Trending Assets

Top investors this month

Trending Assets

Top investors this month

TA Opinion: A Flat, Choppy Market

I (Colin) haven't posted my Technical Analysis for a few weeks because this is the phase of the market where trend traders like myself tend to sit quietly on the sidelines. It's not a profit-friendly market for this style of trading. It's more of a range-bound, swing trader's market where oscillators work best. That's outside my circle of competence. Those who trade for a living usually master several different trading styles so they've got coverage across different market conditions (trending non-volatile, trending volatile, non-trending volatile etc). They might also trade different markets, so if stocks aren't trending, they can move to commodity futures or some other market that is trending. That's how they try to maintain a steady flow of income, they need a steady flow of trading opportunities. In contrast, our household relies on a diversified flow of stable dividend income to pay the bills. Trading income is only a discretionary bonus. I try to pick the low-hanging fruit at my favoured orchard when it's "in season". When that orchard is out of season, I don't go looking at other orchards that happen to be "in season" because they grow different fruit. The consequence of this approach is my trading operations can sit dormant for very long periods of time.

The S&P 500 index has been very choppy of late, oscillating above and below a flattish 200-Day moving average. This seems to be the short-term battleground level as the bulls and bears continue to duke it out, blow for blow. It's been a fairly epic tussle of late with neither side really getting the upper hand. As a long-only investor (and long-only trader), I feel the 3,800 level is absolutely vital to defend. If we breach that level and don't resurface quickly, we could easily head down to retest those lows at the 3,500 level. That would be sad.

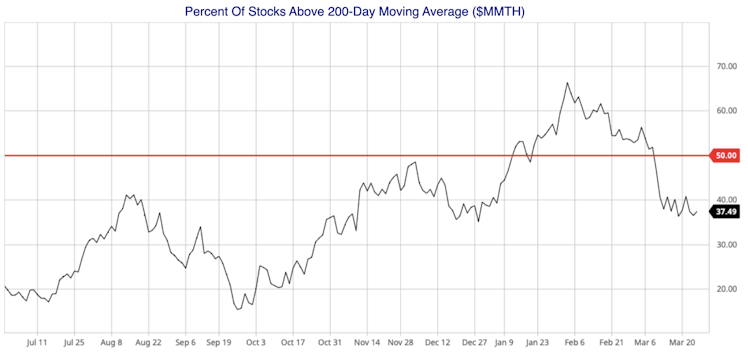

The market definitely has a bearish tone with only 37% of stocks trading above their 200-Day moving average.

It's quite impressive how well the market has held up so far given all the hits that it's been taking. It's withstood so many hits, Rocky Balboa would be proud. I imagine few had "Bank Failures" written on their Bingo cards at the start of the year. Most narratives coming out of the institutions at the end of last year were all about anticipating a recession in 2023, continuing inflationary pressures, a hawkish Fed and declining corporate earnings.

As a Gen-Xer, the best advice I can pass on at the moment is the immortal words of Sergeant Phil Esterhaus:

Already have an account?