Trending Assets

Top investors this month

Trending Assets

Top investors this month

Quick $ALGN Valuation

Just like $ADBE yesterday, this is a high-level, numbers only type of valuation. I didn't take the business or management into account.

Let's dive in!

Pros

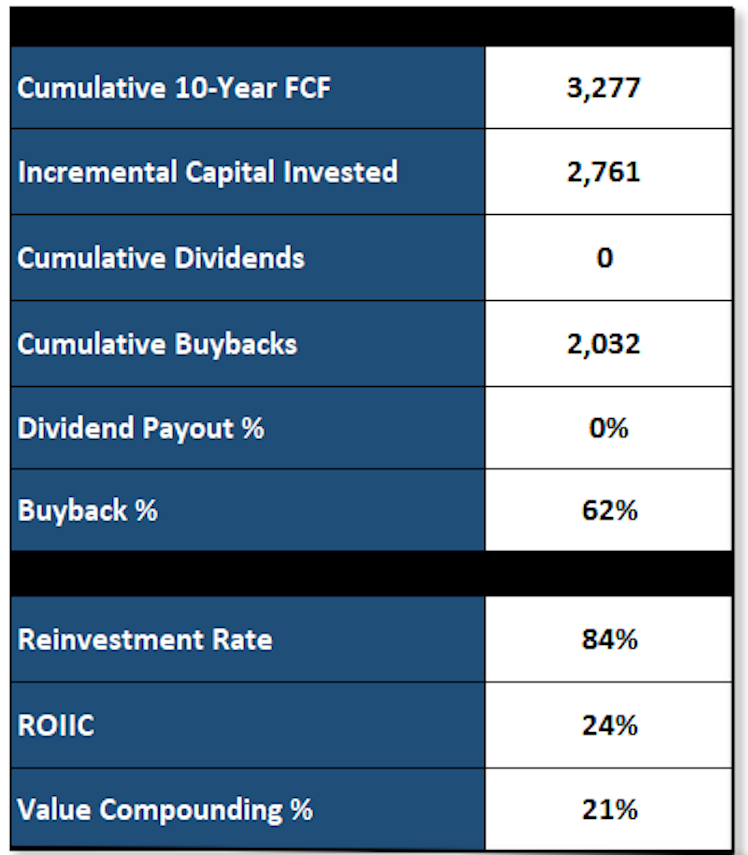

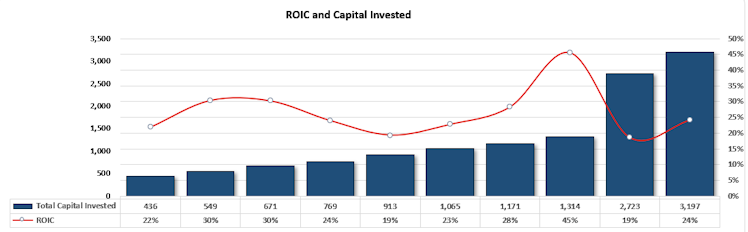

The company's value has compounded at 21% annually over the past decade, on par with the company's FCF growth of 23%.

$ALGN has almost zero debt and reinvests nearly all capital back into the biz. ROIIC is high at 24%.

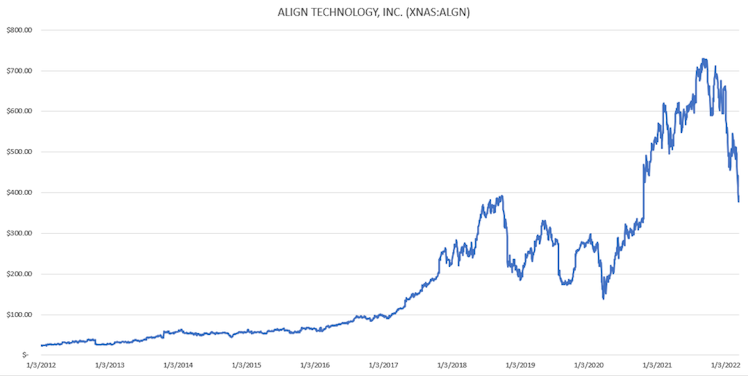

This amazing growth has translated to an amazing 30% CAGR in the stock price, even with the recent drawdown.

Annual ROIC is high, almost always remaining above 20%.

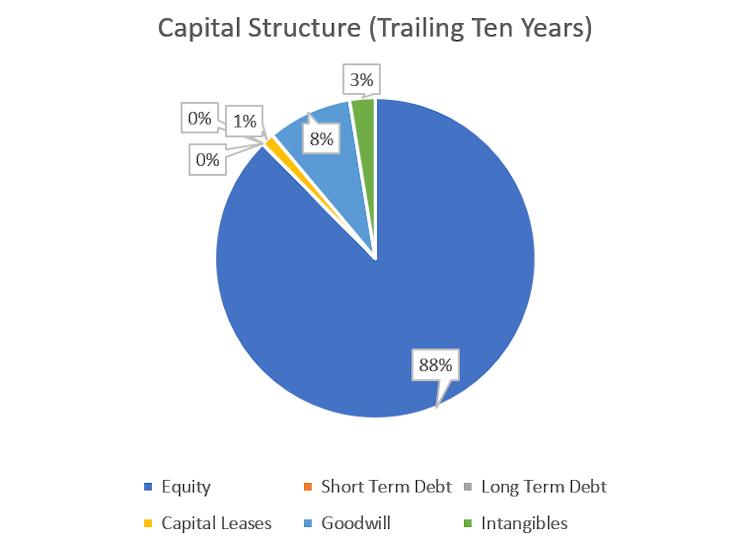

Capital Structure is almost flawless, with nearly zero debt and 88% equity. Goodwill is surprisingly low for a company of this caliber.

Cons

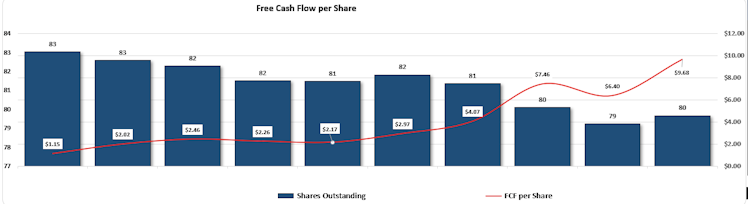

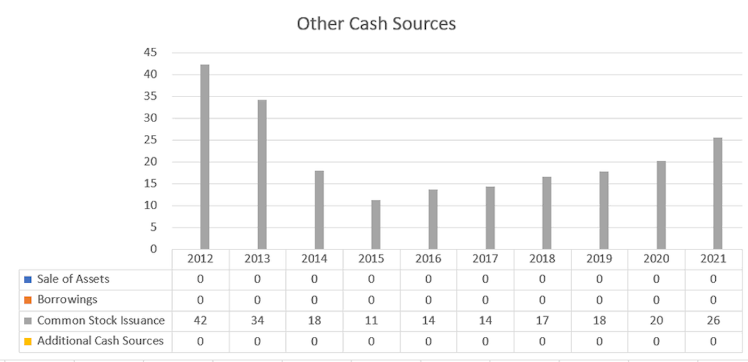

Stock issuance is $ALGN's main method of raising capital.

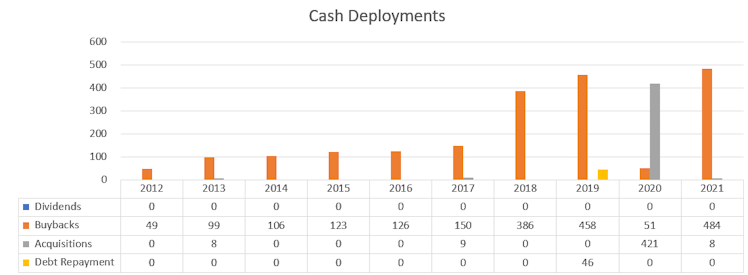

This is not necessarily a bad thing, but nearly all of the FCF is spent on buybacks, decreasing their value.

Share count has not risen significantly because of this, but hasn't shrank much either.

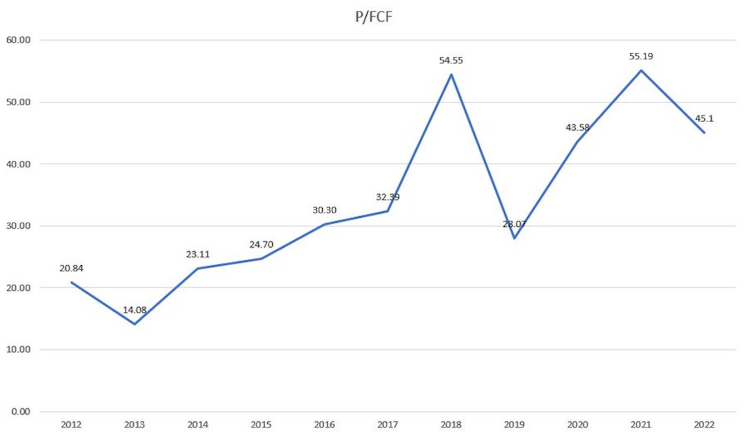

Unsurprisingly, $ALGN has traded at a very high premium, reaching nearly 60 P/FCF.

The recent pullback has brought the stock back down to (a still expensive) 45 P/FCF.

DCF

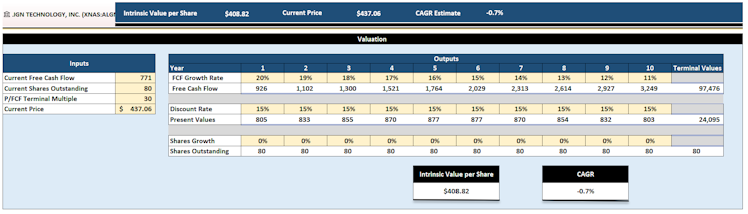

Assuming a very slow and gradual decline in FCF and no significant share buybacks, $ALGN remains overpriced with an intrinsic value of $408.82 per share.

I also assumed a pretty high P/FCF of 30.

FCF Growth

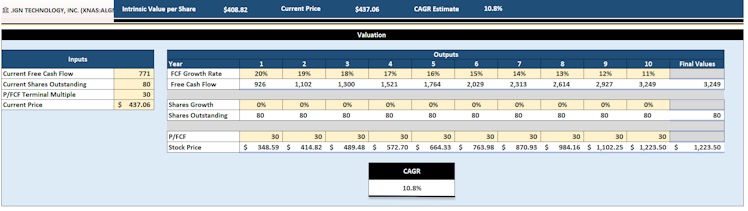

Assuming the same numbers as the DCF, it seems $ALGN could compound at around 10.8% per year.

Conclusion

$ALGN seems like a really solid cash flowing business, but the capital allocation leave me wanting.

The buybacks aren't doing much and there has only been one recent acquisition.

Capex also increased significantly last year, which could hinder FCF growth.

In fact, I think taking on some debt would help management add some value to shareholders.

Their solid business history makes them well positioned to do so.

Still a bit too pricey for me to buy at these levels.

Feedback welcome!

Already have an account?