Trending Assets

Top investors this month

Trending Assets

Top investors this month

Peloton: "What's Next?"

In “The Magic Happens on the Screen”, I wrote the following:

“Is there some way to tweak the equation, both in terms of the dollar amount spent over the product’s useful life and the mix between upfront and recurring monthly costs, that results in a more attractive customer value proposition and a sustainable long-term business model for Peloton? I suspect that CEO Barry McCarthy and the team are working through this as we speak.”

On May 10th, Peloton reported quarterly results for Q3 FY22 – and in McCarthy’s first opportunity to directly communicate with the company’s shareholders, “Mr. No Bullshit” lived up to his reputation. The primary takeaway? While Peloton clearly faces a number of significant short-term headwinds, the reimaging of the company’s business model has begun.

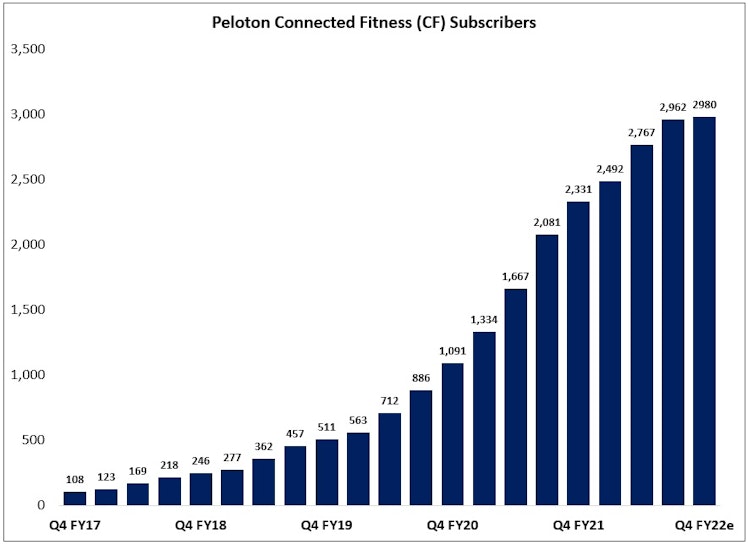

Starting with the financials, the connected fitness (CF) base continues to grow, ending Q3 at ~2.96 million subs (~6x larger than pre-pandemic).

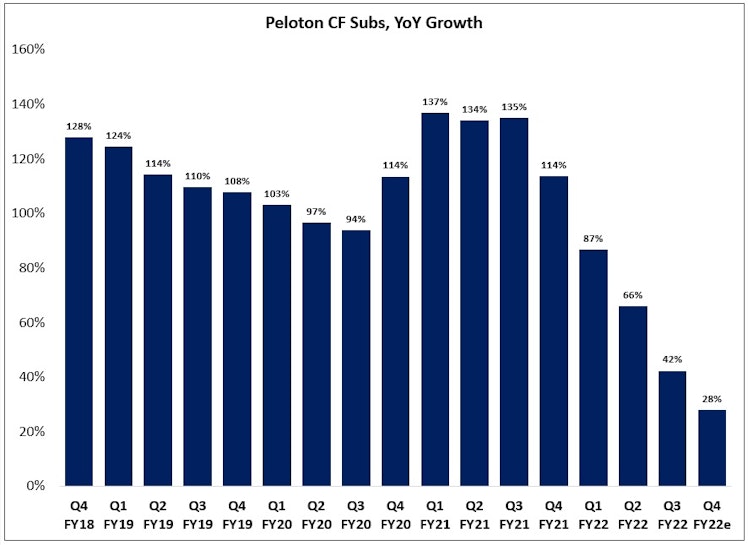

However, the pace of CF sub growth has slowed significantly. Based on the Q4 guide, Peloton will add 650,000 net CF subs throughout FY22, compared to a peak TTM contribution in Q4 FY21 of 1.24 million net CF subs. As shown below, this has led to a large deceleration in the YoY growth rate (it’s been cut in half over the past six months, with the Q4 guide implying YoY CF sub growth of less than 30%). As with many companies, it’s now apparent that the pandemic was a one-time, and temporary, boost for Peloton – and the hangover presents real challenges. (“Management’s view was that there was a paradigm shift… It was a false narrative.”)

The slowdown in CF sub growth aligns with the significant decline in new hardware sales, with Connected Fitness product revenues down 42% YoY to $594 million. Meanwhile, the company ended the quarter with $1.41 billion in inventories, up 50% YoY. Simply put, Peloton has been blindsided by a huge decline in customer demand (and as a reminder, the price of the core Bike offering has been reduced by ~35% since September 2020); this has put a lot of strain on the company’s financial position, with FCF of -$747 million in the third quarter. (“We have too much [inventory] for the current run rate of the business.. it has consumed an enormous amount of cash.”) That said, management believes this is ultimately a timing issue (“the obsolescence risk is negligible”); if that proves accurate, it will provide a much needed tailwind in the coming year (“Our goal is to restore positive FCF in FY23”).

But first, the company has to make it through FY22. As McCarthy noted in the letter, Peloton is “thinly capitalized for a business of our scale.” In response, they issued $750 million of five-year term debt, which should provide sufficient oxygen to manage the business through the remainder of the year. (McCarthy: “With the money we raised in the term loan, I'm very confident we've got plenty of capital, regardless of what happens in the economy, full stop. To the extent that there are concerns amongst investors about our ability to do that, I don't share them.”) It’s also worth noting, as reported by the WSJ, that Peloton has considered selling 15% - 20% of the company to a minority investor; needless to say, liquidity concerns only add to the stress for a company that already faces many difficult decisions.

This is a preview of Thursday's post (Peloton: "What's Next?"). To read the remainder of this post, please subscribe to the TSOH Investment Research service.

thescienceofhitting.com

Peloton: "What's Next?"

In “The Magic Happens on the Screen”, I wrote the following: “Is there some way to tweak the equation, both in terms of the dollar amount spent over the product’s useful life and the mix between upfront and recurring monthly costs, that results in a more attractive customer value proposition

Already have an account?