Trending Assets

Top investors this month

Trending Assets

Top investors this month

Any people here smart on railroads?

I've loved Railroads ever since I noticed their margins and ability to increase EPS year after year with flat revenue growth. Just playing with a model and coming up with some pretty attractive returns relative to what I'd expect from the market, with probably less risk given the nature of their businesses.

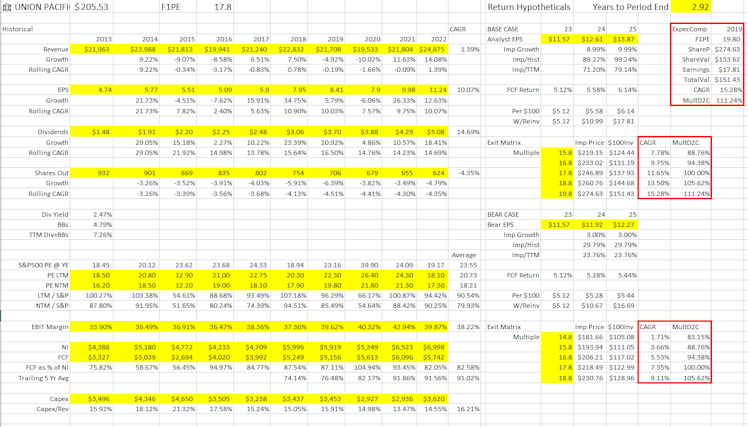

Just put a spreadsheet together that runs through some potential exit scenarios, here's a snapshot of the $UNP version (if anyone wants I'm happy to send you spreadsheet, just DM me).

Also, please let me know if I've made any stupid errors or assumptions. Basically, I'm assuming the annual shareholder return is equal to analyst forecasted EPS adjusted to FCF by taking FCF as a percent of net income over the past 5 trailing year average. Then creating a matrix to compare exit multiples and adding the exit to the annualized return from FCF.

Other interesting things to note: UNP returned 7.26% to shareholders last year through buybacks and dividend, NSC was at 7% and CSX was at 6.32%. All companies have reduced FLOAT compounded at 4.3%, 3.2% and 3.9% respectively. Dividend growth past 10 years has been 14%, 10%, and 8% respectively.

Also, was just listening to last quarter's calls and management seems to be confident in ability to increase prices more than inflation (and judging by financials they have been).

I'd love to read anything anyone has on the railroads, they look super interesting w/ tech margins and steady businesses. Only long term major downside I can think of is reduction in materials transport (short term from less coal? long term from more energy being generated by solar/wind that doesn't get trasnported?)

Already have an account?