Trending Assets

Top investors this month

Trending Assets

Top investors this month

September Idea Competition: Process Control for the Semicon Industry

Electronics are more relevant and strategic than ever and this will remain a reality for many years to come.

The demand for electronics continues strong with no sign of slowing down. We have many examples of companies from multiple industries with huge orders backlog in queue just waiting for electronics supplies.

If you are aware of it, then it shouldn’t be a surprise that the US approved $52B in manufacturing subsides that for sure will cause great impact the industry in the future (we may talk more about this in a further post).

However, before all this investment starts to generate returns, we may take some time to know the major players that already play a big role supplying the infrastructure and technology that enables semiconductor manufacturing today and in the future.

KLA Corporation develops equipment and provide end-to-end services in the electronics manufacturing process, from wafers and reticles to ICs, PCBs, flat panel displays and packaging.

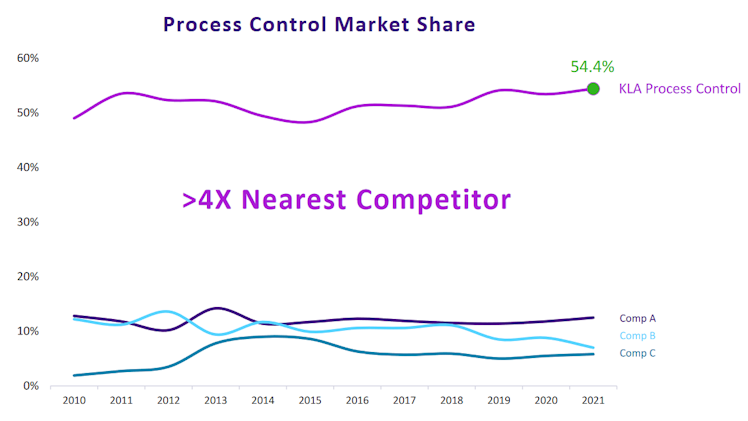

This company core business – Semiconductor Process Control – that represents ~85% of the revenues, allowed them to differentiate from competition and establish a wide moat market leadership, holding 54.4% of the Market Share in a field expected to grow even more than the Wafer Fab Equipments (WFE), expertise from $ASML.

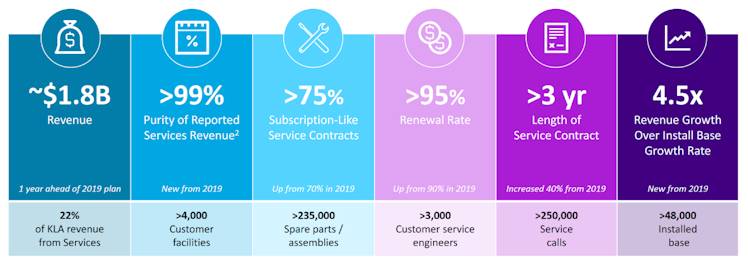

If I’ve learned something from studying Tech companies, is that Service is the way. Recurring revenues give companies a very welcomed revenue previsibility and also help them to create more value to their products and fidelize customers with a complete solution and experience. KLA not only understand this very well, as it executes. This is one of the foundations of the company, since 22% of the revenue come from services.

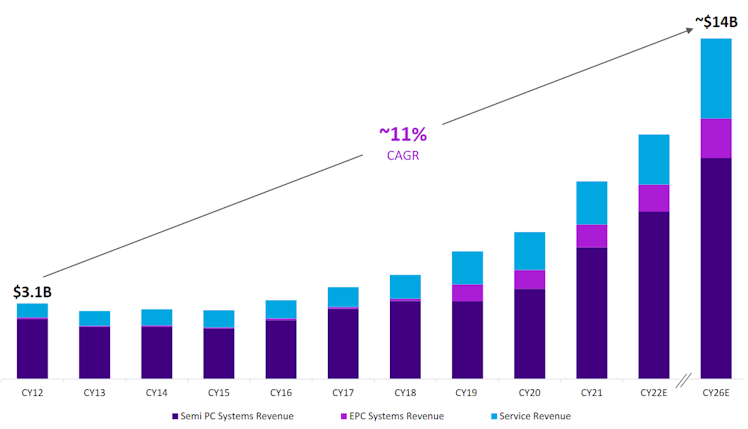

What also influence its leadership position, in an ever-growing demand environment, forecasted to an exponential growth of ~11% CAGR of revenues expected from 2012 to 2026.

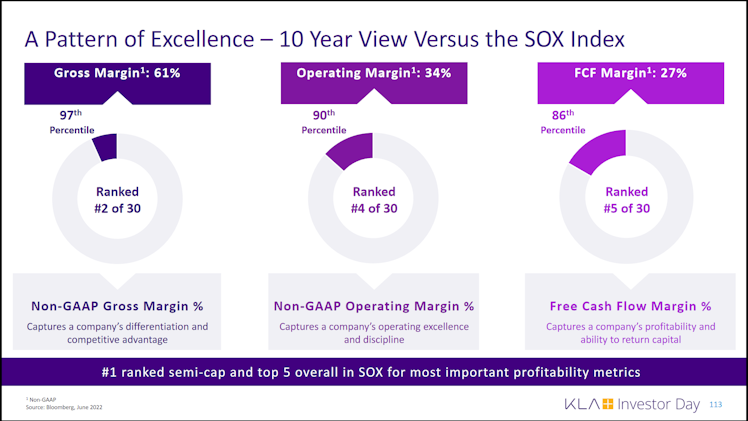

Together with an operational excellence, the company have consolidated its leadership position with higher margins than its peers, including $AMAT, $ASML & $LRCX.

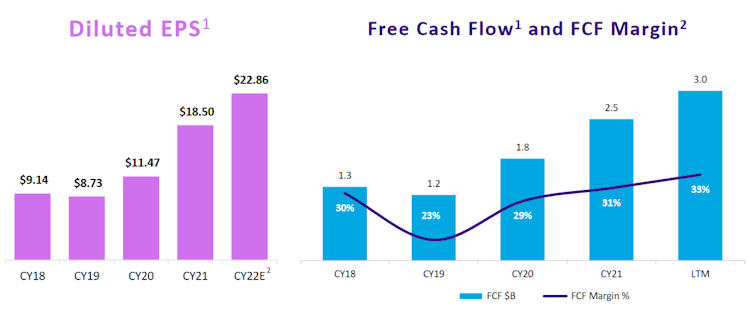

Accordingly, KLA delivered a stupendous profitability growth and cash flow generation in the last years, marked by the context of constraints in the semiconductor supply chain.

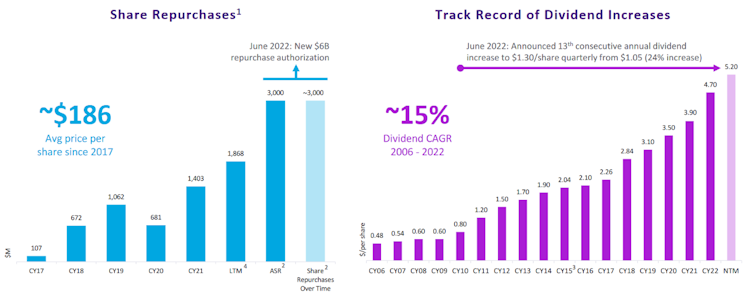

Thanks to this strong cash generation, the company is able to generate value and return capital to shareholders through constantly growing share repurchases and dividends distribution. In the end of the last quarter, it was announced a new $6B repurchase authorization and 24% dividend increase to $1.30/share.

From the 2022 full-year earnings report, $KLAC have $50.0B Market Cap, $3.7B EBIT, $21.92 Diluted EPS, $3.0B Free Cash Flow, no bond maturities until 2024 and a long-term debt of $6.7B compared to a cash position of $2.7B.

What implies in a ~15x EV/EBIT, P/E and P/FCF, very solid multiples for an expressively growing tech company.

Therefore, we can get to the conclusion that KLA Corporation have strong both top and bottom-line growth over the last decade, especially in the last 3 years, and have seized very well its wide moat position, as seen in its high margins, specialized market leadership, healthy balance sheet, growing profitability and shareholder return.

As it is now, KLA Corporation checks all the boxes of a great company to generate value in the long term.

#investing #commonstock

Already have an account?