Trending Assets

Top investors this month

Trending Assets

Top investors this month

A Company at the Centre of the Latest African Coup - Eramet

### Summary

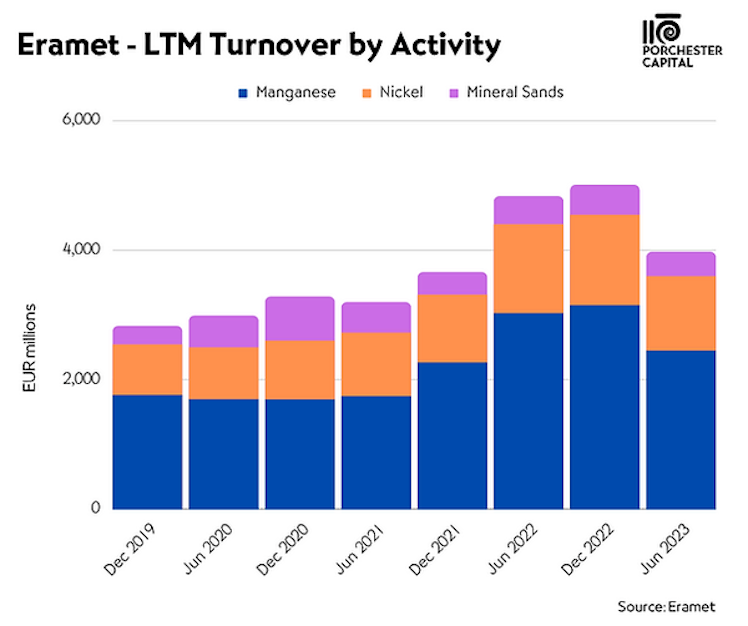

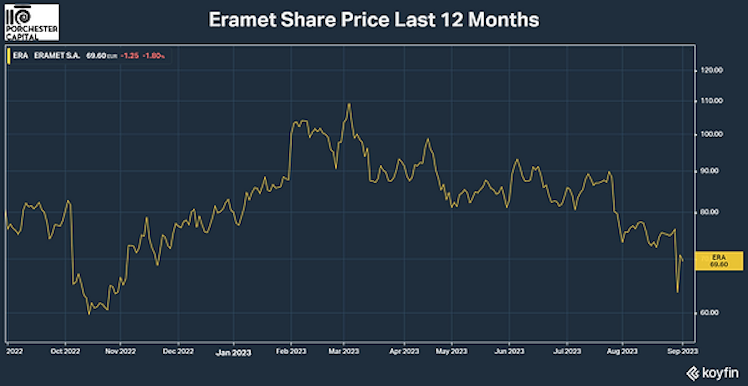

Eramet's share price has tumbled on the back of the news that the company temporarily had to suspend operations in Gabon after the latest military coup. This coupled with the already weak outlook for metals key to the steel manufacturing process has meant the share price has fallen fairly dramatically over the past twelve months.

When considering the current state of operations, future opportunities, and the depressed share price, Eramet shares look attractive to fairly priced and as such assign a BUY rating to the shares.

### Company Overview

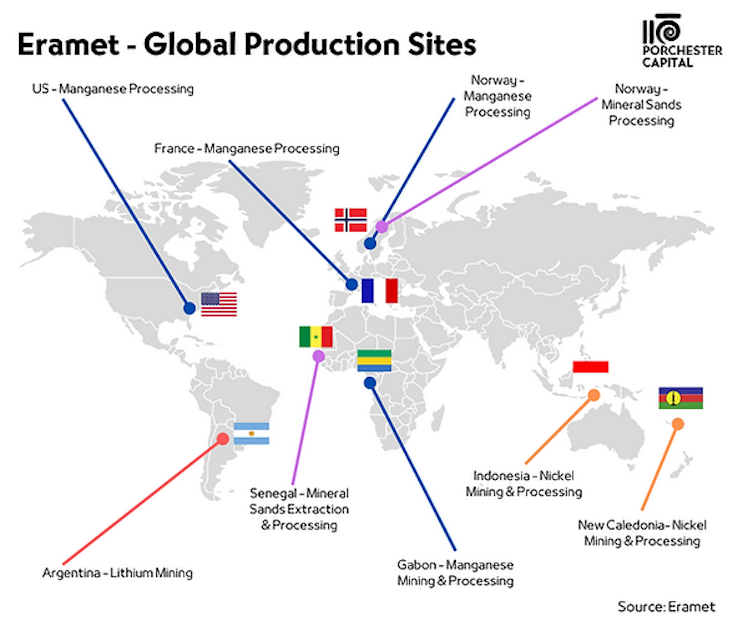

Eramet is a mining and metallurgical company with operations globally headquartered in France. The company operates in the extraction and processing principally of three groups of metals and minerals - Manganese, Nickel and Mineral Sands.

Manganese

Eramet is the largest producer of high grade manganese ore and refined manganese alloys in the world. Manganese is a crucial metal in the production of iron and steel. It is used as an alloy in steel to remove excess oxygen, sulphur and phosphorus from the metal improving the malleability of the alloy. This makes up around 90% of global manganese demand. Other uses of manganese include in alloys for aluminium, batteries and resistors.

As such, when considering the overall manganese market, it is key to understand the dynamics of the steel market. As demand for steel rises, so will demand for manganese given how important an alloy it is in the steel making process. Manganese steel alloys are particularly used in the construction and car industries.

The company mines its manganese in the Moanda mine in Gabon. Eramet estimates that another 20 years of manganese reserves are available at the mine. There are plans to modernise the railway link that runs from the mines to the port of Owendo, so as to improve the company’s ability to export manganese ore out of Gabon. Further plans to improve production at the site include adding modular washing plants and a new conveyor for the mine.

When it comes to processing the manganese ore into refined manganese products, the company relies on six pyrometallurgical plants - three in Norway, one in France, one in the United States and one closer to the mine in Gabon.

Nickel

Nickel is another metal important in the production of steel, however the nickel steel alloys create stainless steel which makes up around 70% of global nickel demand. The remaining demand can be attributed to batteries in particular in electric vehicles.

Eramet operates the largest nickel mine in the world at Weda Bay in Indonesia. This is via a joint venture with Chinese steel group Tsingshan. Additionally, the company has smaller nickel mines in New Caledonia. All the sites have hydrometallurgical plants to produce the final product once mined. The company estimates a further 22 years of production from the Weda Bay mine and 25 years at the New Caledonia mines.

Mineral Sands

Eramet extracts sands which contain various metals and minerals including titanium and zircon. The company is the largest producer of titanium containing raw materials and the fourth largest producer of zircon. Zircon is a mineral that is principally used in the ceramics industry, which makes up 54% of the global demand. It is used to improve the whiteness of tiles or enhance pigments.

The mineral sands are mined at a mine in Senegal, and then partly enriched in Senegal or Norway. The company expects a further 24 years of reserves from its mineral sands mines. Eramet hopes to see a 10% increase in mineral sands production thanks to initiatives it is implementing. These began in October 2022 and are expected to be on stream across the whole mineral sands operation by 2024. Additionally, renovation of the furnace in Norway should also help with the titanium oxide processing. This improvement is expected to also be online by 2024.

Other Business Areas

Eramet has added a new business segment in lithium. The company has acquired perpetual mining rights over a lithium mining concession in Argentina. Lithium has many uses however is key to the energy transition process given its role in the production of lithium-ion batteries. This makes up more than 75% of the global market for lithium.

The lithium plant is to begin production in early 2024, with an annual expected production target of 24,000 tonnes of lithium carbonate to be mined by 2026. Cash costs for the project are currently slated at USD 3,500 per tonne of lithium mined.

### The Latest Military Coup to Rock Africa

The big news to have affected Eramet recently was the military coup this week in Gabon. As a result of the coup, the company initially announced it was temporarily halting operations in the country on Wednesday. That included the manganese mine, the processing operations and the transport to the port. 24 hours after this announcement after considering the political situation, the company reopened operations in the country.

The price action on the stock was quite dramatic. The stock initially fell -16.5% from EUR 76.2 to EUR 63.6 a share on Wednesday before rebounding the next day to EUR 70.85.

This is not surprising when considering the prospect of a long term suspension of the company’s manganese operations which comprised 61.6% of the company’s revenue for the 12 months to June and 96% of EBITDA for the same period. Operations were halted for only a day, so there should not be a significant impact on the earnings for the upcoming quarter, however since the stock hasn’t rebound back to the pre-coup price, the market clearly expects the coup to materially affect operations going forward.

### Other Recent Updates

Taking the coup in Gabon out of the picture for now, the company was having some operational issues. On the 26th July, Eramet issued its results for the second quarter of this year which saw a sell-off in the price of the stock by -9.3% the following day.

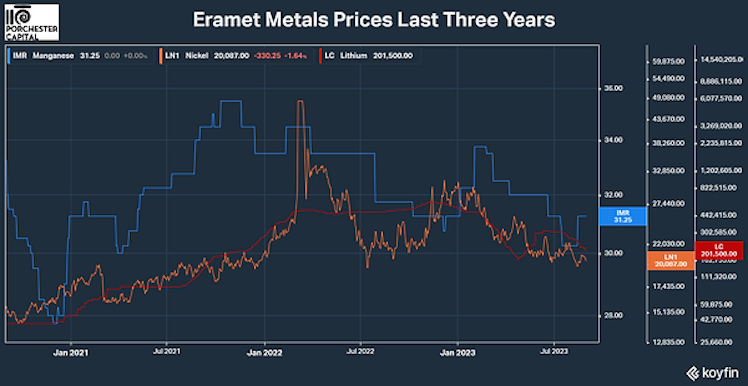

Firstly, the report flagged falling market prices for all materials produced and sold by the company. This is consistent with the rest of the commodities and mining sector. Metals prices have fallen dramatically after spiking midway through last year as a result of the slowing global macroeconomic picture. Rising interest rates are hampering real estate markets globally and as such a fall in demand for steel for construction.

In particular it is worth considering the disappointing post-COVID rebound in China. With the Chinese real estate sector being near enough anaemic, this has led to an even more dramatic fall in demand for metals key in construction. China produces over 50% of manganese steel alloys globally. The average China manganese ore price was USD 5.2/dmtu for the first six months of the year, which is down -23% as compared to the same period in 2022.

Of the metals important to Eramet, since mid last year, manganese prices have seen a -12% drop (though manganese alloys have seen a near -50% fall) and both nickel and lithium prices have seen a close to -60% drop. The fall in metals prices certainly hit Eramet’s revenues.

Revenues for the first six months of 2023 were EUR 1,901m, or a -32% drop as compared to the same six month period last year.

There have also been issues from a cost perspective. Not only is the company dealing with continued high input costs (energy, freight, wages etc.) but logistical incidents at the Gabon mine significantly impacted manganese production, with volumes down -27% for the six month period to June 2023 as compared to the same period last year.

The Moanda mine in Gabon was halted for the whole of January and again in April, because of transportation logistics issues and difficulty delivering fuel and necessary parts to the mine.

EBITDA for the first six months of 2023 were EUR 339m, or a -71% drop as compared to the same six month period last year.

Freight costs have fallen as compared to the peaks seen during the COVID-19 pandemic and through last year, so this has helped to ease cost pressures somewhat. Stabilising energy prices will also help margins in the near term.

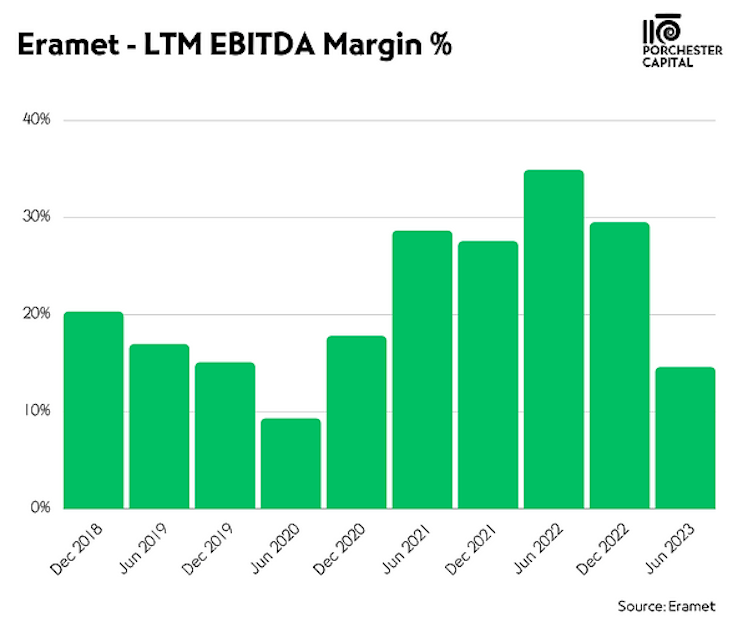

Although EBITDA has fallen so dramatically and the company is seeing both revenue and cost pressures, margins overall have remained fairly strong considering. Although a lot lower than the 35% EBITDA margins seen mid last year, EBITDA margin for the twelve months to June was 14.6%.

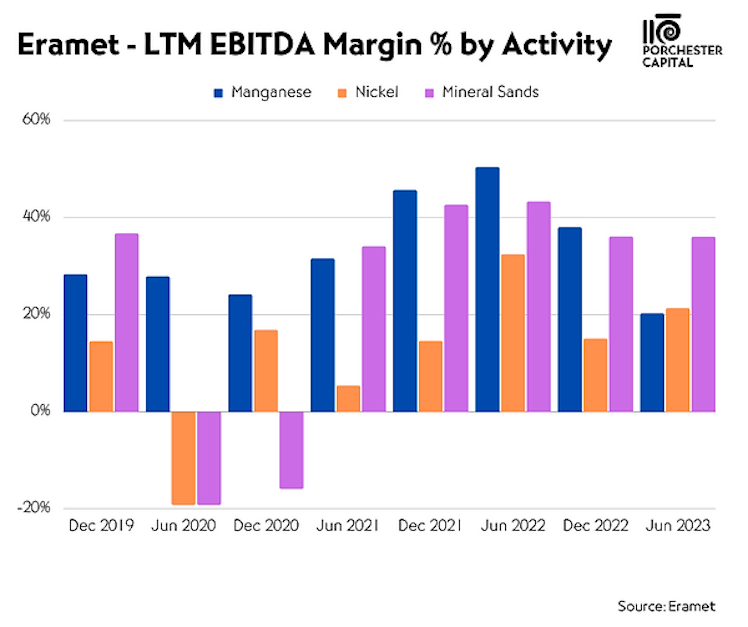

This is a testament to the company’s already impressively low cost operation, that it can see metal prices fall by half and have significant cost pressures and yet still remain operationally profitable. The picture is the same if you consider the company’s separate business segments.

### Opportunities for Revenue Growth

The near term outlook provided by the company remains subdued, and revised downwards EBITDA expectations for 2023 down to EUR 900m. This is accounting for continued manganese price depression and upwards trends in nickel pricing.

Steel outlook continues to be negative with the Chinese real estate sector in particular still far from being reinvigorated. The company suggests that there will realistically be a -15% drop in China manganese ore prices for the remainder of this year.

Demand for manganese outside of China for the rest of the year also seems subdued, as manganese inventory stocks continue to remain high especially in Europe.

Although the steel market will also impact demand for nickel, there are other factors involved which suggest a more robust pricing environment. Global battery demand remains high and overall nickel inventories remain low, which should carry the nickel price for the short to medium term.

In the medium term, the addition of the lithium segment should help grow and diversify the company further. In the latest results, Eramet confirmed the lithium project in Argentina would begin in mid 2024, with the construction of the project 60% completed by June this year.

In the longer term, the picture looks encouraging. Construction is dependent on overall economic growth and population growth and as such the demand for steel will continue to grow. Chinese steel demand may temper with the country’s aging population likely weighing on economic growth and construction, so global growth from that sector will come from elsewhere. There are significant other developing markets with large growth needs such as in India, Indonesia, Latin America and Africa where much more infrastructure and real estate construction can be expected. For example you are seeing extensive road building across India and the building of Indonesia’s new capital city Nusantara. Both hugely steel dependent projects. Just a snapshot of the construction still required in developing economies.

The biggest driver of growth for Eramet however will be the energy transition and in particular the battery metals it mines. Both nickel and lithium play an important part in battery manufacturing and thus the electric vehicle market. According to Goldman Sachs, global electric vehicle sales will jump to 73 million units by 2040 which compares to around 2 million for 2020. Electric vehicles will make up close to 61% of vehicles globally.

Currently, China makes over 50% of electric vehicle battery components, with the rest predominantly made in Japan and South Korea. Under the US’s Inflation Reduction Act, American companies cannot use battery components that have been built in China. This is in an effort to promote battery production and assembly in the United States. A competitive environment between the United States and China for battery metals with potential supply chain disruptions such as the measures under the Inflation Reduction Act will drive battery metals demand and prices further.

### Valuation Considerations

When it comes to a valuation, the coup has certainly made things difficult. It is unclear how much of an impact the new military regime will have on Eramet’s Gabonese operations. With political disruption (and in particular some African countries) comes some level of corruption. The new military regime may want to distance themselves from French influence, which has been strong up until now and kept going by previous president Ali Bongo. Could Eramet’s assets be seized by the Gabonese state and brought under state control? The state does own a 9% stake in the Gabonese project and receives tax receipts as well, but a taking of control is not out of the question.

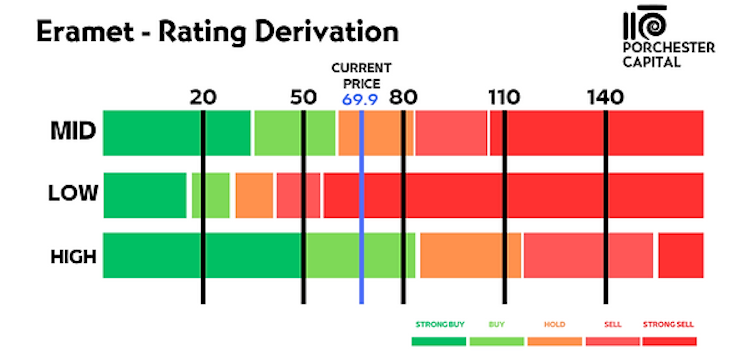

To arrive at a valuation, I will consider three outlooks:

Mid Case

For the mid case we will consider the company’s base guidance and outlook.

Low Case

We will consider a scenario where manganese operations are considerably held up by the coup and metals prices remain depressed.

High Case

Limited impact on operations in Gabon, with metals prices quickly recovering to levels seen in early 2022 before the price spikes.

We will apply these three outlooks on earnings to a range of price/earnings ratios for the stock to create a realistic trading range.

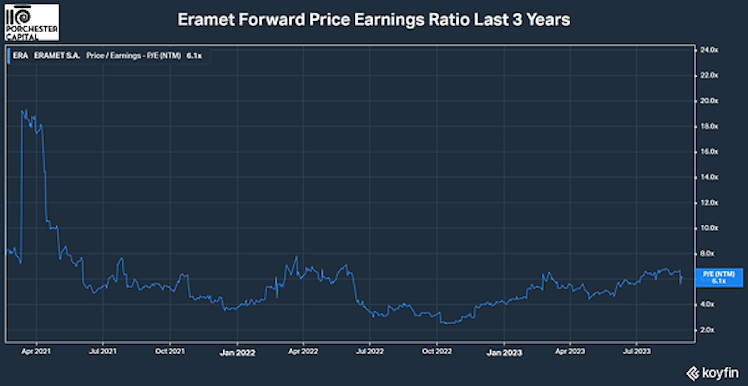

Over the past three years, the Eramet stock has generally traded in a range between 3x and 8x price / forward earnings. As such it would be reasonable to expect the stock to trade within this range going forward. It currently trades at a 6.1x price to forward earnings ratio.

These levels are fairly low compared to other mining companies. Large mining companies trade at much higher ratios for example BHP Group at 11.7x, Rio Tinto at 9.8x, Glencore at 8.8x and Anglo American at 9.0x. The other large French-listed metals and mining conglomerate Constellium is currently trading at a ratio of 8.7x. The discount for Eramet is primarily because it mines in developing and potentially unstable regions such as Gabon, so the discount is somewhat understandable from that perspective.

Considering this price to forward earnings ratio history, we can classify various ratios as follows:

Strong Buy - trading below 3x

Buy - trading below 5x

Hold - trading below 7x

Sell - trading below 9x

Strong Sell - trading above 9x

Inputting the outputs from our previous three scenarios we get the below ranges.

Given potential earnings over the next 12 months, the stock seems overall fairly priced considering the risks, with potentially a BUY rating on further price weakness. Given potential volatility arising from the Gabonese coup, there could be an opportunity to rate the position as a BUY.

What is also worth considering is that we are only looking at earnings over the next 12 months. Taking a longer term view there is a significant potential earnings catalyst in the new lithium segment. Production will only begin in early 2024, and will take a few years to ramp up. As discussed previously, the environment in the longer term when it comes to lithium prices is certainly favourable thanks to the rapid rise in electric vehicle take up.

When assessing a longer term investment window, this seems like an attractive entry point. There could be a significant rise in earnings as a result of the lithium segment. With expected cash costs to the company of USD 3,500 per tonne of lithium and lithium already trading at around USD 20,000 a tonne, there is certainly opportunity for rapid earnings generation.

Considering this, I rate Eramet a BUY at current pricing levels with significant upside potential thanks to the strength of the battery metals market and its long term reserves. It is worth considering however the shorter term implications of the coup in Gabon escalating and impacting operations which is a risk.

Porchester

Already have an account?