Trending Assets

Top investors this month

Trending Assets

Top investors this month

Quick $ADBE Valuation

Did some quick pros and cons on $ADBE today due to the recent pullback.

This is a high-level, numbers only type of valuation. I didn't take the business or management into account.

Pros

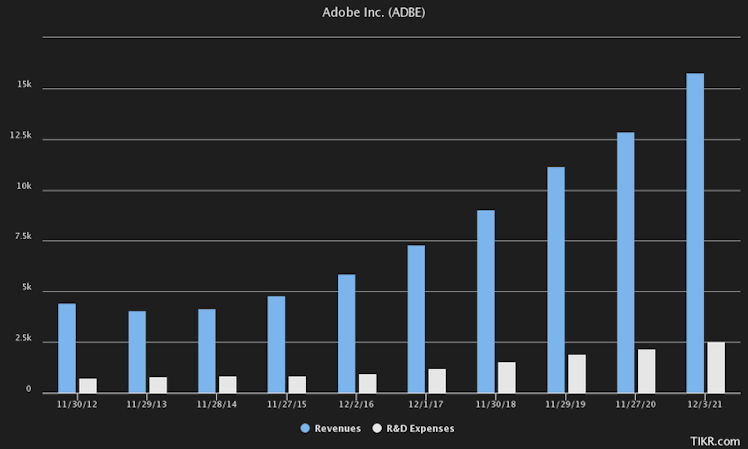

Great cash flow and low capex. R&D is really the capex here, but it's still growing perfectly along with revenues.

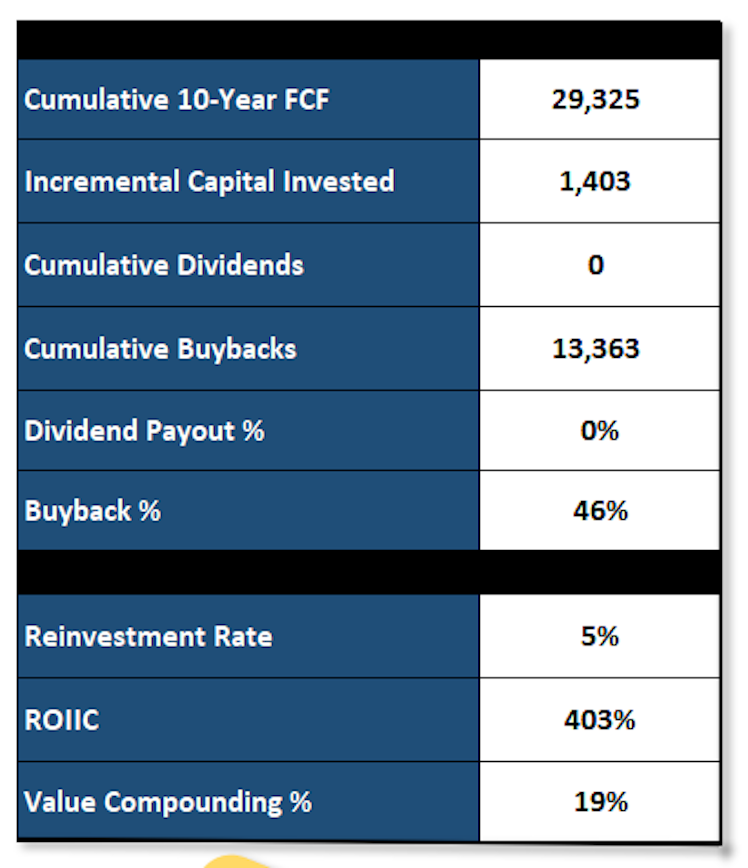

$ADBE also requires very little reinvestment and only requires 5% of FCF back into the biz.

FCF has compounded steadily at 19% CAGR.

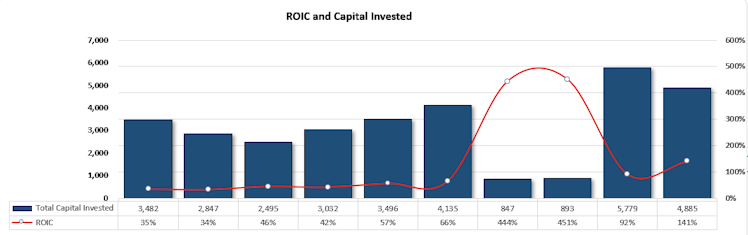

ROIC has been consistently very high, but in part due to limited reinvestment.

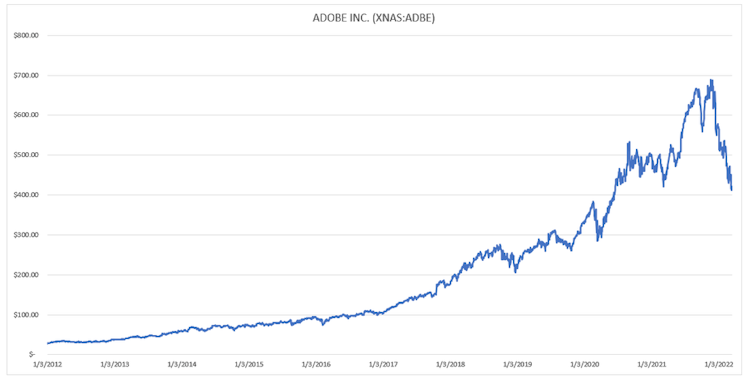

The stock has compounded at a stunning 29% CAGR, even with the recent drawdown.

Cons

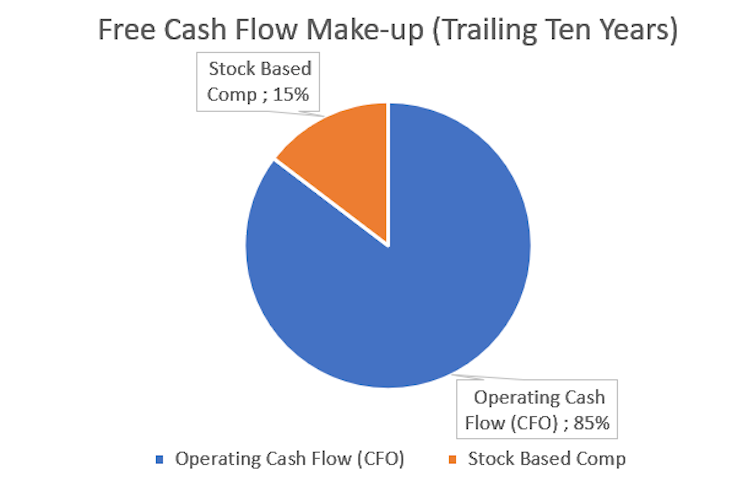

Stock-based compensation accounts for 15% of FCF.

My preference would be 10%, but luckily it's getting lower every year.

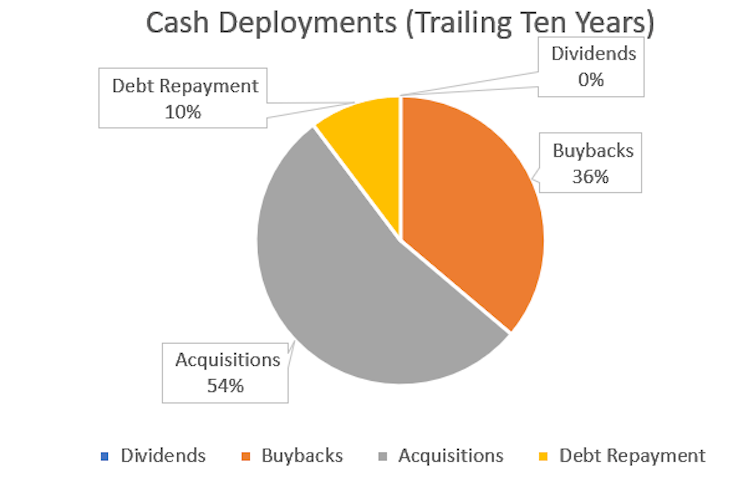

Most cash deployments have been acquisitions and buybacks, but annual stock issuances hinder buyback effectiveness.

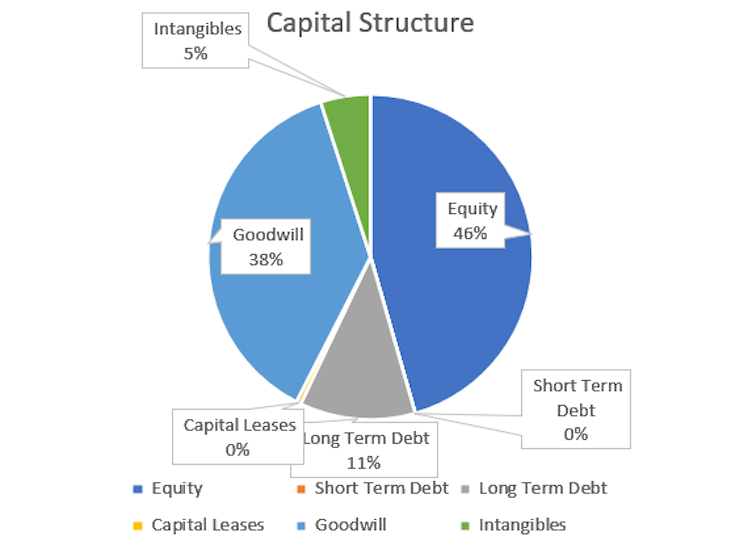

Goodwill makes up nearly half the assets, and almost as much as the equity base.

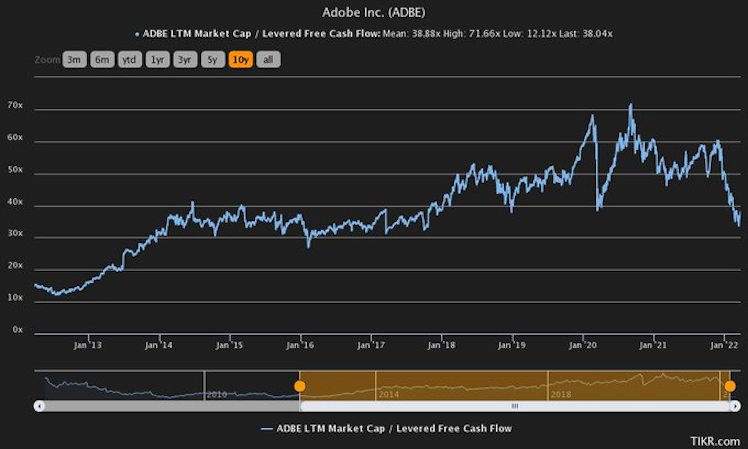

Over the last 5 years, value ratios have steadily risen above 40 P/FCF and up to 60 P/FCF.

Quite pricey indeed.

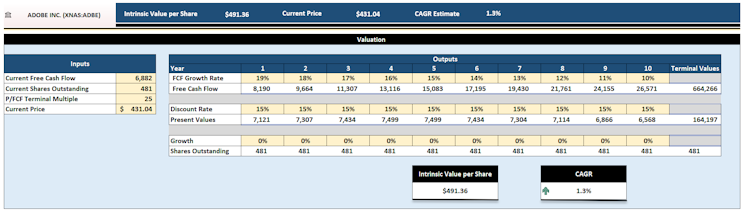

DCF

Here's my base case DCF.

FCF growth starts at 19% and continues to decline slowly.

With a 15% discount rate (my required rate of return) and no buybacks, $ADBE is worth $491.36, or a 1.3% CAGR.

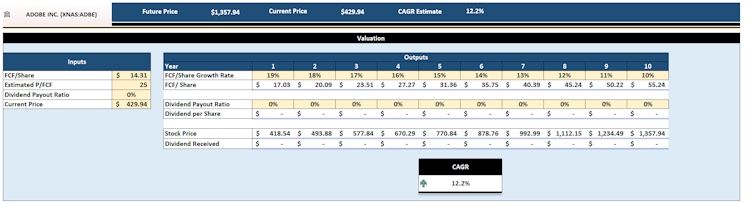

FCF Growth

In the same scenario, no dividends are assumed, and P/FCF is estimated at 25, $ADBE may offer a 12% CAGR.

Conclusion

It's pretty obvious most people consider $ADBE a growth stock.

Personally, I don't like to bank on growth without a baseline for rewards (meaningful buybacks, dividends, etc.).

The margin of error in my valuation is too wide, so I need to do more research.

Feedback welcome!

Already have an account?