Trending Assets

Top investors this month

Trending Assets

Top investors this month

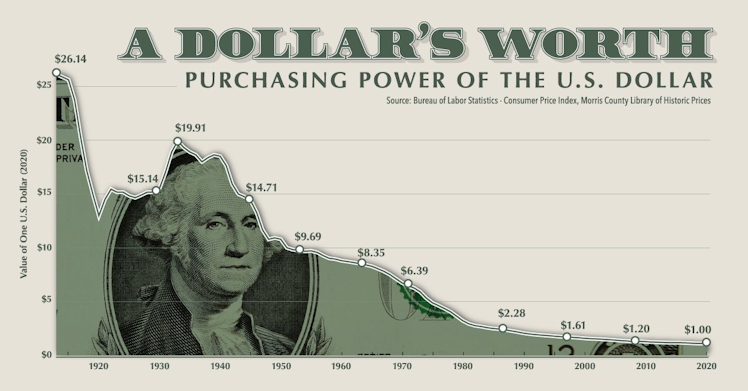

This is the Fed creating inflation with quantitative easing. Look.

They said it themselves in June, yet people continue to say “reserves don’t leak” and “it’s just an asset swap.” That’s not true when they’re buyin__g assets fro__m _non-bank_s, which they did all through the pandemic (and who knows when, where, and how else until we achieve an audit of their books, which has never been more sorely needed). From “Understanding Bank Deposit Growth during the COVID-19 Pandemic,” published on June 3, 2022 (my emphasis):

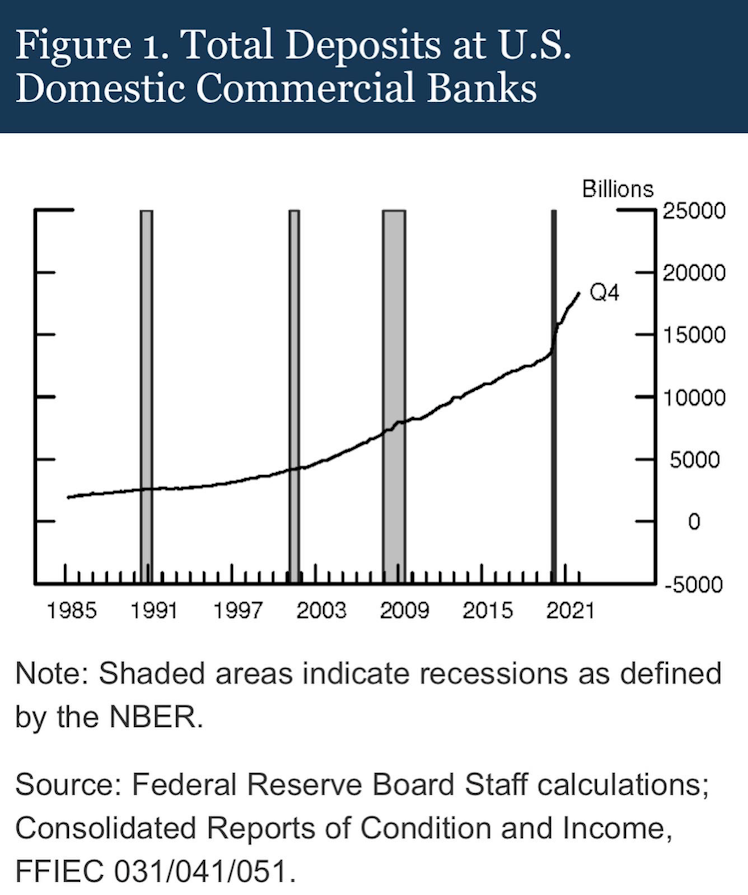

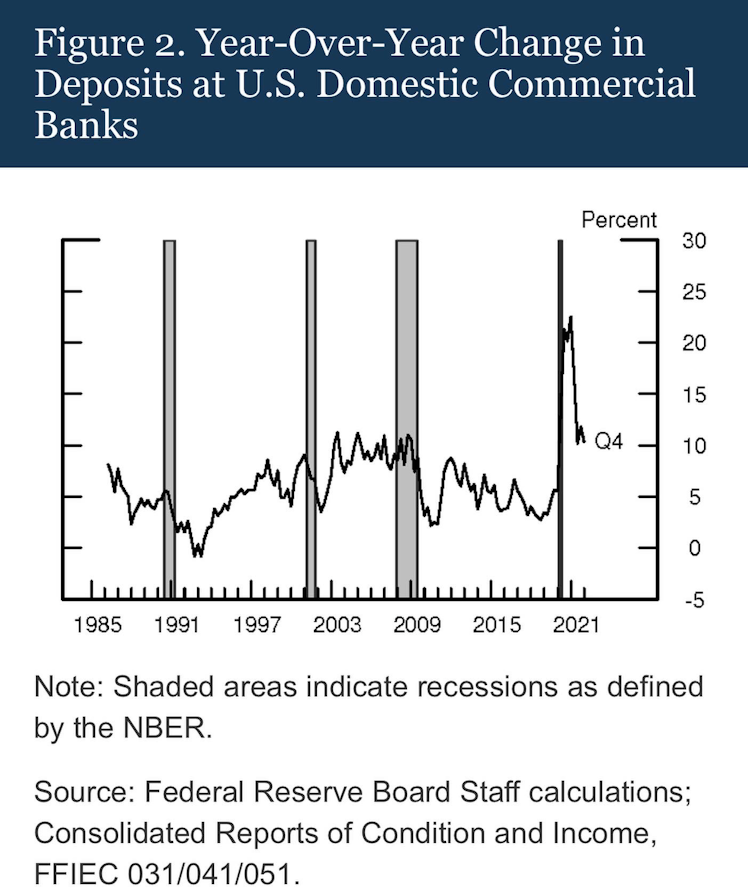

“At the onset of the global pandemic in March 2020, the Federal Reserve began to purchase Treasury securities and MBS to support the functioning of financial markets that were exhibiting stress during that time. The asset purchases by the Federal Reserve led to the creation of reserves in the banking system, and, to the extent that the Federal Reserve purchased the assets from nonbank entities, they also led to the creation of deposits. At the same time, nonfinancial firms which had established credit lines with banks began to draw on those lines to build cash buffers on their balance sheets.

As a result, in the second quarter of 2020 banks' balance sheets saw an unprecedented increase of nearly 90 percent on an annual basis in commercial and industrial (C&I) loans. The counterpart of the drawdown in C&I credit lines was the creation of deposits. Later in the pandemic period two additional factors—large fiscal stimulus measures and a higher personal savings rate—combined with the Federal Reserve's continued asset purchases to support market functioning and foster accommodative financial conditions contributed to a sustained growth in deposits.”

In what world is this not inflationary? And given the recipients, in what world is this not just another form of the same theft-from-on-high that central banking has been routinely accused of throughout its history? This is a parasitic centralized system; you should expect to find parasitism. And if you look, you will find it.

www.federalreserve.gov

Funding, Credit, Liquidity, and Loan Facilities

The Federal Reserve Board of Governors in Washington DC.

Already have an account?