Trending Assets

Top investors this month

Trending Assets

Top investors this month

American Express: The Specialty Finance Compounder

We discussed American Express $AXP for our Chit Chat Money Not So Deep Dive episode this week and I came away really impressed.

Since AmEx operates across the entire transaction lifecycle, they earn money in a number of ways. The primary ones being:

1) Merchant Fees

2) Card Fees

3) Interest Income

Because of this diverse revenue mix, AmEx's earnings have been generally well protected from the recent surge in interest rates. Most credit providers can't say the same. Additionally, AmEx is home to a highly attractive cardholder base which should give them better spending resilience in an economic downturn.

Here are 4 charts that I think encapsulate the durability quite well and indicate that this could be an even better business in 5 years.

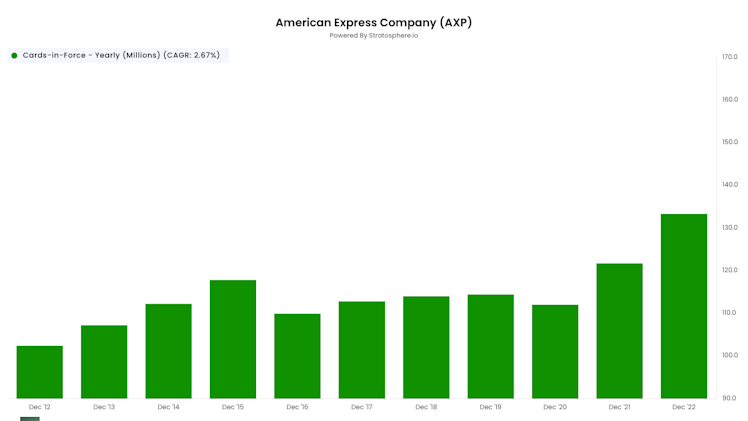

Total Cards-In-Force since 2012:

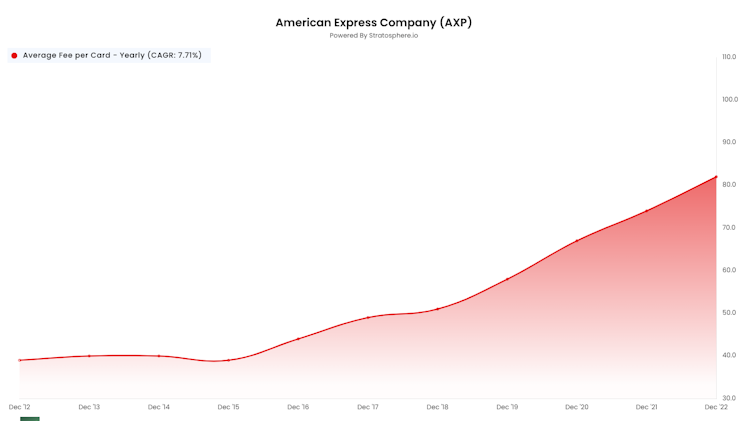

Average annual fee to be an AmEx Cardholder:

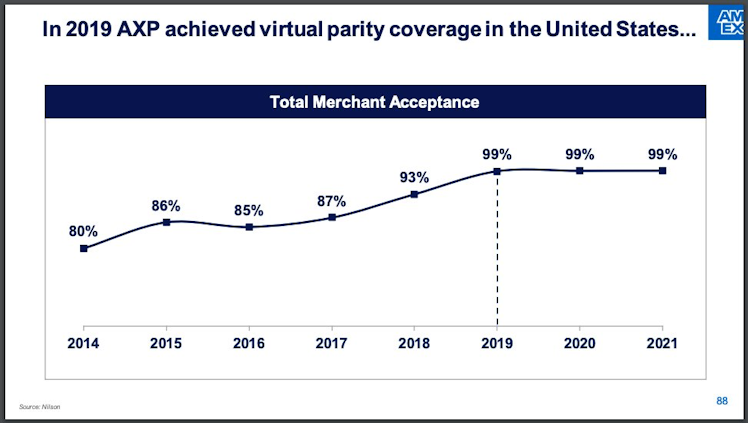

Merchant Acceptance rate in the US:

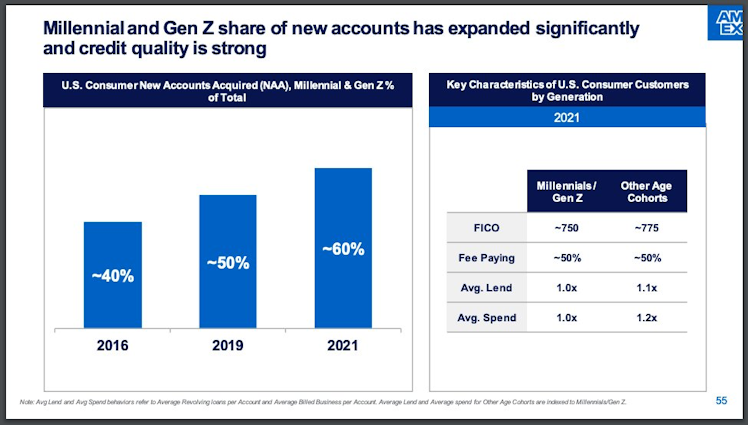

And an increasingly younger age demographic for new accounts:

If you want to listen to an entire breakdown of the business, here's our episode on American Express. https://open.spotify.com/episode/02CYJiR78ge96EYza3YqL7?si=Lp7h-dQUQ_arWbtUuAbTEw

Spotify

American Express (Ticker: AXP) Not So Deep Dive

Chit Chat Stocks · Episode

Bufftett has kept $AXP as a core portfolio position for decades for good reasons ! Despite competition from all directions, it seems to be holding up really well. Running those airport lounges must be expensive though - perpetually crowded each time I visit one!

Already have an account?