Trending Assets

Top investors this month

Trending Assets

Top investors this month

Beyond the Ecommerce Behemoth: Examining Amazon's Diverse Business Ventures

Every month we share 2 write-ups on companies we decided to examine as potential additions to our portfolio. Although the companies analysed may tick most of the boxes, if the margin of safety is not considered sufficient, we will not initiate a position but rather monitor the stock.

In case we decide to initiate a position at any time, we will share an Investment Thesis memo. For any additions to existing positions we will update you through our Quarterly Portfolio Updates.

The below is an extract from the Business Overview section on $AMZN (Beyond the Ecommerce Behemoth: Examining Amazon's Diverse Business Ventures). For the full write-up (in-depth analysis of financials, industry, management, valuation and more) you can subscribe to our newsletter.

---------------------------------------------------------------------------------------------------------------------------------------------------------

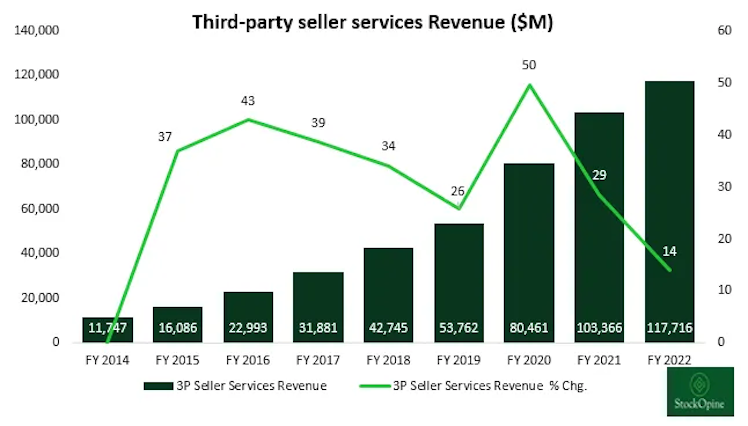

Third-party seller services – a key growth driver

For this segment, the Company does not sell own inventory but inventory of third parties on Amazon’s marketplace and generates revenue through commissions on sales and related fulfillment, shipping fees, and other third-party seller services.

AMZN competes with companies like Shopify, eBay, Alibaba etc. and although the competition is high the Company managed to increase sales from less than $12B in FY14 to c. $118B in FY22, i.e. a CAGR of 33.4%.

This segment increased faster than online store revenue and contributed 23% to revenue in FY22, indicating the growing number of third-party sellers on Amazon's platform. This was also highlighted in Q4’22, as sellers comprised a record 59% of overall unit sales for the quarter.

Source: Stratosphere.io, StockOpine analysis

Amazon competes with peers on price, selection of products, customer experience and seller experience (such as commission rate, fulfillment services, fast delivery etc.). Having nearly 2 million third-party seller partners on Amazon helps the Company differentiate itself and at the same time provide great deals to customers that need it the most. In comparison with Shopify it seems that there is room for growth for Amazon as Shopify reports ‘millions’ of merchants and Shopify appears more merchant centric.

Nevertheless, Amazon improved the value proposition to merchants over the years and it is no coincidence that sales grew by 10x since FY14. Recent developments include:

- Buy with Prime (in US) that increases shopper conversion by 25%, Amazon does the fulfillment while it lets merchants offer the benefits that come with Prime (fast, free delivery, easy returns etc.).

- 3-way match on the Amazon Business mobile in US helping 1m active users on Amazon Business (no need for handheld scanners).

- Merchant Cash Advance Program providing eligible Amazon sellers with easy and quick access to capital (up to $10M) when they need it.

Other than the recent developments, Amazon has the A-to-z Guarantee that protects customers (timely delivery and condition) when they buy items sold and fulfilled by a third-party seller. This adds value to consumers and further credibility for third-party sellers. To be eligible for the A-to-z Guarantee a purchase should be made through Amazon Pay button that ensures fast, seamless and secured checkout minimizing frauds.

Pricing fees, i.e., the commissions that Amazon gets from sellers vary depending on the service (i.e. if it includes, storage, fulfillment etc.), type of product and whether sellers are signed up on its Professional Selling Plan but given the overall growth in the segment, pricing does not appear to be a repellent factor for merchants.

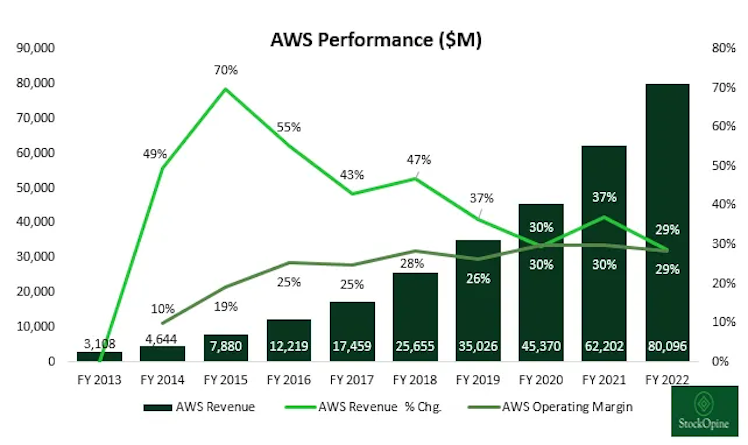

AWS Revenue – the crown jewel

Amazon started offering IT infrastructure services in the cloud back in 2006 whereas its current CEO Andrew Jassy along with Jeff Bezos were the pioneers of this idea that turned out to be its most precious asset.

The Amazon Web Services (“AWS”) segment generates revenue from the global sales of compute, storage, database, analytics, built-in security, backups and other services for start-ups, enterprises, government agencies, and academic institutions. Generally, when a client joins a cloud provider is ‘locked-in’ and it’s difficult to migrate to a different provider.

Cloud computing has three main models, namely, Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS) and Amazon explains them simply in this link.

We are not cloud experts but going over AWS site, one can understand that AWS offers vast of services for an organization to support any cloud workload. As per its website it has more than 200 fully featured services for compute, storage, databases, networking, analytics, AI, security, IoT etc.

Its flagship products are Elastic Compute Cloud (EC2) that rent out computer processing power, e.g. renting virtual servers that allow users to run their computer applications and the Simple Storage Service (S3), which effectively rents data storage in the cloud.

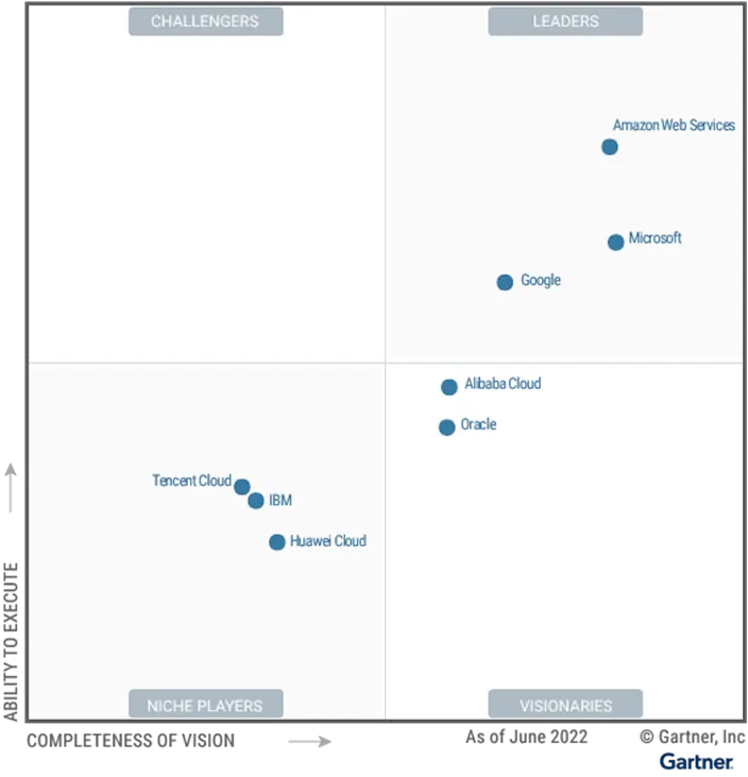

Let the experts do the comparison!! Gartner ranks AWS as a Leader in its Magic Quadrant for Cloud Infrastructure and Platform Services (“CIPS”) with the highest score in ‘Ability to execute’.

Source: Gartner

Per Gartner, AWS leads on breadth and depth of capabilities and exceeds the second close competitor, Microsoft Azure by 2 times in the CIPS market, whereas ‘Gartner client inquiry surfaces that AWS often optimizes for the short term when dealing with customers’ which is something to follow up if it remains the case.

Source: Stratosphere.io, StockOpine analysis

Over the years FY13 to FY22 AWS revenue grew from $3.1B to $80.1B, i.e. a CAGR of 43.5%, representing 16% of total revenue compared to 4% in FY13, while at the same time operating margin grew from 10% in FY14 to 29% in FY22 reaching $22.8B. Growth is mainly justified by cloud adoption and customer usage. Some pressures are expected in the near future for Cloud IT spending but the long term trend is intact (see Industry section).

The following quote explains just that but also shows a better picture for client relationships than what was addressed by Gartner.

“And the reality is that the way that we've built all our businesses, but AWS in this particular instance, is that we're going to help our customers find a way to spend less money. We are not focused on trying to optimize in any one quarter or any one year, we're trying to build a set of relationships in business that outlast all of us. And so if it's good for our customers to find a way to be more cost effective in an uncertain economy, our team is going to spend a lot of cycles doing that.”, Andrew Jassy, CEO

Efficiencies - The interesting stuff

Amazon has a tendency to turn costs into revenues (think of fulfillment, AWS etc.)!

Compute power needs energy, but energy costs. AWS Graviton3 (first Graviton in 2018) a CPU custom designed by AWS delivers up to 3x better performance compared to AWS Graviton2 processors for ML workloads. Graviton2 offers up to 40% better price performance for cloud workloads and Graviton3 provide up to 25% better compute performance and it is more energy efficient, i.e. 60% less energy. Obviously, Amazon strives for efficiencies.

Fulfillment centers and physical stores also need energy so Amazon in order to optimize costs grew its renewable energy capacity to 20 gigawatts (“GW”), enough to power 5.3 million U.S homes by growing its capacity by 8.3 GW in 2022. Amazon is also the largest corporate buyer of renewables and through these investments it aims to achieve a 100% powering through renewable energy by 2025.

Do you know what could be the new revenue line for Amazon? It feels that this would be renewable energy!

Hope you enjoyed this extract! Feel free to share it with friends. As a reminder, students with an .edu email can benefit from a 50% discount (if you face any issues or you are a student without an .edu email but wish to subscribe to the paid tier contact us).

---------------------------------------------------------------------------------------------------------------------------------------------------------

Disclaimer: The content of our newsletter is not a trading or investment advice and we do not provide any personal investment advice tailored to the needs of any recipient. The information provided should not be considered as a specific advice on the merits of any investment decision.

Press Center

Amazon Sets a New Record for Most Renewable Energy Purchased by a Single Company

The company’s renewable energy portfolio now totals more than 20 GW and will generate enough clean energy to power 5.3 million homes in the U.S.

Already have an account?