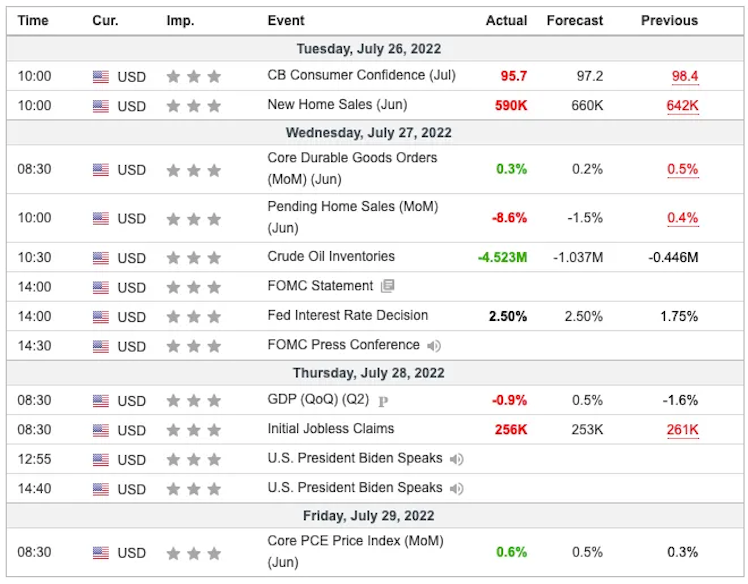

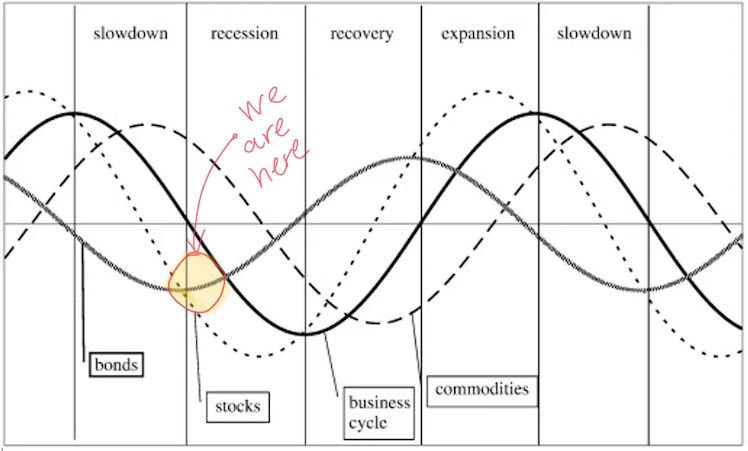

- While it’s impossible to predict what comes next, understanding the cycles and where we are at provides a reasonable ground for valid expectations in the market. The Commerce Department announced that the GDP output contracted at an annualized clip of 0.9% during the second quarter. It marked the second-consecutive quarterly decline, which many consider being a recession.

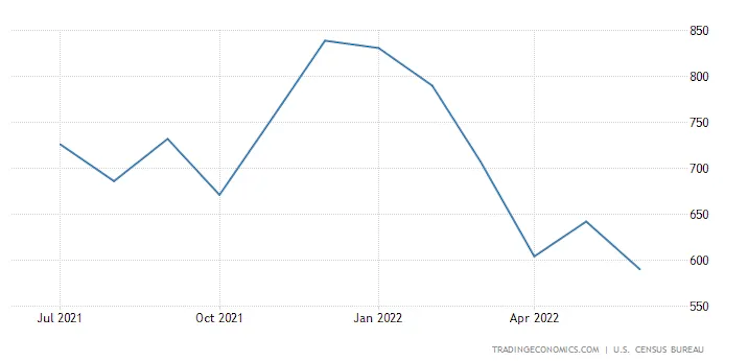

- The annualized rate of New Home Sales fell to 590K, reporting a nearly 11% variance from the forecasted 660K. Not surprisingly, pending home sales have dropped by -8.6% more than anticipated and mortgage purchase applications are also down 18% this week. Despite the easing in housing market prices, there is still an imbalance in the market.

- Conference Board's consumer confidence index also declined in light of persistent rising inflation.

- Last week, Initial claims for unemployment insurance fell by 5K to 256Kcompared to the previous week.

- The central bank's benchmark short-term interest rate was increased by +0.75 e*, a move already anticipated by the market.

Inflation

Not surprisingly, the billionaire hedge fund manager of Pershing Square, Bill Ackman, has criticized FED that the neutral rate (2.25-2.5%) is insufficient to tackle 9% inflation rates.

- Core and noncore Personal Consumption Expenditure (PCE) Inflation and personal income report showed that personal income increased 0.6% last month while personal spending rose 1.1%.

- Indeed those reports are closely followed by the FED as they are a good indication of inflation. Accounting for inflation, consumer spending increased by only 0.1%, while disposable income dropped by 0.3%. Thus, consumer spending has signs of slowing down.

Some Earnings News

- After their most recent quarterly results were released, the shares of Alphabet GOOG 1.92%↑ and Microsoft MSFT 1.37%↑ increased due to the not-as-bad as expected data and the recovery rally for the technology sector, which had been hammered earlier in the year due to rising interest rates, continued.

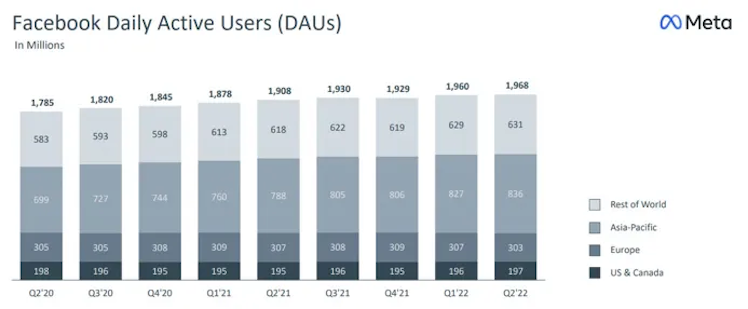

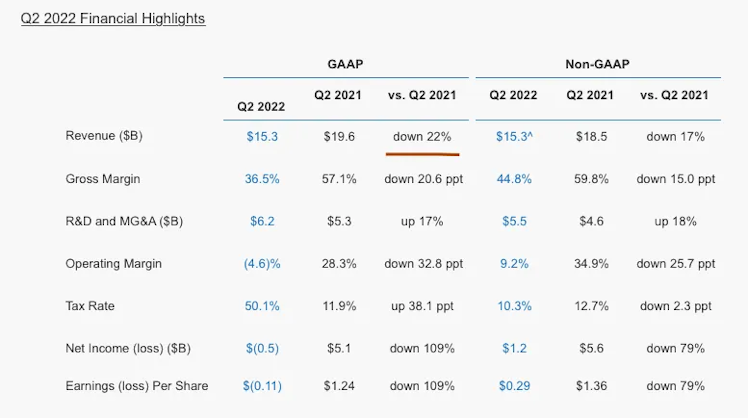

- Next in the earnings includes results from Meta Platforms META -0.44%↓, which despite the geopolitical, global challenges and rising competition from TikTok, the company reported a revenue decline of only 1%. However, what caused a more than 8% drop in the stock price is the uncertainty created regarding the company’s ‘ongoing challenges’, which are expected to persist for the foreseeable future. Nevertheless, DAU, a critical metric for META, has maintained its minor rising trajectory.

- Investors' bullish outlook during the week was supported by better-than-expected earnings news, as Apple's AAPL 0.82%↑ and Amazon.com's AMZN -0.28%↓ reported revenues that exceeded Wall Street expectations.

- On the contrary, after releasing a disastrous quarter, Intel INTC 2.86%↑ stock has crashed by nearly 10% due to the deteriorating PC shipments and cutting its full-year guidance. The CEO Pat Gelsinger highlighted: “The sudden and rapid decline in economic activity was the largest driver of the shortfall but Q2 also reflected our own execution issues in areas like product design, and the ramp of AXG [Accelerated Computing Systems and Graphics Group] offerings,”

Looking ahead: All investors care about is what happens next!

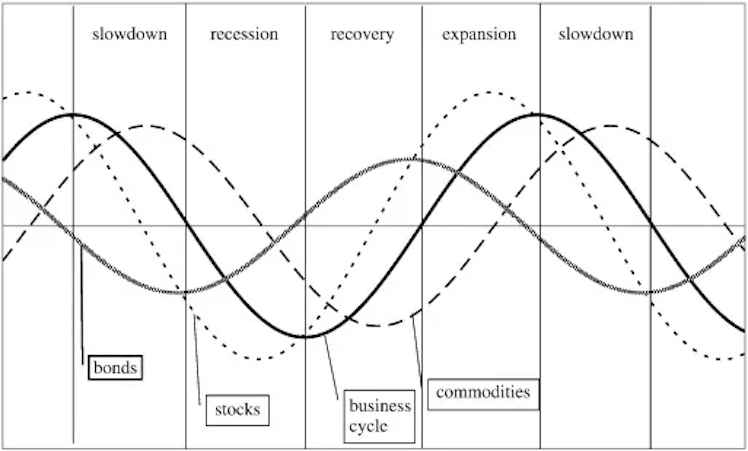

- Inflation and a potential recession (assuming we aren't already in one) are two threats still facing the equity market. Thus, a recession may occur, according to the yield curve's ongoing inversion.

- Despite the recent Wall Street rally, investors' recent moves into fixed-income securities in response to yesterday's GDP statistics and their increased interest in more defensive stocks are signs that we are in a recession.

- Even though it is impossible to forecast the way forward, my best estimate to describe the current cycle would be as follows.

Next Week’s Earnings Releases

Takeaway

People now believe that a "soft landing" for the American economy is possible in the wake of Wednesday's news conference by the Federal Reserve. The labor market's ongoing strength supports this optimism.

Maintaining a well-balanced portfolio of stocks, bonds, and cash, with exposure to higher-quality companies with solid balance sheets, ample liquidity, and a history of steady earnings growth, are well positioned to weather an economic downturn.

Already have an account?