Trending Assets

Top investors this month

Trending Assets

Top investors this month

✍️ Nvidia $NVDA Phenomenal Business, Overcooked Stock - Hedge & Protect Gain, Long Puts, Sell/Trim or Short Sell

Nvidia $NVDA downside risk report structure:

📊 Nvidia - Ecosystem & AI Parabolic Run

📊 Price & Valuation Relative Analysis

📊 Wall Street coverage - No Bears Left

📊 Action: Hedge, Sell, Short Sell

Here we go:

📊 Nvidia - Ecosystem & AI Parabolic Run

First of all, Nvidia is a great business with many applications and infrastructure across many industries and one can even say an AI hardware leader down the road. Additionally, Elon Musk has recently reportedly acquired thousands of Nvidia GPUs.

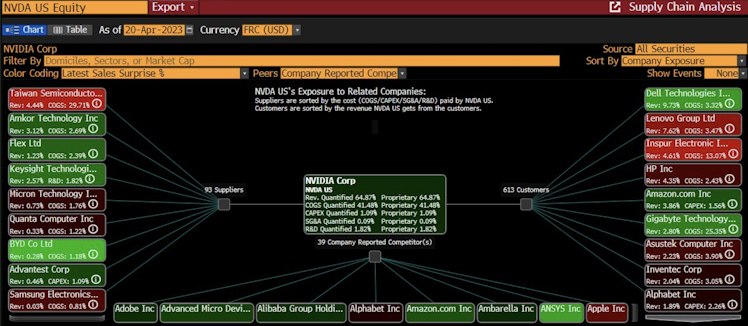

Below you can see Nvidia’s ecosystem of Customers, Competitors & Suppliers via a great supply chain analysis visual. Overall, a big business with a wide moat in a great secular sector, hence a name that very likely will be here 10-20-30 years down the road.

Semiconductors in general have been a top sector lately given AI advancements like the ChatGPT breakthrough, and the overall combo of high demand & supply issues.

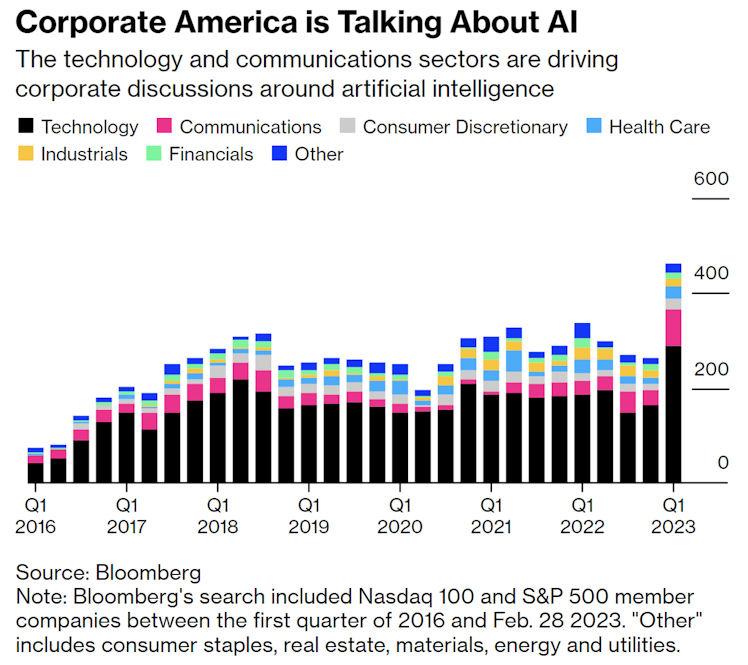

Corporate America is Talking About AI like no other time. It was always there since many decades actually, but lately the increase is from 50% more to a doubling relative to the recent past. AI definitely made big leaps recently & it will have various applications across many industries, though the value creation pockets are uncertain and some will get overcooked within the AI hype …

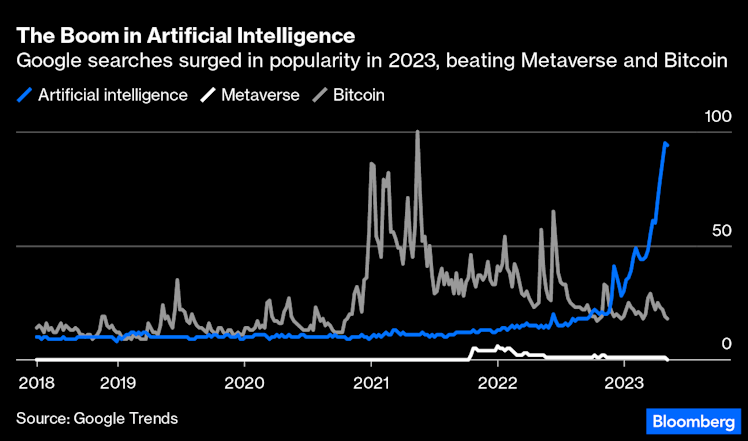

Not just corporates, but people googling AI also went off the charts: namely, bitcoin & Meta(Verse) are peanuts as AI is about to even peak the bitcoin record levels:

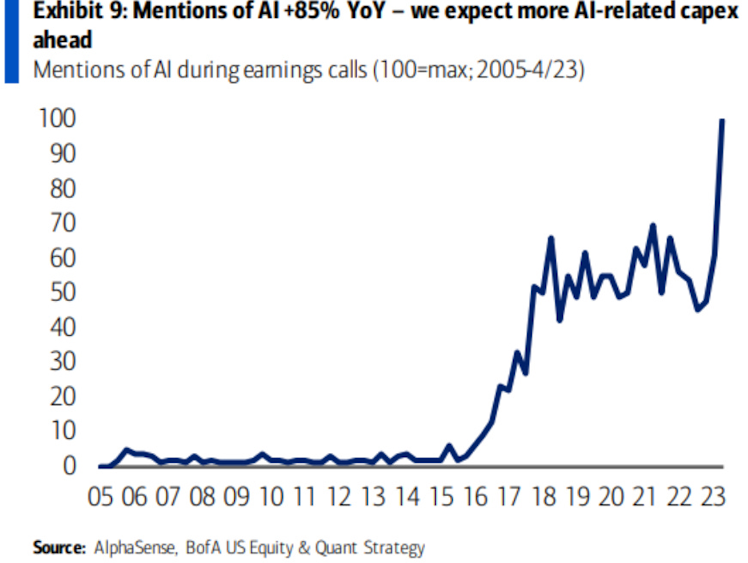

We also find a parabolic rise in AI mentions during the latest earnings calls:

- NVDA: 75 times

- Overall mentions: +85% YoY

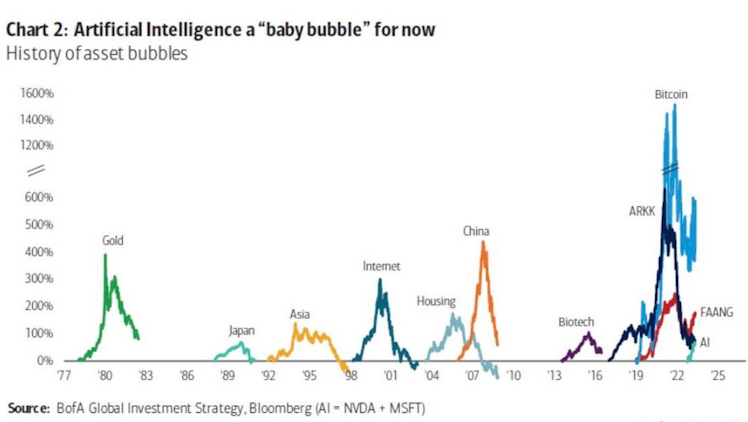

BofA also just added the ‘AI’ theme to its legendary chart depicting the history of asset bubbles … for now I think they were too nice including just NVDA & MSFT:

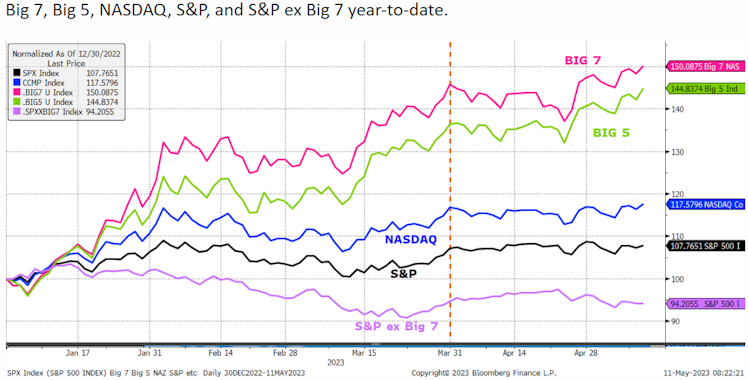

AI talks, market reacts: strip out the biggest seven FAANG stocks, which include Nvidia and the other big tech, and the S&P 500 is down for the year:

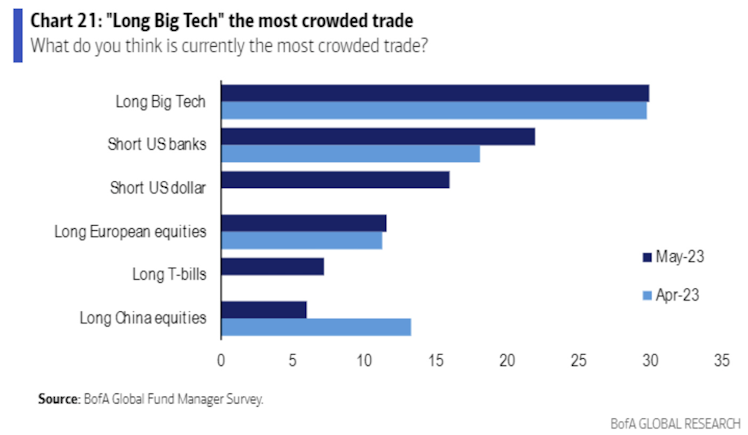

Now guess what is the most crowded trade out there? Simple: Big Tech!

And now also one meme via Shrub Ceiling as I did tweet him that I will feature him … because we like having fun also:

📊 Price & Valuation Relative Analysis

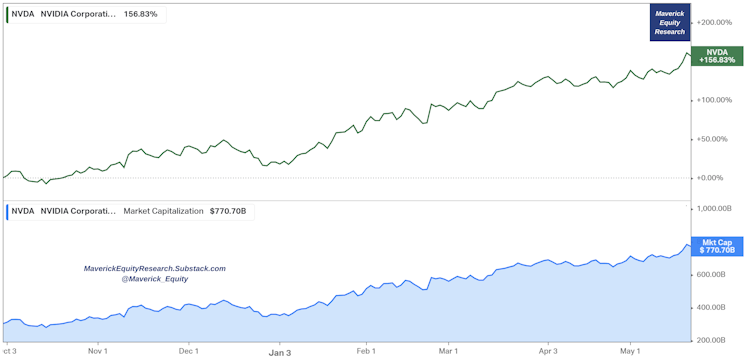

Thinking about value creation, a sector occasionally becomes hot or very hot. Hence, NVDA likely just ran too fast & too soon driven by the recent ‘AI’ exuberance & consequent parabolic run. Precisely, since October 2022 the stock more than doubled for a 157% gain. Big bull runs in a small cap stock should not raise many eyebrows, but Nvidia was already a mega cap & the recent run equates to a whooping $490bn gain since just the recent Oct 2022 lows for a current $770bn market cap

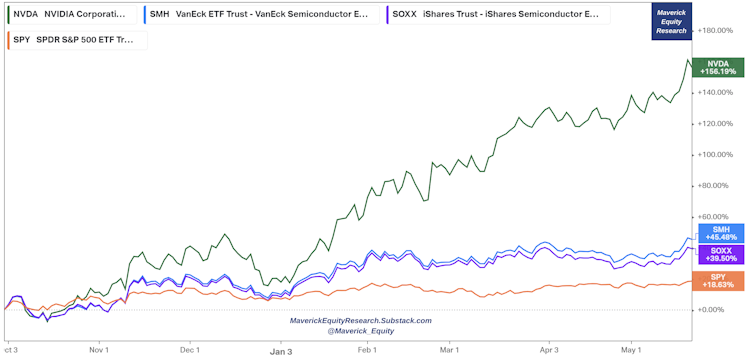

Interesting also to place NVDA in the context of the overall market & sector/peers. For that I did plot Nvidia, the 2 SOXX & SMH Semiconductors ETFs and the S&P 500: we clearly see NVDA is such a big outlier via this parabolic run

Next: Berkshire (BRK), Tesla (TSLA), price & valuation scatterplots to place Nvidia in proper contexts & visualise what’s really going on because charts say 1,000 words:

- 1st: Nvidia & Buffett’s Berkshire empire, NVDA > BRK ?

- 2nd Nvidia & Tesla juggernaut, NVDA > TSLA ?

- 3rd Nvidia inside the market via the S&P 500

- 4th given that the S&P 500 has 11 very different sectors, we will further get closer to Nvidia’s techie nature via the Nasdaq 100 components

- 5th inside Nvidia’s 35 peers via the SOXX Semiconductors ETF

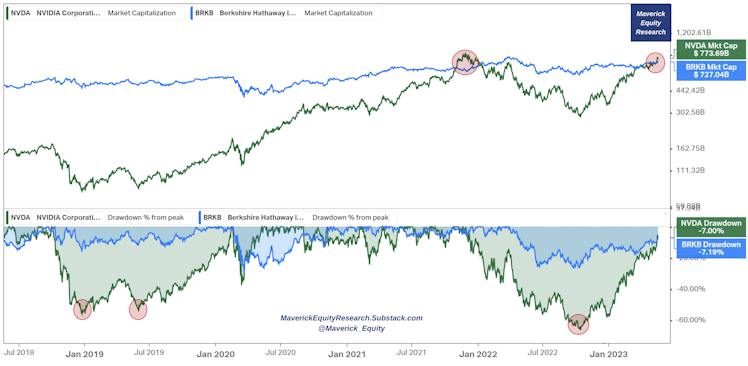

1) Nvidia & Buffett’s Berkshire empire: NVDA > BRK ?

To start, a comparison that will raise some eyebrows, Nvidia & Berkshire (BRK-B):

- Nvidia’s value crossed Berkshire’s: $774bn vs $727bn. Not the 1st time, but the 2nd after in Q4 2021 Nvidia reached all time highs of $834bn vs Berkshire $631bn

- recall the above info, Nvidia recent run equates to a whooping $490bn gain since just the recent Oct 2022 lows for a current $774bn market cap

- $490bn market cap gain equates to 67% of the entire Berkshire market capitalisation … Let that sink in!

- Not an apples-apples comparison, but a question of market pricing & value creation: Nvidia a great business, but better than a compounder for almost 60 years led by legendary investors Warren Buffett & Charlie Munger?

Following the 2021 all-time high, Nvidia dropped hugely -66.34% in October 2022. It also had 2 bigger than 50% in drawdowns in 2018 & 2019 as well. Berkshire naturally way more stable, hence with way less drawdowns.

2) Nvidia & Tesla juggernaut, NVDA > TSLA ?

- Nvidia’s value crossed Tesla’s by a wide margin recently: $775bn vs $570bn

- recall the above info, Nvidia recent run equates to a whooping $490bn gain since just the recent Oct 2022 lows for a current $775bn market cap - $490bn gain equates to 86% of the entire Tesla market capitalisation!

Let that sink in & bring the sink!

This also reminds me when Tesla (TSLA) was 2x the market capitalisation of BRK, hence quite an easy Tesla sell signal to me. Nov 2022 post & chart:

3) How does Nvidia (NVDA) look inside the S&P 500?

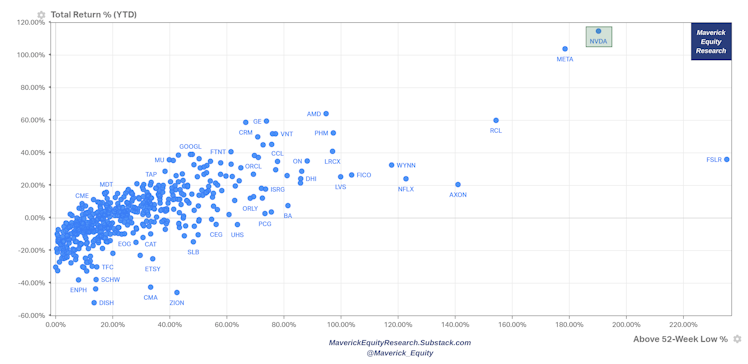

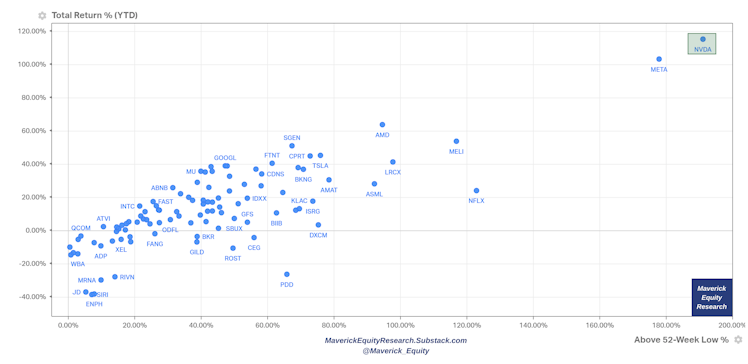

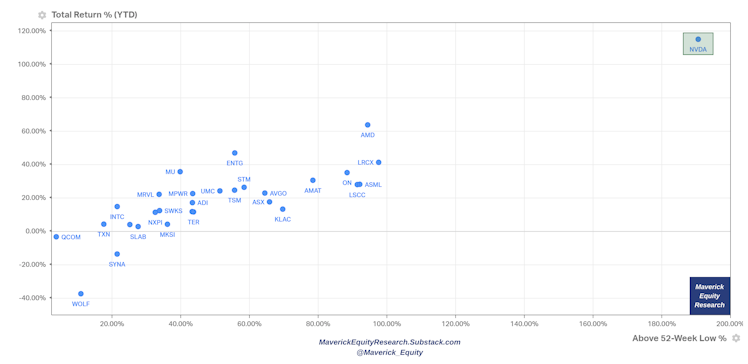

2023 Winners & Rebounders from their 52-week low: NVDA outlier with a 114% gain in 2023 and a massive 190% rebound from the 52-week low

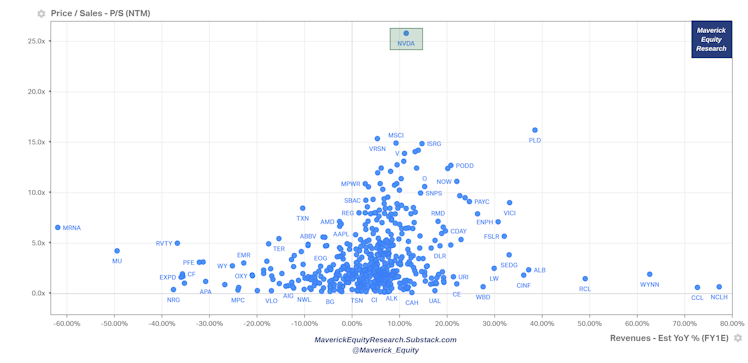

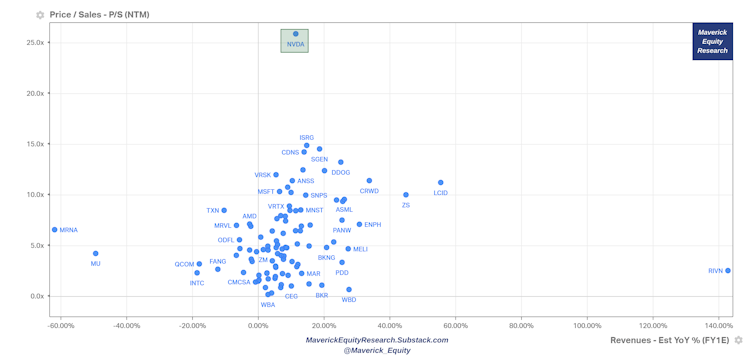

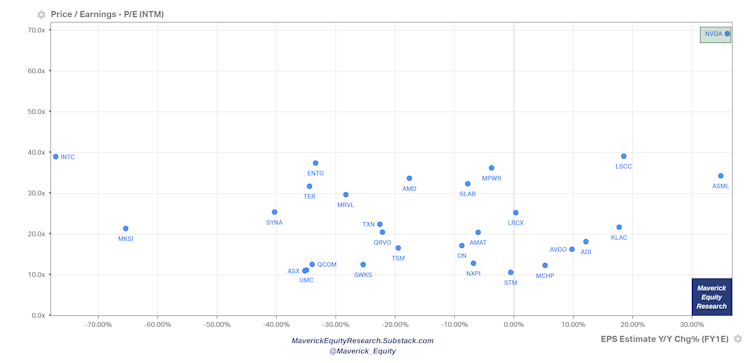

S&P 500 - Sales/Revenue aka ‘Top-line’ view: P/S multiple & Revenue growth (next year estimates). Interpretation: Forward P/S multiple the stock is trading at for the given level of estimated Sales growth - NVDA a major outlier with a 25.8x P/S multiple for 11.39% Sales growth

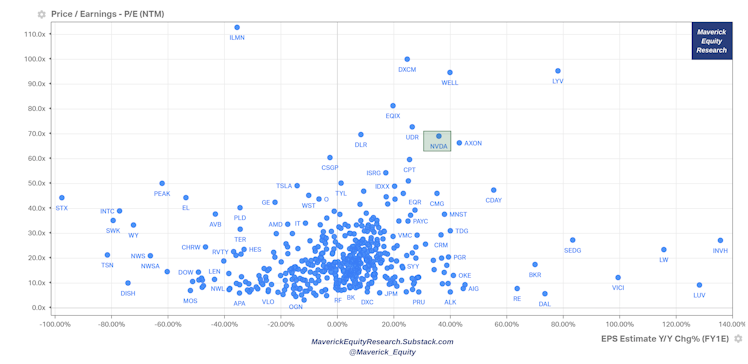

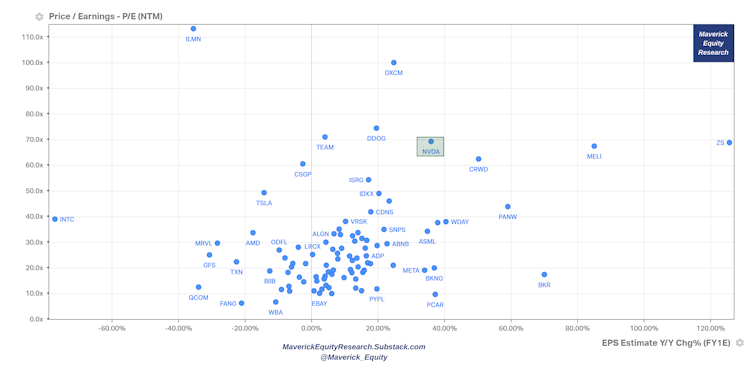

Profitability aka ‘Bottom-line’ view: P/E multiple & Earnings/EPS growth (next year estimates). Interpretation: Forward P/E multiple the stock is trading at for the given level of estimated Earnings/EPS growth - NVDA priced at a 69x forward P/E multiple with a 36% growth in EPS estimates (if it materialises) backs it up to an extent

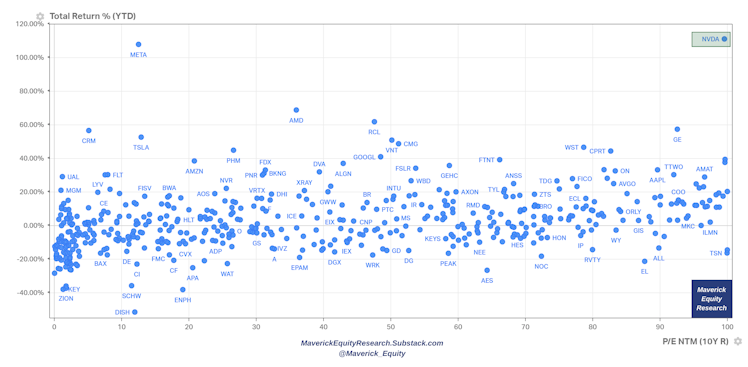

A great complementary chart view now: S&P 500 components with 2023 total return & the percentile of each stock’s forward PE ratio vs their 10-year history: NVDA is a big outlier also via this view relative to the market & itself: currently the most expensive it has ever been on a forward earnings basis in 10 years with a 114% gain in 2023 alone! Let that sink in!

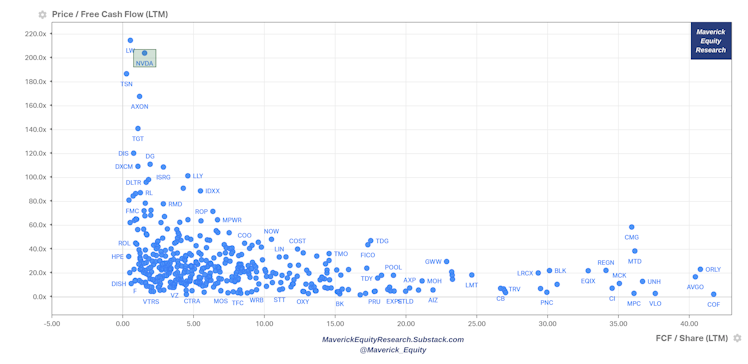

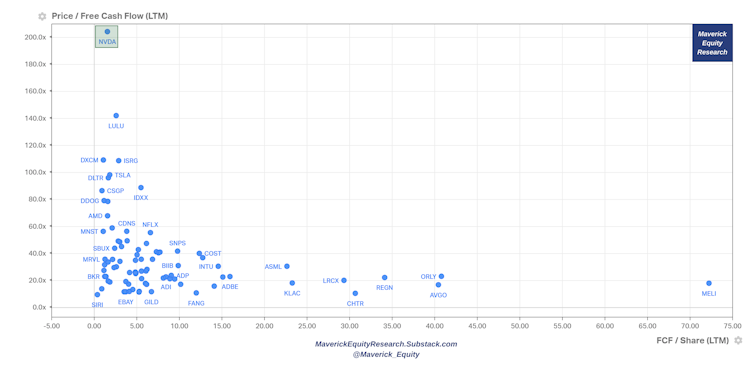

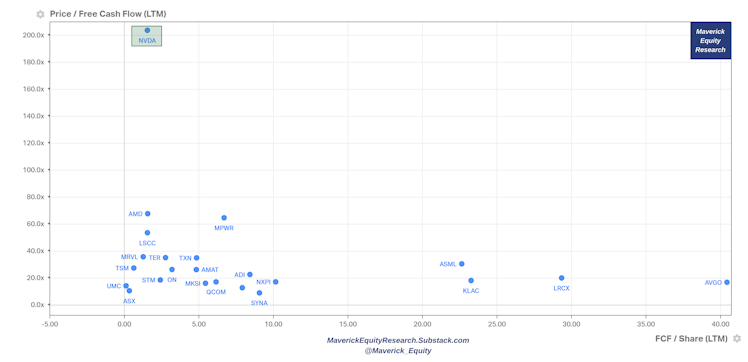

Free Cash flow aka ‘cash’ view: P/FCF multiple & FCF/Share (last twelve months). Interpretation: P/FCF multiple the stock is trading at for the given level of FCF/Share - NVDA outlier also here via a 203x P/FCF multiple for 1.54 FCF/share

4) How does Nvidia (NVDA) look inside the techie ecosystem Nasdaq 100?

2023 Winners & Rebounders from their 52-week low: NVDA a big outlier in both returns in 2023 and rebound magnitude from the 52-week low: a 114% gain in 2023 with a massive 190% rebound from the 52-week low

Sales/Revenue aka ‘Top-line’ view: NVDA a big outlier … NVDA a major outlier with a 25.8x P/S multiple for 11.39% Sales growth

Profitability aka ‘Bottom-line’ view: NVDA not cheap either via this view: NVDA priced at a 69x forward P/E multiple with a 36% growth in EPS estimates (if it materialises) backs it up to an extent

Free Cash flow aka ‘cash’ view: NVDA on top here also after the only hot LULU

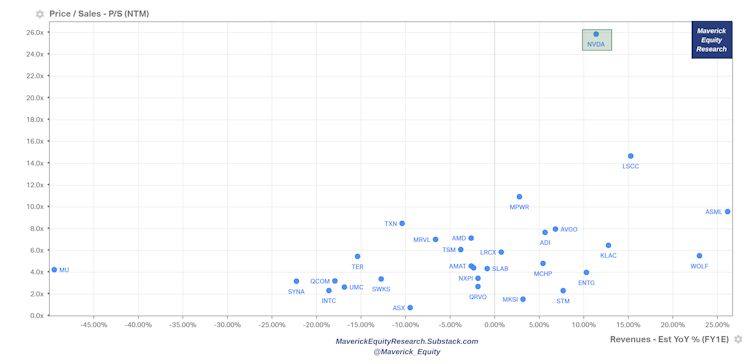

5) And, how does Nvidia (NVDA) look relative to it’s peers via SOXX ETF?

2023 Winners & Rebounders from their 52-week low: NVDA a major outlier in both returns in 2023 and rebound magnitude from the 52-week low: a 114% gain in 2023 with a massive 190% rebound from the 52-week low

Sales/Revenue aka ‘Top-line’ view: NVDA a big outlier among peers … NVDA a major outlier with a 25.8x P/S multiple for 11.39% Sales growth

Profitability aka ‘Bottom-line’ view: NVDA priced at a 69x forward P/E multiple with a 36% growth in EPS estimates (if it materialises) backs it up to an extent

How about current Nvidia and industry average P/E? Industry average 24.5x while NVDA at 167x = off the charts via own historical (percentile 100%) & industry average

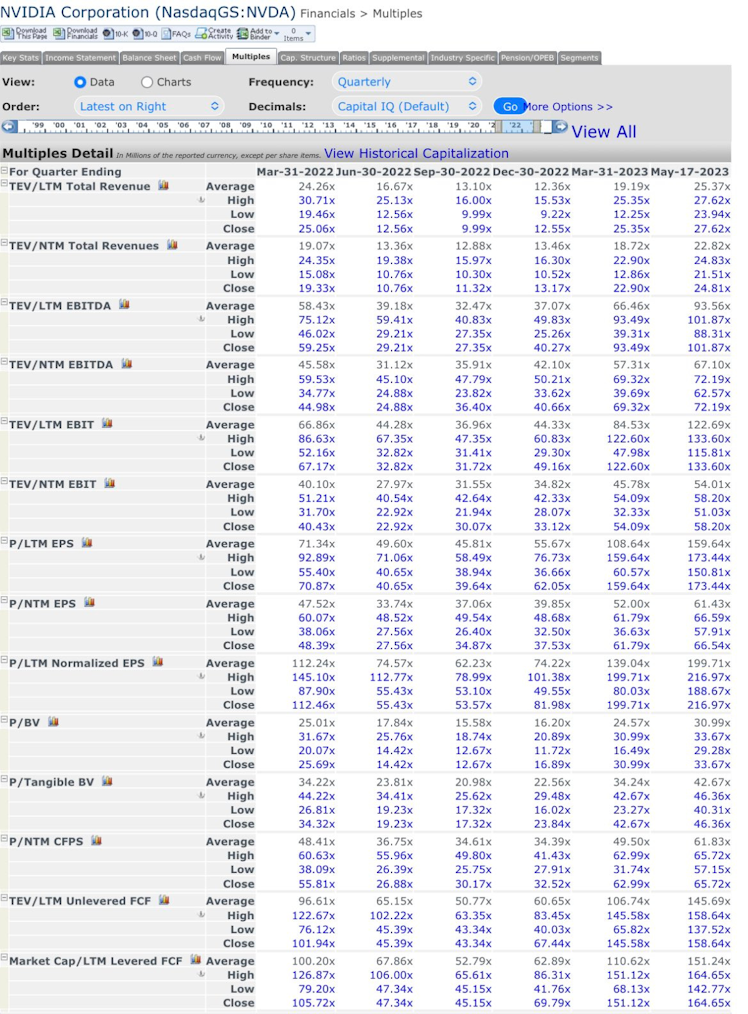

PEG ratio relative to industry? NVDA with a PEG ratio of 5.00 compared to the semiconductor industry's PEG ratio of 3.02 + via CapitalIQ multiples overview:

Back to SOXX with the Free Cash flow aka ‘cash’ view: NVDA a major outlier trading at a 203x P/FCF multiple for 1.54 FCF/share

📊 Wall Street coverage - No Bears Left

Wall Street coverage: until last week, we had only one Wall Street house that still had a Sell rating. Now we have 0 analysts with a Sell after also HSBC gave up and now has a Buy rating as they doubled their price target to Street high of $355 vs $308 now.

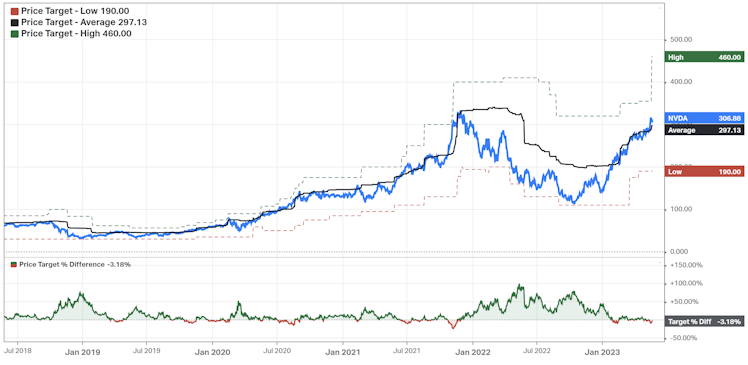

Overall 5 year Wall Street price targets overview is also interesting to see:

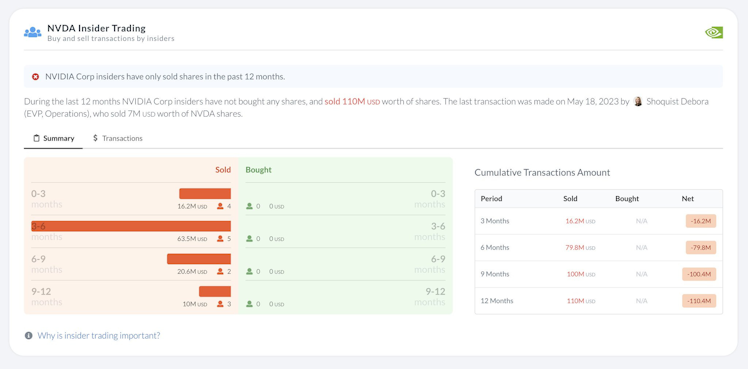

From Wall Street to Nvidia insiders, what have they been doing in the last 12 months with the stock? Only sold … H/T @nathanworden

📊 Action: Hedge, Sell, Short Sell

Let’s start with a funny meme which requires no comment:

All right, so what’s the key question? AI exuberant narrative, ChatGPT launch, sentiment & more = fair for such a big jump in Nvidia? To me not, it’s way too much for the stock in such a short time. Other than that, Nvidia a great business. Stock can disconnect from the business at times, and this is one of those cases.

Hence, 3 options: short sell, sell & book a profit, hedge to protect the gains

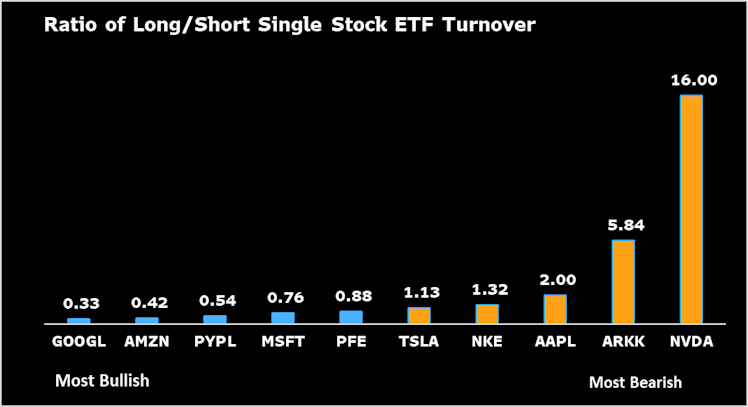

- Short selling: in 2023, bulls are winning clearly & it will be very interesting to see how this evolves from here given that big short bets starting to come now: the ratio of long-short single stock ETF trading - most bearish bets on NVDA & ARKK

I am not a big fan shorting given that it is a very hard business, kudos to whom is good: 1) unlimited downside, limited upside as markets can stay way longer irrational than one can stay solvent, can be right, yet bankrupt by the time right 2) time consuming & costly research 3) just keeping the position rolling can be & get costly 4) opportunity cost of capital by being long just a basic dividend stock or S&P 500, or bonds which pay now both short & long term ones. I very rarely short, except when obvious like Beyond Meat (BYND) which was beyond clear (pun intended).

- Selling or Trimming

This one does not deserve much explanation, selling or trimming a big run is a luxury scenario, and simply put a scenario in which nobody ever got hurt booking a profit. Markets will always open, one can always get back in.

- Hedging, my favourite:

When one has a 30-40-80-100+% gain, paying 3-15% for insurance to protect gains can get very decent - one can do that via options, namely buying puts / Long Puts. Note: selling/trimming likely creates a tax event, while long puts might even help taxes wise depending on the investor’s portfolio & jurisdiction . It is always good to compare pros & cons, which also tells us why there is no one size fits all ‘solution’.

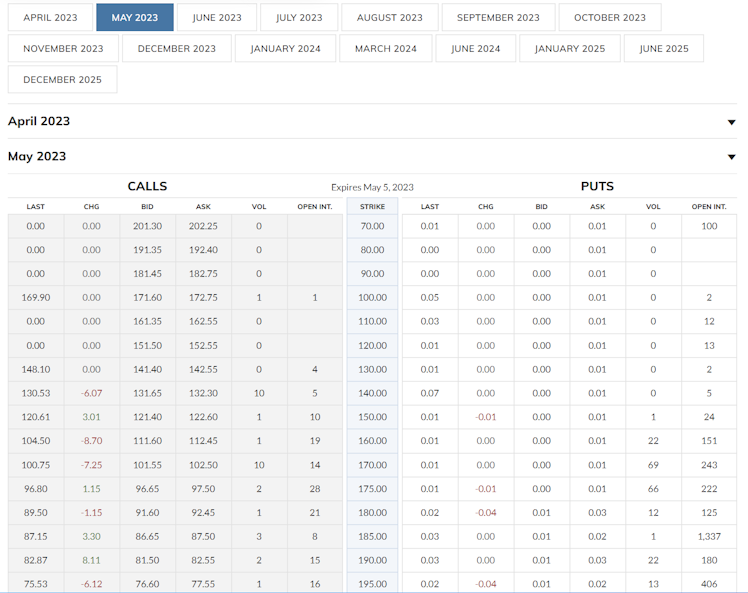

Choosing the option to hedge: here time and volatility is of essence, one can look at the options chains & decide for which strike price, premium and option expiry to choose from. Nobody can say which one is ‘the best’, it will depend from investor to investor, current equity position, time & cost preference etc. Great thing here is that NVDA has a rich/deep options market that goes up to December 2025:

To wrap it up, my thesis here is downside risk after a great recent run while on the long term Nvidia is a great business and should do well across many business cycles. Though short term:

- a lot is baked in into the price/valuation - years of great revenue growth, free cash flow & market share gain seems like a given

- let’s not forget the potential black swan via the current geopolitical issue between China & Taiwan - recall the above supply chain analysis & the inter-dependency between Nvidia & Taiwan Semiconductor (TSMC). Recall also Buffett did sell TSMC recently despite saying how good the business is

- overall, there is no margin of safety here and that is not value investing in my book no matter how good things look right now!

3 final notes on trade execution:

- Short Selling can work from here, but not my way

- Booking a profit by selling or trimming: if too early now & Nvidia keeps running, it would be a good signal for the market & economic recovery overall & one can always jump in back into … markets will always open

- hedging cheap is my preferred way when it can be done relatively cheap and after big & fast parabolic runs, cheap hedges show up

Have a great day!

Maverick Equity Research

maverickequityresearch.substack.com

✍️ Nvidia (NVDA) Phenomenal Business, Overcooked Stock - Hedge & Protect Gains

Nvidia recent parabolic run: Hedge, Sell & Short Sell choices

Already have an account?