Trending Assets

Top investors this month

Trending Assets

Top investors this month

US Labor Market Surprises Again, 50 bps Hike Now Firmly on the Table

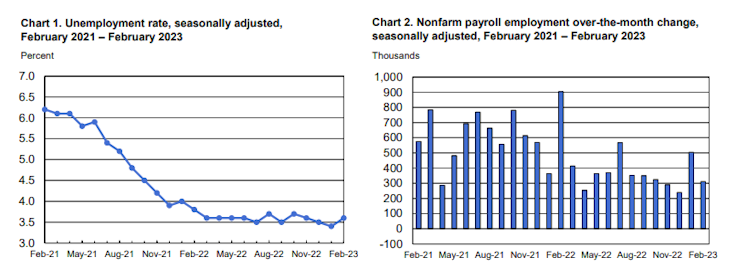

The US added 311,000 jobs in February to make for another strong month in the labor market. Importantly, the small downward revisions of -21,000 in December (to 239,000) and -13,000 in January (to 504,000) confirm that the labor market is really as hot as it is. Despite the nice jobs gain, the unemployment rate ticked up 0.2 ppts from the extreme low of 3.4% to 3.6%. The increase in the unemployment rate was caused by an increase of 242,000 in the number of unemployed and a 0.1 ppt increase in the labor force participation rate. This puts the labor force participation rate up 0.3 ppts from a year ago, a welcome change that will continue to help cool off the labor market. The service sector continues to be the driver of labor market strength, adding 245,000 jobs, well over the 20,000 added in the goods sector and 46,000 added in the government sector. The leisure and hospitality industry added another 100,000+ jobs with the education and health services industry not far behind at 74,000. Despite weakness in the manufacturing industry, it still posts marginal employment gains, adding 20,000+ jobs in each of the last three months. As expected, strong labor demand has led to further wage growth. The general level of average hourly earnings grew 0.2% MoM to an annual increase of 4.6% YoY which is higher than the 4.4% YoY reported in January. However, there was some upward pressure from base effects.

Regardless, there is little evidence that the labor market is weakening. Some of the underlying data suggest there is a more complicated trend to decipher as unemployment measures did advance in February, but the increase in the labor force is the likely explanation there. While a growing labor force helps to loosen labor market tightness, it will do little to stem economic strength derived from growing consumer disposable income which drives inflationary pressures. And in fact, wage growth is still strong which is putting more money in the hands of consumers to spend (which they’ve been very willing to do in the post-COVID era). This report will support the narrative of a 50 bps rate hike later this month by the Fed, and the CPI report next will be key in confirming that pace. That being said, I see little reason to expect the US economy to enter a recession in the first half of 2023, and a higher terminal rate will likely be needed to make that more likely in the latter half of 2023.

From today's Econ Mornings newsletter.

Already have an account?