Trending Assets

Top investors this month

Trending Assets

Top investors this month

$META: Pain and Patience

In 2018, following the Cambridge Analytica scandal, headlines declared Facebook finished. People predicted a mass exodus of users, giant government fines, and new regulations that would choke the business. The viability of the company’s model, and its profitability, would be further weakened by Huge requisite spending on tech and infrastructure to protect user data, ensure privacy, and moderate content.

Those who believed this felt validated when the company released its Q2 2018 results - the first full quarter following the scandal:

- User growth, while still positive, was slowing.

- Revenue, while still up significantly y/y, missed analyst expectations.

- The company was heavily investing in personnel and AI to moderate content.

- The European Union’s General Data Protection Regulation (GDPR) had gone into effect on May 25th, regulating the way companies process, use, share, and move the personal data they collect from consumers online.

- There was also a deep concern over Stories, the recently rolled-out product that appeared to be monetizing at a much lower rate relative to the incumbent media it sought to replace.

The company did not mince words when it explained the continuation of these dynamics would cause its operating margin to fall steeply.

The stock tanked.

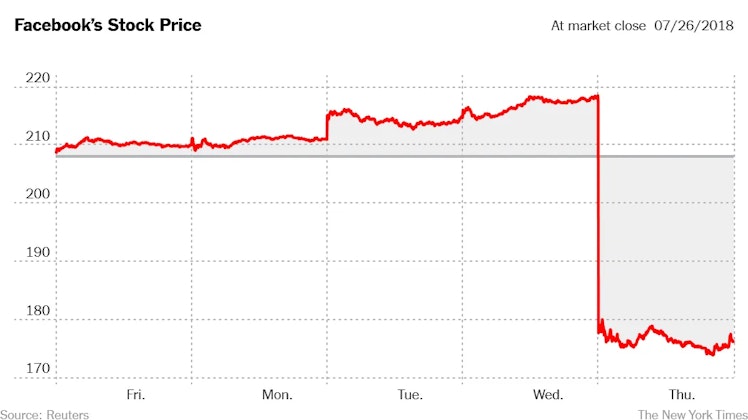

On July 25th, 2018, the stock closed at $217.50.

On July 26th, it rested at $176.26.

Nearly 19% of the company’s total market capitalization, $119 billion, poof, gone in a single day.

The narrative had been shattered.

What was once the darling of Wallstreet became its punching bag and the butt of every joke. Forget growth. Profitability was permanently impaired! Expenses would continue to balloon, and with the stock price tanking, stock-based compensation was kicked in the teeth and there would be an exodus of talent on pace to match the fleeing users. Or at least, that’s how it all looked to most at the time.

Without investor confidence, the stock continued to grind lower throughout the year, hitting $123.42 on December 24th - a 43% drop from its July high close.

That 2018 period was when I became very interested.

If you’ve read any of my previous work, you might find it odd that I would even look at such a company. I (mostly) explore and invest in things that are mature, old-economy, and not flashy in the slightest, like cigarettes, mouthwash, and elevators. I’ve also never (NEVER) had a personal Facebook or Instagram account. But I appreciate entrenched networks, and I’m especially drawn to assets that others have soured on. Meta (then Facebook) was viewed by most as rancid.

However, with conservative napkin math, I saw something much more palatable. There was no evidence of a user exodus, and it seemed that even with slowing user growth there were plenty of levers to pull to create long-term value. And I didn’t have to be precise. I believed the massive drop in share price more than accounted for people’s fears. This was a company led by a hungry, young founder and was still very profitable, with no debt and lots of cash on the balance sheet. And most people still seemed fixated on the Facebook platform and gave Instagram too little focus. Whatsapp and the rest of the business weren’t part of the dialogue. But more important was a thought I couldn’t shake.

Regulation.

Everyone said it was going to crush the company. I had my doubts. After all, how many politicians are too out of touch to understand what exactly the company does, let alone regulate it? Also, mind you, through third parties, these are also the same people who rely on the company’s platforms for their reelection campaigns. I didn’t think they’d bite the hand that fed them.

But what if I was wrong? What if a tsunami of regulation was coming? That’s when I realized I was probably thinking about this entirely wrong. The world constantly debated if Facebook had any competitive advantages and if so, what they were. It seemed clear that regulation would become one.

Entering a market enveloped by stringent regulations is hard and expensive. Operating in an environment where regulation is being radically overhauled is often more so. For the majority of competitors, it looked like the costs of navigating new rules surrounding data security, privacy, as well as moderating content would become quite prohibitive. But for Facebook, with its size and profitability and seemingly endless resources at hand, it would mostly equate to speedbumps.

What’s happened since then?

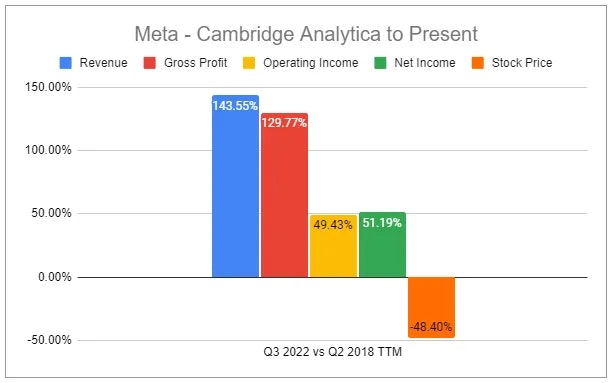

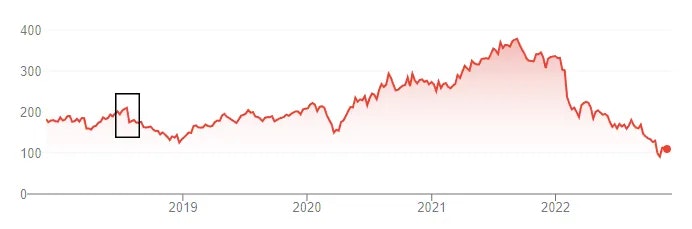

Perhaps partly responsible for the rebrand to Meta, the company has continued to face a litany of governmental inquiries, investigations, fines, countless new regulations, accusations, scandals, and awful headlines. Yet, revenue, gross profit, operating income, and net income are all up considerably. Along with this, the stock reached over $380 in September of last year before crashing; falling nearly 70% from its peak and 50% from the July 25th, 2018 close of $217.50 to $111.41 as of Friday.

For context, centered in the black box below is the Q2 2018 drop:

What a difference a few years makes.

To some, it may seem insane that a company can grow at such a rate and experience such a decline in stock price over the same period. To others, it’s clear that not only were lofty expectations previously baked in and unmet, but new threats have also emerged and the narrative has once again been broken. Further fanning the flames have been Meta’s buybacks.

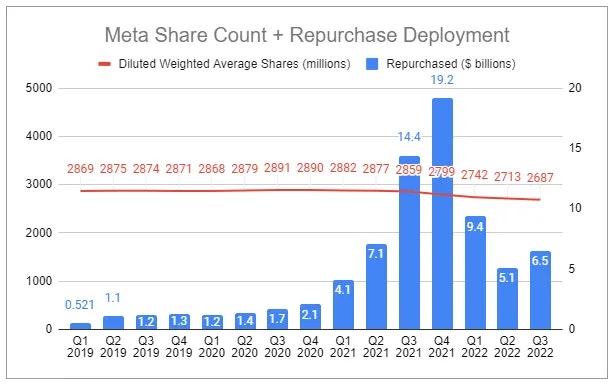

It was not all that long ago when cash on the balance sheet was growing at an astronomical rate, leading the company to ramp up its massive buyback program.

At the end of 2020, Meta (then Facebook) ended the year with $62 billion in cash and marketable securities on its balance sheet and had repurchased $6.3 billion of Class A common stock over the full-year period. With $8.6 billion remaining on its previously authorized repurchase program, it then increased the sum by an additional $25 billion. This was despite the company referencing “significant uncertainty as we manage through a number of crosscurrents in 2021.” The ramp since then has been nothing short of astounding, ballooning to a peak in Q4 2021 and is still chugging along:

Meta's diluted weighted average shares outstanding peaked in Q3 2017 at 2956m. Since then, the total result of repurchases is a reduction in share count of 9.1%. The full effectiveness of the buybacks is obfuscated by the company’s stock-based compensation, which it has largely absorbed. There’s just one slight problem. Over its history, Meta’s average buyback price per share is $253.54, whereas the current share price is $112.05 as of Friday’s close. This was largely due to the massive ramp right before the stock price fell off a cliff.

READ THE REST AT THE LINK BELOW:

open.substack.com

Meta: Pain and Patience

Liking what everyone else loves to hate.

Already have an account?