Trending Assets

Top investors this month

Trending Assets

Top investors this month

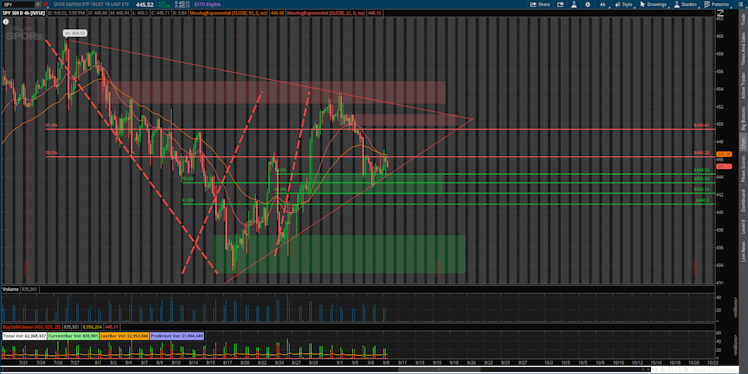

SPY, F and AMD update

Weekly Outlook 9/11 to 9/15

9/11 and 9/12:

There is no major market news being reported on Monday or Tuesday. The big thing to keep in mind for Monday and Tuesday is it might be a bit choppy due to CPI and PPI being Wednesday and Thursday. If the markets stop to chop I would expect them to chop from 443.34 to 446.28. this range has multiple high timeframe Fibonacci and supply/demand levels. Keep in mind that SPY is in a symmetrical triangle pattern being that price could break to either side.

9/13 to 9/15:

On Wednesday there is CPI being reported. Is the numbers come back hotter than expected you could see a major decline within the markets. If the numbers come in as expected or better than a rate hike pause will be likely. On Thursday there is PPI before market open and could another day that you get some volatility. Same thing applies for PPI, if numbers comeback as expected or better than you will see a rally in the markets and if the numbers come in hot you will see a possible pull back depending on how the CPI data came out. On Friday there is no major market news but be careful of people liquidating there positions before the weekend.

Watchlist for this week:

Ford(F)

Ford has been ranging for the last year and a half and is finally breaking out of the demand zone again. It closed Friday at 12.30 breaking the major resistance zone of 12.27. if F continues in a bullish direction then look for 12.79 and 13.00 as price targets for this week. If F goes back down look to find support at 12.00. currently I as a percentage of my total swing trade portfolio I have %50 of it in ford at the moment. If price moves to 12.79 and 13.00 this week I am looking to sell 25 to 50 percent of my position.

AMD:

AMD is looking very good. As I am taking profits on F I plan on moving those profits over to AMD and slowly plan on starting to build a position. If AMD cracks this bull flag then I plan on buying good amount of stock. If AMD moves sharply lower to the lower limits of the bull flag then I will also take stake in the company.

Already have an account?