Trending Assets

Top investors this month

Trending Assets

Top investors this month

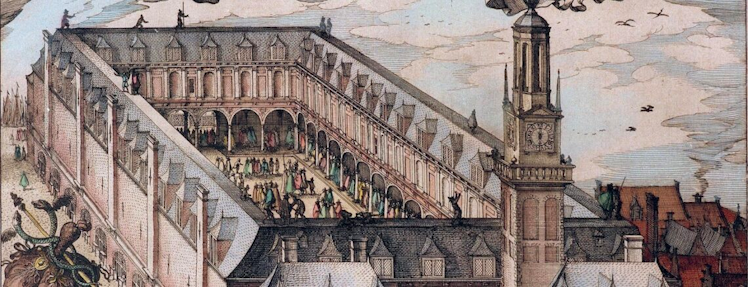

The World Runs on Accounting: An Introduction

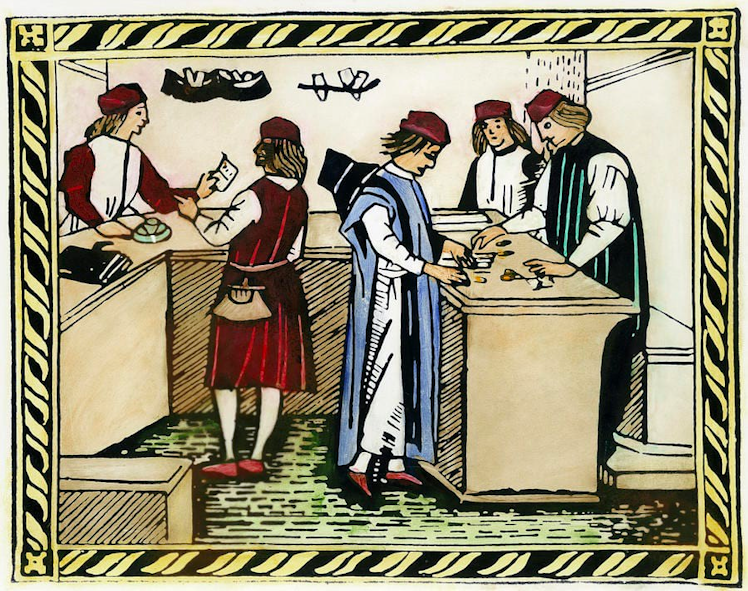

Accounting is a discipline that has evolved over the centuries, influenced by a variety of factors, including economic and philosophical ideas. From ancient Greece to the world we know today, accounting has been shaped by a range of societal and cultural contexts, resulting in a diverse array of accounting practices across the globe.

The field of accounting is closely related to economics in many ways. Accounting provides information on a company's financial performance and position, which is essential for economic decision-making. That information is used by investors, creditors, and other stakeholders to determine whether to invest in a company, extend credit, or engage in other financial transactions.

For financial markets, accounting plays an important role in the efficient markets hypothesis, which is a central concept in finance that assumes that financial markets are efficient in incorporating all relevant information into asset prices. Accounting information is a key component of this information, and the accuracy and reliability of accounting information can impact market efficiency.

In government policymaking, accounting, and economics play a big role in shaping those policies. Tax policies aimed at encouraging economic growth or social welfare use economic theory to determine what direction a policy needs to take to achieve those goals and use accounting information on forming the strategies for executing the plans needed to achieve the goals.

Economic Theory is the Foundation for Accounting

Although accounting and economics are closely related fields, economic theory is not often recognized as the foundation of accounting. However, many economic concepts, such as supply and demand, are used in accounting to determine the appropriate pricing of goods and services. This is evident in how companies value their inventory and calculate their revenue, as well as in the accounting practice of depreciation. For instance, economic theory explains that the value of machinery and other assets decreases over time, and accounting reflects this by marking down the value of these assets in a specified period.

Accounting allows us to quantify economic measures such as assets, income, and profit, which can then be used to analyze economic performance and behavior. Economic concepts like market value and expected future value have led to the development of fair value accounting.

Additionally, opportunity cost, time value of money, and marginal analysis are economic concepts that are reflected in accounting. The discounted cash flow (DCF) analysis reflects time value of money, while opportunity cost and marginal analysis are frequently used in managerial accounting to help companies make better decisions on product offerings and investments.

The way in which financial information is presented is essential in informing decision-making. A standard exists for the presentation of financial information to ensure that it is clear, concise, and relevant. Part of accounting involves presenting information in this way, as financial information presentation plays a significant role in the efficient markets hypothesis.

Finally, economic theory is used to develop policies that promote efficient and effective accounting practices in current accounting standards and regulations. The regulations behind the way in which depreciation is recorded influences whether more capital intensive industries would want to open factories in a country. Tobacco taxes help deter businesses from selling cigarettes to consumers and also deter consumers from consuming them.

Adam Smith & Skyrocketing Healthcare Costs

Although the economists of Adam Smith's time and earlier did not place much emphasis on accounting, their ideas have had a significant impact on the field. For instance, consider Smith's ideas regarding the division of labor and specialization. Accounting plays a critical role in these concepts by enabling individuals and companies to keep track of the costs and revenues associated with specific activities, enabling them to allocate resources more effectively. This, in turn, promotes better decision-making, leading to more efficient resource allocation and economic growth.

As accounting facilitates the concepts of division of labor and specialization in practice, it also helps businesses identify their strengths and weaknesses. Accounting information can assist companies in determining which products or services are the most profitable, allowing them to focus on their core competencies and allocate resources more efficiently. For example, managers can use financial reports to determine which product lines are the most profitable, the most efficient production methods, and the most effective marketing strategies. Such insights enable companies to optimize their operations and improve profitability, identifying areas where the business can benefit from increased specialization or division of labor.

However, the drawbacks of specialization are well-known, particularly in healthcare. The skyrocketing cost of healthcare is largely attributed to the growth in specialization, which has increased the barriers for patients to receive healthcare. Nonetheless, accounting has played a crucial role in addressing this challenge. Hospitals and clinics are now able to track the cost of providing various services, procedures, and treatments, identifying which ones are profitable and which ones are not. This information helps healthcare providers allocate more resources in areas where they can provide the most value, leading to better resource allocation and contributing to the growth of specialization in healthcare.

Conclusion

In conclusion, accounting and economics are two closely related disciplines that have evolved over time, shaped by a variety of societal, cultural, and economic factors. Accounting provides critical information on a company's financial performance and position, which is essential for economic decision-making. The accuracy and reliability of accounting information impact market efficiency and can influence government policymaking. Economic concepts and theories have led to the development of fair value accounting and are reflected in various accounting practices such as depreciation and discounted cash flow analysis.

Accounting also helps businesses optimize their operations and improve profitability by identifying areas of specialization and division of labor. However, the drawbacks of specialization in healthcare have increased the cost of healthcare, which accounting has helped address by providing information to allocate resources effectively. The importance of accounting in economic decision-making and policymaking cannot be overstated, making it a crucial discipline in promoting economic growth and development.

Already have an account?