Trending Assets

Top investors this month

Trending Assets

Top investors this month

British American Tobacco $BTI: Analysis, Valuation, and Pricing, 2022

The bases are loaded, there are no outs, and BAT is ready to swing for the fences.

Company Overview

In 1902, British American Tobacco was formed as a joint venture between UK-based Imperial Tobacco Company and U.S.-based American Tobacco Company. Not too clever with the names back then, were they? Experiencing massive changes in both ownership structure and operations, including a reorganization in 1976 to form a new holding company, and more recently, its 2017 acquisition of Reynolds American, the company has turned into a multinational dynamo.

Presently, British American Tobacco (BAT) owns an impressive portfolio of tobacco and nicotine products, including:

Legacy Categories

- Combustible brands, such as Lucky Strike, Pall Mall, Dunhill, Kent, Rothmans, Camel, Natural American Spirits, and Newport. The company also has less prominent brands including Vogue, Viceroy, Kool, Peper Stuyvesant, Craven A, State Express 555, and Shuang Xi.

- Traditional Oral including moist snuff tobacco brands of Grizzly, Mocca, Granit, and Kodiak, and snus products (including Camel snus).

New Categories

- Vapour (ENDS) - Vuse

- Tobacco Heating (HTP) - Glo

- Modern Oral (TFNP) - Velo

Championing its “A Better Tomorrow” strategy, BAT has seen rapid, accelerating growth in its New Category segments. Complimenting these New Categories, the company is moving Beyond Nicotine by actively investing in health and wellness R&D, bolt-on M&A, and strategic collaborations. These initiatives fit into the company’s overall “Faster Transformation” objective, in which, along with growing new consumer product brands, BAT is simplifying its organizational structure through rationalizing combustible SKUs and reducing related business units. These programs, paired with its ability to generate substantial operating cash flow, have allowed the company to meaningfully deleverage since 2017 while remaining committed to returning significant capital to shareholders.

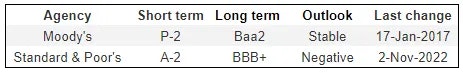

The company’s corporate headquarters are in London, England. Shares trade on the LSE under the ticker BATS and on the NYSE under the ticker BTI. Shares are also available on the JSE and the KN. Presently, the company holds the following credit ratings and outlooks:

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Investment Thesis

Since fully acquiring Reynolds American, British American Tobacco has steadily deleveraged while paying an increasing dividend while also engaging in significant R&D and M&A, and now, the company’s transformation is reaching a powerful inflection point.

Despite macro headwinds, BAT is seeing sustained and significant growth across New Categories, which are now contributing significantly to sales. Continued scaling will enhance operational leverage that will generate substantial long-term value. BAT is trading at a depressed multiple, and management has signaled its intentions to prioritize share repurchases to further drive shareholder returns.

Industry Overview

The global tobacco industry is quickly transforming into a space offering a wide variety of nicotine products. Aiming to substantiate reduced risk claims, major manufacturers have sunk billions into R&D to stay ahead of the curve. This has led major manufacturers to pull further ahead - though they have already held a lead due to historically significant regulation.

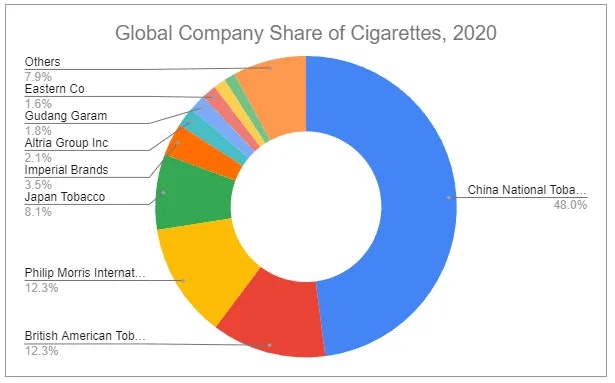

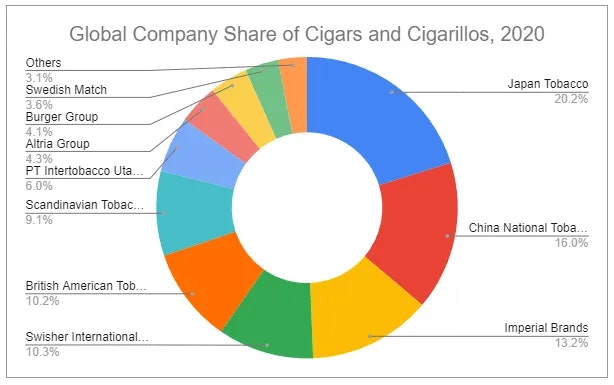

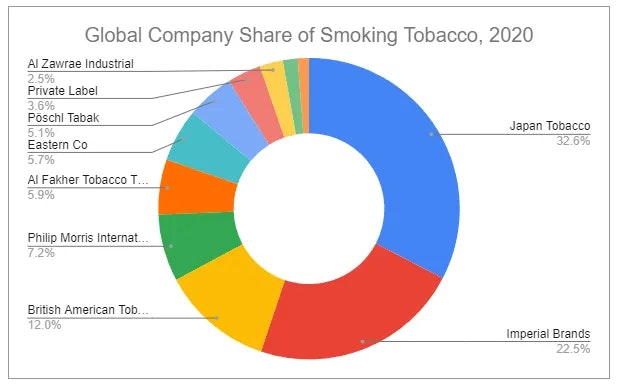

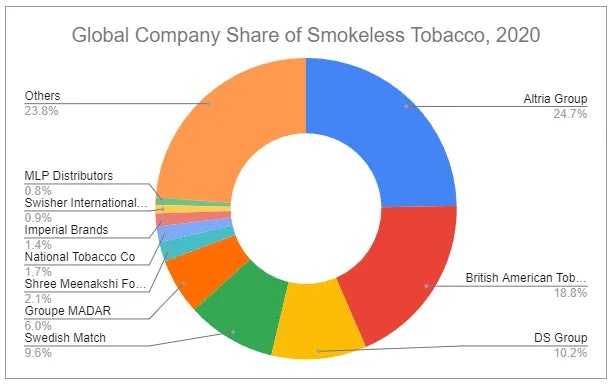

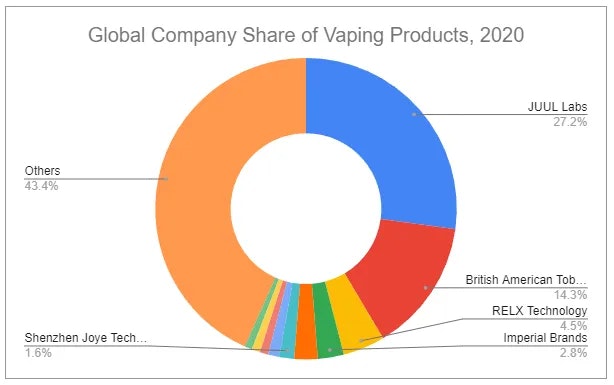

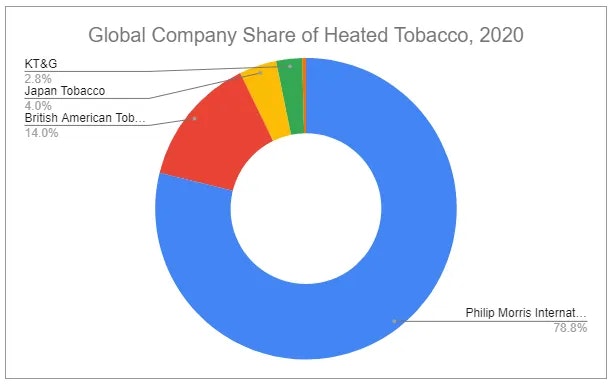

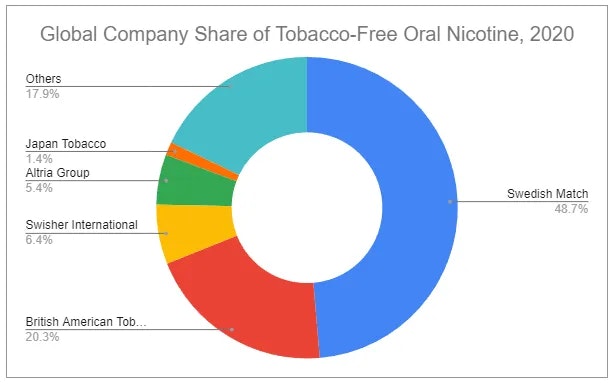

The consolidation of market share is rather clear, as per recent global data:

China National Tobacco Company (CNTC) sells almost half of all cigarettes and dominates the Chinese market.

The Cigars and Cigarillos market is less concentrated, and the majority of incremental demand is driven by China.

Smoking tobacco is dominated by a few major brands, and most demand is serviced from Europe.

Smokeless tobacco has several large players, but oddly, nearly a quarter of the market is hyper-fragmented amongst tiny manufacturers.

Vaping has seen a massive deceleration in growth due to unsubstantiated health scares and resulting regulation, including device and flavor bans. The category has several large players, though JUUL’s share has fallen significantly since this data became available, and British American Tobacco’s share has grown. Overall, the vaping (ENDS) space has remained quite fragmented globally, though regulation may force small players out (this is especially true in places such as the United States).

HTPs are fast-growing, and due to the complexity of product development, there are only a few players in the market, with PMI being the most dominant by far. BAT has grown its share notably in the last two years.

Modern oral nicotine is fast growing, with only a few companies dominating most of the market, with SWMA clearly leading. However, in recent years, BAT has taken considerable share and has begun to dominate the Scandinavian market.

Industry Outlook

The future of the nicotine industry can be condensed into several key points:

- Cigarettes account for most retail value globally, and while volumes are slowly declining, retail value incrementally increases due to pricing.

- New categories, like Vaping, Heated Tobacco (HTP), and Modern Oral (Tobacco-Free Nicotine Pouches), are fast-growing, though are currently still small pieces of overall volumes and retail value.

- The retail value for all nicotine categories has been continually growing.

The rest of the report covers:

- Regulation

- Operations and Segment Specifics

- Management and Culture

- Additional Risks and Considerations

- Valuation and Pricing

Read the remaining 90% of the comprehensive report at the link below:

invariant.substack.com

British American Tobacco $BTI: Analysis, Valuation, and Pricing, 2022

The bases are loaded, there are no outs, and BAT is ready to swing for the fences.

Already have an account?