Trending Assets

Top investors this month

Trending Assets

Top investors this month

Economic Update - Home and Confidence Data

Stocks have dropped today due to Walmart’s late day earnings announcement yesterday, cutting its quarterly and full-year profit estimates. The lower estimates are due to rising food inflation, which now makes up a bigger share of individuals’ budget.

For US economic data, all signs point to slowing growth. The S&P Case-Shiller home price index slowed for the 2nd month in a row in May due to higher rates and inflation fears. The annual increase in May was 19.7%, down from 20.6% in April. The 10-city composite increased 19%, down from 19.6%, and the 20-city composite increased 20.5%, down from 21.2%. Tampa, Miami, and Dallas saw the biggest gains.

The Consumer Confidence Index decreased for the 3rd straight month from 98.4 in June to 95.7 in July. The Present Situation Index, an assessment of current business and labor market conditions, dropped from 147.2 to 141.3. The Expectations Index, an assessment of consumers’ short-term outlook for income, business, and labor market conditions, decreased from 65.8 to 65.3.

New home sales in June declined 8.1% month over month and 17.4% year over year. The median sales price of new houses sold in June was $402,400, the average was $456,800. The estimate of new houses for sale was 457,000, which represents a supply of 9.3 months at the current sales rate.

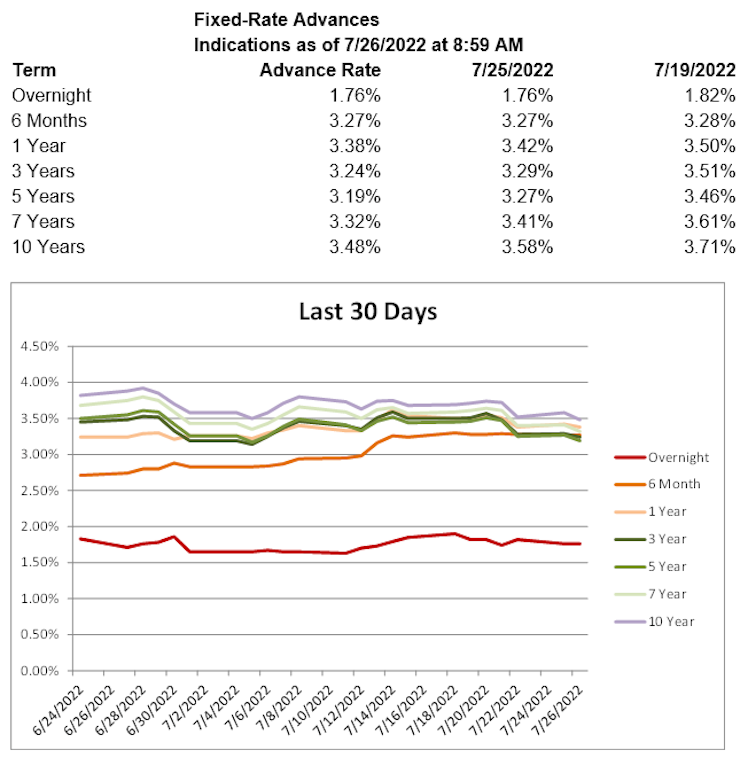

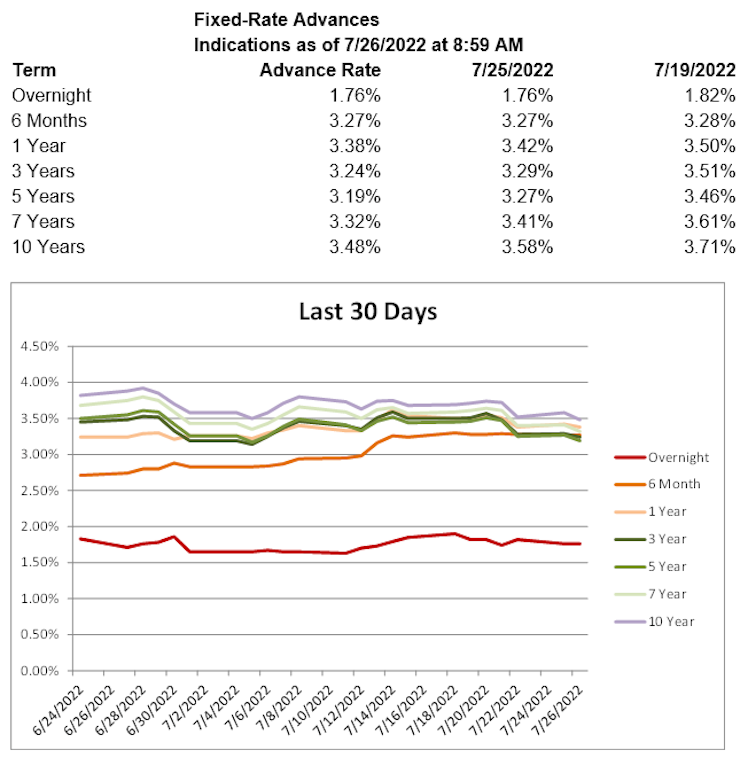

Treasury yields are lower, with the 2-year T yield down 1.8 basis points to 3.00%, the 5-year T yield down 7.6 basis points to 2.82% and the 10-year T yield down 8.8 basis points to 2.74%. With the exception of terms 3-months and in, advance rates are lower.

Already have an account?