Trending Assets

Top investors this month

Trending Assets

Top investors this month

Taking Another Look @ $CRWD

I would be lying if I said I didn't like Crowdstrike. In fact, it may just be one of my favorite public companies ever. What the company represents and the challenges it seeks to solve and has already solved are astounding. That's why I have a really hard time evaluating the company. But let's give it a go anyway.

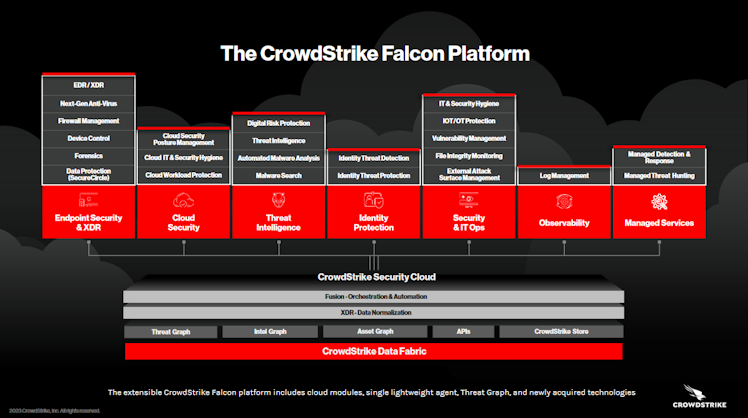

For those that don't know Crowdstrike is a Cloud-Based Cybersecurity company. It offers multiple platforms on top of which companies and individuals can run their cybersecurity operations from. That is the simple dumbed-down version and here is the pretty chart that explains everything more technically.

While there is now a lot of competition in this space Crowdstrike was really the first the wheel this idea out and definentey have first movers advantage. They are also maintaining the lead by continuing to innovate.

After having had the opportunity to speak with someone who works in the cybersecurity space, specifically in banking, they said that the Crowdstrike platform is uniquely easy to use and integrates well with other platforms such as VMwares Carbon Black and even Microsofts ecosystem.

While these are the main competition along with SentinelOne $CRWD seems to be in a league of their own.

But in terms of actual operations there is a lot to like.

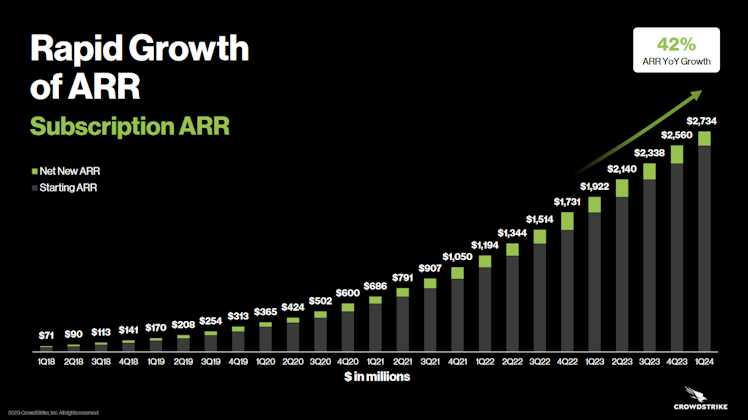

ARR has continued its rapid path upward. When I wrote about Crowdstrike a number of months ago this was my biggest concern, if they we're going to be able to keep this growth up, and it seems they have.

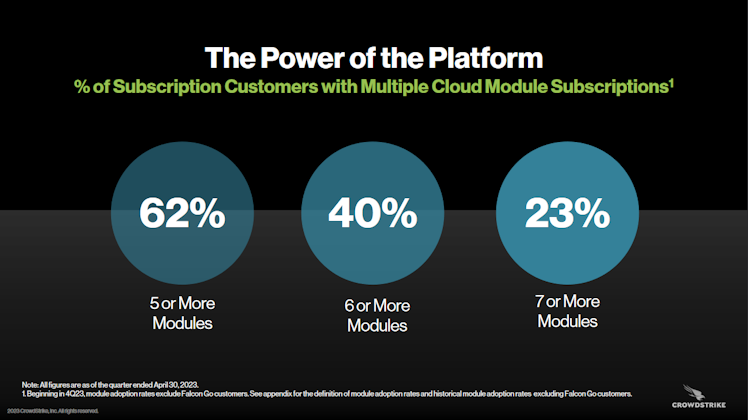

Crowdstrikes consistent ability to cross sell its own services is also fairly impressive and isn't something I see brought up to often but seems to be a market of a great service.

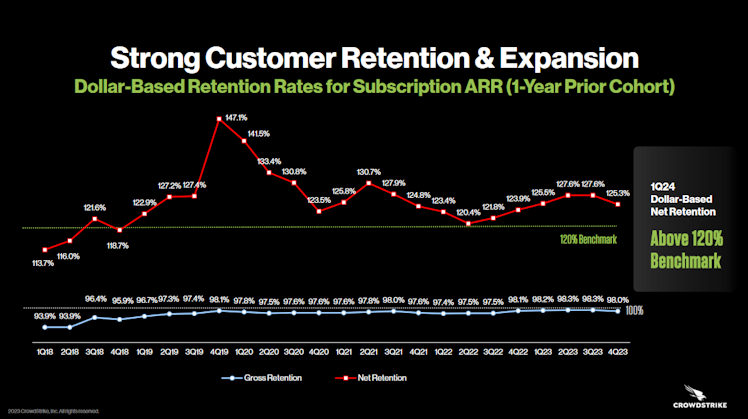

And its not like these customers are going anywhere, in fact they are spending more and more money every year.

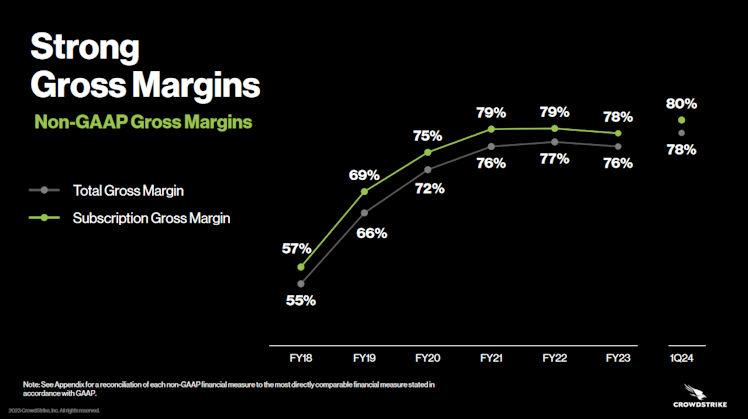

While Gross Margins seem to be leveling out I think this is somewhat to be expected as the company gets to scale, it seems exceedingly rare for companies to really get much higher in terms of gross margins.

Its weird to see this because it seems like everytime I revisit Crowdstrike I am telling the same story. More exponential growth every quarter.

This seems almost contrary to the stock price over the same time period. Having halved from its all time highs just 2 years ago. Despite this the company still seems relatively expensive trading at 10x Sales and 80 times last years FCF.

Ultimately it might be time to consider Crowdstrike worth the premium given its position and the industry it is in. But that requires even further research...

Already have an account?