Trending Assets

Top investors this month

Trending Assets

Top investors this month

Economic Update

Stocks are broadly lower as investors continue to wait for a debt ceiling solution. Government spending remains a key hurdle as negotiators discuss a spending freeze versus cuts. Later today, investors will turn their focus to the release of the latest FOMC minutes as they look for clues about the potential future rate path.

Looking at economic data today, MBA mortgage applications fell 4.6% last week as high rates keep detering borrowers. Purchases were down 4% & refinance activity was down 5%. The report also showed the average interest rate of a mortgage rose 12 basis points to 6.69%, the highest level since March.

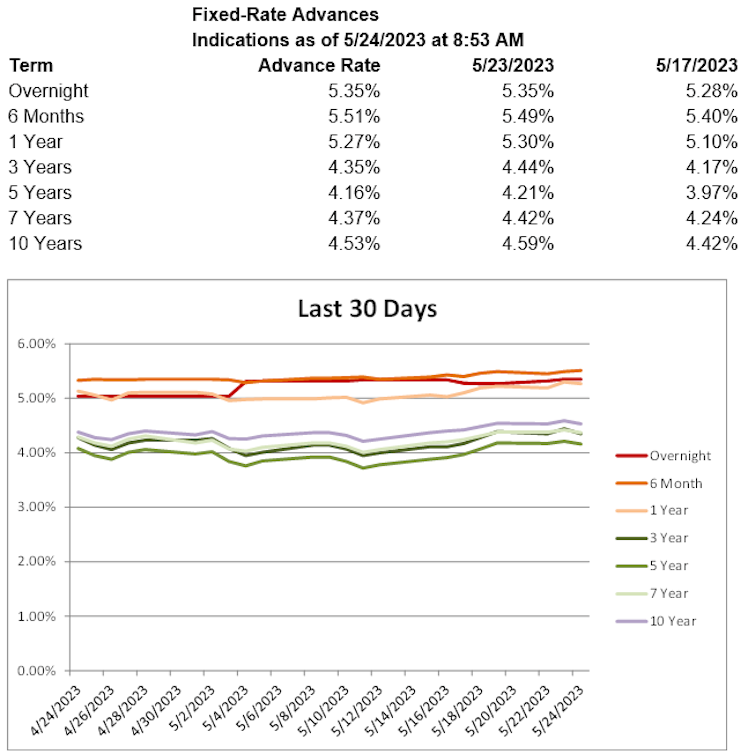

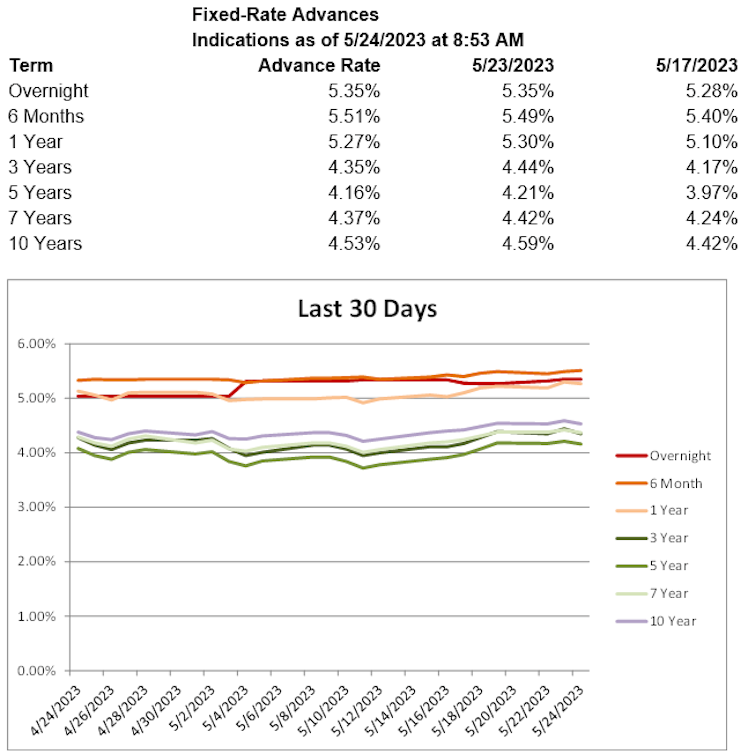

Treasury yields are flatter, with the 2-year T yield up 0.8 basis points to 4.29%, the 5-year T yield up 0.2 basis points to 3.75%, and the 10-year T yield down 0.8 basis points to 3.69%. Short-term advance rates are higher today, while the rest of the curve is lower.

Already have an account?